sbayram/iStock via Getty Images

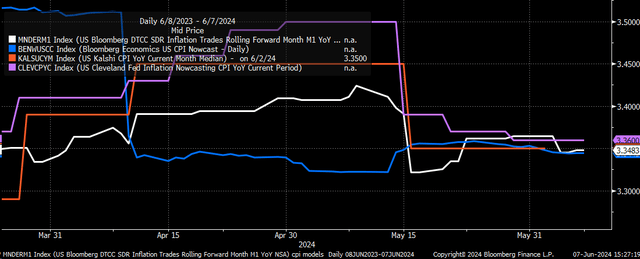

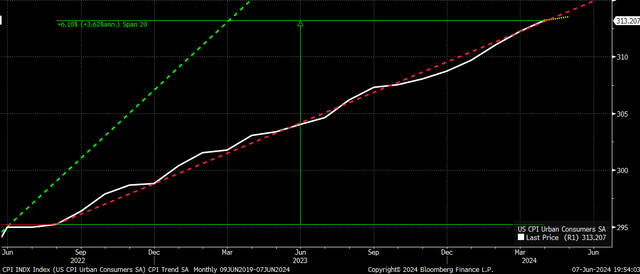

The May CPI report shows the headline index is expected to cool slightly in May, dropping from 0.3% to 0.1% month-on-month, while the year-on-year increase is expected to be 3.4%, the same as in April of last year. The core CPI tells a different story. Year-over-year growth was up 3.5%, down from 3.6% in April, and is expected to maintain its trend at 0.3%, the same as April.

CPI Swap is in line with analysts’ expectations, with the headline showing a 0.1% increase from the previous month and a 3.4% increase from a year ago, while Karsi, the Cleveland Fed and Bloomberg Economics are also forecasting a 3.4% increase from a year ago. So there is not a big deviation in expectations this month.

Recent trends suggest that the main estimates may be too low.

Wage growth suggests 4% inflation

Despite these estimates, there is not much to suggest that overall inflation has changed since April. Gasoline prices are down slightly. Wage growth in the May jobs report indicates inflation is still running at around 4%.

Meanwhile, the May employment report showed wages growing 4.1% year over year, higher than the upwardly revised 4.0% growth rate from 3.9% in the previous month. Wage growth, like inflation, appears to be stagnating around this 4.0% level. It may resume a downward trend later this year, but there is no sign of a slowdown at present.

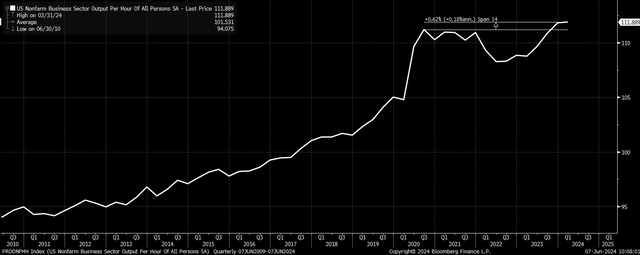

Wage growth of 4.1% is inconsistent with inflation at or near 2%. Based on these data, productivity would need to increase further to bring inflation down to the Fed’s target. Productivity was just 0.2% in the first quarter. Over the past 14 quarters, the productivity index has risen just 0.62%, for an annualized growth rate of just 0.2%.

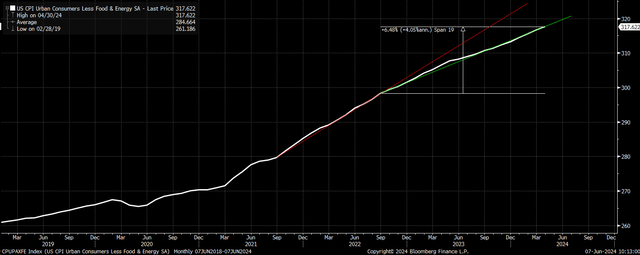

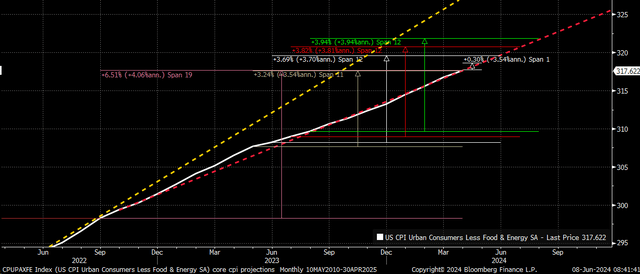

Thus, 4% wage growth and near-0% productivity are consistent with core CPI inflation of roughly 4% over the past 19 months. There is far more evidence supporting core inflation hovering around 4% for the past few months than there is evidence to suggest the Fed is winning the battle against inflation. If May’s core CPI turns out as expected, the 4% trend will continue into the 20th month.

Core CPI bottoms in May

The issue is that based on current trends over the past 19 months, and likely to be confirmed again in May, at the current pace, core CPI year-over-year growth will rise to 3.7% in June, 3.8% in July, and 3.9% in August. Thus, the May core CPI report will be the lowest year-over-year growth rate before beginning to rise.

Meanwhile, the slowdown in Headline CPI growth is likely due to lower crude oil and gasoline prices in May. The 0.1% increase is a clear departure from the trend of recent months. Over the past 20 months, Headline CPI has increased at an annualized rate of 3.6%. Analysts estimate this would be the lowest monthly Headline CPI increase since October and mark a clear change in trend.

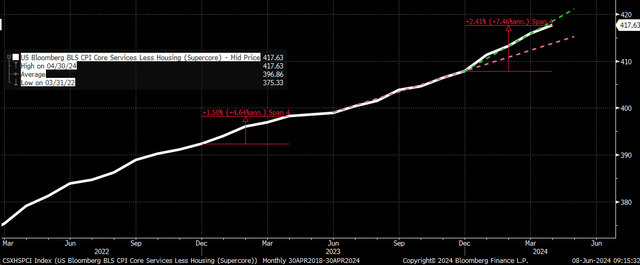

But what matters most here is whether services and housing inflation will continue to pace the May numbers to fall below their trend rates over the past 20 months. Housing inflation has been slowing and services inflation is not cooperating at all. CPI core services excluding housing has been trending upward since June 2023, up about 5.2% year-over-year in April and trending upwards further.

The problem is that there has been a notable change in trends for core services: the annual growth rate for the first four months of 2024 is significantly faster than that for the first four months of 2023, increasing by 7.46% vs. 4.64%, respectively.

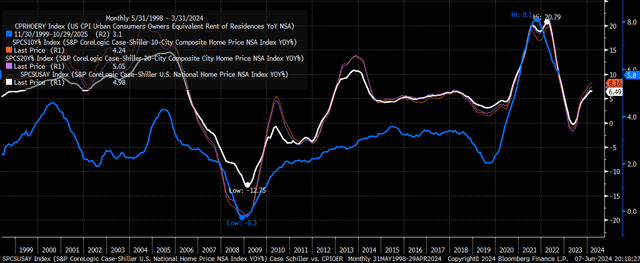

Meanwhile, CPI homeowner equivalent rents, based on the Case-Shiller index, have been falling slowly but tend to lag home prices by about 18 months. These Case-Shiller values have been rising in recent months. Whether home prices, as measured by the OER, will start to rise in the coming months will determine whether the fight against inflation is won.

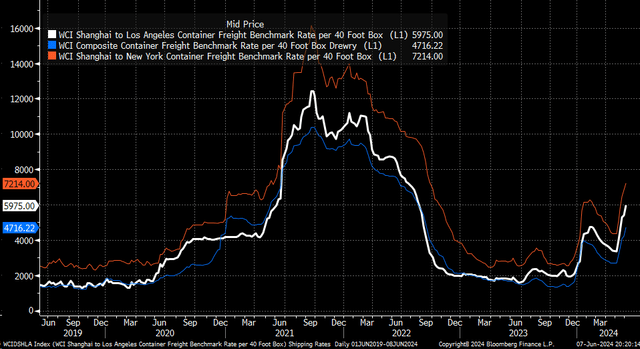

Moreover, ocean freight rates continue to rise, with the WCI Container benchmark up since the start of the year and, more notably, rising further in recent weeks. Thus, energy prices may see some relief in May, and autos may also weigh on inflation, although it may not be as easy to achieve 0.1% as analysts predict.

Money is moving much faster

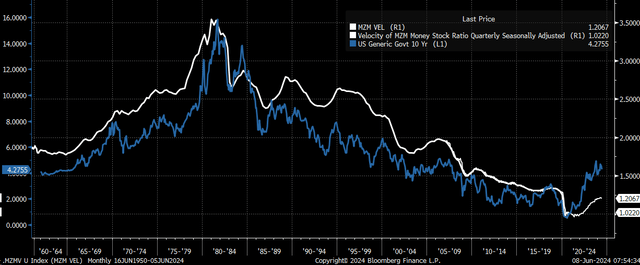

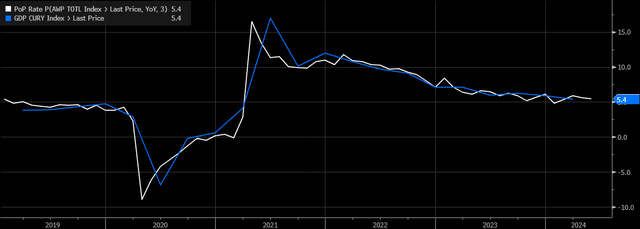

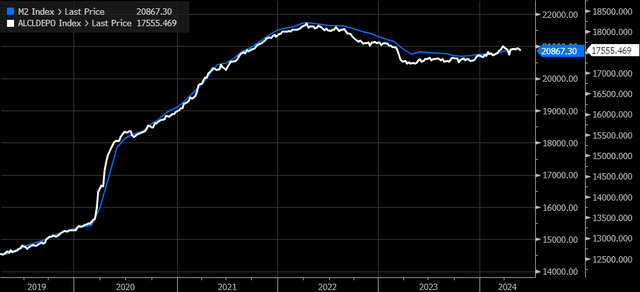

But ultimately, the underlying problem seems to be that money growth has been stagnant, with the money supply M2 and bank deposits declining in recent years while nominal GDP accelerates and money velocity increasing no matter how you measure it. Increasing money velocity means that a dollar today is moving through the economy much faster – that’s inflation.

This is also illustrated by rising bond yields, which tend to track and move in tandem with money velocity, suggesting that bond yields will likely continue to rise until nominal growth slows, money supply growth accelerates, and velocity falls.

The latest jobs report also suggests that nominal growth, as measured by the weekly payroll index, which tends to track nominal GDP over time, is unlikely to slow, at least through May, when it will remain roughly flat from April and faster than January.

Meanwhile, the latest bank deposit data shows that M2 growth hasn’t changed much in recent weeks. At the moment, money growth is still fairly sluggish, which suggests that dollars are still flowing into the economy at a high rate.

So while this month’s CPI report may be coming out at a much more desirable pace on the headlines, it also appears to be a month with very low expectations due to weakness in energy and autos, which may not be able to offset other factors we’ve seen in core services in recent months, as well as stubborn increases in housing and transportation costs.

But if this month is one of those, it seems like markets could be caught off guard. After all, inflation is generally between 3.5% and 4%, based on economic fundamentals, and there’s little evidence to suggest that that’s changing.