by Calculated Risk June 7, 2024 1:15 PM

In today’s Real Estate Newsletter: “Home ATMs” were mostly closed in the first quarter

excerpt:

During the housing bubble, many homeowners borrowed heavily against the equity in their homes, which they jokingly called “home ATMs,” and this contributed to the subsequent collapse of the housing bubble, as many homeowners had negative equity in their homes when home prices fell.

Unlike during the housing bubble, very few homeowners are now in negative equity. News from CoreLogic this morning: Homeowner Wealth Insights – Q1 2024

According to CoreLogic analysis, U.S. homeowners with mortgages (approximately 62% of all properties*) have a combined $1.5 trillion in additional wealth since the first quarter of 2023, a 9.6% increase from the previous year.

In 1Q24, the total number of mortgaged residential properties with negative debt was 1.0 million, or 1.8% of all mortgaged properties, down 2.1% from 4Q23. Year-over-year, the number of mortgaged residential properties with negative debt was 1.2 million, or 2.1% of all mortgaged properties, down 16.1% from 1Q23.

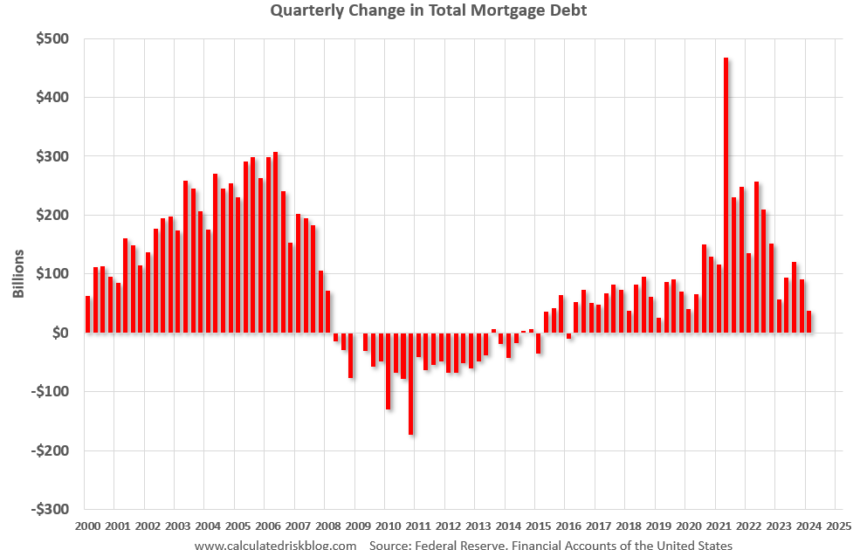

Here’s the Federal Reserve’s quarterly mortgage debt growth: United States Financial Statements – Z.1 (also known as the Flow of Funds Report) was released today. The mid-2000s saw a large increase in mortgage debt associated with the housing bubble.

Mortgage debt increased by $38 billion in Q1 2024, down from $91 billion in Q4 and also down from the cycle peak of $467 billion in Q2 2021. Note that mortgage debt has been declining for almost seven years as large amounts of debt have been wiped out through distressed loan sales (foreclosures and short sales).

However, some of this debt is being used to increase the housing stock (purchasing new homes), so it is not all mortgage-backed securities (MEWs).

There’s much more to this article. Subscribe now https://calculatedrisk.substack.com/.