SolStock/E+ via Getty Images

Recycle Holdings (New York Stock Exchange:Ressie) is a battery recycling company operating mainly in the North American and European markets. Its main business is the recovery and recycling of lithium-ion batteries.

Its stock price performance so far has been disappointing. Since its listing in 2020, At $77, the stock was most recently trading in the low single digits before the 8-for-1 stock combination on June 4. Currently, the stock is trading at $3 per share and has already fallen 44% in the past month.

I rate the stock Neutral. My one-year price target is $2.7 per share, and I project a downside of about -10%. At these levels, LICY does not immediately become an attractive investment opportunity, especially given its cash-starved position. That said, I would like to point out that LICY’s ability to secure external funding in FY2024 will play a key role in influencing the share price movement.

Finance review

Like any company developing advanced technologies such as battery recycling, LICY’s fundamentals were disappointing as it is largely in the investment stage. It has been in the commercialization stage since 2020, and while revenues are trending upwards, visibility, profitability and operating cash flow (OCF) generation remain challenges. In Q1, LICY generated $4.2 million in revenue, growing about 17% year-over-year. However, LICY missed guidance by $1.6 million. Meanwhile, LICY has been in the business of burning cash since going public. OCF burn is also worsening. In Q1, LICY burned OCF of -$29 million. Losses improved slightly, but not enough to make a big difference. Q1 adjusted EBITDA loss was -$27 million, a sizeable figure, despite shrinking by more than 10% year-over-year.

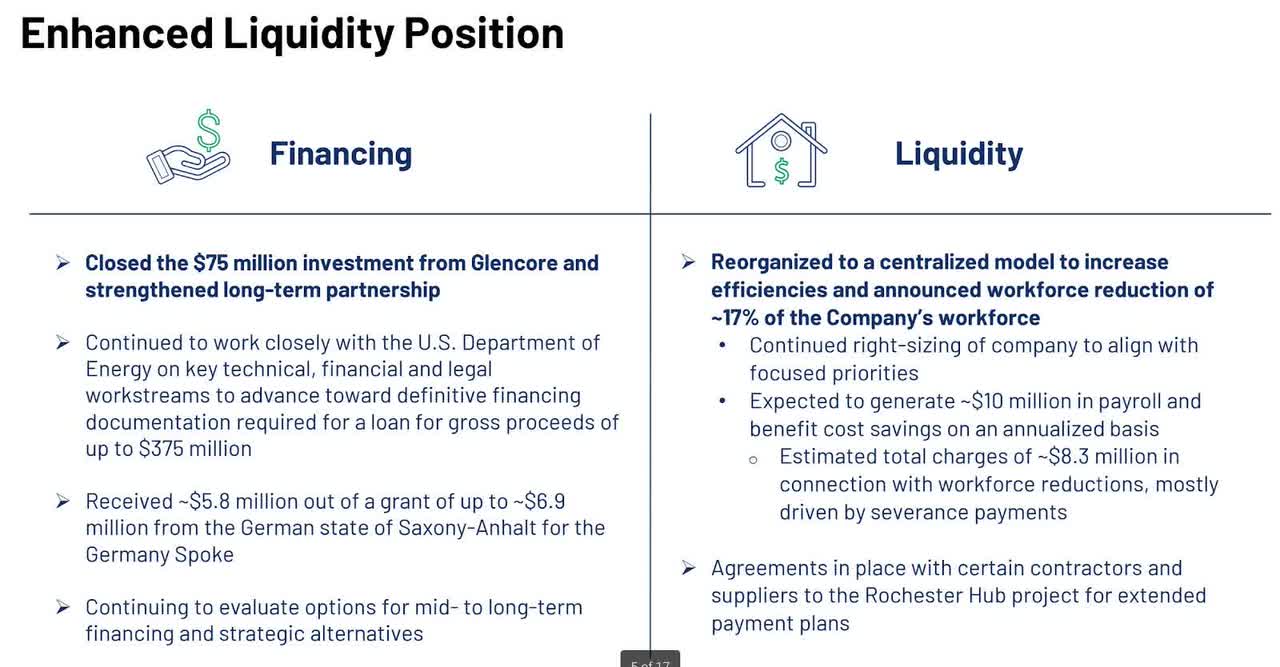

The lack of OCF generation has forced LICY to rely on cash flows from financing activities to continue operations. Liquidity has been declining sharply since around 2022. At the time, cash and short-term investments were just under $650 million. In Q1 2024, it was only $109 million. Moreover, this was mainly due to financing activities. In Q1, LICY raised $75 million through the issuance of convertible notes to bolster its liquidity. This increased its debt-to-equity ratio, which was almost double as of Q1.

catalyst

While the key catalyst remains small, I believe the overall cost optimization efforts will act as a catalyst for LICY’s liquidity and profitability. In the first quarter, LICY announced that it will continue to focus on cost optimization efforts within its spoke network as well as within the organization. In my view, these are important steps to further reduce losses and cash burn, which will boost investor confidence in the stock.

Beyond Spoke optimization, potential savings from rightsizing the company should reach $10 million annually, as management indicated during the first quarter earnings call.

In March, we made the strategic decision to pivot from a regional to a centralized business model and restructure Li-Cycle to become more efficient. This decision is expected to result in approximately $10 million in annual cost savings through workforce reductions. Additionally, we are actively working with certain contractors and suppliers in our Rochester hub to enter into agreements to extend payment cycles.

sauce: First quarter earnings report.

Meanwhile, optimizing the spoke network should also reduce cost of sales significantly. As of Q1, LICY’s cost of sales was still 4x revenue and the main driver of its declining profitability. This indicates that there is still a lot of room for cost improvement. In Q1, cost of sales was already down -2.3%, but in my opinion it was only a marginal improvement.

danger

I believe LICY remains a very high-risk opportunity. With current liquidity of just $109 million, LICY will need to be successful in all of its major fundraising efforts. The company recently announced the appointment of a new interim CFO, which should help improve the situation, but the outlook remains unclear in my view.

Assuming LICY maintains its quarterly OCF burn at -$29 million, similar to Q1, LICY will run out of cash before the end of fiscal 2024. The best-case scenario would still involve headcount reductions, which would reduce quarterly burn but could impact performance.

At this time, the main opportunity for LICY to maintain the same cost structure and performance while surviving through fiscal 2024 is the U.S. Financing Office. While the loan program’s $375 million limit is certainly attractive, successful acquisition of this loan will also depend on LICY’s overall execution in closing deals under its relatively new CFO. To me, this is the main risk factor for LICY today.

Rating/Pricing

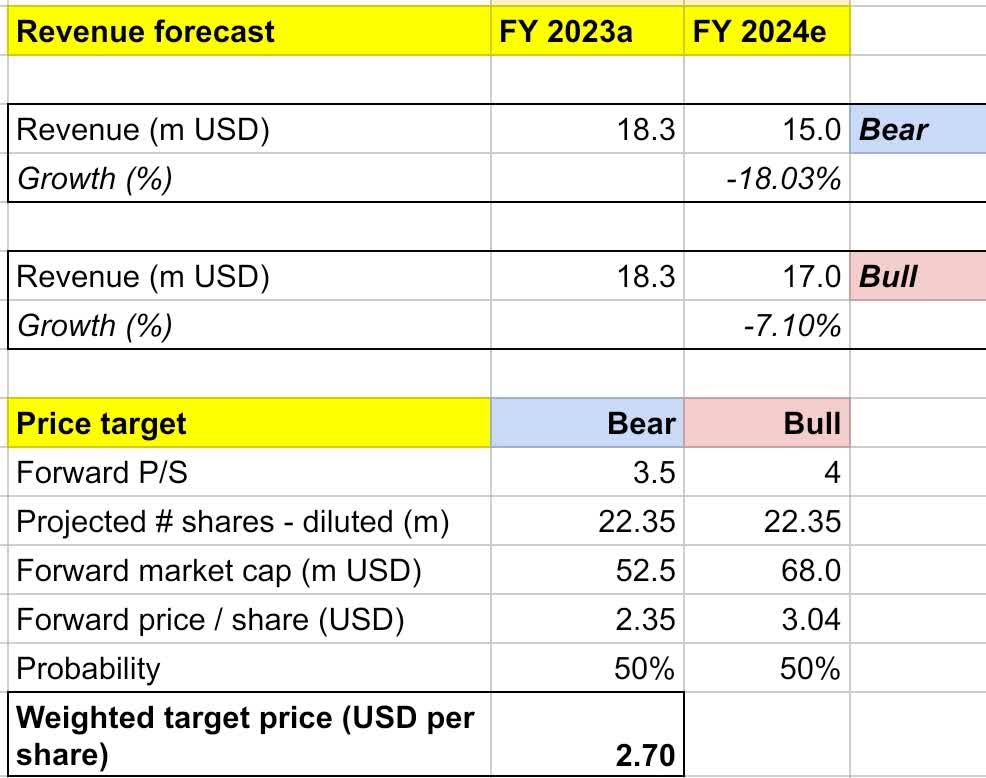

My price target for LICY is based on the following assumptions for bull and bear scenarios for the FY2024 forecast.

Assuming a bullish scenario (50% probability) – Revenues will decrease 7% year over year to $17 million, Market EstimationAssuming the stock remains at current price levels, we assume a forward P/S expansion of 4x.

Assuming a bearish scenario (50% probability) – LICY will post revenues of $15 million in FY2024, down 18% YoY and $2 million below market expectations. We assume the P/S will shrink slightly to 3.5x and the stock price will fall to the $2 level.

Original Analysis (Original Analysis)

Integrating all of the above information into my model, I arrive at a weighted target price of $2.7 per share for fiscal 2024, projecting a one-year downside of approximately -10%. I rate the stock Neutral.

My 50/50 bullish/bearish odds are based on my belief that LICY’s outlook is highly uncertain and it is relatively difficult to properly value LICY at present. At this point, I believe existing holders should continue to monitor LICY’s progress in reducing operational costs beyond the second quarter and securing a U.S. Treasury loan. This is the most critical activity in the fiscal year to ensure that LICY has sufficient room to not only survive but also improve its financial stability. If LICY does not show sufficient progress in these areas, I believe existing holders may need to consider selling their positions and new investors should distance themselves from the stock. That said, conversely, if LICY begins to show signs of success in these areas, it could spur a recovery in the stock price.

Conclusion

LICY is a company that operates in the battery recycling industry. Despite reaching the commercialization stage, the cost of delivering its key products remains very high, resulting in unprofitable and negative OCF outlook, and a high reliance on fundraising cash flows to sustain the entire business. In FY24, LICY’s external fundraising efforts, such as the US State Department loan application, will be key catalysts alongside operational cost improvements to reduce cash burn and narrow losses. LICY remains a very risky opportunity right now, but early signs of success for its two major fundraising efforts could restore a bit of confidence that could drive a rebound in the stock price. My target price model suggests that LICY could realize a decline of about -10% over the course of a year. This means the company remains in survival mode and may not be an investment opportunity in the near term until further progress updates in Q2 at the earliest. I rate the stock Neutral.