Luis Alvarez/DigitalVision via Getty Images

“High High Low” Closed End Fund Report

Quantitative screening helps quickly narrow down attractive candidates from a database of over 500 closed-end funds (CEFs) for further due diligence and research.The “High-High-Low” report was inspired by the following comment from a member of the CEF/ETF Income Laboratory:

Stanford, you should write a follow up article on CEFs with dividend yields over 8%, coverage over 90%, and trading below NAV. What does that look like in today’s world? How many funds do that? What’s the Z-score? I think many investors looking for higher yields would be interested in identifying best-in-class aggressive funds that are nearly covering their dividends. You can then reassess your risk vs reward.

author

In the High-High-Low report, there are three attributes to screen for:

- expensive Dividend (>8%) (i.e., yield of 8% or more)

- expensive Coverage (>90%) (i.e., coverage of 90% or more)

- low Premium/Discount Value (<0%) (i.e. trading at a discount)

How is coverage calculated?

For the fund companies listed below, the latest coverage figures from the fund’s most recent unaudited monthly estimates are used.

- PIMCO: Six-Month Coverage

- BlackRock: Last 3 Months Coverage

- Nuveen: Past 3 Months Coverage

- Eaton Vance: Coverage from the past three months

For the remaining funds, coverage ratios are calculated using return data from their most recent annual/semi-annual reports. Because these reports are only published twice a year, coverage ratios have a larger lag (up to six months) compared to fund families that publish monthly return forecasts.

We hope that these rankings of “high-high-low” CEFs provide fertile ground for further research and due diligence. As a reminder, these top lists are meant as a preliminary shortlist for further research and are not intended as a final analysis for a buy or sell decision.

Table header key:

P/D = Premium/Discount

Z = 1-year Z-score

Cov = coverage

1Y NAV = NAV total return for one year

Lev = Leverage

BE = Base cost

Data is, May 29, 2024.

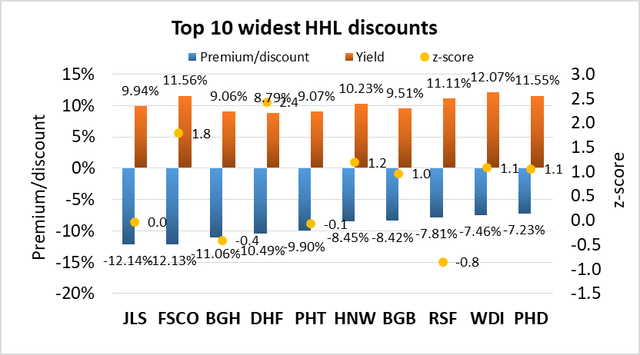

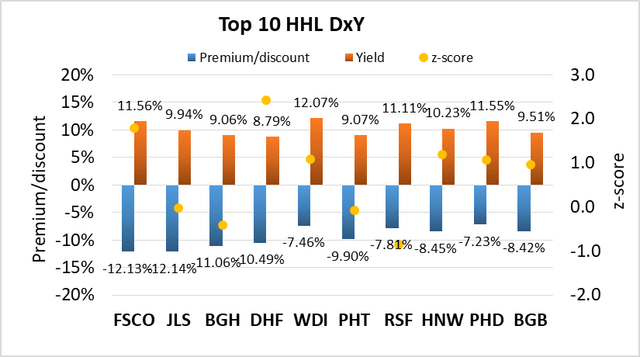

1. Top 10 Most Extensive “High High Low” Discounts

The data below shows the 10 CEFs with the highest discount rates, yields above 8%, and coverage above 90%. For comparison, Z-scores, leverage, and baseline expenses are shown.

| Fund | Ticker | Categories | P/D | yield | figure | cover | 1 year NA | Lev | Become familiar |

| Nuveen Mortgage and Income Fund | (JLS) | High yield | -12.14% | 9.94% | 0.0 | 92% | 11.7% | twenty five% | 2.00% |

| FS Credit Opportunities Corporation | (Financial Services) | Multi-sector Revenues | -12.13% | 11.56% | 1.8 | 101% | 20.7% | 17% | 4.62% |

| Barings Global Short Term High Yield | (BGH) | High yield | -11.06% | 9.06% | -0.4 | 111% | 16.1% | 26% | 1.88% |

| BNY Mellon High Yield Strategy Fund | (India) | High yield | -10.49% | 8.79% | 2.4 | 106% | 11.2% | 29% | 1.33% |

| Pioneer high income | (PHT) | High yield | -9.90% | 9.07% | -0.1 | 100% | 15.6% | 31% | 1.00% |

| Pioneer Diversification High Income | (High-cost network) | High yield | -8.45% | 10.23% | 1.2 | 91% | 16.7% | 29% | 2.00% |

| Blackstone Strategic Credit 2027 Term | (Germany) | Senior Loan | -8.42% | 9.51% | 1.0 | 107% | 13.3% | 36% | 2.58% |

| River North Capital and Inc. Fund | (RSF) | High yield | -7.81% | 11.11% | -0.8 | 138% | 8.4% | 57% | 8.84% |

| Western Asset Diversified Inc. Fund | (WDI) | Multi-sector Revenues | -7.46% | 12.07% | 1.1 | 102% | 12.4% | 32% | 1.81% |

| Pioneer Floating Rate Fund | (PhD) | Senior Loan | -7.23% | 11.55% | 1.1 | 107% | 15.8% | 32% | 1.40% |

Revenue Lab

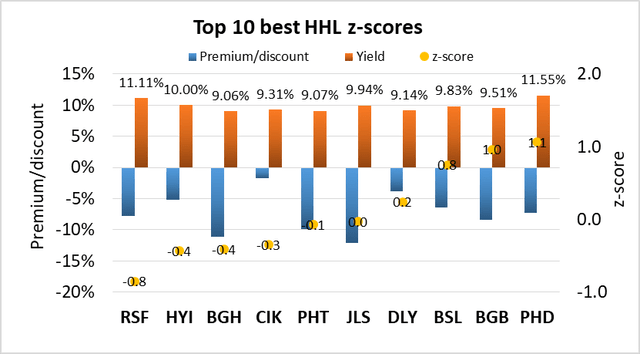

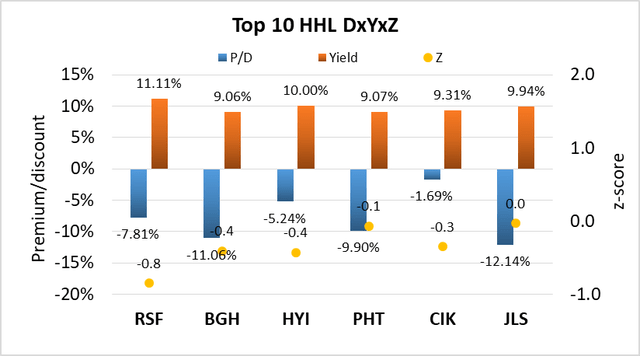

2. Top 10 lowest “High-High-Low” Z-scores

The data below shows the 10 CEFs with the lowest one-year Z-scores, yields above 8%, coverage above 90%, and premiums/discounts below 0%. The more negative the Z-score, the cheaper the fund is relative to its recent average discount. Leverage and baseline expenses are shown for comparison.

| Fund | Ticker | Categories | figure | P/D | yield | cover | 1 year NA | Lev | Become familiar |

| River North Capital and Inc. Fund | (RSF) | High yield | -0.8 | -7.81% | 11.11% | 138% | 8.4% | 57% | 8.84% |

| Western Asset High Yield Defining Opportunity | (Yes) | High yield | -0.4 | -5.24% | 10.00% | 94% | 6.8% | 0% | 0.95% |

| Barings Global Short Term High Yield | (BGH) | High yield | -0.4 | -11.06% | 9.06% | 111% | 16.1% | 26% | 1.88% |

| Credit Suisse Asset Management Income | (CIK) | High yield | -0.3 | -1.69% | 9.31% | 93% | 13.3% | 28% | 0.88% |

| Pioneer high income | (PHT) | High yield | -0.1 | -9.90% | 9.07% | 100% | 15.6% | 31% | 1.00% |

| Nuveen Mortgage and Income Fund | (JLS) | High yield | 0.0 | -12.14% | 9.94% | 92% | 11.7% | twenty five% | 2.00% |

| DoubleLine Yield Opportunities Fund | (daily) | Multi-sector Revenues | 0.2 | -3.77% | 9.14% | 95% | 13.9% | 20% | 1.84% |

| Blackstone Senior Floating Rt 2027 Term | (BSDL) | Senior Loan | 0.8 | -6.38% | 9.83% | 101% | 14.2% | 32% | 1.93% |

| Blackstone Strategic Credit 2027 Term | (Germany) | Senior Loan | 1.0 | -8.42% | 9.51% | 107% | 13.3% | 36% | 2.58% |

| Pioneer Floating Rate Fund | (PhD) | Senior Loan | 1.1 | -7.23% | 11.55% | 107% | 15.8% | 32% | 1.40% |

Revenue Lab

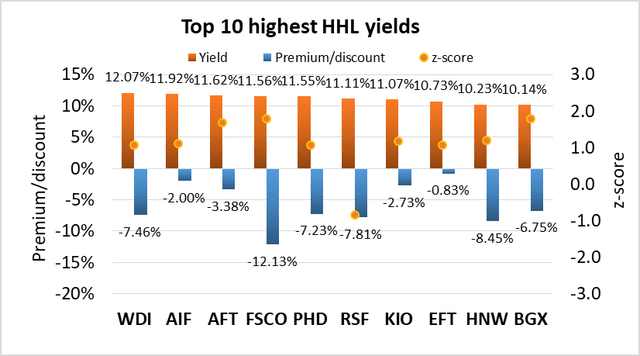

3. Top 20 “High, High, Low” Yields

The data below shows the 20 CEFs with the highest yields, coverage above 90%, and premium/discount below 0%. However, it is important to note that higher yields may also come with higher risk due to leverage, investments in risky assets, etc. Z-scores, leverage, and baseline expenses are shown for comparison.

| Fund | Ticker | Categories | yield | P/D | figure | cover | 1 year NA | Lev | Become familiar |

| Western Asset Diversified Inc. Fund | (WDI) | Multi-sector Revenues | 12.07% | -7.46% | 1.1 | 102% | 12.4% | 32% | 1.81% |

| Apollo Tactical Income Fund, Inc. | (Australia) | High yield | 11.92% | -2.00% | 1.1 | 96% | 14.8% | 36% | 2.53% |

| Apollo Senior Floating Rate Fund | (rear end) | Senior Loan | 11.62% | -3.38% | 1.7 | 97% | 13.2% | 36% | 2.48% |

| FS Credit Opportunities Corporation | (Financial Services) | Multi-sector Revenues | 11.56% | -12.13% | 1.8 | 101% | 20.7% | 17% | 4.62% |

| Pioneer Floating Rate Fund | (PhD) | Senior Loan | 11.55% | -7.23% | 1.1 | 107% | 15.8% | 32% | 1.40% |

| River North Capital and Inc. Fund | (RSF) | High yield | 11.11% | -7.81% | -0.8 | 138% | 8.4% | 57% | 8.84% |

| KKR Income Opportunities Fund | (Kio) | High yield | 11.07% | -2.73% | 1.2 | 106% | 20.3% | 36% | 2.14% |

| Eaton Vance Floating Rate | (EFT) | Senior Loan | 10.73% | -0.83% | 1.1 | 97% | 14.7% | 36% | 1.31% |

| Pioneer Diversification High Income | (High-cost network) | High yield | 10.23% | -8.45% | 1.2 | 91% | 16.7% | 29% | 2.00% |

| Blackstone Long Short Credit Income | (England) | Senior Loan | 10.14% | -6.75% | 1.8 | 105% | 14.0% | 31% | 2.20% |

Revenue Lab

4. Top 10 Best Combinations of “High-High-Low” Yields and Discounts

Buying a CEF with both a high yield and a discount not only gives you the opportunity to profit from the narrowing discount, but also gives you “free” alpha every time a distribution is paid, since paying a distribution is essentially the same as liquidating the fund at NAV and returning capital to unit holders.Only funds with yields above 8%, coverage above 90%, and premium/discounts below 0% will be considered.

| Fund | Ticker | Categories | P/D | yield | figure | Length and width | cover | 1 year NA | Lev | Become familiar |

| FS Credit Opportunities Corporation | (Financial Services) | Multi-sector Revenues | -12.13% | 11.56% | 1.8 | -1.4 | 101% | 20.7% | 17% | 4.62% |

| Nuveen Mortgage and Income Fund | (JLS) | High yield | -12.14% | 9.94% | 0.0 | -1.2 | 92% | 11.7% | twenty five% | 2.00% |

| Barings Global Short Term High Yield | (BGH) | High yield | -11.06% | 9.06% | -0.4 | -1.0 | 111% | 16.1% | 26% | 1.88% |

| BNY Mellon High Yield Strategy Fund | (India) | High yield | -10.49% | 8.79% | 2.4 | -0.9 | 106% | 11.2% | 29% | 1.33% |

| Western Asset Diversified Inc. Fund | (WDI) | Multi-sector Revenues | -7.46% | 12.07% | 1.1 | -0.9 | 102% | 12.4% | 32% | 1.81% |

| Pioneer high income | (PHT) | High yield | -9.90% | 9.07% | -0.1 | -0.9 | 100% | 15.6% | 31% | 1.00% |

| River North Capital and Inc. Fund | (RSF) | High yield | -7.81% | 11.11% | -0.8 | -0.9 | 138% | 8.4% | 57% | 8.84% |

| Pioneer Diversification High Income | (High-cost network) | High yield | -8.45% | 10.23% | 1.2 | -0.9 | 91% | 16.7% | 29% | 2.00% |

| Pioneer Floating Rate Fund | (PhD) | Senior Loan | -7.23% | 11.55% | 1.1 | -0.8 | 107% | 15.8% | 32% | 1.40% |

| Blackstone Strategic Credit 2027 Term | (Germany) | Senior Loan | -8.42% | 9.51% | 1.0 | -0.8 | 107% | 13.3% | 36% | 2.58% |

Revenue Lab

FiveTop 10 Best Combinations of “High-High-Low” Yield, Discount and Z-Score

This index takes into account all three components: yield, discount, and Z-score. The composite index simply multiplies the three quantities together, revealing funds that are undervalued both absolutely and relatively. A screen is applied to include only CEFs with negative one-year Z-scores. Only funds with yields ≥ 8%, coverage ≥ 90%, and premium/discount < 0% are considered. (This month, there are only six funds that meet these criteria)

| Fund | CEF | Categories | P/D | yield | figure | Height x Width x Z | cover | 1 year NA | Lev | Become familiar |

| River North Capital and Inc. Fund | (RSF) | High yield | -7.81% | 11.11% | -0.8 | 0.7 | 138% | 8.4% | 57% | 8.84% |

| Barings Global Short Term High Yield | (BGH) | High yield | -11.06% | 9.06% | -0.4 | 0.4 | 111% | 16.1% | 26% | 1.88% |

| Western Asset High Yield Defining Opportunity | (Yes) | High yield | -5.24% | 10.00% | -0.4 | 0.2 | 94% | 6.8% | 0% | 0.95% |

| Pioneer high income | (PHT) | High yield | -9.90% | 9.07% | -0.1 | 0.1 | 100% | 15.6% | 31% | 1.00% |

| Credit Suisse Asset Management Income | (CIK) | High yield | -1.69% | 9.31% | -0.3 | 0.1 | 93% | 13.3% | 28% | 0.88% |

| Nuveen Mortgage and Income Fund | (JLS) | High yield | -12.14% | 9.94% | 0.0 | 0.0 | 92% | 11.7% | twenty five% | 2.00% |

Revenue Lab