Prime Image

The first big difference between the stock markets of the late 1990s and today (i.e. the S&P 500 and the Nasdaq Composite) is sentiment.

Sentiments today are largely apathetic compared to the enthusiasm of the late 1990s. Looking at the monthly chart of the Nasdaq Composite Index in September 1999, the Nasdaq Composite Index closed at 2,750 on September 23, 1999, and then by March 23, 2000, it had risen a cumulative 86% to reach 5,132.52 in just six months. (Just think about it, this was five years after January 1, 1995.)

From 1995 to 1999, the S&P 500 returned 28.5% annually, with a cumulative return of 251%, whereas from January 1, 2020 to May 31, 2024, the S&P 500 has an annualized return of 13.56%, with a cumulative return of 70%. (Return data source from YCharts)

If you don’t survive As someone who managed client funds in the late 1990s, it’s really hard for me to understand what it was like.

Today I’ll highlight some similarities.

Narrow width

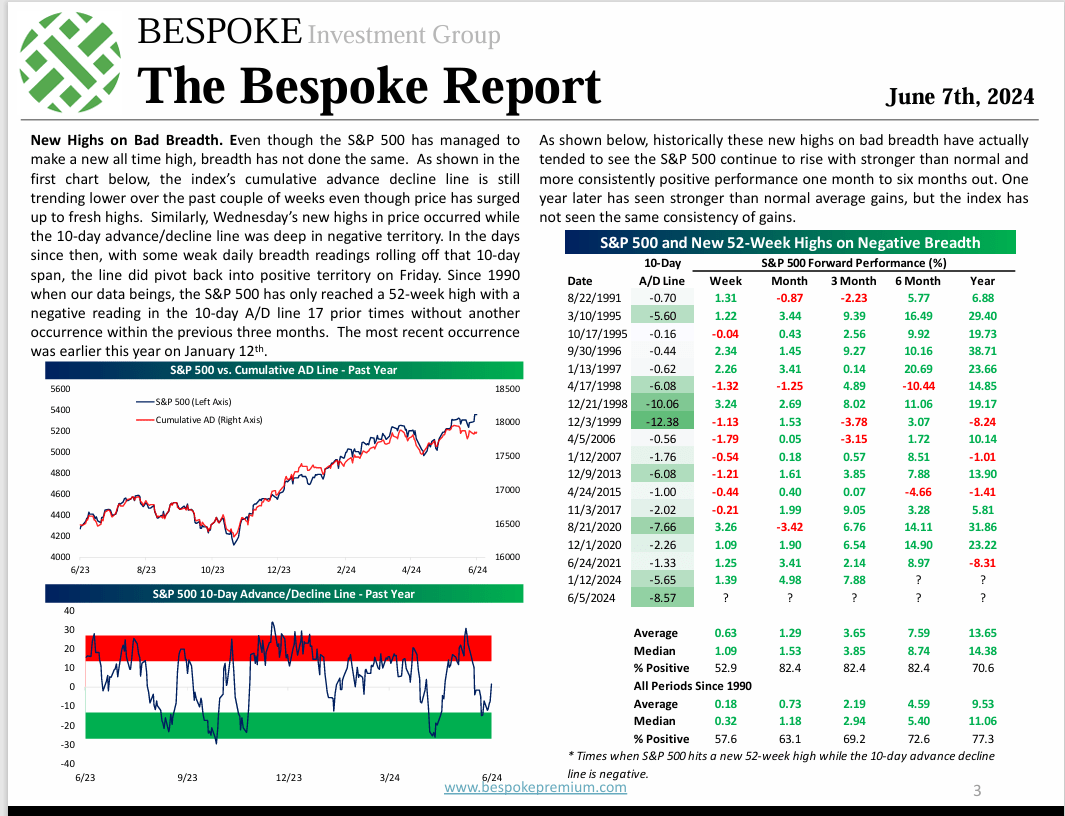

This is page three of this weekend’s Bespoke Report: The “weak breadth” conundrum lasted for almost five years in the late 1990s, when we saw similarly narrow leadership within the S&P 500 as well.

What’s interesting about the range is that if you look at the table on the right hand side of page 3 of the Bespoke Report above, the “average” future earnings are particularly good over the next year. (Be sure to read the commentary too.)

This blog follows the breadth pretty closely, but it has narrowed in recent months.

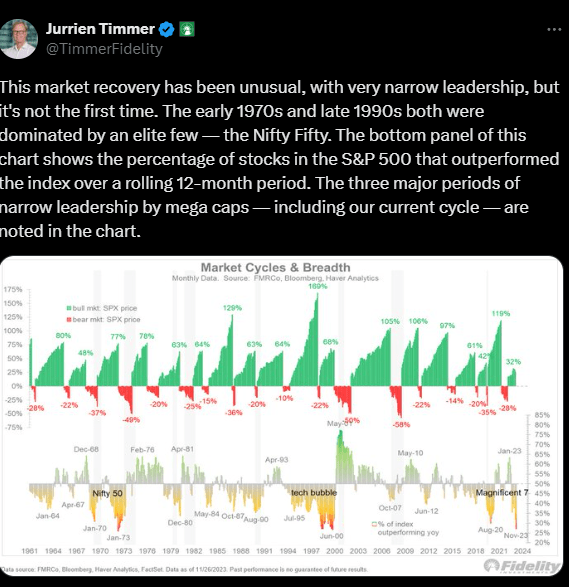

Narrow Market Leadership

This chart, created by Julian Timmer of Fidelity in late 2023, shows the narrow market leadership that the S&P 500 is becoming famous for (again), just like in the late 1990s. Readers can look back to the Nifty 50 bear market of 1973-1974, then the “tech bubble” of the late 1990s, then late 2021, and today.

While writing this, I realised that the time gap between the 1973-1974 Nifty 50 bear market and the S&P 500 and Nasdaq peaks in March 2000 was around 25 years. In March 2025, it will have been 25 years from the peaks of tech and growth stocks to today’s markets. The 2008 bear market was also a 50% correction caused by the housing and financial system, but this bear market may ease to some extent.

It’s been about 15 years since the S&P 500 bottomed at 667 in March 2009 that we’ve seen a similar correction.

Federal Reserve System

Alan Greenspan led the Fed in the late 1990s. Interest rate hike Many believe this was the main cause of the bursting of the growth stock bubble from June 1999 to May 2000, but as dramatic events always do, there were other causes. Although the Fed stopped raising the federal funds rate as of July 2023, the tight monetary policy clearly led to sharp corrections in the S&P 500 (-18% return) and Nasdaq Composite Index (-32% return) in 2022.

When considering wholesale rebalancing from a market leadership perspective, the Fed remains important.

Finally, underperforming asset classes

Russell 2000, S&P 500 equal weighting (RSP) and International Returns all significantly underperformed relative to the S&P 500 and Nasdaq in the late 1990s. (Technically, the RSP wasn’t released until May 2003, thus eliminating a period when equal-weight ETFs would have outperformed, as the top 10 stocks in the Nasdaq and S&P 500 began to diverge rapidly after March 2000.)

Let’s take the Russell 2000 as an example and compare its annual returns since January 1, 2000 to the S&P 500.

From January 1, 1995 to December 31, 1999:

- S&P 500: +28.5%

- Russell 2000: +16.57%

From 1 January 2000 to 31 May 2024:

- S&P 500: +10.7%

- Russell 2000: +8.9%

From January 1, 2010 to May 31, 2024:

- S&P 500: +13.55%

- Russell 2000: +10.13%

From January 1, 2015 to May 31, 2024:

- S&P 500: +12.56%

- Russell 2000: +7.37%

From January 1, 2020 to May 31, 2024:

- S&P 500: +13.56%

- Russell 2000: +6.41%

From January 1, 2023 to May 31, 2024:

- S&P 500: +27.11%

- Russell 2000: +13.75%

It’s the ratio that gets me intrigued. I crunched the numbers and was surprised to see that the Russell 2000’s return was half of the S&P 500’s in the late 1990s. A 16.5% return is still a reasonable return for that decade.

Readers will see that over the last decade, from 2010 to 2019, and now this decade, the return gap between the Russell 2000 and the S&P 500 has steadily increased, reaching the same ratio again.

Summary/Conclusion

The main thing to consider when writing a “Perspective” article like this is that you are forced to remember major market events, what triggered them, and how similar or different today is compared to history.

Initially, I thought it was unlikely that investors would experience another 50% bear market this soon, given that there were two 50% bear markets between 2000 and 2009. (The Nasdaq’s 2000-2002 bear market was 80%)

As of Friday, June 7, 2024, the S&P 500 total return was 12.7%, while the 60%/40% balanced portfolio returned 7.15%. This is an election year, and traditional stock market election year cycle returns are usually pretty good (and S&P 500 earnings remain strong), don’t think too much about it.

What keeps me bullish is the fact that the S&P 500 didn’t surpass its March 2000 highs of 1,550-1,575 until May 2013, and the Nasdaq 100 and Nasdaq Composite didn’t surpass their March 2000 highs until 2017.

However, Russell 2000 (International Hydrology), S&P 500 Equal Weight (RSP) and International Positions will have increased weightings in client accounts going forward.

Much will depend on the presidential election.

It makes sense to be more cautious about “expected future earnings.”

These are not advice or recommendations, just opinions. Past performance is no guarantee of future results. All return data above is taken from YCharts and all S&P 500 EPS and earnings data is taken from LSEG. Investments may incur losses, even over short periods. Readers should determine their own tolerance for portfolio and stock market volatility and adjust their accounts accordingly.

thank you for reading.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.