Daniel Griselli

With most of the stock market gains this year driven by tech stocks, especially AI, companies often need to dig into other sectors for growth.

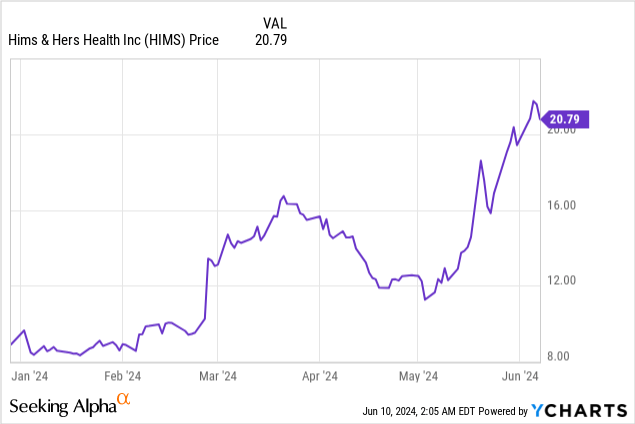

Another key trend dominating the healthcare sector Ozempic and related weight loss drugs have exploded in popularity this year.New York Stock Exchange:Hims) With its strengthened product portfolio, the company has been a big beneficiary of this trend, and its shares have more than doubled so far this year.

Despite the strong gains so far this year, I have a Buy recommendation on Hims & Hers. Broadly speaking, there are a few factors that attract me to this company.

- Astonishing growth rate. Hims & Hers is currently experiencing year-over-year sales growth of over 40%, despite sales being expected to exceed $1 billion. 2024.

- Huge gross profit. The company’s focus on generic drugs means it sells drugs that are cheap to produce and have high profit margins (and it doesn’t spend much on research and development itself).

- Delivering customer centricity and personalization helps build a sustainable revenue base. The company prioritizes personalized solutions that allow customers to receive custom medications for multiple conditions at once, creating advantage and recurring revenue potential for Hims & Hers.

In my view, there is significant upside potential here as Hims & Hers continues to expand into new therapeutic areas. Let’s ride the upside rally here.

Continued expanding market opportunities

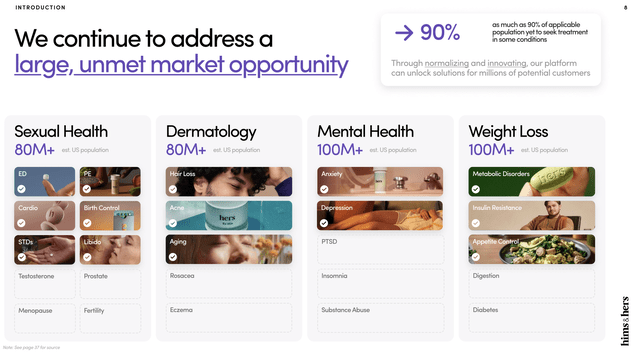

Hims started out as a distributor of generic erectile dysfunction (ED) drug sildenafil (best known for its most common brand in the industry, Viagra) in 2017. The company quickly expanded into other men’s health categories, including hair loss, and in 2018 also launched a sister brand, Hers, covering women’s health.

Since then, the company has grown into a comprehensive healthcare company covering a wide range of therapeutic areas (see diagram below).

Hims & Hers Therapeutic Areas (Hims & Hers Investor Presentation May 2024)

The company sells both over-the-counter and prescription drugs, but it’s notable that it’s focused almost entirely on generic drugs. (For investors unfamiliar with this space: Drug patents typically have a 20-year exclusivity period, after which generics flood the market, but the original drug becomes a strong brand and usually remains the best-seller in its category.) So while the company doesn’t take on R&D risk, it also doesn’t have much potential for rapid growth.

The company continues to launch new product offerings. Most notably, in December 2023, it launched its own weight loss management product, starting at $79 per month, building on the momentum of Ozempic.

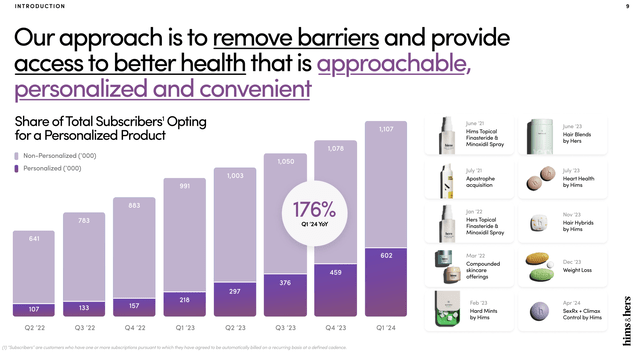

Personalized care is a key differentiator for Hims & Hers. The company’s core philosophy is to make it easy for everyday men and women to quickly and easily diagnose their problems and receive personalized treatment that addresses those symptoms.

35% of the company’s subscribers choose the personalized solution. 100% of people on a weight loss plan use personalized products. It’s also worth noting that the number of users of personalized plans has increased in the most recent quarter. 176% increase from last yearcreating a recurring earnings moat for Hims & Hers.

Hims & Hers Subscription Offer (Hims & Hers May 2024 Investor Presentation)

Incredible growth, backed by stable margin leverage

Meanwhile, Hims & Hers’ recent product expansions and growing brand presence are helping to generate significant growth and impact.

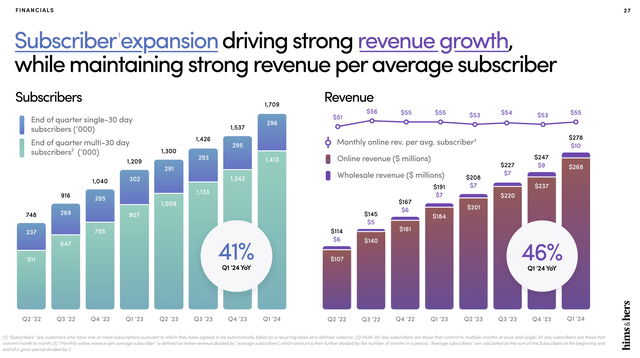

Hims & Hers Q1 Sales Indicators (Hims & Hers Q1 Shareholder Letter)

Total revenue for the first quarter increased 46% year over year to $278 million, well above Wall Street expectations of $269 million (up 41% year over year), while the company ended the quarter with 1.7 million subscribers, up 41% year over year.

While the company gained 172,000 new subscribers in the first quarter (a product of recent marketing efforts to promote its personalization platform), it believes personalized treatment will also improve customer retention, especially due to the convenience of taking fewer pills to treat all symptoms. First quarter earnings announcement:

We believe that this continued transition will yield several benefits in the future. First, improved retention. We are seeing evidence across multiple disciplines that personalized products have higher retention and stronger user preferences than generic products. This is not surprising to us, as feedback from user interactions and behavior is one of the key drivers of our product development.

“We expect this benefit to grow as we continue to offer personalized treatment options at increasingly mass-market prices. Secondly, we also see opportunities for improved efficiency. We expect to benefit from economies of scale from personalized services, similar to those observed in other areas of our business in the past. We believe these benefits will grow as we continue to expand our portfolio of personalized services throughout 2024.”

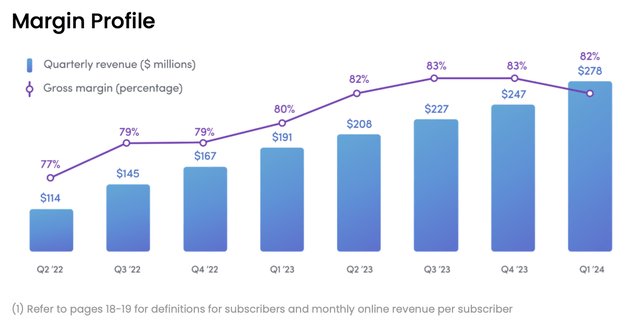

This recurring revenue stream is generated by incredible gross margins that rival those of a software company: gross margins reached 82% in the first quarter, representing a 2 percentage point improvement year over year.

Hims & Hers Q1 Gross Margin (Hims & Hers Q1 Shareholder Letter)

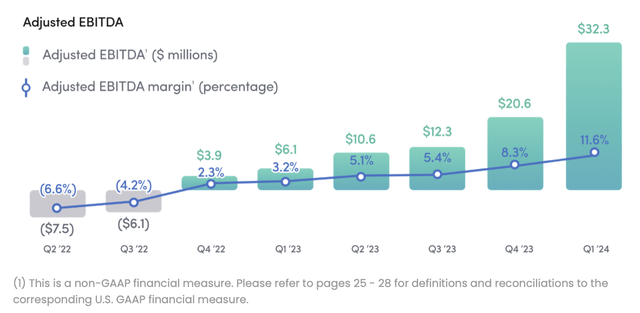

Meanwhile, thanks to operating leverage, Hims & Hers recorded a record quarterly adjusted EBITDA of 11.6%, and nominal adjusted EBITDA of $32.3 million increased 57% sequentially and more than five times higher than the prior year.

Hims & Hers Adjusted EBITDA (Hims & Hers First Quarter Shareholder Letter)

Valuation, risks and key takeaways

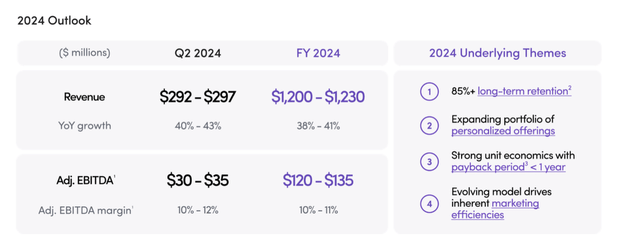

For the current fiscal year, Hims & Hers is targeting sales of $1.2 billion to $1.23 billion (up 38% to 41% year over year) and an adjusted EBITDA margin of 10% to 11% on that sales profile. Longer term, the company is targeting stable adjusted EBITDA margins of 20% to 30% (which is not hard to imagine, given that gross margins are already above 80%; the company currently spends about half of its sales on marketing, which should be tapered off as the company builds its recurring revenue base).

Hims & Hers 2024 Outlook (Hims & Hers First Quarter Shareholder Letter)

Meanwhile, at a current share price of just over $20, Hims & Hers has a market capitalization of $4.47 billion, excluding the $203.7 million in cash listed on the company’s most recent balance sheet. The enterprise value is $4.27 billion. At the midpoint of this year’s guidance range, Hims & Hers would be valued at:

- EV/3.5 times FY24 sales

- EV/FY24 Adjusted EBITDA: 33.3x

For a company whose revenues are still growing at over 40% and whose adjusted EBITDA margins have expanded by roughly 10 percentage points year over year (with a goal of expanding by another 20 percentage points to bring adjusted EBITDA margins up to 30%), these remain reasonable multiples.

Of course, there are risks to this story. As mentioned above, the company has limited intellectual property. It is more of a technology and distribution platform for getting drugs into consumers’ hands than a proprietary pharmaceutical brand. The company’s greatest strength is its ability to personalize medicines and increase consumer convenience, but there’s nothing to stop other generic drug manufacturers and distributors from eating away at Hims & Hers’ customer base (especially when the company is generating such high gross margins on commoditized drugs).

Still, I would argue that the benefits outweigh the risks. Many of the conditions Hims & Hers treats are covered by insurance if deemed medically necessary, so customers are less price sensitive and willing to switch providers than they would be with a purely self-pay product. That the company is able to achieve 40%+ growth at scale is a testament to the generosity and untapped nature of Hims & Hers’ addressable market.

This is a rocket stock you’ll want to own.