FG Trade Latin

Investment Thesis

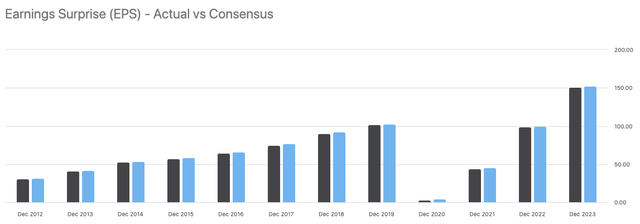

Booking Holdings (Nasdaq:backThe travel giant, which owns Booking.com, Priceline and Kayak,Q1 2024Revenues rose 17% year over year to $4.4 billion, beating analyst expectations, and earnings per share (EPS) also increased significantly to $20.39 from $7.07 in the same period last year. Q1 2023. Total travel bookings reached $43.5 billion, up 10%. Room bookings increased 9% year over year. The company also Cash Dividends $8.75.

Seeking Alpha

This was a strong earnings report, and Booking’s shares rose more than 9% in after-hours trading following the report’s release. Earnings Report Booking’s CEO said the company is experiencing strong growth in “high frequency” users and increased loyalty program enrollments. The company is optimistic about continued demand for travel, especially during the summer. Airline bookings recorded a significant 33% increase year-over-year.

we We are seeing encouraging behavior from our Genius Level 2 and 3 travelers, including higher frequency and rates of direct bookings compared to our overall business.

Besides the positive outcomes, it is important to consider some risks: Reservations are facing increasing difficulties. Regulatory Oversight in EuropeToday, regulators are calling the company a “gatekeeper” and have launched an investigation into potential anti-competitive behavior. I don’t think this will impact revenue, and regulatory scrutiny is usually reserved for larger companies like Booking.

another articleI recently took a look at Booking.com’s second-closest rival, Expedia (experienceAlthough the number of bookings exceeded expectations, Expedia in particular Total booking amount Because of their platform. I think Booking is taking market share from Expedia.

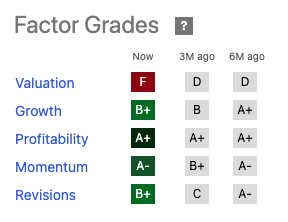

The stock price soared after Q1 2024 bookings beat analyst expectations. I believe the company’s leadership and focus on direct bookings, supplier partnerships, and innovation, especially generative AI for customer experience, could lead to further growth in the future. The company is also a strong contender for my Growth at a Fair Price (GARP) strategy. However, as you will read later, I believe the stock is fairly or overvalued at the moment. Furthermore, while the company’s leadership and financial resources allow for long-term growth, the all-time high stock price calls for a conservative approach.

So, taking all these factors into account, I am initiating coverage as a buyer of the stock in a bear market with a “cautious buy”.

Management Evaluation

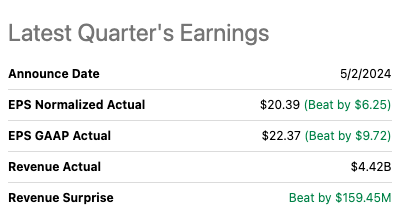

Glenn FogelThe CEO of Booking Holdings, he has been with the company for 24 years. He has overseen Booking’s growth strategy, including major acquisitions, and now leads the company’s global operations. Employees seem to value his leadership, which is reflected in his high Glassdoor rating. Interestingly, most of his compensation is paid in stock options, aligning his financial success with the company’s long-term performance. This compensation structure suggests a strong focus on Booking’s future success, but it also makes him one of the highest-paid CEOs in the industry.

Salary.com

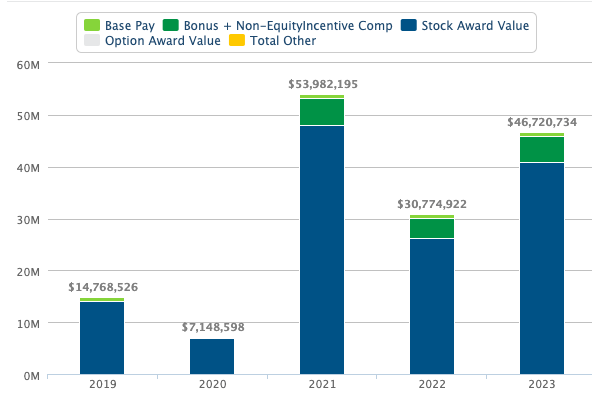

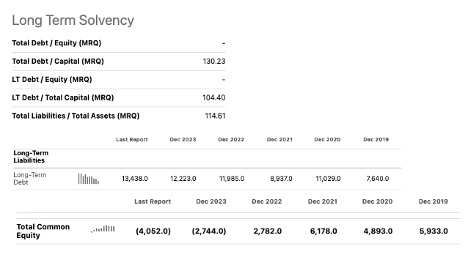

Eau de Steenbergen He took over as CFO of Booking Holdings, taking over a company with complicated financial situations. Booking is buying back its own shares, which are funded by debt issuance, putting pressure on free cash flow (FCF). While I don’t think this method of buying back its own shares is necessarily a negative thing as a one-time event to show confidence in the company’s future, it is concerning as the company’s debt has been steadily increasing since the pandemic and it is now in a negative equity position.

I believe that every dollar spent on interest payments is a dollar that cannot be used for growth initiatives. Steenburgen needs to navigate this effectively to ensure Booking maintains its financial health and drives future success.

Now, on to our cash and liquidity position. We ended the first quarter with $16.4 billion in cash and investments, up from $13.1 billion at the end of the fourth quarter. This was driven by our $3.0 billion debt issuance in the first quarter and $2.6 billion in free cash flow generated in the quarter. This was partially offset by $1.9 billion in capital returns, including share repurchases and dividends, initiated during the quarter, and an additional $315 million in share repurchases to satisfy employee withholding tax obligations.

Seeking Alpha

Overall, I think Booking is a mixed bag. CEO Glen Fogel has had a stellar career, including strategic acquisitions and strong employee morale. His stock-heavy compensation aligns his interests with long-term success, making him the highest-paid CEO in the industry. But the company’s financials require monitoring. New CFO Ewout inherits a company that has seen debt-financed buybacks reduce FCF and put equity in negative territory, limiting resources for growth. Additionally, the company also began paying a dividend this year, which is a sign that management has not found other avenues for growth, so I’m grading it positively for now. Taking all factors into account, I give management a “Meets Expectations” rating. Fogel’s leadership is solid, but future growth plans outside of share buybacks are key.

Glass Door

Corporate Strategy

Booking is a leader in the Online Travel Agency (OTA) market by offering a huge selection of flexible accommodations, from budget-friendly options to luxury stays, catering to a wide range of traveller needs. It further strengthens its market position by offering flexible booking options and rewarding repeat customers.

The company is constantly growing by expanding into new markets and acquiring complementary businesses to broaden its service offering beyond accommodations. Additionally, the company is prioritizing investments in technologies such as AI and machine learning to help users plan their vacations, optimize search results and personalize the user experience.

In a previous article, I created a table comparing Booking’s current strategy with some of its current competitors. here But I will update it and add it here:

Expedia(experience) | Booking Holdings (back) | Airbnb (ABNB) | Trip.com (TCOM) | |

Market share (hotel reservations) | 15% | 27% | 13% | Ten% |

Corporate Strategy | It focuses on bundled travel packages and brand diversification. | Active in direct bookings and partnering with suppliers, focusing on enhancing loyalty programs with AI, a one-stop shop for all your travel needs. | Disrupting traditional hospitality with a unique stay and expanding it into an experience | We are focusing on the Asia Pacific market, growing our mobile presence and expanding our vacation rentals. |

Competitive Advantage | Extensive network of travel suppliers, brand recognition and loyalty programs (OneKey) | Largest online accommodation marketplace. Strong mobile presence. Efficient marketing. Solid financial position. | Unique Accommodation Options and a Growing Experience Marketplace | Strong brand recognition in Asia, competitive pricing and focus on mobile users. |

Sources: Company websites, presentations, SeekingAlpha

market share: Statista (2023)

There are several key factors that differentiate Booking from its competitors: Compared to Expedia, Booking boasts a wider range of flexible accommodations, especially in non-Western markets. While Airbnb offers unique lodging options, Booking caters to those looking for a standardized hotel experience. Finally, compared to Asia-focused Trip.com, Booking has a clear advantage in terms of user experience and global reach.

However, Booking also faces several challenges. Its reliance on commissions from accommodation providers could limit its profit margins if rates fall. Additionally, its focus on hotels may not be attractive to travelers looking for unique experiences. Finally, strict regulations in some regions could hinder Booking’s operations and data collection.

evaluation

Booking is currently trading at around $3,800, closing at a record high since last reporting earnings in early May.

To assess its value, I have adopted a discount rate of 11%, which reflects the minimum rate of return that investors would expect on their investment. Here, I have used a risk-free rate of 5%, combined with the additional risk premium of holding equities over a risk-free investment, and have used a risk premium of 6%. This can be further adjusted and could be lower or higher, but I am only using this as a starting point to get an unbiased indication of market expectations.

Next, using a simple 10-year two-stage DCF model, I inverted the equation and solved for the high growth rate, which is the growth in the first stage.

To accomplish this, I assumed a 4% terminal growth rate in the second stage. Growth 10 years into the future is difficult to predict, but in my experience, for mature companies, a 4% growth rate reflects a more sustainable long-term trajectory that is closer to historical GDP growth rates. Again, these assumptions can be higher or lower, but my experience has led me to feel comfortable using a 4% growth rate as a base scenario. The formula I used is:

$3,800 = (Total^10 FCF (1 + “X”) / 1+r)) + TV (Total^10 FCF (1+g) / (1+r))

Solving g = 14%

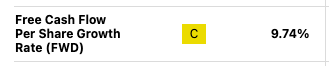

This suggests that the market currently values BKNG FCF growth at 14%, while the Seeking Alpha analyst consensus predicts FCF will grow at a rate of 9.74%.

Seeking Alpha

Therefore, I believe BKNG is overvalued at the moment. However, it is important to note that the company is issuing debt to artificially buy back shares, which is impacting FCF growth. I am a buyer on the weakness as I believe the company has a competitive advantage and will maintain its leadership in the OTA industry.

Technical Analysis

BKNG has risen about 10% since its last reported earnings in early May. The RSI appears to be stabilizing around 56, above its 14-day average of 49, and is continuing to trend upwards, suggesting the stock may continue to rise. BKNG’s all-time high is around $3,904, which is about 2% up from current levels. Momentum is positive, according to SeekingAlpha.

Seeking Alpha

I believe BKNG will reach all-time highs due to positive momentum, but will remain neutral once it gets there, hovering around the $4,100 to $3,700 range. Based on management’s ability to generate excess EPS over time, I believe FCF will improve faster than expected, so I would buy the stock in a bear market despite the current challenges.

Next earnings are on August 5th

remove

Booking impressed with a strong Q1 that beat analyst expectations. The company has a solid track record led by an experienced CEO with high employee satisfaction, but I am a bit cautious. The company is poised for future growth and appears to be taking market share from competitors. However, the stock price has hit an all-time high and it recently started paying a dividend, but FCF is declining due to debt-financed share buybacks. Overall, while the stock appears to be overpriced, Booking is a leader with solid fundamentals. So, despite mixed stock signals, I would start buying cautiously, especially on the bearish side.