Abstract Aerial Art

Oil market in deficit for the rest of 2024

Oil prices have been relatively range bound throughout May but have recently come under pressure. Signs of a decline in oil prices are growing. The crude oil market has halted any significant gains in crude oil prices as refineries have begun to reduce run rates due to declining refinery margins, but recent weakness in crude oil timespreads suggests there are few concerns about near-term supply.

Falling oil prices are a concern for OPEC+, so the group’s decision at its June 2 meeting was not surprising. Extending additional voluntary supply cuts The cuts of 2.2 million barrels per day will continue until the end of September 2024. Member countries will then phase out the cuts between October and September 2025. Meanwhile, the group as a whole is scheduled to cut production by 2 million barrels per day. Production cuts that were due to expire at the end of 2024 have been extended until the end of next year. Voluntary production cuts of 1.66 million barrels per day, which have been in place since May 2023, will likewise be extended until the end of 2025.

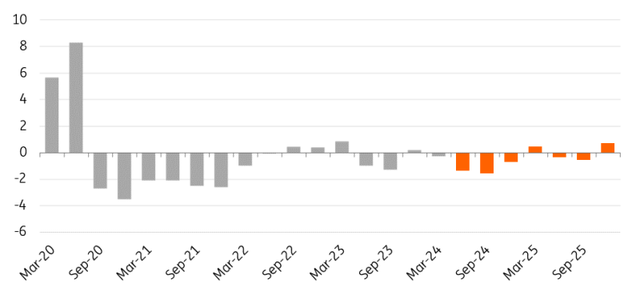

The actions taken by OPEC+ will keep the market undersupplied for the rest of the year, which should support oil prices during the peak summer demand period.

However, oil prices are expected to fall from their peak in the third quarter of this year through 2025, and the market is likely to return to a small surplus as OPEC+ gradually brings supply back into the market. OPEC+ may hold off on lifting the production cuts if market conditions do not allow for additional supply. In the longer term, however, the size of the group’s production cuts could be an issue. Member countries are likely to be unhappy with holding so much oil off the market and ceding market share to non-OPEC+ producers.

The oil market will be in short supply through 2024, but is expected to recover to a surplus in 2025 (mb/d).

Supply worries boost natural gas demand in Europe

European natural gas prices have risen significantly in the last month, with TTF rising nearly 18% in May and prices exceeding EUR34/MWh, as some supply concerns have boosted the market.

First, ongoing summer maintenance in Norway has reduced flows from Norway to Europe, with average daily flows down 8% in May compared to the previous month. More recently, an unplanned outage in Norway due to a pipeline crack has further reduced pipeline flows, adding to supply concerns and increasing volatility.

Second, LNG demand in Asia has been strong so far this year. LNG imports in the first five months of 2024 were up 11% year-on-year. The rise in demand is due to rising temperatures across much of Asia, and price-sensitive buyers are returning to the LNG market in the region, with spot prices falling from the highs seen in 2022 and 2023.

And concerns remain about the remaining pipelines from Russia to the EU, particularly Austria. Austrian oil and gas company OMV (OTCPK:OMVJF, OTCPK:OMVKY) is Gazprom (OTCPK:GZPFYAustria will halt LNG deliveries to the country following a ruling that could halt payments for gas supplies to Gazprom. If the ruling is enforced, Gazprom will likely halt supplies. OMV has long-term contracts with Gazprom for around 6 billion cubic meters per year. However, a disruption to this supply should be manageable in Austria and across Europe. Moreover, significant new LNG supply capacities are due to come on stream from late 2024 onwards, mainly from the US.

There is also a strong possibility that the pipeline transporting goods from Russia to the EU via Ukraine will be shut down at the end of this year. Ukraine has made it clear that it does not intend to extend its transit contract with Gazprom. This would mean the loss of around 15 billion cubic metres of gas, about 5% of total EU imports. Gazprom may be able to divert some marginal flows via TurkStream, but Europe will have to look for alternative sources of supply. This potential loss of supply has gone from being a risk for the market to one that is probably largely expected.

Despite numerous concerns, storage in Europe is on track to be 100% full ahead of the 2024/25 heating season. It is already over 71% full, well above the five-year average of 59% and slightly above last year’s level of 70%. As a result, we continue to expect European gas prices to fall through the third quarter of the year.

Copper hits record level

Metals stood out in May, driving the broader stock market rally. Copper prices rose more than 10% last month to reach an all-time high of over $11,000 a tonne, but have since given up much of the gains. The rise in copper prices was driven by bullish speculators worried about a mining supply shortage at a time when the energy transition is expected to boost demand. Additionally, several supportive measures announced last month for China’s real estate sector added fuel to the rally.

However, while copper’s long-term outlook remains positive, near-term fundamentals remain a concern, particularly in China. Copper inventories stored in Shanghai Futures Exchange (SHFE) warehouses are at seasonal record highs. China’s refined copper import premium is negative, and domestic refined copper production continues to grow year-on-year despite a significant decline in smelter processing costs.

Moreover, LME copper inventories have increased by more than 15% since mid-May, while the three-month physical spread remains significantly in line and not far from recent record lows, suggesting there are few concerns about refined copper supplies in the near term.

Content Disclaimer

This publication has been prepared by ING for informational purposes only, without regard to the assets, financial situation or investment objectives of any particular user. This information does not constitute an investment recommendation, nor does it constitute investment, legal or tax advice or an offer or solicitation to buy or sell any financial instrument. read more