Philo

STAG Industrial (New York Stock Exchange:Men only) With stock prices unfairly depressed recently, in my view, industrial real estate investment trusts are attractive as long-term anchor investments in a passive income portfolio.

STAG Industrial has you covered in comfort The company’s dividends are funded by operating funds, its FFO payout ratio is very low, and its dividends have been growing every year.

I believe STAG Industrial has great growth potential in the industrial market, given its relatively small size.

The stock is selling at a very reasonable FFO multiple, and with acquisitions continuing to play a big role for the industrial real estate investment trust, dividends should continue to grow going forward.

My rating history

My final stock classification for STAG Industrial is buy The trust’s main focus is on industrial real estate. It will be a passive income investor in the long term. I make this claim because STAG Industrial’s asset size allows it to participate in the underlying growth of the e-commerce industry in which the trust leases a lot of its real estate.

With new share price weakness keeping STAG Industrial’s share price in check, I think passive income investors are looking for a buying opportunity.

REIT specializing in industries with high growth potential

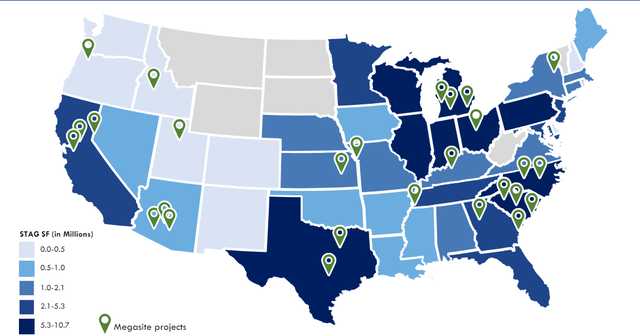

STAG Industrial is a $6.4 billion industrial real estate company with industrial properties across the U.S. The trust owns 570 buildings in 41 states as of March 31, 2024, totaling 113 million square feet.

Although STAG Industrial has been around for over a decade (the trust’s inception date was 2010), the real estate investment trust is relatively small compared to the industry giants. Prologis Co., Ltd.PLD)The trust has a market capitalization of $102.7 billion, about 16 times the size of STAG Industrial.

Megasite Project (STAG Industrial)

STAG Industrial focuses on owning and leasing single-tenant industrial real estate. A key number for passive income investors to look at is the trust’s cash net operating income, as this number ultimately supports the trust’s ability to pay growing dividends to shareholders.

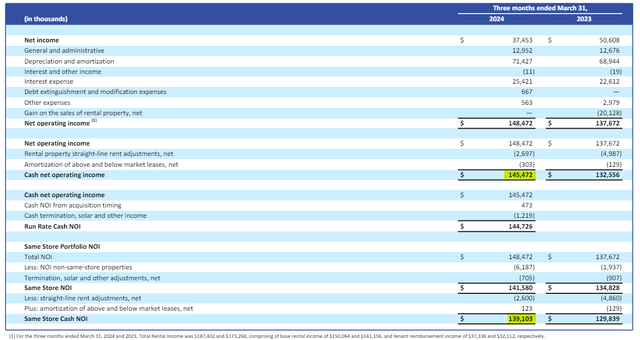

In the first quarter, STAG Industrial generated $145.5 million in cash NOI from its industrial real estate portfolio, up 9.7% year over year. This growth was achieved primarily through acquisitions, as the trust has been very active in adding new industrial real estate space to its portfolio.

To correct for the impact of acquisitions, we look at funds from operations, which increased 7.1% year over year to $139.1 million. The trust was able to increase FFO through acquisitions and rent increases.

Cash Net Operating Profit (STAG Industrial)

The outlook for the industrial REITs sector is bright as the e-commerce industry is booming, creating a need for more space in warehouses, distribution centers and other areas.

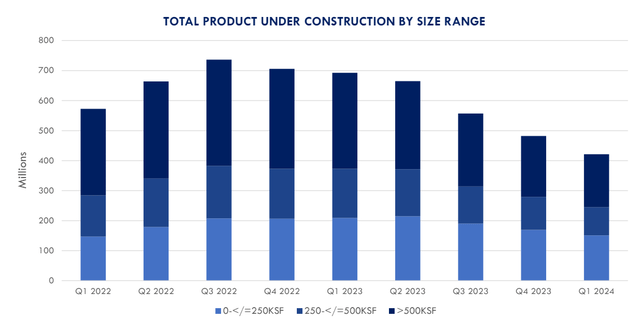

Additionally, there is limited supply of industrial real estate, especially in properties under 150,000 square feet, which is STAG Industrial’s focus. With limited supply in the market, STAG Industrial has the opportunity to drive strong rental growth for its properties.

According to the latest NAREIT report, STAG Industrial: updateIt expects its net operating income to grow by 4.75% to 5.25% in 2024.

Total products under construction (STAG Industrial)

Why Buy STAG Industrial?

Investors looking for passive income should consider STAG Industrial primarily for its solid 4% yield, which is fully covered by the trust’s operating funds, and the fact that STAG Industrial is aggressively growing its dividend.

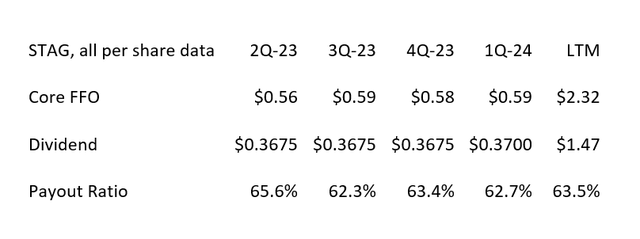

In terms of dividend payout ratios, STAG Industrial earned $2.32 per share in core operating funds last year, more than enough to pay the dividend and to further invest in real estate acquisitions.

With a dividend payout ratio of just 64% over the last 12 months, STAG Industrial offers a high-quality dividend yield of 4% for passive income investors who don’t need to worry about dividend continuity.

dividend (Table created by authors using company supplementary materials)

Passive Income Investors Should Consider Buying Drop

I think STAG Industrial is selling at a very reasonable core FFO multiple, especially when compared to its peers. The industrial trust expects to earn core operating funds of $2.36 and $2.40 per share in 2024, which has not changed since I last reviewed the industrial trust.

However, STAG Industrial’s recent share price slump has made the stock significantly cheaper. Passive income investors are currently paying 14.7x core FFO for STAG Industrial’s 4% dividend yield, compared to nearly 16.0x at the end of 1Q24.

Prologis shares are selling for 20.3 times its 2024 core FFO estimate, based on a revised 2024 FFO estimate of $5.37 to $5.47 per share. However, Prologis is a much larger and more diversified large industrial REIT.

In light of its low payout ratio and growing dividends, I believe STAG Industrial’s valuation multiple represents an attractive value proposition for passive income investors.

Why Investment Thesis Disappoints Passive Income Investors

There can be no assurance that demand for industrial real estate will remain as high and strong as it is today. Real estate is fundamentally cyclical, so while STAG Industrial is currently doing well due to strong demand for industrial real estate space, the sector is not immune to economic downturns or shifts in capital allocation patterns.

STAG Industrial also relies heavily on acquisitions to grow its net operating income and working capital, so if the pool of available industrial properties dries up, STAG Industrial, as a concentrated industrial trust, could suffer weakening growth prospects and weakening dividend coverage.

My conclusion

STAG Industrial is a very solid industrial REIT investment. This industrial real estate investment trust has seen double-digit growth in cash net operating income due to limited supply and rising rents in the trust’s core segments.

The trust also continues to benefit from its aggressive stance on acquisitions, which has been a primary driver of FFO growth.What I appreciate most about STAG Industrial is that this industrial REIT offers investors a very low FFO-based dividend payout ratio in the low 60s, which translates to very high dividend safety in my view.

This means that STAG Industrial continues to have enough cash to invest in its real estate portfolio while still leaving room for dividend growth.From a valuation perspective, STAG Industrial shares also look attractive.

I believe STAG Industrial can (and probably should) be an anchor investment in any passive income investor’s portfolio, especially with its dividends expected to continue to grow in the future.