Shahrir Maulana

VBK Strategy

Vanguard Small Cap Growth Index Fund ETF Shares (NYSEARCA:Vibk) began investment operations on January 26, 2004 and tracks the CRSP US Small Cap Growth Index. It has 624 holdings, a 30-day SEC yield of 0.56% and an expense ratio of 0.07%. It is also available as a mutual fund, the Vanguard Small Cap Growth Index Fund Institute (VSGAX).

It is described as follows: CRSPthe underlying index.”Represents the growth style of companies that represent 85%-98% of the cumulative market capitalization of CRSP US Total Market.“It is rebalanced quarterly. No further information about this methodology is available on CRSP’s website or in the fund’s prospectus. The fund’s turnover rate in the most recent fiscal year was 19%.”

In this article, we will look at the Vanguard Small Cap Index Fund ETF Shares (VB).

VBK Portfolio

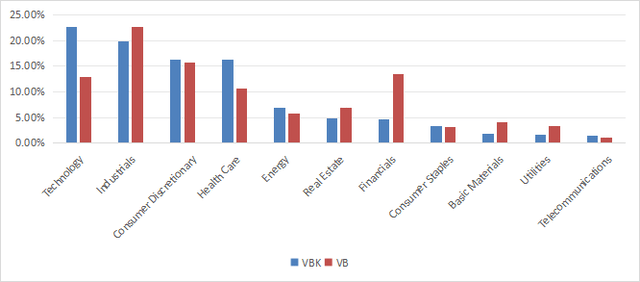

The portfolio’s heaviest sector is technology (22.6% of asset value), followed by industrials (19.8%), consumer discretionary (16.4%) and healthcare (two at 16.4%). All other sectors are under 7%. Compared to its parent index, VBK is significantly overweight technology and healthcare. It is primarily underweight financials, materials and utilities.

VBK Sector Breakdown (Graphic: Authors, Data: Vanguard)

The top 10 holdings, listed in the following table with their growth metrics, account for 8% of the asset value: The weighting of the top stocks is 1.09%, so the risk associated with each individual company is low.

Ticker | name | weight% | EPS Growth Rate (%TTM) | EPS Growth Rate %5Y | Sales Growth Rate %TTM | Sales growth rate %5Y |

Targa Resources Co., Ltd. | 1.09% | 25.52 | 54.79 | -20.22 | 8.15 | |

Axon Enterprises, Inc. | 0.96% | 81.77 | 35.57 | 31.69 | 30.06 | |

Deckers Outdoor Corporation | 0.90% | 50.87 | 26.96 | 18.29 | 16.34 | |

PTC Corporation | 0.86% | -10.10 | 36.14 | 13.33 | 11.04 | |

Entegris Inc. | 0.85% | 7866.66 | -6.65 | -5.13 | 17.85 | |

DraftKings, Inc. | 0.76% | 59.76 | N/A | 57.00 | N/A | |

Vertiv Holdings Inc. | 0.72% | 245.17 | 82.85 | 15.27 | N/A | |

Pure Storage, Inc. | 0.65% | 796.14 | 17.53 | 7.80 | 15.79 | |

Lennox International Co., Ltd. | 0.63% | 20.17 | 13.61 | 4.74 | 5.11 | |

Nutanix Inc. | 0.63% | 95.61 | 6.92 | 19.43 | 10.02 |

Basics

VBK is more expensive than its benchmark in terms of valuation ratios and has better growth metrics depending on its investment style. The gap in cash flow growth is the most impressive, as shown in the following table.

Vibk | VB | |

P/E ratio over the last 12 months | 26.76 | 17.53 |

Price/Book | 3.83 | 2.23 |

Price/Sales | 2.92 | 1.36 |

Price/Cash Flow | 15.64 | 10.45 |

Revenue Growth | 23.12% | 19.68% |

Sales growth % | 9.38% | 6.51% |

Cash Flow Growth Rate % | 22.09% | 8.93% |

Data source: Fidelity.

performance

Since February 1, 2004, VBK has underperformed its parent index by 14 bps, which is almost meaningless, and it exhibits similar risk metrics (maximum drawdown and volatility) as shown in the following table.

Total Return | Annual Report | Drawdown | Sharpe Ratio | Volatility | |

Vibk | 476.35% | 8.99% | -58.69% | 0.46 | 19.84% |

VB | 491.91% | 9.13% | -59.57% | 0.48 | 19.31% |

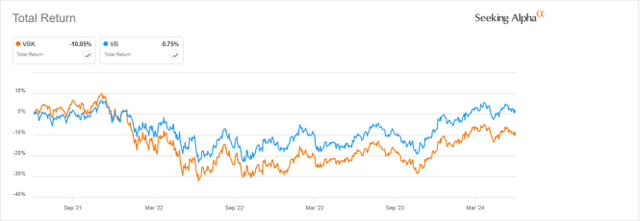

Growth funds have lagged by about 9% over the past three years.

VBK vs VB, 3-Year Returns (Seeking Alpha)

VBK vs. Competitors

The following table compares the characteristics of VBK to five small-cap growth ETFs that implement a variety of methodologies.

- iShares S&P Small Cap 600 Growth ETF (IJT).

- iShares Russell 2000 Growth ETF (international).

- iShares Morningstar Small Cap Growth ETF (international).

- First Trust Small Cap Growth Alpha DEX Fund ETF (FYC).

- Janus Henderson Small Cap Growth Alpha ETF (JSML).

Vibk | IJT | international | international | FYC | JSML | |

Inception | January 26, 2004 | July 24, 2000 | July 24, 2000 | June 28, 2004 | April 19, 2011 | February 23, 2016 |

Expense ratio | 0.07% | 0.18% | 0.24% | 0.06% | 0.70% | 0.30% |

Assets under management | $34.19 billion | $5.8 billion | $10.87 billion | $545.44 million | $268.66 million | $211.95 million |

Average Daily Volume | $60.96 million | $11.7 million | $98.84 million | $1.51 million | $717.60K | $584.93K |

VBK is the largest and second most liquid of these funds. It has the second lowest fees, roughly on par with ISCG.

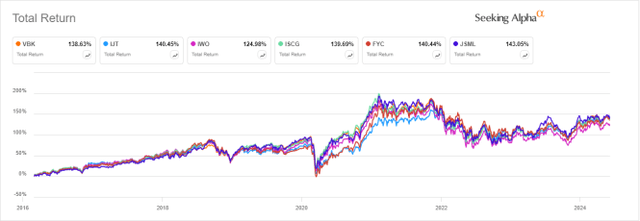

The following chart compares total returns across all start dates combined since February 29, 2016. Five of the six funds have total returns that fall within a narrow range, with VBK falling in the middle with annualized returns about 0.5% lower than the best-performing JSML.

VBK vs. Competitors, February 29, 2016 onwards (Seeking Alpha)

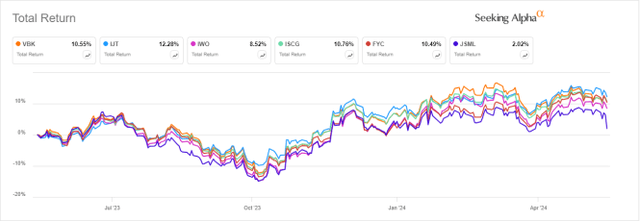

Over the past 12 months, VBK has come very close to some of its peers and lagged behind IJT.

VBK vs. Competitors, Last 12 Months (Seeking Alpha)

remove

Vanguard Small Cap Growth Index Fund ETF Shares (VBK) holds over 600 small caps with growth characteristics. Holdings and sectors are well diversified, with a bias towards technology and industrials. Based on past performance, VBK does not appear to have a methodological advantage over its competitors or small cap benchmarks. Despite its lack of appeal as a long-term investment, its combination of relatively high liquidity and low fees makes it a good vehicle for tactical allocation strategies that switch between size segments and investment styles.