Vivek Vishwakarma

Net worth is a good measure of wealth, but it shouldn’t be used as the only measure because, just like when valuing a company, free cash flow generation is another way to measure a household’s financial flexibility.

The freedom to do what you like without selling your principal comes down to free cash flow from truly passive investments that incur expenses, such as dividend-paying stocks and bonds.

That’s why I favor a balanced approach when it comes to investing, ideally a mix of both high and medium dividend stocks, with a balance of uncorrelated risk and cash flows that allow investors to protect their net worth while also enjoying a meaningful income stream.

This is what I The next two stocks are a high-yielding stock across a diversified investment landscape, and one backed by quality assets with reasonable yields. Let’s explore why each is a “buy” right now for a balanced, cash-flow-driven portfolio. Let’s get started.

1st place: Crescent Capital

Crescent Capital (C.C.A.P.) is an externally managed BDC that provides direct lending to mid-market businesses. As the market continues to shift from traditional banking to BDC lending, CCAP works with private equity-backed companies.

Currently, CCAP’s portfolio has a fair value of $1.56 billion and is diversified across 183 companies. Most of the interest-bearing investments (98%) are floating rate, helping to boost CCAP’s NII in the current high interest rate environment.

The firm’s portfolio is well diversified, with 84% of the portfolio value invested in non-cyclical industries. CCAP is one of the few BDCs with international exposure, with 11% of its investments outside the U.S., 8% in Europe, 2% in Australia and New Zealand, and 1% in Canada. As shown below, healthcare, software, business and consumer services, and insurance make up CCAP’s top five segments, accounting for just over three-quarters (76%) of the total portfolio.

CCAP has demonstrated strong performance in the current environment, with the weighted average yield on income-producing assets increasing 50 basis points year-over-year to 12.3% in 1Q24, as shown below.

Additionally, CCAP’s NII per share increased 2 cents quarter-over-quarter and $0.09 year-over-year. $0.63This represents a high NII-to-dividend coverage ratio of 1.50x, or 1.19x if you include the $0.11 special dividend.

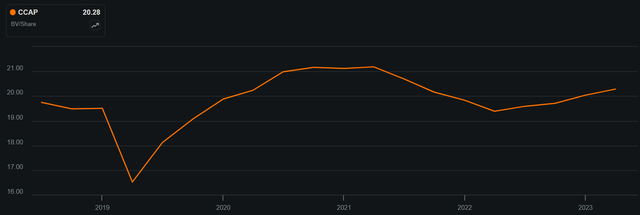

Additionally, CCAP’s net asset value per share increased 1.1% sequentially and 4.6% year over year to $20.28. Accrued interest also remained at a low level. 0.9% Portfolio Fair Value.As shown below, CCAP’s NAV/share has recovered strongly since 2022, when the initial impact of rising interest rates caused mark-to-market valuations to decline.

CCAP NAV/Share (Seeking Alpha)

CCAP is expected to see a rebound in deal activity this year, as rising interest rates kept many private equity players on the sidelines last year. As shown below, the amount of dry powder currently available to invest is at a record high and far exceeds the amount of venture debt being financed by BDCs such as CCAP.

CCAP has total liquidity of $372 million and is well positioned to raise capital as opportunities arise, and its debt-to-equity ratio was 1.11x, down from 1.15x last quarter and well below the statutory limit of 2.0x.

CCAP is currently attractively priced at $18.66, which equates to a price to NAV ratio of 0.92x. This compares favorably to a time when many of the larger BDCs are trading at a premium to their NAV. As shown below, Ares Capital (ARCC) is trading at a 9% premium to NAV, while Blue Owl Capital Corp. (OBDC) and Golub Capital (GBDC) is trading at a 6% premium. With a dividend yield of 8.7%, 8% below NAV and solid portfolio fundamentals, CCAP is an undervalued gem in the BDC space.

CCAP v. Peers P/Book (Seeking Alpha)

2. Federal Realty Trust

Federal Realty Trust (FRT) is one of the oldest REITs on the market today, with a track record of growing dividends for over 50 years. It owns high-quality shopping centers in Tier 1 markets, as shown below.

FRT’s properties are strategically located within these markets. As shown below, the company’s properties have the highest population density and median household income within a three-mile radius compared to larger peers such as Regency Centers:Registration) and Kimco Realty (KimThis allows FRT to have more pricing power when it comes to highly popular locations.

Meanwhile, FRT demonstrated strong portfolio fundamentals, with same property operating income increasing 3.8% year over year in the first quarter of 2024. This was driven by record transaction volume in the first quarter with 104 leases signed across 567,000 square feet of space, and cash-based lease spreads of 9%.

The portfolio was leasing at 94.3% and, importantly, small retail occupancy, which drives rent growth per square foot, increased 70 basis points quarter-on-quarter and 140 basis points year-on-year to 91.4%.

The management team: $6.77 Full year 2024 FFO per share is at the midpoint of the full year 2024 range, which represents a 3.3% increase in full year 2024 FFO per share. $6.55 FFO per share is expected to be accretive in 2023. Potential upside to management’s guidance could come from opportunistic, revenue-accretive acquisition opportunities, as discussed in the recent CEO speech. Conference call:

We are looking for shopping centers that will generate immediate revenue accretion based on a cost of capital advantage, but more importantly, revenue that significantly exceeds our long-term cost of capital. We are looking for shopping centers that we can immediately fund through a combination of the sale of other assets and our largely unused $1.25 billion credit facility, and then refinance over the longer term. We are currently beginning the due diligence process on one such large asset and have a growing pipeline of other assets.

Importantly, FRT maintains a BBB+ credit rating from S&P and has $1.3 billion in liquidity assets in the form of unused capacity in its revolving credit facility and cash on hand. Additionally, 86% of FRT’s debt is held at fixed interest rates, giving it a relatively safe net debt-to-EBITDA ratio of 6.0x, with management targeting a mid-5x ratio over the long term.

This supports a dividend yield of 4.3%. 64% The dividend payout ratio leaves enough capital left over to pay down debt and fund external growth.

FRT is quite attractive at its current price of $102 and a forward P/FFO of 15.0, well below the historical P/FFO of 21.2, as shown below.

FRT is significantly more expensive than Kimco Realty’s 12.0 P/FFO but only slightly more expensive than Regency Centers’ 14.7 P/FFO. I like KIM for its cheapness and Regency Centers for its expensive grocery store-anchored property exposure, but FRT is the clear leader in the shopping center space with its 56-year streak of consecutive dividend increases (the longest in the REIT industry) and high-quality property portfolio.

Investor View

Crescent Capital and Federal Realty Trust are a solid combination for a diversified, income-focused portfolio, and CCAP is a well-managed BDC that benefits from rising interest rates and a strong financial base, providing middle market companies with diversification and high yields through a primarily floating rate loan portfolio.

Meanwhile, FRT operates high quality shopping centres strategically located in affluent and densely populated areas, delivering stability and consistent growth supported by a long history of dividend growth and a strong financial position. CCAP and FRT have a balanced approach to generating high and stable cash flows, supported by strong asset quality and diversified risk exposure.