South Agency

Investment Thesis

I used to Covered Keysight (New York Stock Exchange:Key) where I went into more detail about the business model and the qualities I believe it possesses. In that article, I decided that it was best to hold for now, Since then, the company’s shares have fallen 11% compared with a 2% rise in the S&P 500.

While this may not seem like a huge drop, the 33% drop from the previous peak is one of the largest drops in Keysight’s history, and there have only been three larger drops. Q2 2024 resultsI’d like to dig into what’s happened to the company since then.

KEYS Drawdown (Coiffin)

Q2 2024

The summary of the results is that the company slightly outperformed. While these results exceeded expectations, it is notable that they surpassed management’s own guidance provided prior to the quarter, given the extremely challenging economic environment we are currently in.

On first-quarter core bookings of $1.14 billion, the company expects second-quarter revenue to be in the range of $1.19 billion to $1.21 billion and second-quarter earnings per share to be in the range of $1.34 to $1.40.

CFO Neil Doherty 2024 Q1 Financial Results Announcement

The less positive aspect that has the market being so cautious about Keysight is that Q2 2024 revenues were down 12.5% (even considering they beat expectations) and initial guidance for Q3 suggests a decline of almost 14%. So it would come as no surprise to anyone if the company finishes the fiscal year with a double-digit decline in sales.

| estimate | Actual | Beats/Misses | |

| Revenue | $1.2 billion | $1.22 billion | 1.0% |

|---|---|---|---|

| EBITDA | $327 million | $332 million | 1.4% |

| Per share | $1.39 | $1.41 | 1.6% |

Author’s edit

The company expects third quarter revenue to be in the range of $1.18 billion to $1.2 billion and third quarter earnings per share to be in the range of $1.30 to $1.36, based on weighted diluted shares of approximately 175 million.

CFO Neil Doherty 2024 Q2 Financial Results Announcement

| 2023 | 2024 | Changes in earnings | |

|---|---|---|---|

| Q1 | $1,381 | $1,259 | -8.8% |

| Q2 | $1,390 | $1,216 | -12.5% |

| Q3 | $1,382 | $1,190 | -13.9% |

| Q4 | $1,311 | ? | ? |

Author’s edit

To be clear, this issue is not unique to the company and is not due to a loss of market share or competitive advantage. To help you visualize what I mean, I’ve created a comparison chart of Keysight with similar but different sized companies.

It’s easy to see that Keysight isn’t the only company having trouble with both growth and profitability this year. Smaller companies like Calnex Solutions have also seen a tough 40% decline this year. So while no one wants their own revenue to fall by 10%, we can at least attribute this to an industry-wide impact arising from the fact that these companies’ customers (semiconductor companies, telecommunications companies, etc.) are also resenting the high interest rate environment and are postponing capital expenditures.

Author’s edit

evaluation

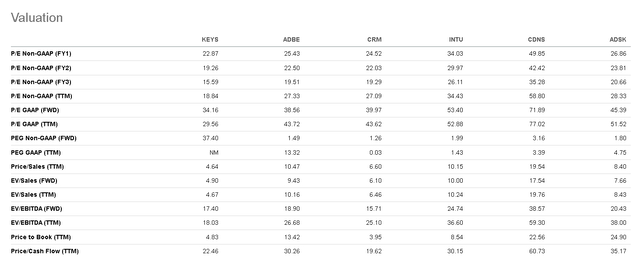

Keysight is currently trading at a P/E ratio of 34 times 2024 earnings. That doesn’t seem cheap, but that’s because the company is expecting margin compression and declining revenue this year. Net profit margins have fallen from 19% in 2023 to 15% over the past 12 months.

We’re already seeing a recovery in sectors like semiconductors, but if we forecast a recovery in 2025, the P/E ratio would rise from 34 to 23 as profit margins improve.

The semiconductor industry outlook is improving, with a recovery expected in 2025. Inventories are declining to healthier levels and demand is recovering in certain areas, such as high-bandwidth memory.

CEO Satish Dhanasekaran 2024 Q2 Financial Results Announcement

Market Screener

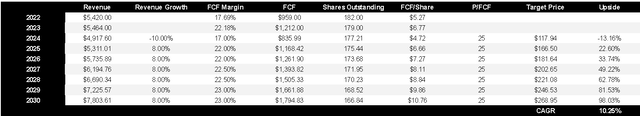

While I expect free cash flow to be significantly lower than revenue this year, this lower comparable base will allow FCF/share growth over the next few years to be greater than in the past few years, at 12% per year in my projections, somewhat higher than the 10% per year from 2014 to 2023. Under this projection, Keysight will generate about $12 per share in 2030, which would be a 12% return if bought at today’s prices.

Evaluation Model (Edited by the author)

I chose a multiple of 25x free cash flow based on examples from other software companies. This is not a cheap ratio, but it’s hard to find a software company trading below 20x unless it has structural issues or problems that justify a lower valuation.

Evaluation ratio (Seeking Alpha)

Conclusion

As I said in the article, I don’t see Keysight in any problems that will affect its future. They haven’t lost market share, and their services are essential to their customers, so the downturn will likely be temporary. That’s why I’m finally considering buying now, when valuations are higher than they were a few months ago.

The biggest risk is that the company benefits from operating leverage and maintains fixed costs. This is positive in a growth scenario, but could cause earnings to fall more than revenues in a downturn, leading to debt issuance to raise capital and under-estimating FCF declines. If that happens, the stock could remain flat for longer than expected, but I think the stock will do well as an investment if your time horizon is greater than 2 years.