In retrospect, all that Bitcoin needed to actually be adopted by institutional investors was the introduction of a product in the form of a risk-minimized, easy-to-use exchange-traded fund (ETF). SEC Approves Nine New ETFs Providing exposure to Bitcoin through the spot market, Rigorous Improvement That’s more than any futures-based ETF that began trading in 2021. In the first quarter of trading, the size and number of institutional allocations to these ETFs far exceeded consensus expectations. BlackRock’s ETF alone set the record for the shortest period in which ETF assets reached $10 billion.

In addition to the staggering AUM figures these ETFs have garnered, last Wednesday marked the deadline for institutional investors with over $100 million in assets to report their holdings to the SEC via 13F filings. These filings provide a full account of who owns the Bitcoin ETFs, and the results are nothing short of bullish.

Institutional adoption is widespread

For the past few years, even one institutional investor reporting ownership of Bitcoin was a newsworthy, market-moving event. Just three years ago, Tesla Decision to add Bitcoin Their balance sheet investment helped Bitcoin rise by over 13% in a single day.

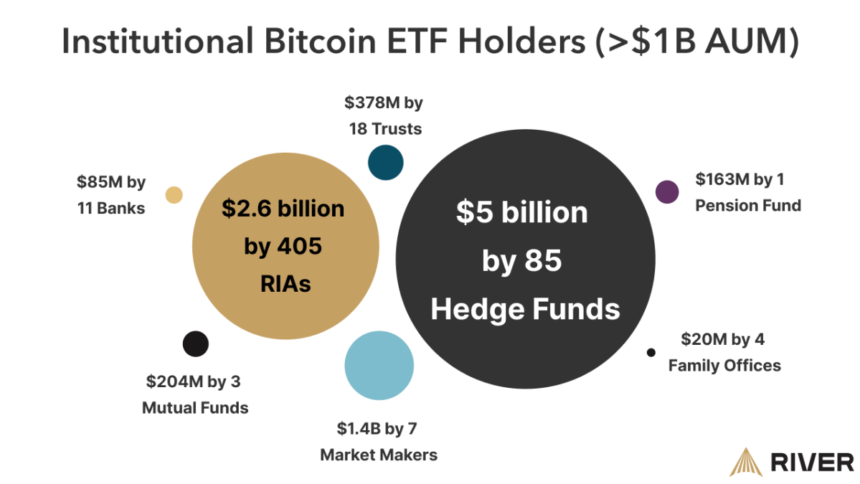

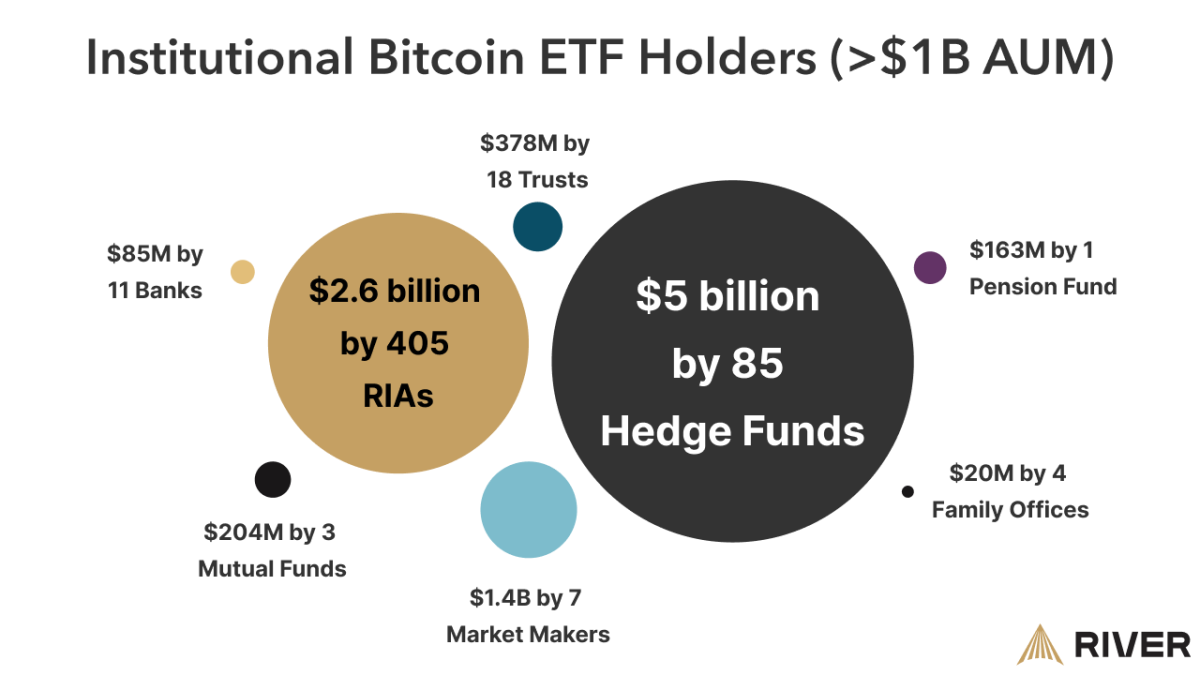

2024 will certainly be different. As of Wednesday, we knew that 534 institutions with more than $1 billion in assets had chosen to start investing in Bitcoin in the first quarter of this year. The breadth of adoption is notable, ranging from hedge funds to pensions and insurance companies.

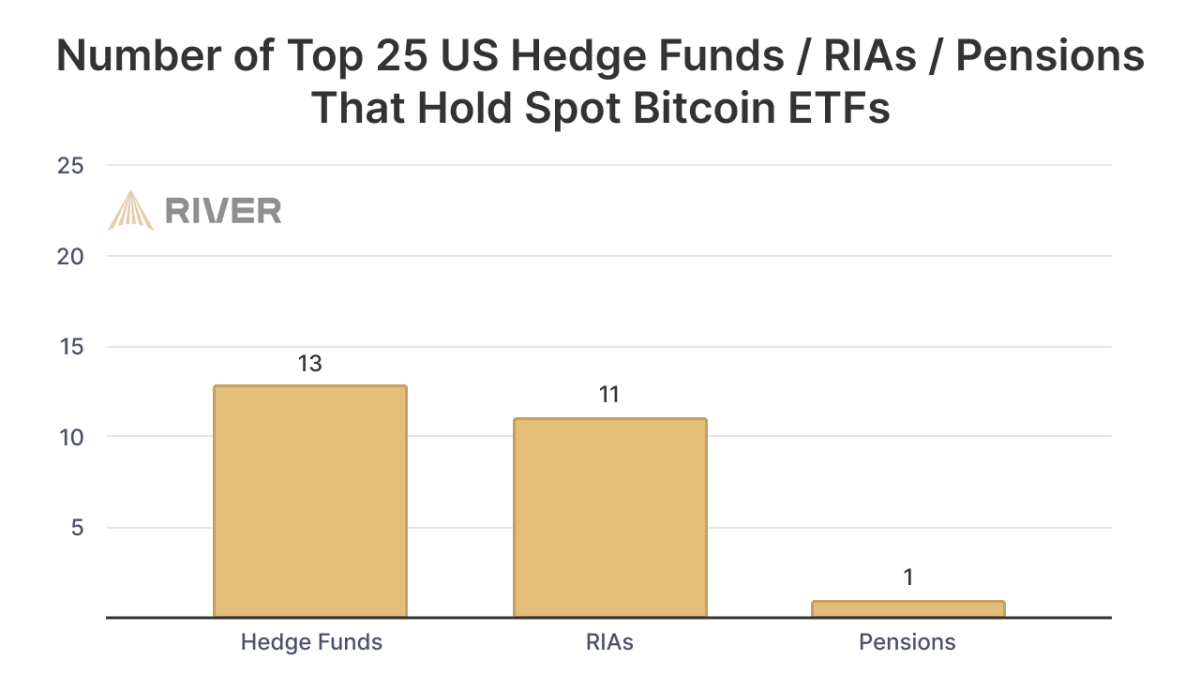

More than half of the 25 largest hedge funds in the U.S. have invested in Bitcoin, most notably Millennium Management’s $2 billion investment, as well as 11 of the 25 largest registered investment advisors (RIAs).

But why are Bitcoin ETFs so attractive to institutional investors who only need to buy Bitcoin?

Big institutional investors are slow movers born of a financial system steeped in tradition, risk management and regulation. For pension funds to update their investment portfolios, it often takes months, even years, of multiple rounds of committee meetings, due diligence and board approvals.

Investing in Bitcoin by buying and holding actual Bitcoin requires thoroughly vetting multiple trading providers (such as Galaxy Digital), custodians (such as Coinbase), and forensic services (such as Chainalysis), in addition to building new processes such as accounting and risk management.

By comparison, investing in Bitcoin by buying a BlackRock ETF is easy. As Lynn Alden said at TFTC: Podcasts“For developers, ETFs are essentially APIs for the fiat system. They just allow the fiat system to be integrated into Bitcoin a little bit more than before.”

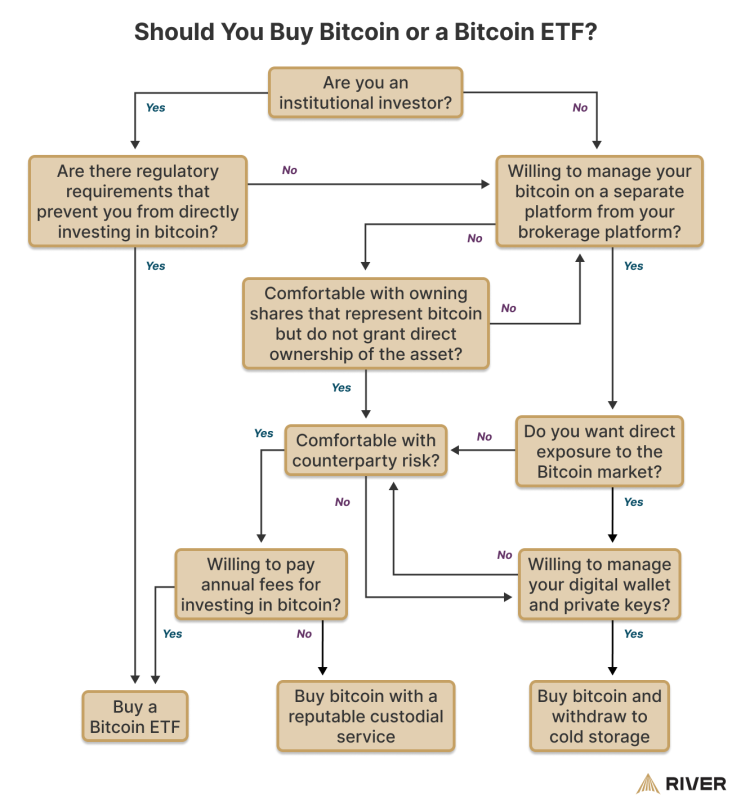

This is not to say that ETFs are the ideal way to gain exposure to Bitcoin. In addition to the management fees that come with owning an ETF, such products come with a number of trade-offs that can undermine the core value that Bitcoin offers in the first place: clean money. These trade-offs are beyond the scope of this article, but the flowchart below illustrates some of the considerations involved.

Why didn’t Bitcoin rise more this quarter?

With such high ETF adoption, it may be surprising that Bitcoin prices are only up 50% year to date – in fact, with 48% of top hedge funds currently allocated to it, how much upside does it really have left?

While ETFs are widely owned, the average allocations of the institutions that own them are extremely modest. The weighted average allocation of the large ($1 billion+) hedge funds, RIAs, and pension funds that have made allocations is less than 0.20% of assets under management. Even Millennium’s $2 billion allocation represents less than 1% of its reported 13F holdings.

Therefore, the first quarter of 2024 will be remembered as the time when financial institutions “started from scratch.” So when will they be able to move beyond the toe-dipping stage? Only time will tell.

This is a guest post by Sam Baker of River. The opinions expressed here are entirely Sam Baker’s own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.