Editor’s note: Seeking Alpha is proud to welcome Value Boss as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Aerial image directly above an industrial machine working in a coal pit, Vietnam Abstract Aerial Art

Investment Thesis

Alliance Resource Partners (NASDAQ:ARLP) has demonstrated strong returns over the past several years, with thermal coal as its primary product, as well as a growing oil and gas royalty portfolio. Unit holders received over 11% in dividends in 2023, and unit holders could receive another ~9.75% in dividends in 2024. The company is the largest coal producer in the eastern United States and could have additional upside amid increased energy demand driven by EVs, data centers, and the AI revolution. A growing royalty portfolio, and new strategic ventures into high-growth segments are additional drivers of value. I use a discounted cash flow analysis to arrive at a target price of $30/share.

Company Overview

Alliance Resource Partners is a diversified natural resource company that produces and markets coal primarily to utilities and industrial users in the U.S. Roughly 85% (pg 103) of the company’s revenues are derived from the sale of thermal coal, which is used to provide reliable baseload energy to the power grid.

The company has been around for nearly 50 years with a management team that has nearly 30 years of operational expertise in the natural resources industry.

The Company also has an oil and gas mineral platform that generates roughly 5% of their revenues, at a roughly 80% EBITDA margin. The partnership has “established a successful track record of investing in mineral interests under top-tier operators in the core of the prolific Permian Basin, with additional exposure to Anadarko, Williston and Appalachia Basins”.

The partnership is also investing in platforms that capitalize on the advancement of energy and related infrastructure, focused on electricity transmission, distribution manufacturing, industrial land, data centers, and battery energy storage systems. This is a relatively new business segment for the partnership, with $119 million of capital invested as of Q1 ’24.

Lastly, digital assets, particularly bitcoin, have appeared on the company’s 10-Q for Q1 2024. In 2020, the company was looking for ways to monetize extra capacity at its mining operations and decided to enter the Bitcoin mining area by purchasing some miners. Management is selling what is needed to cover expenses and limiting exposure. As of March 31, 2024, the company holds 425 Bitcoin, with a market value of roughly $30 million. If these operations expand, and/or if Bitcoin continues to appreciate in price, this could add some upside velocity to an otherwise slow and steady investment.

Investment Overview

ARLP is a publicly traded master limited partnership with units trading at approximately $24. As of this writing, the market cap is roughly $3.1 billion, forward price-to-earnings is 5.56x, and the trailing 12-month dividend yield was over 11%. The partnership paid $2.80 in dividends in 2023, with a dividend payout ratio of roughly 57%. For full year 2023, total revenue was $2.56 billion, EBITDA was $940 million, net income was $636 million, operating cash flow was $830 million, and free cash flow was over $450 million. Guidance for 2024 implies roughly $2.53 billion in total revenue, $874 million in EBITDA, net income of $546 million, operating cash flow of $788 million, and free cash flow of $313 million. If management keeps the dividend payout ratio at roughly 57%, units could be paid $2.45, and could yield 9.74% in 2024. Dividends are decided upon by management, but I have this as my base case based on the earnings guidance provided.

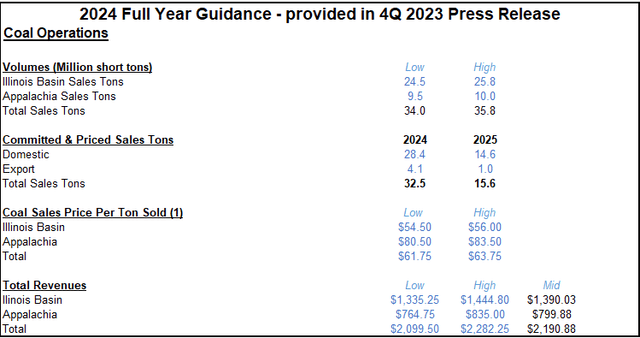

ARLP expects to have between 34 million and 35.8 million short tons available for sale in 2024, or 34.9 million short tons at the mid-point. Roughly 93%, or 32.5 million, of those available short tons are already committed and priced, as shown below.

2024 Full Year Guidance (Company filings, guidance, and Value Boss projections and inputs)

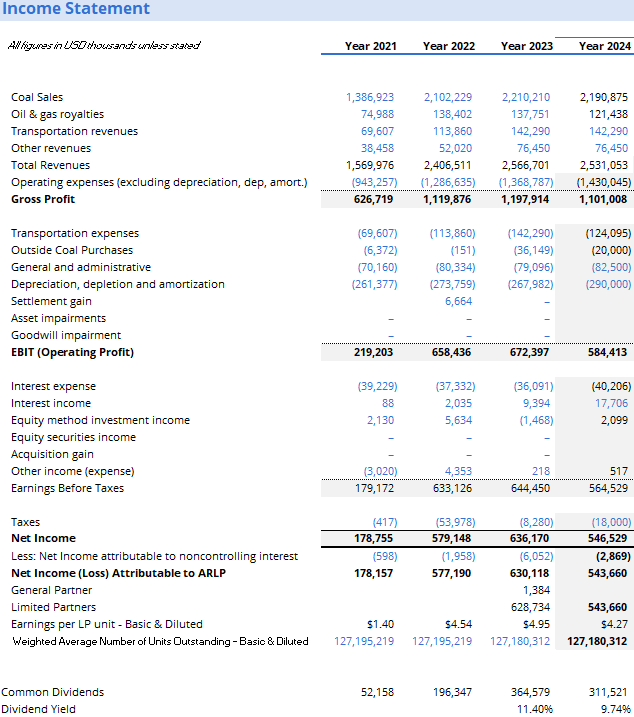

The income statement below puts everything that management has guided to together for 2024:

ARLP Annual Income Statement (Company filings, guidance, and Value Boss projections and inputs)

Royalties

Since 2014, Alliance has invested in mineral interests that consist of high quality, liquids-weighted assets across core regions of top-tier basins in the lower 48 United States. Revenues from oil & gas royalties have grown from ~$75 million in 2021 to $137 million in 2023. Importantly, EBITDA margins on royalties’ revenue is ~88%, and provides a reliable stream of income that is less exposed to commodity pricing cycles.

Recent Events

In the first quarter of 2024, the company generated $140 million of distributable cash flow and paid out $91 million to unit holders in the quarter, a testament to strong free cash flow generation. Coal operations segment adjusted EBITDA margins were strong at 35%, and LTM Adjusted EBITDA through March 31, 2024 was $900 million, with $367 million of free cash flow generated.

The company recently issued new 2029 unsecured notes, the proceeds of which will be used to fund the redemption of the outstanding 2025 notes. This was announced following first quarter earnings, when they announced that they were able to increase an accounts receivable securitization facility from $45 million to $90 million, and enter a new $54.6 million, four-year amortizing term loan maturing February 2028, that replaced a previous equipment financing agreement that matured last year.

Overall, the company operates with a modest degree of leverage, with no debt maturing until February 2028.

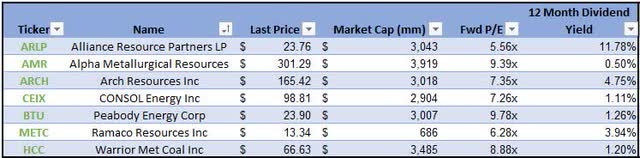

Relative Value

ARLP has the lowest price-to-earnings ratio among peers, and the highest trailing twelve-month dividend yield. In the eyes of a technology, or other high-growth sector, analyst, the ratios below may seem confounding. I attribute the low P/E ratios and high dividend yields, relative to the broader market, to the discount that is assigned to coal related companies, as ESG concerns are pertinent for an increasing number of investors.

Consol energy is perhaps the best comparison to Alliance, since many of the peers also sell metallurgical (steel-making) coal. (In fact, AMR, HCC and METC are all pure-play metallurgical coal producers). Metallurgical coal has a different set of drivers that I will go over in a later publication.

Comparable Stock Table (Company Filings & Value Boss)

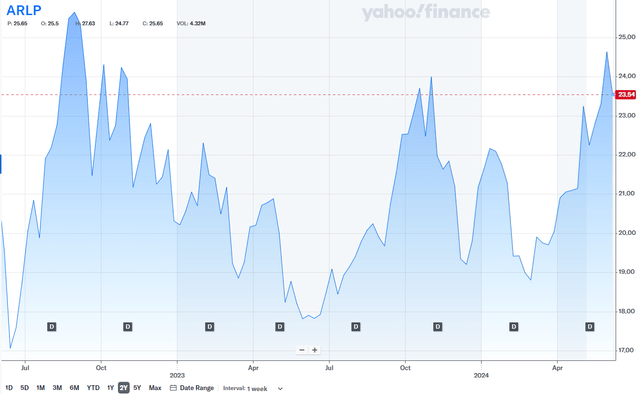

Price Action

Over the past 2 years, ARLP has been in the range of $17.00 to $25.00 per share, and consistently paid out dividends. The dropdown to the $17-$18 range, was likely attributable to a precipitous drop in natural gas prices, as it was a warm winter and production was up. Henry Hub natural gas spot prices averaged $1.50 per MMbtu on February 20, which was “the lowest inflation-adjusted price since at least 1997”. Since natural gas is a substitute for coal, the two generally move synchronously.

ARLP 2-Year Price Chart (Yahoo Finance)

If we look at Natural Gas prices today, they have recovered meaningfully and currently sit around $2.85 per MMbtu, with futures beyond November 2024 quoted at $3.29 and higher. Nevertheless, ARLP was able to perform relatively well during this volatile time period with a trough to peak performance of 34%.

Additional Drivers

The combination of the old world coal business, a growing oil and gas royalties segment, and the new ventures/technology business, makes ARLP a well-rounded and attractive investment. Artificial Intelligence requires an immense amount of energy, as do data centers, which are two of the most prevalent themes driving the stock market and investment today. According to an analysis by the Electric Power Research Institute, US data center electricity demand could double by 2030, driven by artificial intelligence. This data center boom will require a lot more fuel from all sources, including coal, renewables, and nuclear.

Lastly, as of Q1 2024, Alliance has included digital assets in the notes to its financial statements in its first quarter press release. The company holds 30 BTC that were mined using excess capacity at its coal facilities. According to management’s comments during the earnings call, they do not plan to speculate on the price of Bitcoin, but rather mine, and sell what is needed to cover any operating costs related to such mining. While a relatively new venture, I believe it is interesting that an old world business like Alliance is using excess capacity to generate incremental value for shareholders in this way. The highly speculative nature of Bitcoin happens to be complementary to ARLP’s otherwise stable, and what some might call, boring, business of selling coal and collecting oil and gas royalties.

Valuation

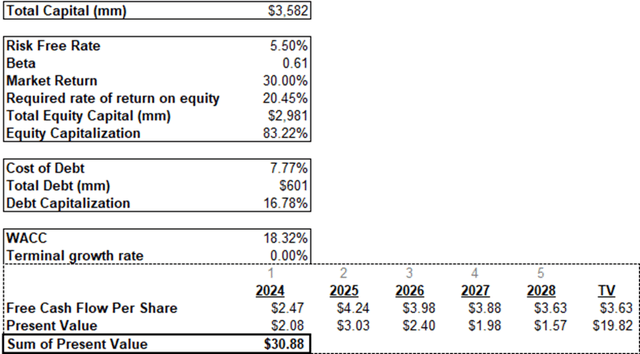

Given the free cash flow that ARLP generates, I have decided to use a discounted cash flow analysis to value the units.

You can see my calculations below, using free cash flow per share estimates that are generated from my financial model that uses the company’s 2024 financial guidance, negative 3% revenue growth, beginning in 2025 through 2028, with a 0% terminal growth rate. I have decided to use negative revenue growth to skew towards conservatism, as well as account for volatile energy markets. I have also used management’s capital expenditure guidance of $475mm in 2024, and normalized them to $300mm every year thereafter, which is slightly above historical capital expenditure spend.

In my opinion, the weighted average cost of capital of 18.32% is conservative, and I used a large market return of 30% in the WACC calculation to account for ESG concerns as well as commodity price-risk.

Summing it all up, I get a present value of $30.88 per share, as shown below.

ARLP Discounted Cash Flow Analysis (Value Boss)

Risks

A common refrain towards investing in a coal company is that coal is being retired as an energy source. I believe the correct perspective is that developing nations are retiring energy as a fuel source, while developing countries in the Middle East, Africa, and Asia continue to build coal-fired power generation plants. In fact, the total global compounded annual growth rate of seaborne thermal coal has grown by 2% from 2015 to 20242. Even in the U.S., amid growing power demand, customers are starting to delay plant closures. Another concern is that contracts roll off at lower prices; however, I’d argue that this is a 2025 and 2026 event, and I am encouraged by the energy demands that Artificial Intelligence, and data centers bring with them.

Furthermore, as a low-cost producer, Alliance’s coal product is extremely competitive with natural gas, at a $2.03 average of natural gas equivalent per million BTU. Natural gas is a natural substitute for coal, and 2023 was a year when Nat Gas was priced below $3 for most of it, and ARLP managed to post exceptional numbers. Looking back to 2020 and 2021, when the effects of Covid-19 were most pronounced, is a good measure of where prices could go in a low demand environment. In 2020, the average realized price per ton was $44, and in 2021 it was $43. Coal operations adjusted EBITDA were $385 million and $438 million, respectively. Looking at 2021, net income was $178 million, with EPS of $1.40, which would still yield unit holders over 5% if it were to be 100% distributed. However, I do not expect the world to go back to the reduced energy demands that came in the COVID-19 environment.

Summary

ARLP units are an attractive value investment for the prudent investor. With strong earnings, > 90% contracted tonnage through 2024, amid a backdrop of increased energy demand from artificial intelligence and data centers. The years 2020 and 2021 provide an idea of what I believe to be the worst-case scenario for Alliance; however, I believe that history is unlikely to repeat itself in that regard. Unit holders are poised to benefit from strong dividend potential in the years ahead, as well as potential appreciation as the themes described above become more clear.

Putting it all together, I believe ARLP unit holders can expect a 10% dividend yield in 2024, and units could trade at around $30 per unit, which would imply additional upside of 25% and a dividend yield of 8%. Investors would be wise to add this well-managed company to their income generating tactical portfolio.