Olena_T/E+ via Getty Images

Investment thesis

Prologis (NYSE:PLD) is the biggest industrial REIT in the world. Its share price has recently dropped significantly, leaving the Company undervalued. That was a result of some headwinds surrounding the industrial property sector, which I believe to be temporary as there are signs indicating the upcoming market shift leading into an increasingly favorable supply-to-demand relationship.

On top of that, PLD:

- has a fortress-like balance sheet

- owns a high-quality, well-located property portfolio with a mission-critical character to its tenants

- has clearly defined pillars of its further growth

- has a robust development pipeline and impressive land bank

- provides a coherent and accurate outlook on the market environment

- remains capable of growing rents despite a high market vacancy rate

While the sector is facing some challenges, there is potential for attractive investment opportunities to emerge. I believe that to be the case for PLD, which currently offers one of the best risk-to-reward ratios within a highly attractive sector.

I am bullish on PLD and give it a “strong-buy” rating due to its potential for double-digit total returns resulting from multiple appreciation, growing dividends, and comprehensive growth prospects.

Introduction

Prologis crashed recently

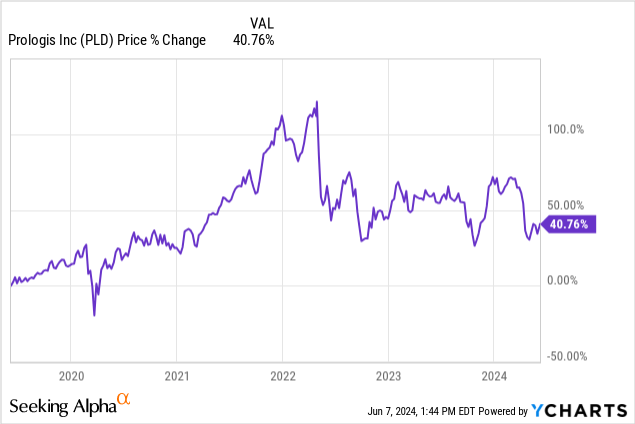

Looking at the 5 years price movement of PLD, the Company saw strong share price growth supported by a post-pandemic demand surge regarding industrial properties. With an attractive supply-to-demand relationship, investors favored PLD due to its strong negotiating position and great growth prospects. However, the market sentiment changed in 2022 with some initial FED interest rate increases and some shifts occurring in the supply-to-demand prospects.

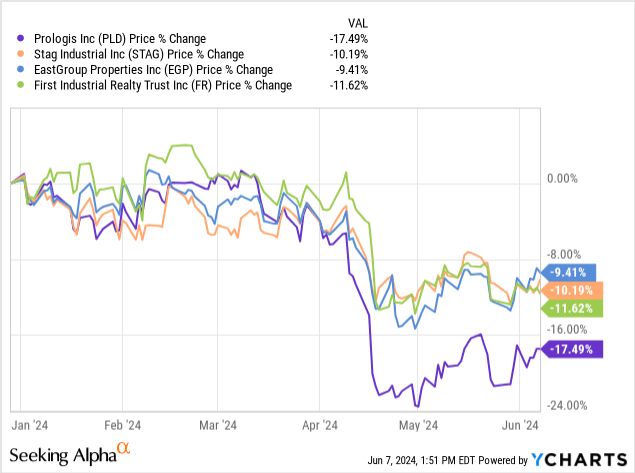

Zooming into the 2024, PLD’s stock went down ~17.5% YTD. It has not been abandoned by some other industrial property REITs, which also faced a negative market sentiment resulting from headwinds surrounding their sector, however, PLD’s stock was the worst-performing one out of the selected entities.

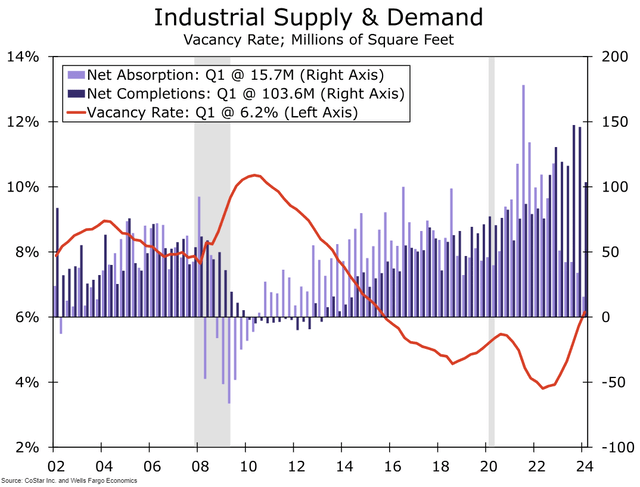

The industrial property sector is facing some headwinds

The industrial property sector has been supported by the post-pandemic demand surge until ~ mid-2022, however, until then the market conditions have been shifting to more and more difficult. Outstandingly high net completions observed during the 2022 – 2023 period, combined with the high-interest rate environment drove the vacancy rate to a high 6.2% level, which has not been observed since 2015 – as indicated within the Wells Fargo report. The net completions remain high with Q1 2024 marking a 7th consecutive quarter with the metric exceeding 100m sq. ft. The net absorption of industrial properties has declined significantly during the recent quarters, which indicates a weakening of the sector, and reached 15.7m sq. ft. – the lowest level observed since 2012, which further emphasizes the sector’s slowdown.

CoStar Inc. and Wells Fargo Economics

The recent PLD’s stock plunge and overall higher volatility is a result of the prolonging of the negative market environment, which the Company’s CFO, Tim Arndt, commented during the Q1 2024 Earnings Call:

That said, as we evaluate the market, persistent inflation and high interest rates have kept more customers focused on controlling costs. The resulting delay in decision making, easily observed through the first quarter’s below average net absorption, will translate to lower leasing volume within the year.

(…)

Net absorption in the US, for example, was very low this quarter at just 27 million square feet. So while the macro landscape and supply chains continue to generate a need for space, we think it’s prudent to expect continued headwinds on overall absorption over the next few quarters.

The interest rate environment and its associated volatility have weighed on customer decision making, especially as the 10 year has increased 70 basis points from its level just 90 days ago and expectations for Fed rate cuts have moved from potentially six to now possibly zero.

Now, after establishing some background on PLD’s recent crash and the overall sector headwinds, let’s move on to the reasoning behind my bullish view of PLD.

Four reasons why PLD is a buy

#1 There are signs of the upcoming market conditions shift

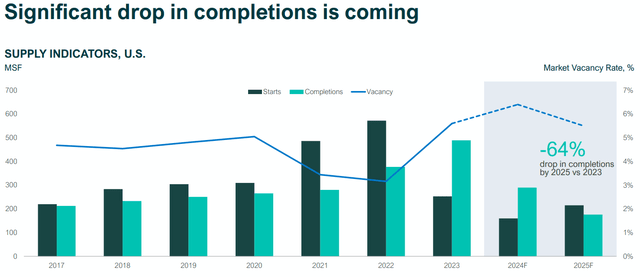

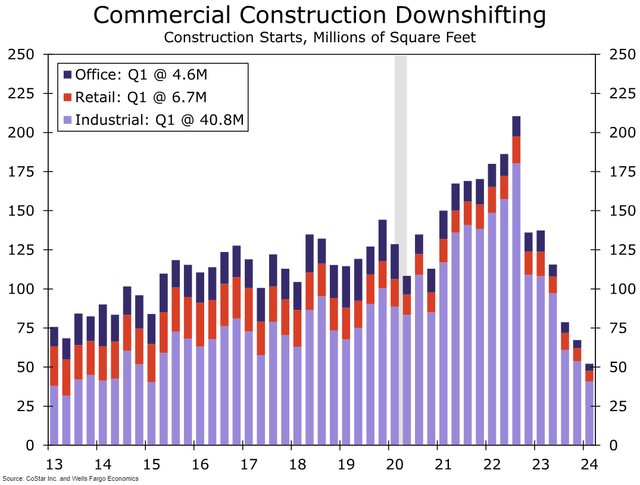

While vacancy rate, net absorption, and net completions have placed themselves at a concerning level for Q1 2024, there are also some positive trends that can be observed in terms of supply. Construction starts within the industrial property sector peaked in Q3 2022 totaling ~175m sq. ft. and have been declining ever since. According to the recent Wells Fargo Chart Book, the construction starts within the sector amounted to 40.8m sq. ft. in Q1 2024, down from over 50m sq. ft. during the previous quarter and down from over 100m sq. ft. during the same quarter of the previous year (Q1 2023). The continuation of this trend will lay the ground floor for the positive shift in the supply-to-demand relationship in the upcoming years.

CoStar Inc. and Wells Fargo Economics

As indicated within PLD’s Investor Presentation for the NAREIT REITweek: 2024 Investor Conference, PLD expects the vacancy rate to peak during the current year and decline going forward, which will be supported by significantly lower completions (~64% lower in 2025 vs 2023) related to the currently declining construction starts.

However, it is also important to keep in mind that the vacancy rates are actually market-specific, thus predicting the peak of this metric is a market-by-market answer.

Also, PLD’s management believes that despite the current negative market environment (e.g. high vacancy rates), the Company remains capable and will be capable of growing its rents. To quote the Enterprise’s CFO from this week’s Nareit’s REITweek: 2024 Investor Conference:

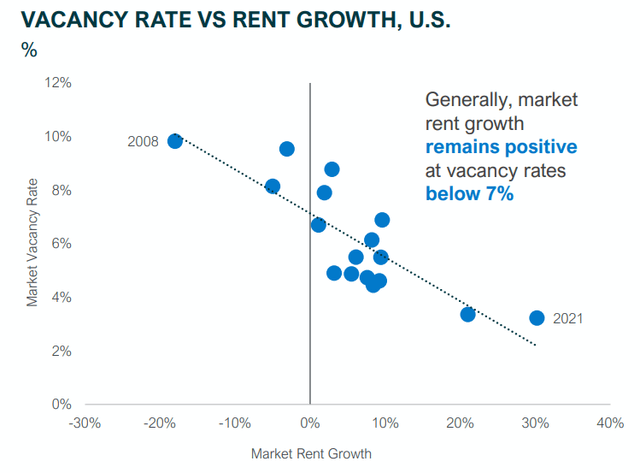

We have a page in our presentation published yesterday that does a correlation between market vacancy rates and rent growth. And what it shows is, it is clearly not a hard switch in terms of, well where is there opportunity for rent growth versus not. It’s a continuum (and at) (PH) lower, amounts of vacancy. Clearly, pricing is going to be better. But on that chart, you can see all the way down to really 7% or even 8% vacancy, you can still have positive rent growth. So that is our expectation that we will have positive rent growth over the next three years. That’s in our forecast.

(…)

So last year, we wound up somewhere between 6% or 7% on a global basis. We had put out a forecast of a CAGR, a three year average between ’24 and ’26 of 4% to 6% on average.

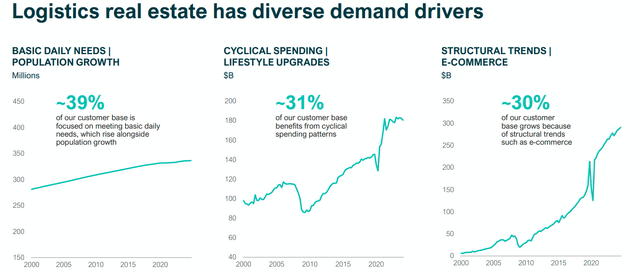

I’ve clearly concentrated on the supply side of the equation as it’s caused the most concern among investors, however, there are also some major, with some being secular, trends supporting the demand drivers, including:

- population growth

- rising household incomes

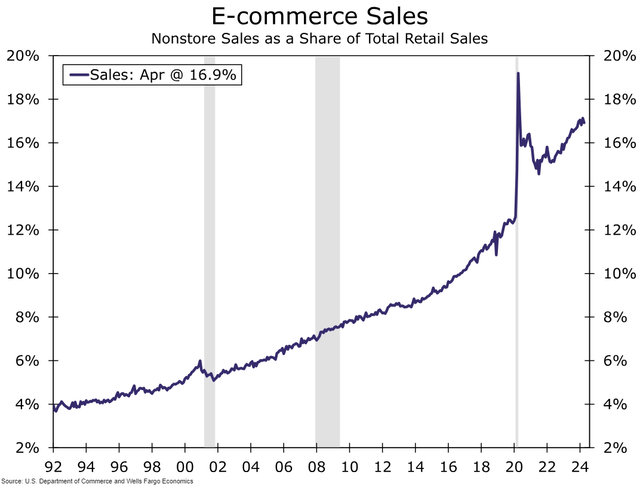

- the increasing significance of e-commerce vs traditional brick-and-mortar sales

PLD’s Investor Presentation U.S. Department of Commerce and Wells Fargo Economics

#2 Top-tier business with growth prospects

PLD is the largest industrial REIT, #88 member of the S&P 500 index (according to its latest Investor Presentation – membership as of June 3, 2024). Prologis owns an almost unimaginable 1.2B sq. ft. across four continents:

- 803m sq. ft. in the US

- 243m sq. ft. in Europe

- 113m sq. ft. in Asia

- 83m sq. ft. within other American markets

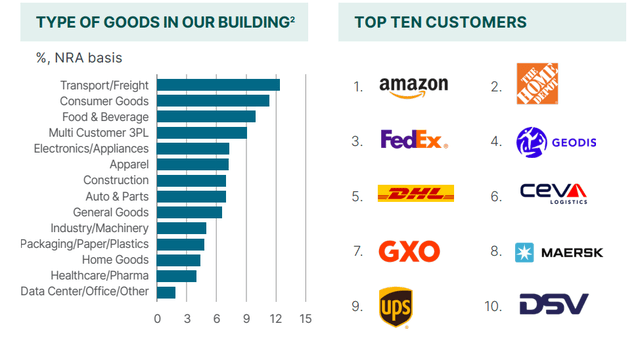

To further emphasize the scale of its business, ~2.8% of the global GDP flows through PLD’s distribution centers. Its leasable area is leased to 6700 customers. As of March 2024, its occupancy rate amounted to 97.0% with some other industry players scoring:

As presented within the Company’s Nareit’s REITweek Investor Presentation, the occupancy rate declined to 96.0% as of May-end 2024. This reflects the increasing headwinds of the industry as a whole and remains within the management’s expectations regarding 2024.

Prologis serves the leading global corporations, whose businesses rely on PLD’s properties. It’s safe to say that PLD’s assets hold an absolute mission-critical character to its tenants. PLD’s elite quality of its assets and their location allow the efficient flow of $2.7 trillion of the economic value of goods through its distribution centers.

On top of that, as explained during Nareit’s REITweek Conference, PLD has robust growth opportunities lying within its core business:

We own or control about 12,000 acres worth of land that embedded in that land portfolio is about a 225 million square foot build-out, representing about $38 billion, $39 billion worth of TEI.

or within other growth paths that PLD is building on top of its global, industrial platform:

- energy business – PLD has 540 megawatts of solar on roofs of its industrial properties, which don’t cover even 5% of its 1.2B sq. ft. of roofs

- storage business associated with the solar business

- electric mobility:

Think about the electrification of fleets that’s happening around the world. If you own an EV vehicle, where would you charge it, you charge it at home, or our buildings are the home of these electric — these EV fleets.

- being a one-stop shop for customers:

Think of everything that goes into a warehouse, racking and forklifts and just other items that our customers use, we were selling them those goods now.

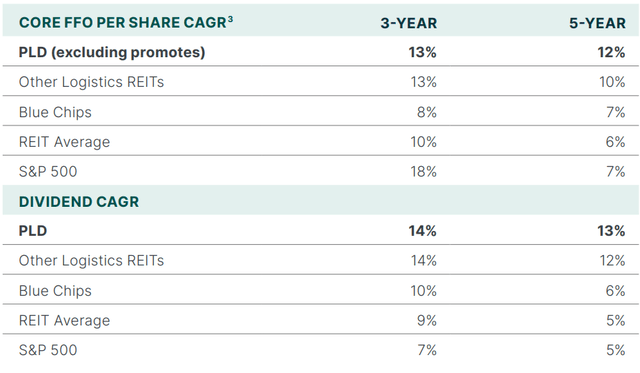

PLD’s competitive advantages, outstanding efficiency of its management, and leading position in a highly attractive industry (despite temporary headwinds) were reflected in its above-average Core FFO per share and dividend CAGRs. PLD currently offers a dividend with a forward-looking yield of ~3.3%, which may not seem like a lot to income-oriented investors, especially when compared to other property sectors, however, it’s the growth of these dividends that is especially impressive for PLD.

#3 Fortress-like balance sheet

Please review the selected credit metrics for key industry players. Please keep in mind that this comparison has been presented for reference to facilitate my strongly bullish case for PLD when compared to other industrial REITs.

Table 1: Selected credit metrics

| PLD | STAG | FR | TRNO | EGP | |

|---|---|---|---|---|---|

| Credit rating | A | BBB | BBB | BBB+ | BBB |

| Share of fixed-rated debt in total debt | 92.5% | 83.7% | 86.3% | 74.2% | 100% |

| Fixed charge coverage ratio | 7.6x | 5.5x | 4.4x | 7.2x | – |

| Weighted avg. debt maturities | 9.3 | 4.3 | 4.5 | 4.1 | – |

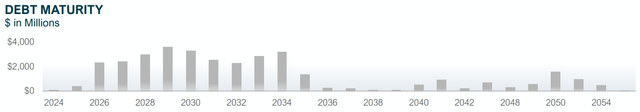

Prologis has a fortress-like, A-rated balance sheet with an outstanding weighted average debt maturity term equal to 9.3, a leading fixed charge coverage ratio of 7.6x, and a fixed-rate-oriented debt structure. Moreover, PLD has a well-laddered debt maturity schedule with negligible debt maturities upcoming in 2024 and 2025. It’s important as the Company currently has a weighted average interest rate on its debt equal to 3.1%, which is well below the market levels (e.g. during Q1 2024, PLD raised $4.1B of debt at a weighted avg. rate of 4.7%, as indicated during the Q1 2024 Earnings Call). Facing significant debt maturities could force PLD to refinance at a higher cost, however, this risk remains limited as no such maturities occur until 2026.

#4 Valuation

As indicated within the introduction section, PLD’s stock price has dropped significantly YTD, which has left its multiple detached from its business fundamentals and long-term ability to generate cash flows.

As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

Please review the forward-looking P/FFO multiples for selected companies in the table below.

Some investors may feel like these valuation multiples are too high, especially those primarily interested in retail/service-oriented property sectors. However, industrial REITs’ valuations, including PLD’s, could also exceed 30.0x on a P/FFO basis. Not so long ago, before the recent share price drop, PLD’s P/FFO multiple ranged from 24.0x to 25.0x. Given that Prologis:

- has a fortress-like balance sheet with outstanding credit metrics

- holds a leadership position

- owns a high-quality, well-located property portfolio with a mission-critical character to its tenants

- provides a coherent and accurate outlook on the market environment

- operates within the attractive property sector, which despite undergoing some temporary headwinds will have an increasingly favorable supply-to-demand relationship

- has clearly defined pillars of its further growth

- has a robust development pipeline and impressive land bank

I believe that the market overreacted to the challenges surrounding the industrial property sector and underestimated PLD, leaving it with a great value proposition and one of the best risk-to-reward ratios.

Assuming no material adverse changes, I consider PLD’s multiple appreciation to at least 24.0x as a highly realistic scenario, which would already indicate a nearly 20.0% upside from its current price.

Risk factors

Some of the risk factors have already been mentioned and include:

- prolonging the high-interest rate environment with the potential to force PLD to refinance at a higher cost

- prolonging headwinds regarding the supply-to-demand relationship, which is one of the driving forces to not only PLD’s fundamentals but also the market sentiment

Moreover, any significant tenant issues, failure to realize its growth prospects or other material adverse changes could lead to higher price volatility.

Summary

While the industrial property sector faces some headwinds, attractive opportunities may emerge. I believe that is the case for PLD, a leading industrial REIT with extensive growth prospects, a strong balance sheet, and a relatively attractive valuation.

We can already observe the signs of the upcoming shift in the market conditions, which would result in PLD operating within a continually attractive sector with an increasingly favorable supply-to-demand ratio.

I don’t rush into giving “strong buy” ratings, however, I believe that the market underestimated PLD’s long-term ability to grow, generate cash flows, and further facilitate the global logistics landscape.

That is a “strong buy” from Cash Flow Venue – I am bullish on PLD.