aydinmutlu/E+ via Getty Images

Introduction

Latest commentary HillenbrandCo., Ltd(New York Stock Exchange:Hello) in March 2023, when he noted that industry players continue to invest in growing markets. However, we maintained our “hold” rating on the stock, and as you can see below, the share price has fallen a little over 4% over the past 15 months or so as a result of ongoing consolidation.

But if you look at Hillenbrand’s latest quarterly earnings numbers (Second quarter The company’s fiscal 2024 earnings forecast ($0.09 EPS) announced on April 30 last year showed it was well below GAAP expectations ($0.09 EPS) and below revenue expectations. In addition, the downward revision of earnings forecasts from both revenue and profit perspectives has resulted in Hillenbrand’s 10-week moving average of It has fallen and is now dangerously below its 40-week average.

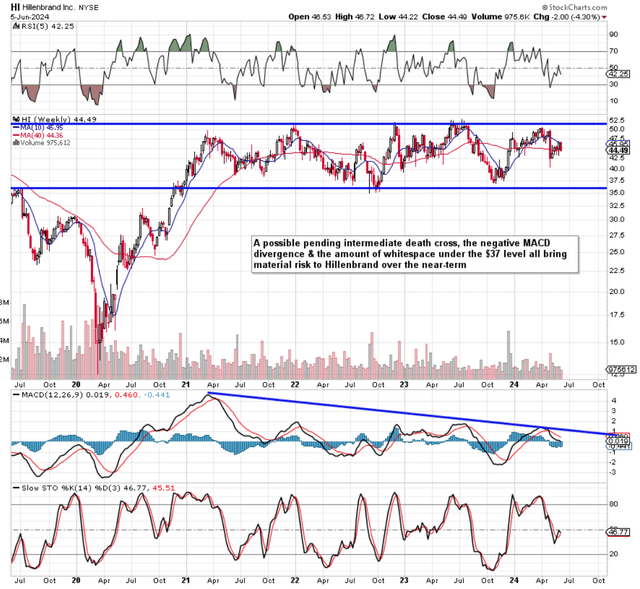

Let’s just say that if a short to medium term bearish crossover materializes here, the stock could fall quickly to the long term support below $37 and then find support again. Additionally, the volume of empty space below $37 and the bearish divergence in the MACD indicator indicate that there is a real risk of a downside if the underlying bearish trend gains momentum. Therefore, investors may want to continue to monitor Hillenbrand technicals in case a major trend change occurs here in the short term. Below are some worrying fundamental trends from the recent Q2 earnings report that support a cautious stance at this time:

Hillenbrand Intermediate Technical (Stockcharts.com)

Need to speed up capital turnover

The most concerning trend in the company’s recent Q2 report is the fact that volume trends continue to be hampered by increasing macroeconomic uncertainty. Remember, to grow returns on capital over the long term, Hillenbrand needs to either increase margins or grow volumes. Currently, margins remain weak from a historical perspective, with the company’s past two-year net margins at 2.79%, remaining below its five-year average of 7.53%. To address this, management has had to cut costs across the business to protect the income statement. While this may help in the short term, there is always a limit to what a company can do with a cost-cutting initiative. In fact, management has suggested that some costs will likely return to the income statement once volume trends recover in earnest, as shown below:

In response, we began implementing cost actions during the quarter, including targeted restructuring and severe limits on hiring, travel and other discretionary costs. I am pleased to see our teams implementing these measures quickly, which continue to contribute to the 100 basis point expansion in adjusted EBITDA margin we saw in the quarter. We expect to incur some of these costs again, but we will remain disciplined until order intake returns to expected levels.

The combination of declining organic volume and low margins has been a real problem for Hillenbrand as it has had the following impact on its financials: With insufficient working capital containment and accounts receivable (over $678 million) continuing to grow at a concerning rate, the knock-on effect is that Hillenbrand continues to struggle to raise enough cash to address its debt burden. Long-term debt now exceeds $2 billion, and interest expense over the past 12 months has totaled nearly $100 million. Again, these adverse trends all stem from negative organic volume trends that are not providing the company with enough growth to cover the associated costs.

Persistent MTS Headwinds

While the FPS acquisition helped Hillenbrand’s Advanced Process Solutions division boost sales in the second quarter, the smaller MTS division continues to disappoint. After an extended period without customer-driven demand, management decided last quarter to begin a restructuring program to essentially “right-size the ship” until some demand returns. This will be painful in the short term before meaningful savings in scale begin to emerge (the $25 million restructuring charge in the second quarter speaks for itself). However, what is concerning from a forward-looking perspective is that the continued weakness in the company’s short-cycle hot runner products (high-margin products) will continue to negatively impact MTS’ mix and, as a result, will do nothing to boost the segment’s revenues. This unfavorable trend stems primarily from the continued weakness of electronics and consumer products in the North American market. Additionally, ongoing inefficiencies at certain hot runner locations are exacerbating this trend, further reducing margins.

Free cash flow is declining

As mentioned above, profitability in the MTS division remains a major concern, while Hillenbrand’s APS division (despite inorganic gains from FPS) continues to suffer from below-average order volumes, primarily in the mid-size division. Free cash flow this year is now expected to be $140 million, well below previous estimates of $230 million. This means that the stock is trading at roughly 22x forward free cash flow (based on management’s latest FCF estimates), but the real questions regarding the company’s cash flow trends are:

Given that debt reduction is management’s top priority and over $60 million continues to be paid out as dividends, one cannot help but be concerned about how future spending will be funded. Hillenbrand ended the second quarter with over $224 million in cash and cash equivalents on the balance sheet, while recent acquisitions have pushed Hillenbrand’s goodwill on the balance sheet to over $2 billion. Suffice it to say that more aggressive spending at Hillenbrand is unlikely in the near term, as there is still a lot of risk remaining regarding future impairment charges resulting from recent transactions. As such, being an acquisitive company, it will be interesting to see how the market digests this trend over time.

Conclusion

In summary, we reiterate our Hold rating on Hillenbrand, but are keeping a close eye on the technicals to see if a bearish mid-term crossover occurs in the near term. Advanced Process Solutions trading volume is trending downwards, Short-term gainst, Profitability MTS’s struggles and downward revision of its fiscal 2024 outlook suggest investors need to remain cautious, so expect continued coverage.