Darren 415

I spoke to Planet 13 after the company reported its first-quarter results and completed its acquisition of Florida-based VidaCann.OTCQX:PLNH)of Best American Cannabis Strains Mid-May. Prices are down 10% as the cannabis market as a whole retreats. But that’s not the only reason the best company is getting even better. As I’ve been saying, this company isn’t on the radar of investors or analysts. I’m the only analyst to start making 2025 predictions, and his outlook reinforces my bullish view.

Latest Outlook on Planet 13

Canaccord Genuity, the sole analyst covering Planet 13, released the update Thursday morning.

Analyst Matt Bottomley lowered his target to C$1.20 from C$1.40 but raised his rating to Buy from Hold, lower than the $0.77 target I shared four weeks ago, which is closer to C$1.06.

CG Analysts lowered their 2024 revenue estimates to $137 million from $143 million and their adjusted EBITDA outlook to $12 million from $18 million, but now expect revenue of $189 million and adjusted EBITDA of $32 million in 2025, both much higher than the 2024 outlook.

I used 2025 estimates for my end-2024 price target and estimated adjusted EBITDA at $29 million, which is 10% lower than the CG analysts.

Planet 13 is priced very cheaply

I am maintaining my year-end price target at $0.77, a 39% increase from Friday’s closing price of around $0.55. My price target is based on 8x enterprise value and projected adjusted EBITDA, but I am keeping my own estimates intact. Note that my price target is also the price at which the recently issued warrants can be exercised.

PLNH’s market cap is currently $179 million and it trades at roughly 1x projected revenue for 2025. On a standalone basis, the stock trades at 5.6x CG analysts’ 2025 adjusted EBITDA forecast (versus 6.2x my forecast). The company has roughly $20 million in cash. Adjusted for enterprise value instead of market cap, the stock trades at just 5.0x projected adjusted EBITDA (versus 5.5x my forecast).

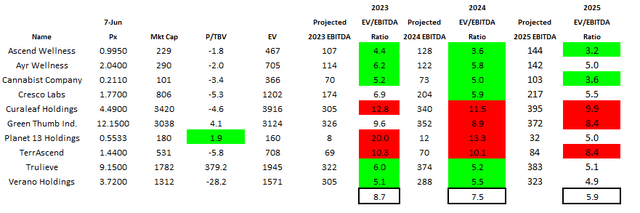

The stock is very cheap relative to projected adjusted EBITDA, but what I like most about it is the downside protection that its balance sheet provides. Planet 13 has zero debt, while all of its peers are heavily indebted. The stock is trading at a very low price relative to tangible book value. Assuming no capital accretion from the VidaCann acquisition, the current ratio is 1.9x. My expectation is that this ratio will be lower, but we will know when the company reports its second quarter results in August.

Comparing Planet 13 to five Tier 1 MSOs and four Tier 2 MSOs highlights its poor rating.

Alan Brochstein, using Sentieo

There are some cheaper Tier 2 MSOs out there, but their 5x 2025 EV/EBITDA is below average despite their much higher growth rates.

Planet 13 chart is promising

Planet 13 is down slightly, down 13.6% in 2024. The New Cannabis Ventures Global Cannabis Stock Index is up 12.2%, while the NCV American Cannabis Operators Index, which is easing off after a very strong first four months, is up 6.3%.

PLNH is down 2.9% since Aug. 29, the day before word broke that the DEA had received a request from the Department of Health and Human Services to change cannabis regulations. Since then, the Global Cannabis Stock Index is up 22.6% and the U.S. Cannabis Business Index is up 42.9%. Planet 13 has lagged far behind.

Looking at the one-year chart, the stock price has fallen to near its all-time low recorded in August of last year.

I see support at $0.48 (maybe a bit higher) and resistance at $0.80 and $0.90. I’m pleased to see a strong increase in trading volume recently. Since the 2021 peak, the stock is down over 93%.

Conclusion

I am a bit bullish on US cannabis stocks as rescheduling is moving forward. If rescheduling happens, it will remove the burden of the 280E tax. Although it is not yet confirmed, the DEA is moving to move cannabis from Schedule 1 to Schedule 3. If that doesn’t happen, it will be a huge problem for our friends at Planet 13.

When I wrote about Planet 13 four weeks ago, I noted the complete lack of projections for 2025 and shared my own forecast. This week, one of the analysts covering the stock provided a forecast for 2025 revenue and adjusted EBITDA, and I was very pleased to see that the adjusted EBITDA outlook was a bit higher than my forecast. This week, I increased my already large position to 19% of my Beat the Global Cannabis Stock Index model portfolio, nearly my maximum position size.

Investors are very optimistic about MSOs in Florida and how they will benefit from the state’s potential adult-use initiative based on a November ballot initiative. It remains to be seen whether the measure will pass, as it requires 60% voter approval, but if it does, I’m confident that Planet 13 will be a big hit in the state.

Even if Florida fails to adopt adult use, Planet 13 appears to be cheaper and safer than other MSOs. The loss of 280E will likely help its peers, but it will also help Planet 13. My goal seems conservative at $0.77 by the end of the year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.