Michal Radhenko/iStock via Getty Images

Introduction and Investment Thesis

Century Aluminum (Nasdaq:Thank youGlencore () is an aluminum smelter operating in the United States and Iceland.OTCPK:GLNCY) and sold 64% of them. CENX is scheduled to hand over production to Glencore in 2023. CENX’s business model is to purchase raw materials, smelt aluminium and sell it to downstream end users.

Century Aluminum’s stock price has soared 89% from $8.39 in early December 2023 to $15.82 on June 7th.NumberThis price increase is likely driven by a corresponding surge in LME aluminium prices.

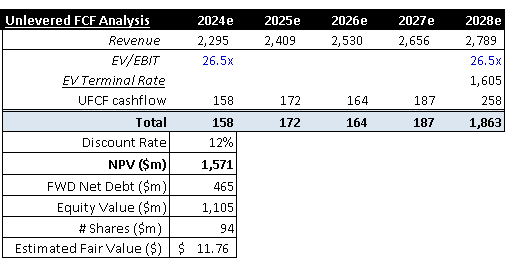

Using a simple DCF model based on unlevered free cash flow and an EV multiple of terminal value, we find that Century Aluminum is fundamentally overvalued. The model assumes a fair value share price of $11.76, or about 26% below the current market price.

However, gold may continue to rise at the same time that the aluminum spot market rises. Historically, the correlation between gold and aluminum has been strong, and even stronger during periods of large fluctuations.

Finally, while the company has diversified its customer base, Glencore remains important to Century Aluminum. It is not only its largest shareholder, but also its main supplier and customer. Without Glencore’s support, Century Aluminum’s business could be in jeopardy.

In conclusion, I would rate Century Aluminum a Sell at this time.

Market Overview and Competitive Environment

Market Overview

China produces about 38.5 million tonnes of aluminium out of the global annual production of around 70 million tonnes, accounting for around 57% of global production. Global consumption shareCentury Aluminum’s main markets, Europe and North America, account for about 24% of global demand. With production of about 690,000 tonnes in 2023, CENX is also a minor player in the industry.

In terms of downstream uses, aluminum is primarily consumed in construction and automobiles, accounting for approximately 50% of the total. Combined with global demandChina’s real estate crisis has caused a slump in the construction industry, and the auto industry Seems to be growing faster than expected.

CENX vs. the Market

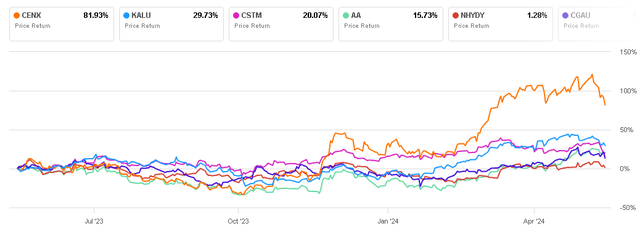

Comparing the performance of Aluminum and Century Aluminum, while the two assets are directionally correlated, Century Aluminum’s share price appears to be more responsive to changes in the underlying asset price, with this relationship being most pronounced throughout 2022, at the end of 2023, and now into mid-2024.

CENX vs. Aluminum Spot (TradingView)

Competitive analysis

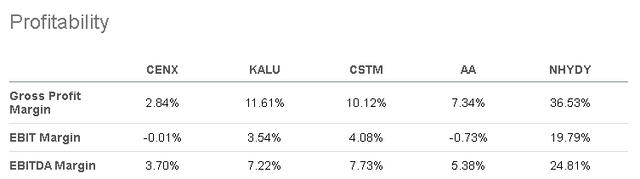

Century Aluminum’s competitors include AlcoaAA), Norsk Hydro (OTCQX:NHYDY), and Constellium SE (CSTMNot only is Century Aluminum the smallest company among its peers, but its operating metrics are also clearly below expectations: The company’s gross profit margins are between 5 and 34 percent below those of its peers.

Despite this, Century Aluminum’s stock price has outperformed its peers year over year. Given the company’s poor financial performance and small market share, one can only speculate as to what unique factors have contributed to such strong performance over the past 52 weeks. Also, one wonders whether this trend can be sustained.

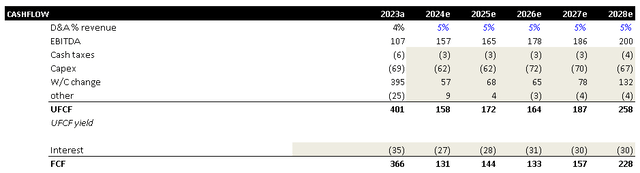

Century Aluminum is also currently in strong position in terms of valuation. Its FWD PE ratio of 38.36x is above the sector median of 15.72x. Its EV/Sales ratio of 0.94x is above the sector median of 1.73x. Its EV/EBIT ratio of 26.45x is above the sector median of 12.98x by 99% of companies.

Find Alpha

CENX Management and Guidance

CENX Operational Model

CENX purchases approximately 50% of its alumina feedstock from Concord Resources (10K, pg. 4). Production ratio 2:1 The rest is supplied by Glencore, which will account for 64% of aluminum sales in 2023, down from 75% two years ago. Glencore is not only a major shareholder in Century Aluminum, but is also clearly a key supplier and essential customer.

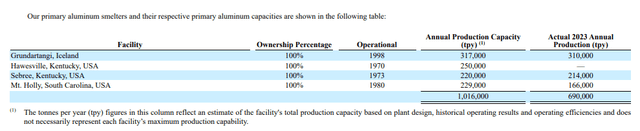

Aging assets and declining production

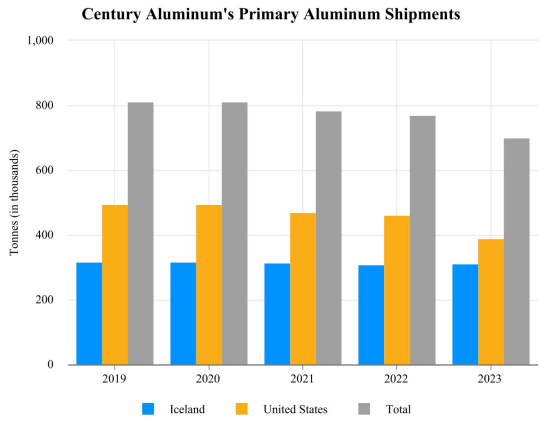

In 2023, CENX produced 690,000 tonnes of aluminium out of a total capacity of 1 million tonnes. Production was approximately 69% of total capacity. Many factors could be influencing this figure; however, the company’s aging assets could suggest one of the main factors behind the declining production levels.

Over the past few years, aluminum shipments from CENX have been declining consistently. While production at the Icelandic plant has remained stable, the decline was driven by plants in the United States. In 2019, CENX still shipped around 800,000 tonnes of aluminum. By 2023, this number had fallen to around 690,000 tonnes.

CENX 10K 2023

When we look more closely at the reasons for this decline, we quickly see that the US facilities are significantly older than the Icelandic ones.

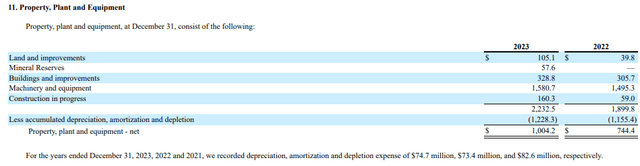

Aging PPE can impact the company’s actual production. A closer look at CENX’s PPE reveals that the accumulated depreciation of the fixed assets has exceeded their estimated useful lives. This supports the hypothesis that CENX’s operations are aging and will require significant CAPEX in the near future.

Unsurprisingly, management has cited the need for capital investment as one of the reasons for cutting production at Hawesville, which has been offline since August 2022.

The company completely curtailed production at its Hawesville facility in August 2022. It plans to resume operations when market conditions permit, including energy prices returning to more normal levels and aluminum prices remaining at levels sufficient to support its ongoing costs. Capital Expenditures need Restart the power plant and get it running. – 10K, page 31

CENX 10K 2023

Management guidelines and special items

Century Aluminum has recently Acquired JamalcoIt is an alumina production facility based in Jamaica with an annual production capacity of 770,000 tonnes. As alumina is the primary feedstock for aluminium production, Century Aluminium is increasing its vertical integration in the value chain, which may have a positive impact on gross margins in the future.

Century Aluminum received a $246 million bargain purchase benefit in connection with the transaction at a lower than expected price. Strong profits from continuing operations In the first quarter of 2024.

In the management guidelines, Second quarter EBITDA between $25 million and $30 millionis roughly in line with the first quarter. If Century Aluminum continues to perform this way through 2024, the EBITDA numbers will be in line with its 2023 EBITDA performance ($107 million).

Over the past few years, gross margins have remained relatively stable, as have operating profit (EBIT) figures. However, the company has continually recorded special items, both positive and negative, resulting in a very volatile bottom line. In my opinion, limiting special items going forward may reassure potential investors.

evaluation

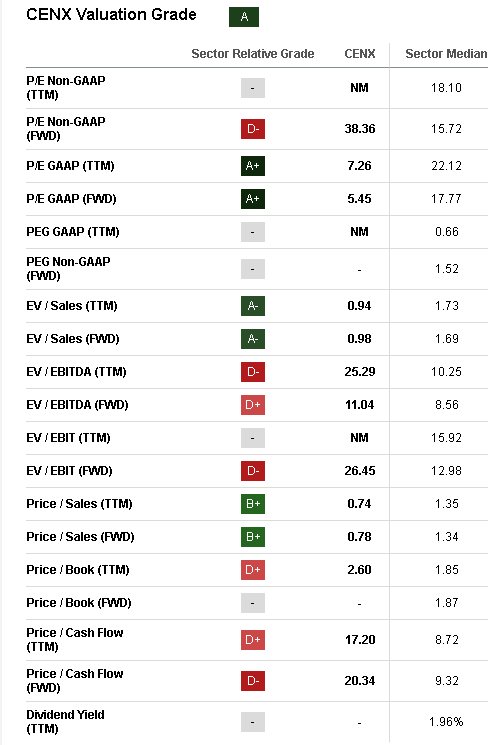

To calculate Century Aluminum’s fair value per share, we use a five-year DCF forecast, and further replace the traditional terminal value approach with a terminal value derived from a forecast of the company’s EV/EBIT multiple five years into the future.

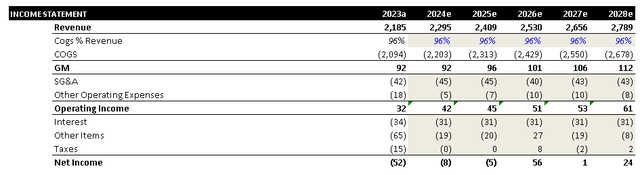

Key assumptions for the income statement forecast are as follows:

- We assume a gross margin of 4% to reflect the 2023 value.

- A 5% annualized growth rate has been applied to sales, which is generous in the current climate and gives Century Aluminum the ability to grow sales amid a structural production slowdown.

- SG&A and other operating expenses, along with interest, other items and taxes, are assumed to be averages over the past five years. The primary reason behind this methodology is that past performance has been highly volatile.

Free cash flow (without leverage) is calculated using a similar methodology: Depreciation and amortization is a percentage of earnings.

I use a discount rate of 12%, which I consider to be conservative. Mining and Minerals SectorNet debt is projected as the historical average and is estimated to decrease from $475 million in 2023 to $465 million in 2028.

Conservatively, we’ll assume an EV/EBIT multiple of 26.5x, the same as today’s figure, and while we think this figure is unlikely to stay this high, the market gives the benefit of the doubt.

Using the UFCF projections above, the equity NPV is projected to be around $1.11 billion, giving a fair share price of $11.76 in my view. Given today’s share price of $15.98, this leaves room for a downside of around 26% to the stock’s intrinsic value.

Author’s model using SA data

Risks and limitations

In addition to geopolitical, macroeconomic and general systemic market risks, Century Aluminum’s report points out three additional idiosyncratic risk factors that need to be considered.

dependenceCentury Aluminium owns 46% of Glencore, supplies over 50% and sells 64% to Glencore. This significant relationship means that Century Aluminium’s future performance is highly dependent on Glencore’s aluminum sales.

Market volatility: Century Aluminum’s share price is highly correlated with the price of aluminum, and any change in the direction of the price of aluminum could affect Century Aluminum’s share price regardless of its intrinsic value.

Aging assets: Century Aluminum’s PPE fleet is aging, and one plant is currently completely scaled down. After years of declining production, the company entered 2023 operating at approximately 70% of capacity. Failure to update the plants could adversely affect sales for the foreseeable future.