PayPal is one of the largest online payment systems, with over 400 million active users worldwide, and it’s also a popular option among online merchants for receiving payments.

Like any other payment system, businesses need to factor transaction fees into their product pricing and operational costs. Below we explain how PayPal fees are calculated, what fees PayPal takes, and how PayPal fees work. Shopify Payments.

What are PayPal fees?

PayPal fees are the costs incurred when using the PayPal platform to process payments and send or receive money. Fees are applied as a percentage of the transaction amount or a flat rate, depending on how you send or receive money. Not all types of PayPal transactions incur fees.

Why does PayPal charge fees?

Most of the fees charged by PayPal are levied on merchants who use its platform. In these cases, PayPal serves as a payment gateway to the merchants, helping their customers enjoy a smooth payment experience. Checkout Experience.

Any other fees charged by PayPal are incurred to cover operating costs and generate profits. PayPal does not charge fees for consumer-to-consumer transfers.

How PayPal fees are calculated

Consumers who buy goods and services in the U.S. don’t have to pay fees to use PayPal, but PayPal charges fees when buying and selling cryptocurrency, sending money internationally, or transferring money from a credit card.

Merchants who sell goods and services via PayPal You need to pay a feeYou will be charged a percentage of the transaction amount plus a fixed commission.

PayPal fees vary based on the type of transaction, currency, and location. If PayPal charges a fee, your invoice will include a breakdown of the cost.

PayPal Fees Calculator

Instead of relying on your own calculations, you can use a PayPal fees calculator. There are many free tools available, such as:

- NerdWallet PayPal Fee Calculator. Estimate the cost to perform digital checkout, in-person Zettle POS, or standard debit and credit card payments.

- Fee calculator. Use this calculator to compare PayPal and Stripe fees.

- Visit SaleCalc.com. Check the fees for various third-party marketplaces, including different types of PayPal transactions.

- A clever PayPal fees calculator. It is tailored for merchants based anywhere in the world who sell to customers around the world.

What are PayPal’s fees?

It’s free for consumers to use PayPal to donate, pay for purchases, or send money domestically, but the platform does charge fees for consumers who make international transfers, credit card transfers, or purchase cryptocurrencies.

For businesses, PayPal charges a percentage of the transaction amount and often a fixed fee.

Here’s a detailed breakdown of the fees PayPal charges consumers and merchants:

PayPal Merchant Fees

Merchants are charged a fee when a customer purchases a product using PayPal’s payment page, POS device, or payment gateway.

Credit and debit card fees

Add PayPal button When customers visit your online store, they are taken to the PayPal payment page and make purchases using their credit or debit card. For these transactions, PayPal 2.99% of transaction amount plus $0.49 fee.

For example, if a customer pays $50, you will incur a fee of $1.99 ($1.50 + $0.49). Make sure you take this into account. Product Price Make a strategy so you don’t miss out on any profits.

Online Checkout Fee

When a customer uses PayPal to purchase an item directly through your website’s checkout (without being redirected to a PayPal payment page), PayPal 3.49% of transaction amount plus $0.49 fee.

POS Fee

Transactions using PayPal face-to-face payment Point of Sale (POS) Systems Prices 2.29% of transaction amount plus $0.09 fee.

Payflow Fee

Payflow PayPal Options Payment Gatewayallowing retailers to build custom checkouts. For sales made through Payflow, PayPal charges a fee of $0.10 per transaction.

The service also has monthly fees: $30 for Payflow Pro, $10 for recurring billing, and $10 for additional fraud prevention services.

Chargeback

Chargeback fees are $20 Instances For US-based merchants, dispute fees are $15 per dispute, or $30 for high volume disputes.

International Fees

If you receive payments from outside the United States, PayPal charges regular domestic transaction fees. Plus 1.5%.

Additionally, there is a fixed international transaction fee that varies by currency.

- USD: $0.49

- Euro: €0.39

- British Pound: £0.39

- Australian Dollar: $0.59

- Singapore Dollar: SGD 40

Other merchant fees

PayPal offers a variety of products to help merchants collect payments, each with their own transaction fees.

- Paying bills: 2.99% + $0.49

- QR Code Trading: 2.29% + $0.09

- Pay with Venmo: 3.49% + $0.49

- Campaign rates and store cash transactions: 8%

- Micropayments ( BNPL business): 4.99% + $0.09

See the full list here Merchant fees associated with all PayPal products and services.

PayPal Consumer Fees

Consumers are charged a fee if they use PayPal for anything other than domestic purchases or sending money to friends and family.

Purchasing products

There are no fees when you use PayPal to pay for in-store or online purchases, unless you convert the currency.

money transfer

There are no fees when you send money from your PayPal balance or bank account to friends and family domestically.

However, if you use a credit card to send money, 2.9% of transaction amount plus a fixed fee of $0.30.

Sending money overseas without converting the currency 5% transaction fee up to $4.99This does not include any additional charges when using a credit card.

Buy, sell and transfer cryptocurrencies

PayPal charges fees for buying and selling cryptocurrency based on the USD value of the purchase or sale.

Different fees apply PYUSDPayPal’s cryptocurrency stablecoin. Converting between $250 and $1,000 worth of PYUSD to or from other cryptocurrencies incurs a fee of 1.75%. For amounts over $1,000, the fee drops to 1.45%.

There are no fees for holding cryptocurrency in your PayPal account, receiving cryptocurrency transfers, or sending cryptocurrency to another PayPal or Venmo account.

Currency Conversion Fee

If you use PayPal to buy or send items in a different currency, Converted If you receive in a different currency there is a 4% transaction fee and the transaction exchange rate includes a currency conversion spread.

PayPal also reserves the right to charge other amounts as conversion fees, in which case PayPal will notify you during the transaction.

See the full list here PayPal Consumer Fees.

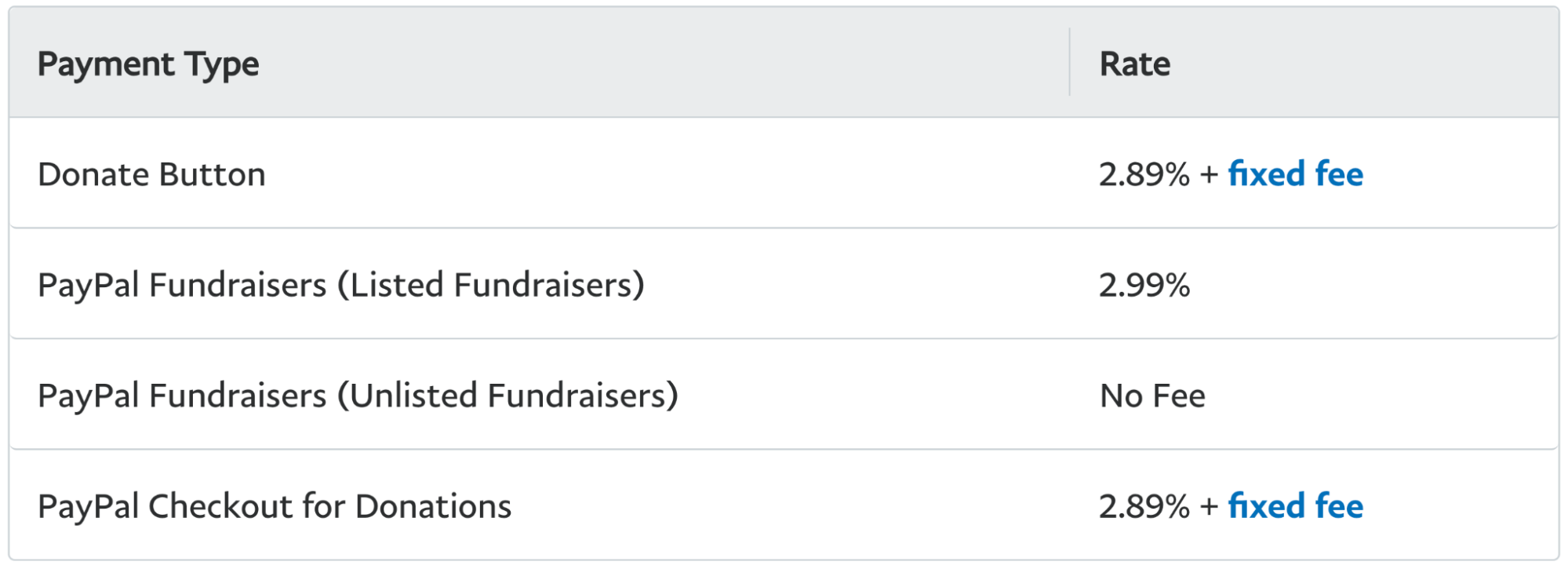

PayPal Donation Fees

PayPal charges consumers and businesses the same fees for sending and receiving donations through its platform.

There are no fees for domestic and international donation transfers. When you receive a donation, PayPal will take the following amounts depending on how you receive your donation (e.g. via PayPal): Donation button):

How PayPal fees work with Shopify Payments

PayPal Express is a payment gateway for Shopify merchants that can be easily integrated into your store. Open a Shopify storeShopify will create a PayPal Express Checkout account for you using the email address associated with your Shopify account.

If you already have a PayPal account with that email address, you can receive your PayPal order immediately. If not, Complete your PayPal account setup.

Merchants who use Shopify Payments with PayPal Express only pay the fees of the payment gateway their customers use to checkout (they won’t be charged twice).

To learn more about using PayPal checkout with your Shopify store, see: Help documentation or Contact Support.

How do PayPal’s fees compare to other payment gateways?

Merchant transaction fees charged by other popular online payment gateways include:

Shopify fees

Shopify Payments is the native payment gateway for Shopify stores. With Shopify Payments, you’re automatically set up to accept all major payment methods as soon as you create your store.

Shopify charges a 2% to 3% fee plus a $0.30 processing fee for all domestic transactions processed using Shopify Payments. The fee amount is: Shopify plansthe type of credit card used, and whether the transaction took place online or in person.

There is No third-party fees Orders processed through Shopify Payments, Shop Pay, Shop Pay Installments, and PayPal Express by Shopify, including cash payments and bank transfers.

Stripe Fees

of Standard Card Fees Merchants who use Stripe pay a 2.9% processing fee plus a $0.30 fee for each successful transaction, but beyond this, Stripe has a range of fees for different products and payment methods.

Square Fees

Square Merchant Fees These include a 2.9% plus $0.30 fee for online transactions, a 2.6% plus $0.10 fee for in-person transactions using a POS, and a 3.3% plus $0.30 fee for invoices.

Venmo Fees

Venmo Payment If you send money to a business, you’ll be charged 1.9% plus a $0.10 fee. If you pay with contactless Venmo using Tap to Pay on your iPhone or Android, the seller’s transaction fee is 2.29% plus$0.10.

PayPal payments

If you don’t support your shoppers’ preferred payment options, you risk losing them to competitors that do. It’s your responsibility as a merchant to take PayPal fees into account when pricing your products to ensure profitability. Shopify users can create a simple and smooth PayPal integration to help customers complete their purchases.

Disclaimer: Prices stated in this article are accurate at the time of publication but are subject to change.

PayPal Fees FAQ

PayPal charges merchants two main transaction fees: For transactions made using a credit or debit card on the PayPal website, PayPal charges 2.99% plus $0.49 per transaction. For transactions made through online checkout on the merchant’s website, PayPal charges 3.49% plus $0.49 per transaction.

How can I avoid PayPal fees?

There is no way for small businesses to avoid PayPal fees without violating PayPal’s user agreement.

Why does PayPal charge fees?

PayPal charges merchants a fee for using its platform. PayPal is a for-profit company, so it aims to make a profit after paying all its operating costs. PayPal does not charge fees for sending money between consumers.

How much are the fees for a PayPal account?

PayPal doesn’t charge a fee for opening a business account, but it does charge fees for certain business transactions, such as receiving payments for purchases, sending money internationally, transferring funds by credit card, and converting currencies. You can view the specific fees in the Activity section of your PayPal account.