Spoo

Sam Peters, CFA

Valuation engine drives portfolio improvement

I’ve written before about how my life as a pilot influences my approach to portfolio management. The fundamental principle of flight is to generate lift. The tenet of portfolio management is to generate attractive risk-adjusted returns. In either case, achieving these objectives requires adapting to a highly dynamic environment and taking full advantage of opportunities that more than offset volatility and turmoil. The key is to position your portfolio for the big upside that occurs when market positioning shifts dramatically in your favor, while keeping your investment process engine running consistently.

The goal of our disciplined investment process is to drive returns in all environments. The process is bottom-up, security-specific and driven by internal factors. At its core, We look for opportunities where the market price and our estimate of the business value are at least 30% apart. When we think we have identified a potential mispricing, we immediately ask ourselves what the market got wrong and why future fundamentals will be better than the current price. This constitutes the engine that drives the internal upside in our portfolio: companies that can generate free cash flow and grow their intrinsic business value over time by wisely allocating that cash flow to attractive return opportunities and/or returning capital to shareholders. If our predictions are correct, returns will be generated as price and value converge to increasing business value. In this environment where most stocks outside of the major index favorites are being ignored, we find plenty of opportunities to put this theory into action.

One example of our internal return engine is American International Group (AIG) and we have held it for about 10 years. We initially purchased AIG at more than 30% below our original business value estimate. At this entry point, we assumed minimal business improvement, but were able to absorb the inevitable downdrafts along the way and built our position to take advantage of them. However, the key is that AIG’s management dramatically improved the business during this period. Risk was mitigated as management overhauled the underwriting process, strengthened the balance sheet, reduced expenses and operational complexity, and structurally improved return on equity, resulting in double-digit percentage increases in intrinsic business value per share. A big driver of the additional upside was prudent capital allocation. Shares outstanding were reduced by more than half during this period as management repurchased shares at prices below intrinsic business value each year.

Another example is our positioning in the Energy sector in Q1 2024. While the market doubled down on its concentration in leading AI companies at the start of the quarter, the spread in performance as the quarter progressed resulted in the Energy sector being the second best performer, outperforming IT in the portfolio despite continued investor outflows and record inflows into the IT sector. As a result, our overweight to this sector has helped us outperform value indexes and keep up with the performance levels of the mega-caps that dominate the S&P 500 index.

But this valuation-driven return engine doesn’t generate big upside on its own. We are constantly looking for big opportunities to exogenously boost returns from dramatic market shifts. The first comes from taking advantage of extreme market changes where the long-term probabilities are heavily in our favor, and the second comes from an underreaction by investors to big shifts in pricing power that we can exploit through our valuation lens.

Taking advantage of market extremes

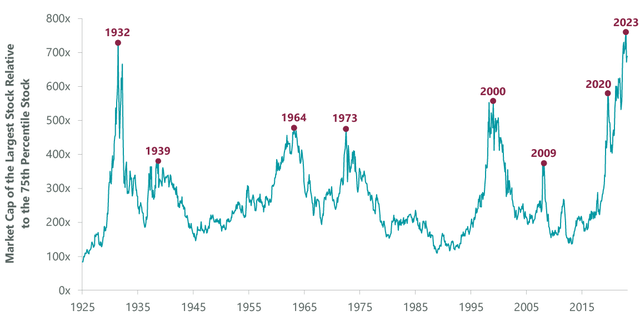

Markets have recently produced some very noteworthy and exploitable historical extremes. Large gains in the markets typically occur when you correctly identify and exploit outcomes that the market has priced with near-zero probability. This strategy is difficult to execute because the market is typically the best system for pricing probability, but sometimes markets experience diversity collapse and misprice the likelihood of mean reversion. An example of this is reflected in the current historical extremes in market concentration (Figure 1). While the market is effectively pricing in the near-certain probability that historical concentration will continue, it is easy to observe that these extreme concentration levels always reverse. The key is to understand what happens when they reverse and whether we can see the signs of this happening.

Figure 1: Market Concentration is Much Higher than It Has Been in the Last Century

As of March 14, 2024. Source: Compustat, CRSP, Kenneth R. French, Goldman Sachs Global Investment Research.

Most investors assume that markets will collapse when market concentration reverses, but historical precedent is more nuanced. In seven cases of excessive market concentration identified since 1925, price momentum rose like a jet when markets reached peak concentration and then reversed sharply when concentration declined. Yet, in each of these major momentum reversals, previously low-momentum laggards in the S&P 500 (which, after the reversal, now exhibit positive momentum coefficients according to the Fama-French model) generated an average absolute return of 27% over the ensuing 12 months. In other words, prior concentrations and associated momentum reversals are opportunities for laggards to catch up, rather than collapse.

Ultimately, this extreme market concentration is like a world-class magician showing up to a child’s birthday party; the child becomes so focused on the magician that he loses sight of everything else. Currently, the market is concentrating investors and their precious capital into an increasingly narrow list of stocks. The result is an opportunity to buy strong fundamentals at attractive valuations in companies beyond the narrow horizons of most investors. This combination can generate attractive portfolio lift from the return engine while preserving the opportunity for significant external returns from the inevitable reversal in favor of laggards.

Sam Peters, CFA A portfolio manager at ClearBridge Investments, where he co-manages the Value Equity and All Cap Value strategies, John has more than 30 years of investment experience. He holds a BA in Economics from the College of William and Mary and an MBA from the University of Chicago. He earned his CFA charter in 1997.