we

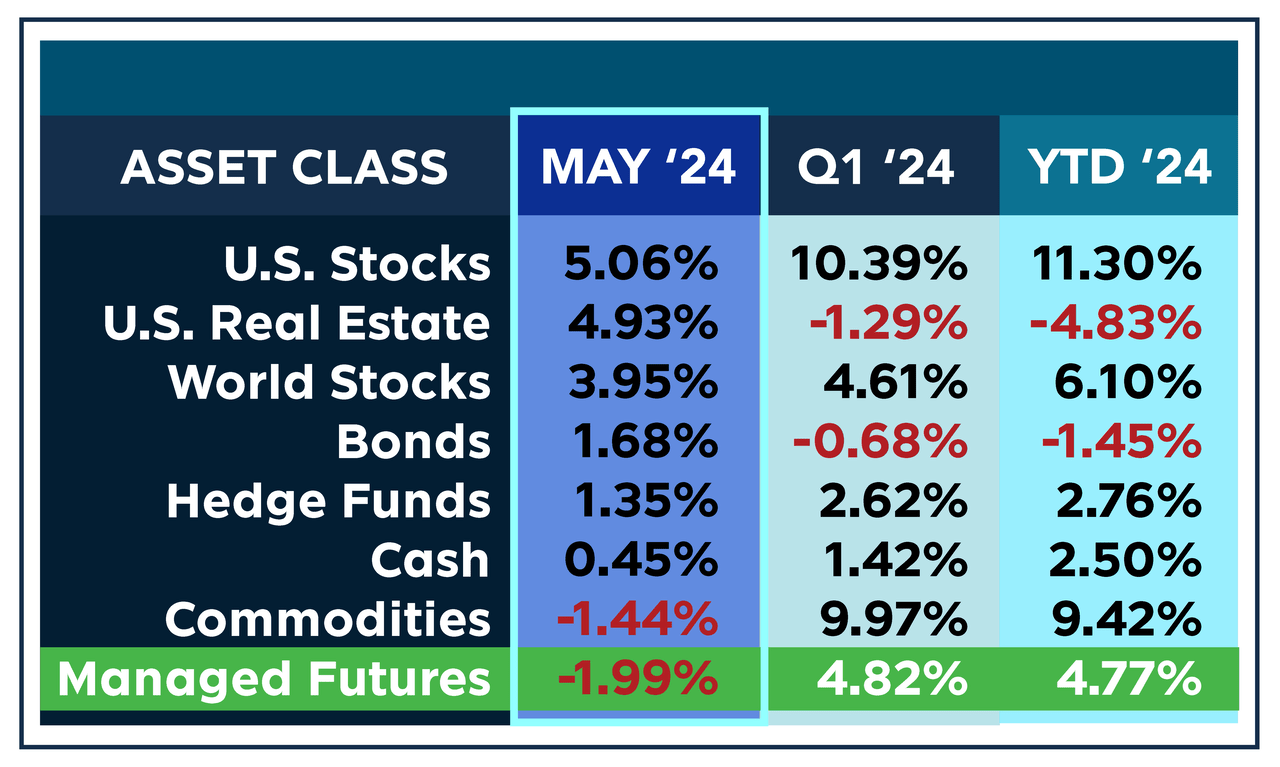

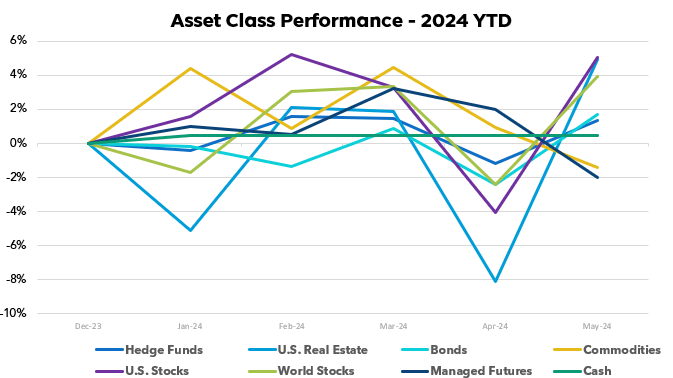

In May, most asset classes recovered after April’s declines.

US stocks led the way, with the S&P 500 up 5.06% on a recovery in corporate earnings. Real estate also recovered, with the IYR index up 4.93% as lower mortgage rates helped revive demand. International stocks Larry rose +3.95%.

Bonds steadied, with yields retreating from recent highs, sending the Barclays Aggregate Index up +1.68%. Hedge funds captured the rally with more directional positions, sending the QAI Index up +1.35%.

Meanwhile, commodities were hit by weak manufacturing data, with the GSG index down -1.44%. Managed Futures strategies gave back some of their gains, with trend reversals in interest rates and commodities acting as headwinds, causing the index to fall -1.99%.

Since the beginning of the year, most asset classes have been in positive territory, with US stocks leading the way at +11.30%. Commodities have also recorded a large increase of +9.42%. The overall stock market rose +6.10%, with international stocks up +6.10%.

Real estate and fixed income remain in negative territory YTD at -4.83% and -1.45%, respectively, as rising interest rates have put pressure on valuations. Managed futures have weathered the volatility well, gaining +5.33% by strategically switching between long and short exposures.

As we head into June, it is important to note the mixed backdrop. On the one hand, the strong recovery in stocks and real estate in May could signal that the worst of the interest rate adjustment is over. However, uncertainty remains high and bond markets are pricing in further interest rate hikes in the coming months. This could put pressure on valuations of interest rate sensitive assets and cause hedge funds to shift to more defensive positions after a strong month.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

Source: Managed Futures = SocGen CTA Index;

Cash = US Treasury Bill 13-week coupon equivalent annual interest rate/12, YTD is the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (BND),

Hedge fund = IQ Hedge Multi-Strategy Tracker ETF (QAI),

Commodities = iShares S&P GSCI Commodity Index Trust ETF (G.S.G.S.G.),

Real Estate = iShares US Real Estate ETF (Year),

Global Equities = iShares MSCI ACWI ex US ETF (Australia),

US stocks = SPDR S&P 500 ETF (spy).

All ETF performance data from YCharts

Disclaimer

The performance data displayed herein is compiled from a variety of sources, including BarclayHedge, and reported directly by the Advisers. These performance figures should not be relied upon without reference to the individual Adviser’s disclosure documents, which contain important information regarding the calculation methodology used, whether the performance includes proprietary results, and other important footnotes regarding the Adviser’s track record.

The programs listed here are a subset of the complete list of programs you can access by subscribing to our database, and reflect programs that you currently use or that you are more familiar with.

Benchmark index performance is based only on the constituents of that index and is not representative of the totality of investments possible within that asset class. In addition, indexes may have limitations and biases, such as survival rates, self-reported and instantaneous history. Individuals cannot invest in an index itself, and actual returns may differ materially from index returns and may be more volatile.

Managed futures accounts may incur significant management and advisory fees. The figures on this website are inclusive of all such fees, however accounts subject to such fees may require significant future trading profits to be made to avoid depletion or exhaustion of assets.

Investors interested in investing in a managed futures program (other than programs offered only to eligible individuals as defined in CFTC Regulation 4.7) will be required to receive and sign certain CFT rule-compliant disclosure documents. The disclosure documents contain a complete description of the principal risk factors and each fee that the CTA will charge for your account, as well as the overall performance of accounts under the CTA’s management for at least the past five years. Investors interested in investing in any of the programs on this website are strongly encouraged to read these disclosure documents carefully, including but not limited to the performance information, before investing in any such program.

Investors who are qualified eligible persons, as defined in CFTC Regulation 4.7, who are interested in investing in programs that are exempt from providing disclosure documents, and who are deemed by the regulations to be knowledgeable enough to understand the risks and to independently interpret the accuracy and completeness of performance information.

RCM will receive a portion of the commodity brokerage commissions you pay in connection with your futures transactions and/or a portion of the interest income (if any) earned on the assets in your account, and the Listing Manager may also pay RCM a portion of the commissions it receives from accounts introduced by RCM.

RCM Quintile + Star Ranking Restrictions

The quintile rankings and RCM Star Rankings shown herein are provided for informational purposes only. RCM does not guarantee the accuracy, timeliness or completeness of this information. The ranking methodology is proprietary and the results have not been audited or verified by an independent third party. Some CTAs may employ trading programs or strategies that are riskier than others. CTAs may manage client accounts differently than the model results shown or trade actual client accounts and their own accounts differently. Different CTAs are subject to different market conditions and risks that may materially affect actual results. RCM and its affiliates receive compensation from some of the rated CTAs. Investors should conduct their own due diligence before investing in a CTA. This ranking information should not be the sole basis for any investment decision.

See full terms of use and risk disclaimer here.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.