Seaway

After a lengthy search process spanning 10 months, AlphabetNasdaq:Google) (Nasdaq:GoogleAnat Ashkenazi, former executive vice president and chief financial officer of Eli Lilly,Lily) as the company’s new CFO.

I have a pretty long wish list In my view, he is a new CFO who has a clear path to creating meaningful value for Alphabet shareholders.

Introduction and reconsideration of Google investment theory

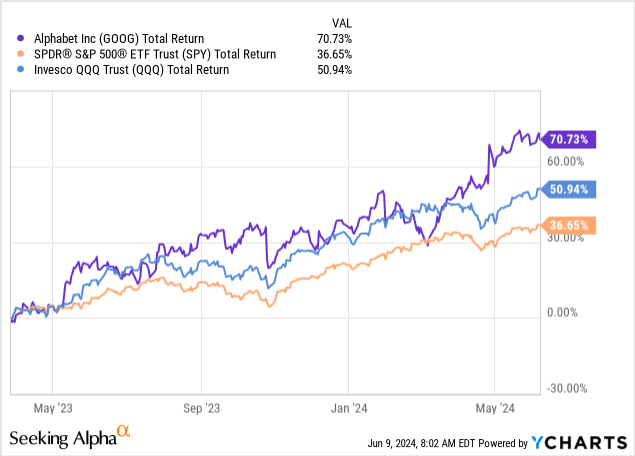

I Cover Alphabet has been on Seeking Alpha since March 2023 and has maintained a bullish rating throughout the period. So far, our judgment has been correct.

The investment thesis here was and remains very simple: Alphabet has some great assets under its belt, including YouTube, Android, Search, Google Cloud, and the rest of the Google suite. These are all extremely well-defensible, mutually beneficial businesses with very attractive margins and ample growth opportunities.

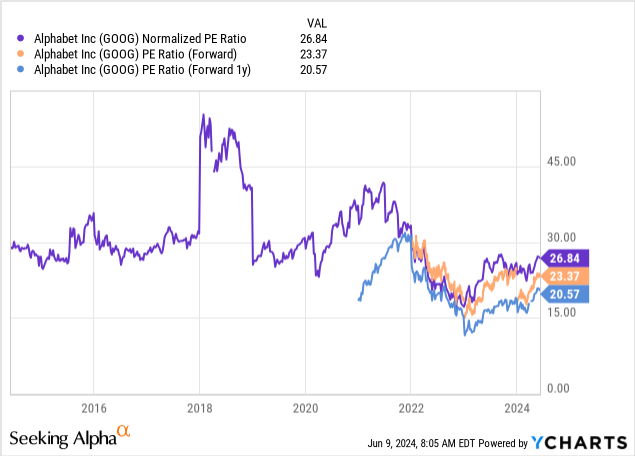

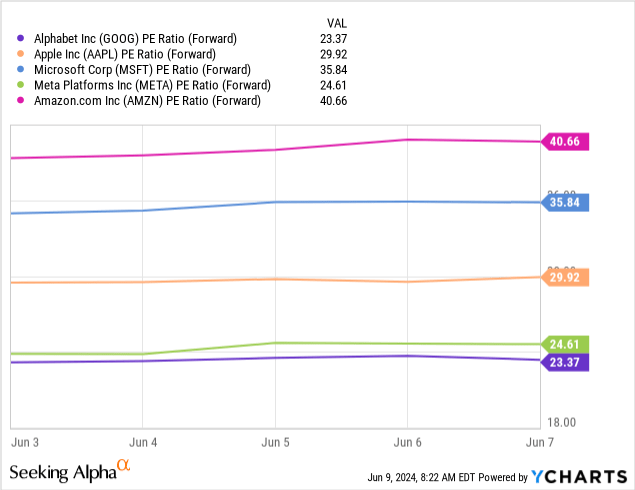

And to make matters worse, Alphabet, the company that owns all of these businesses, is and remains relatively undervalued, both historically and compared to its peers.

That being said, we can’t ignore why the market has assumed higher risk for Google’s parent company over the past few years, hence the lower multiple.

3 reasons why the market was (and still is) rightfully underestimating Alphabet

I had a buy rating on Alphabet and owned shares, but had many negative comments about the company’s complacency, capital allocation, and lack of transparency.

As an aside, this is probably the best evidence of Google’s strength, because its rare combination of quality and reputation has made even the biggest critics consider the company an attractive investment.

It starts with self-satisfaction. 2023 is Meta (MetaThe term was coined by Mark Zuckerberg, CEO of Google Inc. After the massive stock market selloff in 2022, companies, primarily in the tech industry, understood that investors expected them to aggressively cut unnecessary costs, and many did just that. But at a time when Google’s rivals were aggressively cutting employees, Google was less aggressive and more complacent, which slowed the recovery of profit margins.

Second, capital allocation. Continuing its complacency, Alphabet was slow to cut non-core businesses and continued to invest heavily in other projects. Additionally, the company continued to sit on a massive $100 billion in cash and did not aggressively buy back shares or declare dividends, even as its stock price plummeted.

Finally, the company has suffered from a lack of transparency, with former CFO Ruth Pollan being reluctant to provide quantitative guidance about the company’s future, both in terms of expenses and revenue.

While Alphabet has certainly improved in the aspects mentioned above, such as announcing its largest share buyback to date, much better execution, improving margins, and initiating a dividend, we can see that it still trades at the lowest multiple of any large technology company, despite being expected to grow faster than some of the stocks mentioned here.

There are other reasons to justify the discount, including the high risk of AI disrupting its core business and the fact that it is third in the cloud space after Microsoft.MSFT) and Amazon (Amazon).

While these two factors will likely weigh on valuation for some time, I believe there is still room for multiple expansion if the new CFO changes some of the ways things have been done.

Expectations for Alphabet’s new CFO

Anat Ashkenazi, former executive vice president and chief financial officer of Eli Lilly Her role begins July 31, 2024. She worked for Eli Lilly for 23 years and held multiple finance-related positions within the pharmaceutical industry.

Although she does not have significant experience in the technology sector, I believe our new CFO can be a significant driver of shareholder returns in the near term.

Providing clarity and guidance

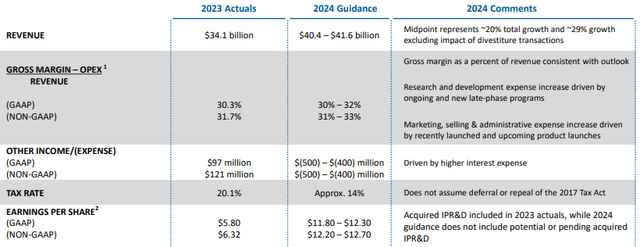

As far as I can remember, Alphabet has not provided specific guidance. With a company with such a broad portfolio, it is very difficult for investors to predict how much investment and expenditure Alphabet will make in any given year. This has led analysts to rely heavily on extrapolation and historical numbers to forecast next year’s numbers.

Not only does it make forecasts less reliable, it also creates perverse incentives for management. For example, Meta provides annual expense guides. If revenue exceeds expectations, investors will still expect expenses to be within the original guide, and Meta’s management will be under pressure to stay within the range.

In Alphabet’s case, if revenue beats expectations, management may be willing to spend more as long as profit margins remain within reasonable limits.

Under Anat’s leadership, typical guidance at Eli Lilly included:

Eli Lilly Q4 2023 Presentation

The company also published comprehensive quarterly presentations, providing detailed explanations for each profit and loss item.

Generally speaking, this is standard practice in the pharmaceutical industry and you shouldn’t expect anything close to this level of transparency.

That being said, I believe even the annual expense target can contribute a few points of multiple expansion, and I expect that to be driven by the new CFO.

Especially with other bets, there is more granularity.

Alphabet recently changed its segment reporting, changing the “Other Google” line item to “Google Subscriptions, Platforms and Devices,” which gives it much more room to provide more granular detail about each business within those divisions, along with Alphabet’s other businesses.

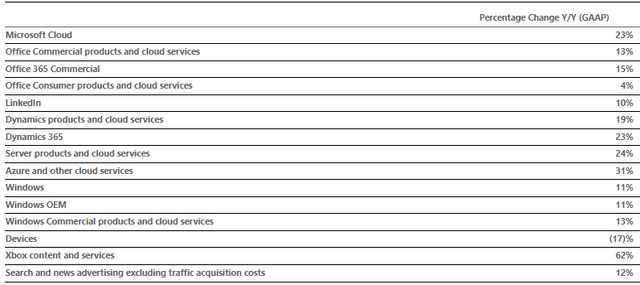

For example, we have no idea how much revenue Google makes from its hardware, how big YouTube’s subscription business is, etc. Here, another very well-known company, and a competitor to Google in many ways, provides the following details of its products and services:

Microsoft 3Q 2024 earnings announcement

There’s an old saying that “what you don’t know can kill you,” and I believe uncertainty is almost always a bad thing when it comes to investing. I’m not saying everything has to be revealed, but it might be helpful to have a few more details about each business line on the earnings call.

Aggressively increase profits during good times and prepare for bad times

This is the area I’m most excited about. One of the capabilities pharma companies need to have is the ability to aggressively leverage successful products (such as Ozempic and Mounjaro). Another key capability is to prepare for the patent cliff.

Alphabet’s portfolio is made up of several gems that are overwhelming leaders in their respective fields, and one of those gems is, of course, search.

In my view, there are many parallels between what Alphabet is currently experiencing with some of its core products and the potential disruption looming from AI.

While I think it’s highly unlikely that Google will lose significant market share to AI, and I expect it to be a positive for the company, especially with Google Cloud, the new CFO should be able to help the company find the right balance between making the most of its previous business model and preparing for a new era.

evaluation

Based on current consensus estimates, Alphabet’s stock is trading at 23.4 times 2024 earnings and 20.6 times 2025 earnings.

We’ve already seen that Alphabet handily beat expectations for Q1, but the current consensus still seems pretty low, reflecting poor seasonality and margin declines from Q1, neither of which we can find a good reason for.

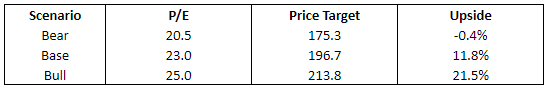

Even if we go by current consensus estimates, our base-case scenario would see the stock trade at 23.0x 2025 earnings by the end of 2024, up roughly 12%. Our bearish scenario would see it trade at 20.5x, and our bullish scenario would see it trade at 25x.

Compiled and calculated by author using data from Seeking Alphabet. Based on Alphabet stock price as of June 9, 2024.

If the new CFO delivers in the three key areas I listed above, I see no reason why Alphabet couldn’t experience significant stock price appreciation.

Combined with the fact that the company expects to beat expectations significantly, I think the most likely outcome will be to end up somewhere between our base and bull scenarios.

This leads me to a mixed price target of $200 per share.

Conclusion

Alphabet’s stock price has recovered since its 2022 offering, with valuation initially being the main driver of the recovery, followed by the inevitable improvement of the company’s legacy businesses.

I believe Alphabet’s leadership deserves significant credit as the market clearly recognized that from March 2024 through today, Alphabet’s management team changed their tone and began to operate at an industry-leading level on many fronts.

Nevertheless, there is still much improvement to be done and we believe the new CFO has an opportunity to drive meaningful improvements in the near future.

Alphabet’s combination of strong growth opportunity and relatively low valuation makes the company a must-hold in my view, and I am therefore reaffirming my buy rating.