Dmytro Varavin

overview

Gates Industrial Corporation (New York Stock Exchange:GTES) specializes in highly engineered power transmission and fluid power solutions, serving customers in 130 countries. Over the past few years, revenue growth has slowed. While revenue growth has been flat, margins have improved. GTES has also long been seizing opportunities in the data center cooling space, leveraging its expertise to provide solutions to address growing data center demand. With increased infrastructure construction activity outside the U.S., GTES will be well placed to capitalize on growing demand for larger equipment through its international operations. GTES has significant upside potential, so we recommend a Buy rating.

Historical Financial Analysis

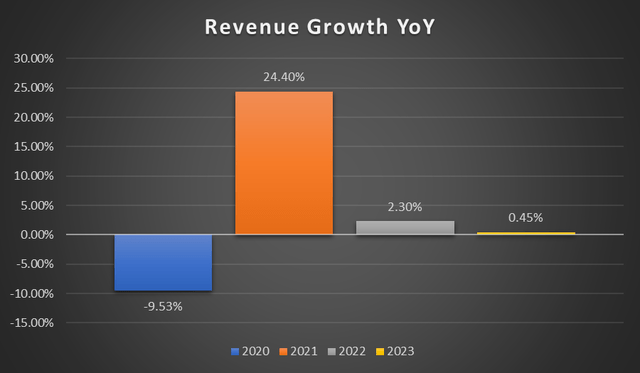

Since FY21, GTES’ year-on-year revenue growth has declined. Fiscal Year 2011Total revenue increased to $3.57 billion from $3.55 billion, reflecting core business growth of 0.45%. Sales increased 0.7%. The slight increase in sales was due to pricing efforts, partially offset by lower volumes. Strong core growth was seen in the Automotive, Energy, Construction and On-Highway divisions, but these gains were offset by declines in the Personal Mobility and Diversified Industrial divisions. Automotive replacement sales were a significant contributor to core sales growth, with the majority of this growth occurring in EMEA, China and South America. Industrial market sales decreased 3.2% year over year. Fiscal Year 21 The significantly higher growth rate of 24.4% was largely due to the large impact of the pandemic, driven mainly by a recovery in industrial demand.

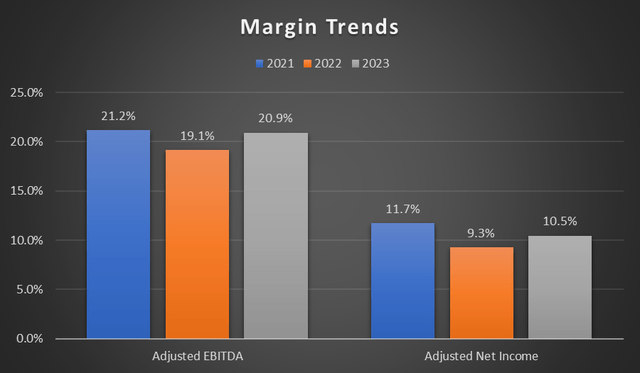

Speaking of profitability, adjusted EBITDA and adjusted net income appear to have remained consistently strong over the years. Margins improved in FY23 compared to the prior year. Gross margins increased 2.9% due to strong commercial and operational execution. Adjusted EBITDA margins improved 1.8%. Improved profitability in FY23 was the primary driver of adjusted EPS increasing approximately 20% from $1.14 to $1.36. FY22‘s margins had been declining due to inflationary pressures and absorption of fixed costs due to supply chain inefficiencies. Overall, GTES is on track to end FY23 on a strong note and drive further margin expansion in FY24 through focus on reducing raw material costs and improving productivity.

First Quarter Earnings Analysis

As reported on May 1, GTES Q1 2024net sales decreased 3.9% year over year to $862.6 million from $897.7 million, $2.74 million below expectations, including a 3.6% and 0.3% decrease in core sales due to unfavorable foreign exchange impacts. Core sales in the auto replacement channel increased slightly, while the first-fit channel experienced a double-digit decrease. Significant declines occurred in the personal mobility and agriculture end markets, partially offset by growth in the automotive and on-highway end markets.

GTES demonstrated operating efficiencies with margin expansion despite declining revenue. Adjusted EBITDA increased 3.3% year over year, from $174.5 million to $195.6 million. Adjusted EBITDA margin increased from 19.4% to 22.7%, due to the company’s restructuring initiatives, which positively impacted manufacturing performance and offset volume declines. Adjusted net earnings per diluted share increased to $0.31 from $0.25, reflecting a 23.4% increase year over year.

Segment Revenues

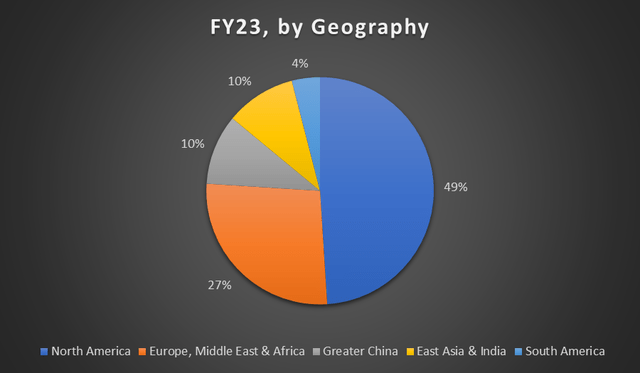

GTES is a global manufacturer of engineered power transmission and fluid power solutions. The company’s products are sold in more than 130 countries, 51% of which are Fiscal Year 2011 GTES ranks #1 in sales outside North America. The business is divided into two segments: Power Transmission and Fluid Power. Power Transmission represented 61% of net sales in FY23, while Fluid Power represented the remaining 39%. GTES’ solutions are used in multiple end markets, including automotive replacement, first-fit end markets, industrial on- and off-highway applications, diversified industrial, energy and resources, and personal mobility. GTES offers a wide range of products in the replacement channel and provides specified components to OEMs. 64% of net sales in FY23 came from the replacement channel. GTES serves a large customer base with equipment that adheres to maintenance cycles. The remaining 36% of GTES works with OEMs, also known as first-fit customers.

Expanding market to data center cooling

The company said it sees opportunity in the data center cooling segment, which it sees as a key new opportunity for accelerated growth over the next three to four years. Cool IT SystemWe are partnering with GTES, a leader in liquid cooling technology, to develop liquid cooling solutions for AI and high performance computing. Leveraging their deep expertise and existing portfolio in thermal management applications, GTES will be able to enter data center cooling with electric water pumps and fluid delivery solutions.

Now the company is in the process of launching a completely revamped liquid transport aimed at data center applications, specifically hyperscale data centers. Data center infrastructure is being built with higher power densities to enable AI, and as a result, energy-intensive GPUs and TPUs generate large amounts of heat, necessitating the use of advanced environmental control systems such as the liquid cooling solutions that GTES can provide.

Further growth outside North America

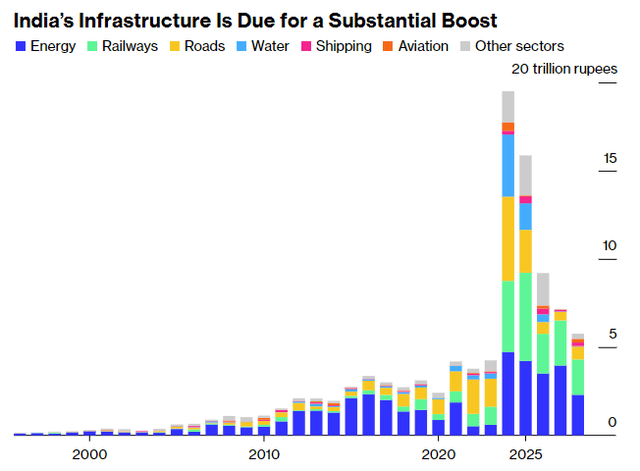

Nearly half of GTES’ net revenues are derived from North America, however, GTES’ products are also sold in Europe, the Middle East and Africa, China, East Asia and India. GTES has a strong presence in these regions and should be able to capitalize on continuing opportunities in these regions. In Europe, GTES’ personal mobility business is strategically positioned to capitalize on the growing demand for electric two-wheelers. In East Asia and India, infrastructure investment as a percentage of GDP is expected to increase in India through 2028. Compared to five years ago, government infrastructure investment has more than tripled to exceed $100 billion by 2025. $132 billion “In FY25, the Indian government plans to spend INR 143 trillion to upgrade ports, railways, roads and many other infrastructure projects. As infrastructure development accelerates in India, the demand for heavy machinery will follow. GTES already has a strong presence in India and these infrastructure developments represent a huge growth opportunity for the company over the next few years.”

Relative Evaluation Model

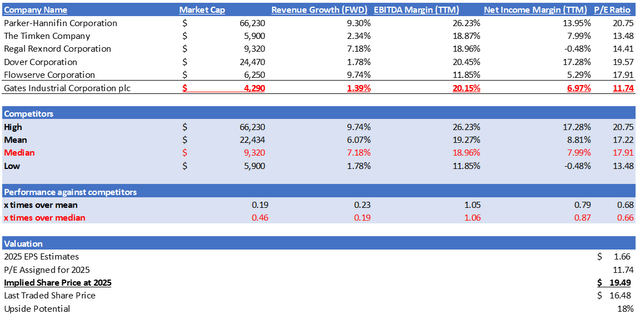

GTES competes in a highly fragmented market and faces competition in all markets and product categories. There are numerous competitors in each of GTES’s markets and product offerings, but none of them can match GTES’ comprehensive range of product offerings, global presence, or end markets. My relative valuation model compares GTES to its peers in terms of growth prospects and trailing twelve month (TTM) returns.

In terms of growth prospects, GTES has the lowest future revenue growth rate of 1.39%, well below the peer median of 7.18%, equating to 0.19x the median. In terms of profit margins, GTES’ EBITDA margin is relatively high among its peers, with EBITDA margin TTM of 20.15%, 1.06x the peer median of 18.96%. Net profit margin TTM is 6.97%, slightly below the peer median of 7.99%.

GTES currently trades at a forward P/E ratio of 11.74x, compared to a higher peer median of 17.91x. Despite relatively strong TTM EBTIDA margins compared to peers, GTES is below expectations in terms of growth prospects and TTM net profit margins. I believe it is reasonable for GTES to trade at a lower P/E ratio.

Based on management guidance, GTES has raised its FY24 adjusted EBITDA guidance to the range of $745-805 million from $725-805 million, given the strong earnings growth this quarter. FY24 market revenues are estimated at $3.53 billion, with EPS of $1.40. FY25 market revenues are estimated at $3.7 billion, with EPS expected to be $1.66. Given the growth drivers I mentioned earlier, the market forecast is reasonable. Applying my target P/E ratio of 11.74 to the 2025 EPS forecast, I get a 2025 target price of $19.49, with room for 18% upside.

Risks and Conclusions

The majority of GTES’s revenues are derived outside the U.S., with approximately 51% coming from EMEA, China, East Asia and India, and South America. GTES sources materials from China, India, and Eastern Europe, making its operations vulnerable to economic and political instability. Raw material availability fluctuated during the Russia-Ukraine conflict. This event led to the suspension of operations in Russia, restructuring charges, and a decline in sales of approximately 2%. Additionally, ongoing uncertainty surrounding the current trade tensions with China poses a threat to GTES’s future performance. At present, GTES has a strong competitive advantage due to its global presence and product availability. As it takes steps to enter the evolving data center cooling market and expand business opportunities outside the U.S., we believe GTES has significant upside potential and therefore recommend a Buy rating.