we

Investment Thesis

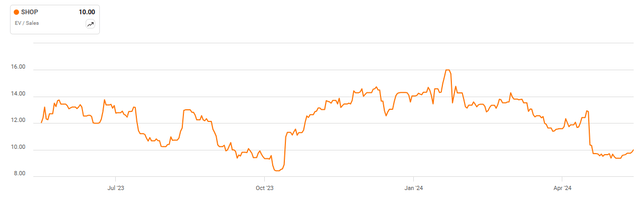

Shopify (New York Stock Exchange:shop) has fallen 20% in the past month following strong fiscal first-quarter 2024 results. The selloff is largely due to weak forward guidance, despite last quarter’s revenue and EPS beating expectations. Not surprisingly, the company’s stock price The premium valuation indicates high expectations heading into the quarter and may be affected by weak forward guidance. Previous AnalysisI initiated a Neutral rating on the stock and expressed concern that a valuation of over 10x EV/Revenue QoQ could pose significant downside risk if revenue growth disappoints investors. The stock is currently trading sideways despite a significant “U” turn over the past seven months, significantly underperforming compared to the S&P 500 Index’s 20% gain.

The recent selloff is excessive, and stock prices at this level “This is an attractive entry point. The company’s key growth drivers remain strong and current heavy spending on marketing should improve growth prospects in the medium term. As such, I have upgraded the stock to a buy recommendation.”

Shopify pricing

First, let’s talk about the pricing change. In February, the monthly rate for existing Shopify Plus customers was expected to increase by 25% from $2,000/month to $2,500/month. However, existing customers can lock in their current $2,000/month rate by renewing with a three-year contract (until 2027) by the end of April 2024. Meanwhile, new customers will pay $2,300/month. Meanwhile, the company also increased its online variable platform fee for customers on annual contracts.

We believe the timing of this renewal will have a significant impact on our financials. Q1 FY2024 Earnings ReportManagement reported that Enterprise migration continues, explaining that the majority of Plus merchants have moved to three-year contracts to lock in the $2,000/month fee. This will lengthen overall contract terms and stabilize billing trends in the near term. However, management also noted that in the second quarter, the overlapping effects of the Standard plan changes will outweigh the initial benefits of the Plus pricing changes, creating a headwind to quarterly revenue growth. That said, underlying demand for SHOP remains strong despite the weak revenue outlook.

Strong consumer spending

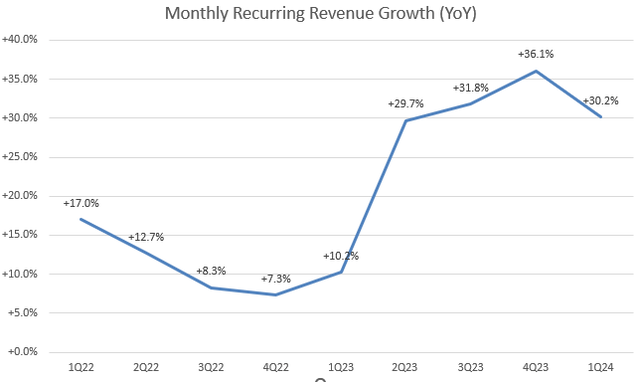

The company lowered its revenue guidance for Q2 FY24 from “low to mid 20%” growth to “high teens” growth, mainly due to a 3%-4% growth headwind from the sale of its logistics business and near-term trends in pricing. Excluding this factor, the company will continue to maintain its 20% growth trajectory in revenue for the quarter. SHOP’s MRR has shown significant growth acceleration since Q2 FY23, so I wonder if investors overreacted to the guidance. Last quarter, the company grew 30.2% year-over-year to $151 million, indicating that consumer spending momentum remains healthy.

Additionally, SHOP has significantly boosted GPV and GMV growth since Q3 FY22, signaling continued same-store sales growth and a strong merchant base. GPV in particular continues to accelerate, from 31.6% YoY in the previous quarter to 31.7% YoY. This growth rate is faster than PayPal (Pipple) Growth trajectory and blocks in early teens (Square) has grown in the high single digits over the past few quarters, so I believe SHOP’s key growth drivers remain strong as a result of the ongoing Shopify Plus migration and strong returns on marketing investments.

Increased marketing spending

Corporate Model

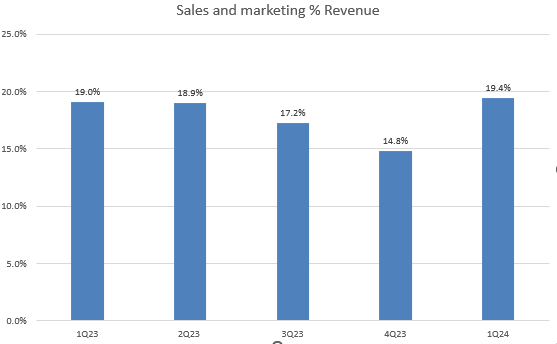

Management also hinted that operating expenses for the current quarter are expected to increase in the low to mid single digits sequentially, mainly due to higher marketing expenses. Looking at the chart, we can see that marketing expenses as a percentage of total revenues has increased significantly from 14.8% to 19.4% in Q1FY24, the highest in the last five quarters.

However, management emphasized the importance of marketing spending, highlighting how the marketing team is leveraging advanced AI and machine learning models to target audiences with unprecedented precision. During the earnings call, the company noted a 180% increase in new merchant acquisition and a nearly 60% improvement in CAC comparing Q3 2022 to Q1 2024. Management plans to maintain marketing spending with an average payback period of 18 months, which I believe is a potential upside for investors to watch in upcoming earnings calls. While higher operating expenses in the short term could impact profitability, these investments could pay off soon and lead to revenue growth and improved margins in the mid to long term.

evaluation

Even after the 20% sell-off following the earnings release, I acknowledge that SHOP is still trading at an expensive valuation of 10x EV/TTM sales. However, when factoring in the company’s FTM revenue growth, I expect this multiple to fall to 8.5x, 16% lower than the 10.1x since our last coverage. As I’ve said before, any ratio above 10x is considered too high and may be unsustainable.

J.P. Morgan

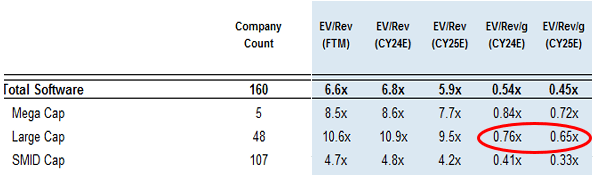

To gauge fair value, you also need to consider the trajectory of revenue growth, because high-growth stocks deserve higher valuation multiples. If a company is trading at 20x EV/Sales FTM, then its revenue growth is expected to sustain 30%+ over the next 5 years. I consider that a fair valuation. Given SHOP’s future revenue growth of 22.4% based on Seeking Alpha, SHOP’s EV/Sales/g ratio is 0.38, which is about 50% lower than the large software average of 0.71x, as the chart shows (prices may lag by one week).

Therefore, I believe the company’s underlying store growth and consumer spending remain strong and may support a higher multiple relative to its peers, making the stock more attractive at current price levels. Additionally, market consensus expects interest rates to decline later this year, which I believe will provide a tailwind for valuations of high multiple stocks like SHOP.

My expectation is that Fed policy is currently very tight, keeping interest rates at 5.25%. However, with unemployment unexpectedly rising to 4%, maintaining interest rates high for an extended period of time increases the likelihood of significant interest rate cuts in the future. Despite the valuation tailwinds, investors should be mindful of the downside risks to the company’s fundamentals. A series of interest rate cuts could signal a severe economic downturn, which would negatively impact overall consumption and, in turn, SHOP’s growth prospects.

Conclusion

In conclusion, I acknowledge that SHOP faced significant selling after its recent Q1 earnings release. Nevertheless, the company’s fundamentals remain strong, with revenue and EPS consistently beating expectations. While concerns remain regarding the impact of premium valuation and price changes on near-term growth, SHOP’s strategic initiatives, such as its use of AI in marketing and attracting new merchants, offer many potential growth opportunities. Additionally, despite current high operational expenses in marketing impacting revenue, I believe their payback will provide a tailwind for the company’s revenue growth. Thus, given the solid underlying growth metrics, a 20% drop in one month is overdone and I upgrade the stock to a buy recommendation.