JHVE Photo

Overview of Results

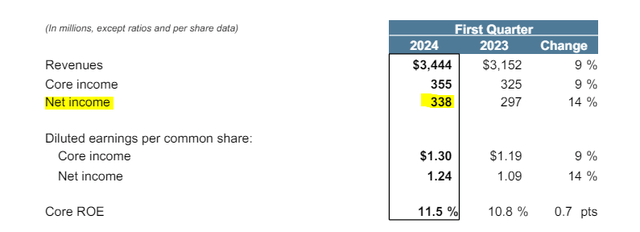

CNA Financial (New York Stock Exchange:Latin America) has been released First Quarter Financial Results It reported stable net profit of $338 million in May.

CNA Financial’s Q1 2024 Presentation

CNA Financial achieved positive revenue during the quarter, up 16% year over year, due to increased investment income. Year-over-year, the effective yield on the bonds increased from 4.6% to 4.7% year-over-year due to the continuing impact of higher reinvestment rates, and underwriting performance remained strong, reaching $126 million.

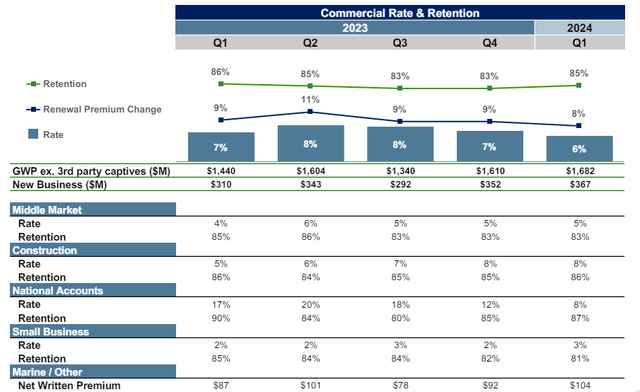

Despite a slight deterioration in its overall ratio year-over-year due to concerns about inflation and catastrophe losses, CNA Financial was able to maintain a stable financial performance.CNA Financial started 2024 on a strong note with renewal premium change at +6% and a stable retention rate of 85%.

While the current valuation may not be particularly attractive, For investors looking for positive returns, insurance companies have consistently delivered strong financial results, allowing them to pay regular dividends to shareholders.

CNA Financial’s Underwriting Performance: Consistently Reliable

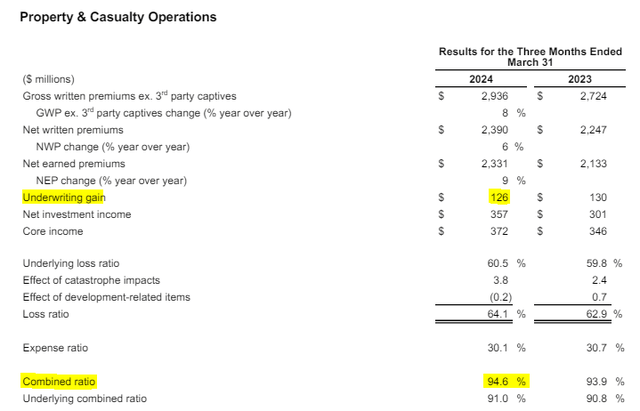

The Property & Casualty segment recorded a quarterly underwriting profit of $126 million, with a composite ratio of 94.6%.

CNA Financial’s Q1 2024 report

The strong quarterly performance of the insurance portfolio was driven by stable, albeit slightly weaker, underwriting results in the specialty insurance business and improved margins in the international insurance business.

However, the year-to-date combined ratio was 94.6%, down 0.7 percentage points from the same period in 2017. The year-to-date combined ratio decline was affected by negative runoff losses and increased catastrophe losses, which together had a negative impact of 4.0 percentage points on the combined ratio.

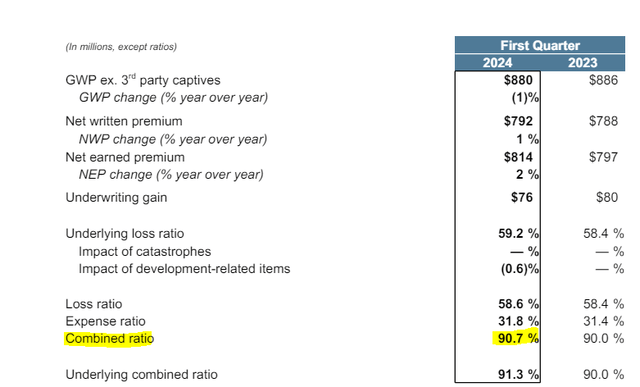

Specialized business overview:

Specialty business, a key component of the insurance portfolio, maintained a stable headline ratio of 90.7% compared to 90% in the same period last year.

CNA Financial’s Q1 2024 report

The deterioration in the overall ratio was driven by a deterioration in the underlying overall ratio, which increased 1.3 percentage points, partially offset by a 0.6 percentage point improvement in the loss ratio due to the impact of claims developments in the prior year period, which was net unchanged in the prior year period.

Commercial business overview:

In the first quarter of 2024, CNA Financial’s commercial business recorded strong sales and a 15% increase in net premiums after reinsurance, driven by an 8% rate change and an 85% retention rate.

CNA Financial’s Q1 2024 report

This segment had positive underwriting gains of $29 million, down $12 million compared to the same period last year. The decrease in underwriting gains was primarily due to a deterioration in overall ratios, which led to an increase in the loss ratio of 3.1 points. The commercial portfolio was impacted by higher catastrophe losses, resulting in a loss ratio of $82 million and a loss ratio of 6.8 points in the second quarter of 2018, compared to $44 million and a loss ratio of 4.2 points in the same period last year.

Despite declining underwriting profits, insurers continued to push through price increases in U.S. commercial P&C lines. In the first quarter, commercial auto premiums increased 14%, excess liability increased 11%, primary general liability increased mid-single digits, and renewal premiums moved in the high single digits due to revenue and employee growth. These premium increases are double those seen six quarters prior.

International business overview:

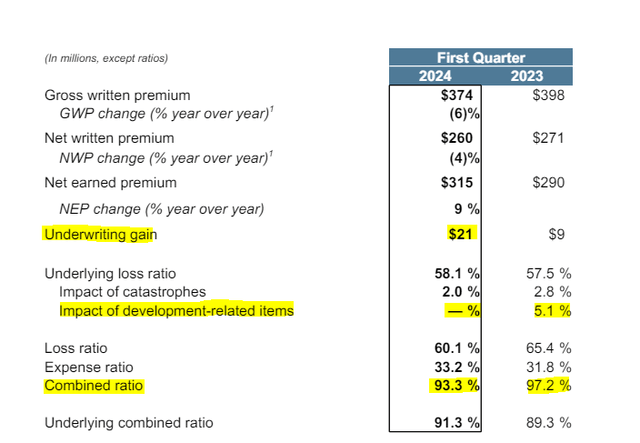

In the first quarter of 2024, pretax underwriting profits for CNA Financial’s international operations more than doubled to $21 million, despite a decline in gross written premiums due to a decline in new business.

Nonetheless, underwriting performance improved, with the overall ratio decreasing from 97.2% to 93.3%.The majority of the improvement in underwriting performance was attributable to the absence of adverse changes in prior claims.

CNA Financial’s Q1 2024 Presentation

CNA Financial’s management expects its international business to contribute more consistently to the company’s overall revenue growth, given the cumulative rate increases and significant re-underwriting actions implemented by the insurer over the past few years.

Non-fixed income performance stimulates investment returns

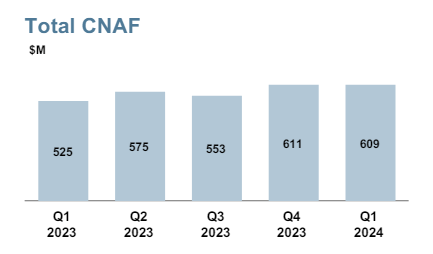

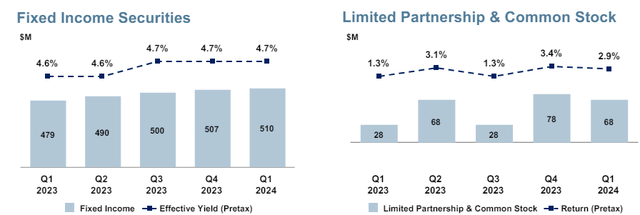

CNA Financial, like other insurers, has benefited from rising average yields on fixed income investments over the past few years. But yields have plateaued, with year-over-year interest rate yields remaining roughly stable at 4.6% to 4.7%. Still, net investment income for the first quarter of 2024 increased by $84 million compared to the same period last year.

CNA Financial’s Q1 2024 Presentation

The increase was driven by favorable returns on limited partnerships and common stock, as well as higher returns from fixed income securities as a result of favorable reinvestment rates.

CNA Financial’s Q1 2024 Presentation

Going forward, we expect investment income to continue to grow as the invested asset base continues to grow and benefits from 4%+ yields, so the investment portfolio will continue to be a big tailwind for income.

For the full year 2024, current shareholders expect to earn approximately $2.175 billion, or a 5% increase compared to full-year 2023, resulting in an effective yield for the entire portfolio approaching 4.8% by the end of 2024.

Outlook for 2024

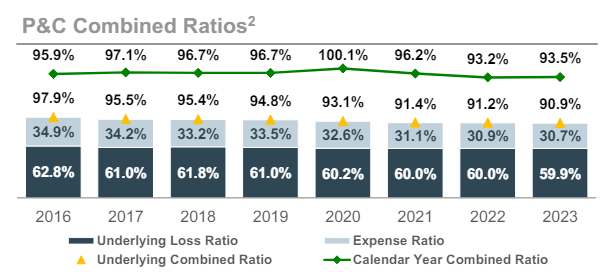

The average combined ratio over the past eight years has ranged from 93% to 97%, excluding 2020 performance which was impacted by COVID-19.

CNA Financial Investor Presentation

Although underwriting performance improved significantly in 2022 and 2023 compared to prior years, it would be unwise to project fiscal 2024 revenues based solely on those years.

CNA Financial’s management has been working steadily to improve the performance of its insurance portfolio over the past few years, so while a composite ratio of around 93% is possible, it should be viewed as an optimistic scenario if underwriting measures in both the international and commercial lines come to fruition.

In the base case scenario, underwriting margins will be 3-5 percentage points and the overall ratio will vary between 95% and 97%. In terms of premium income, the premium income target of $10 billion by 2024 is achievable.

Thus, pretax underwriting profits for the P&C business could reach $300 million to $500 million in 2024. In addition, pretax losses from the wind-down of the long-term care portfolio are expected to be around $1 billion.

Investment income from both the life and non-life insurance segments is expected to be $2.175 billion, with combined pre-tax profits in the range of $1.5 billion to $1.7 billion. Assuming a corporate tax rate of 21%, after-tax profits would be approximately $1.19 billion to $1.34 billion.

So, despite its $3 billion in debt, the company appears well-positioned to maintain stable performance and continue distributing excess capital to shareholders through dividends without compromising its financial health.

Debt situation: More than manageable debt burden

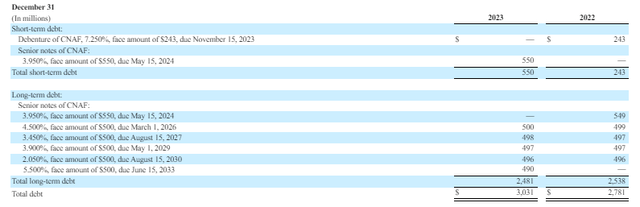

As of December 2023, debt consists of fixed-rate instruments, with 85% of total debt maturing between 2026 and 2033.

CNA Financial’s 2023 Annual Report

In 2024, the company issued $500 million. The company is issuing 5.125% senior unsecured notes due February 15, 2034 to repay its 3.95% notes due May 2024. Debt costs have increased slightly, impacting operating profits by approximately $1 million per year, but are within acceptable limits. Simply put, the increase in debt burden is manageable and is likely to be offset by increased investment income.

Current Rating

CNA Financial’s book value per share is currently $35.62, giving it a price-to-book multiple of approximately 1.25x.

This valuation suggests the company’s shares may be relatively attractive compared to other non-life insurers, whose stocks typically trade at more than 1.5 times book value.

However, CNA’s valuation is heavily influenced by its beneficial ownership by Lowe’s.and others) owns approximately 90% of the company, and as a result, CNA’s outlook is closely tied to Lowe’s operating and capital allocation decisions.

Conclusion

As mentioned above Previous articleCNA Financial may not be a fast-growing stock, nor a significantly undervalued stock. But its stable position in a niche market gives it the potential for steady cash flow. Investors should keep in mind that CNA is largely owned by Lowe’s and is dependent on Lowe’s decisions regarding capital allocation.

Investors should note that CNA is primarily owned by Lowe’s and is dependent on Lowe’s decisions regarding capital allocation.

While the upside potential may be somewhat limited, the company’s stable performance makes it an attractive choice for retirees and investors looking for a solid return with an emphasis on dividends. For these investors, buying the stock at around 1.0 times book value provides a margin of safety.