Al-Qsam

I’ve written a lot about high-yield investing, covering many aspects of value investing, but I haven’t gone into much detail about portfolio construction, investment objectives, or strategies.

So the purpose of this article is to elaborate on three specific points: These are aspects that inform my overall investment allocation process and I hope you will find them interesting and useful in the context of your own investment approach.

- What is the purpose?

- What asset classes meet these objectives?

- What are the main risks?

Now let’s analyze each theme individually.

1. Purpose

The overall aim is to retire early (in about 10 years) before the official state pension is due, without sacrificing my standard of living and without being forced to dip into my portfolio holdings to fund my retirement.

I live in a European country and For jobs that provide ongoing contributions to a defined benefit pension plan, I would exclude any potential income stream from this component from the “retirement” calculation. In other words, I see this as a favorable option that could potentially supplement the income streams from my core retirement portfolio at some point.

It is also important that your retirement income correlates with inflation trends so that you can maintain your standard of living over the long term. If not, any increase in income, while welcome, is not as important as having the stability and predictability of maximum yields.

It all comes down to determining your monthly (or annual) living expenses and building an asset base that will generate sufficient distributions to cover your cost base while leaving an explicit and implicit safety margin. Explicit safety margin means that your cash inflows are higher than your outflows (living expenses), while the implicit factors refer to the following aspects that should be incorporated into your retirement portfolio:

- Dividends and distributions are supported by a sustainable business.

- A conservative cash payout ratio leaves some capital available for growth and provides additional safety in terms of dividend stability.

- Strong capital structure.

- Income is likely to grow over time and at least move in line with inflationary trends.

These aforementioned aspects provide a good flow to the next section on specific asset classes that meet the necessary criteria and make up a large portion of my retirement portfolio.

2. Asset Class

There are three distinct asset classes that work together with the overall objective function of capturing a significant source of defensive and gradually growing income.

#1 Equity REIT

Equity REITs offer a great combination of return drivers that fit well into a dividend or income investing strategy. Equity REITs make up about 40% of my retirement portfolio.

As with any sector or asset class, there are good and bad choices: for example, investing in the office space, the healthcare sector, companies with unusual leverage profiles, or companies without investment grade ratings could introduce undue risk to your portfolio and result in dividend cuts.

To make a sound and defensive income investment, investors need to choose their REITs carefully. If your aim is to tick all the boxes of the implied margin of safety factors outlined above, there are three key measures to follow.

Firstly, sales revenues must be based on long-term lease agreements with regular escalators, and furthermore, the underlying tenant profile must be diversified and financially sound to avoid the impact of potential bankruptcies such as those seen in the retail sector.

Second, the capital structure must be very strong, backed by an investment grade rating. The REIT business is all about capturing a positive spread between the cost of capital and real estate yields. An investment grade rating allows for more attractive spreads to be captured and management is not forced to go too far out on the risk curve by unearthing speculative investment projects just to secure an increased spread.

Third, AFFO dividends must support continued growth in a sustainable manner, whereas REITs can avoid financing organic growth or M&A by only increasing leverage. Retaining a portion of AFFO at the REIT level also serves as a dividend protection mechanism, as if cash generation declines, the REIT will not automatically fall into territory where it has to fund current dividends from debt or asset sales (i.e., dividend cuts are less likely).

Realty Income Corporation (NYSE:oh) (see my article here), STAG Industrial, Inc. (NYSE:Men only) (see my article here), EPR Properties (NYSE:European Commission) (see my article here) is an excellent example that meets the required criteria.

#2 BDC

BDCs are another interesting asset class that aligns well with dividend/income investing strategies. However, in contrast to equity REITs, BDCs are on average riskier, as their nature lies in raising cheap capital and investing in companies that have a hard time obtaining favorable loan terms from traditional banks. Therefore, defensive and retirement-focused investors should be especially careful when selecting stocks suitable for stable income investing.

The reason BDCs excel in this situation is because their strategy is primarily focused on generating a steady stream of income while keeping price appreciation as a secondary goal. Additionally, the yields offered by BDCs are typically higher than those available from well-known dividend stocks or below-investment-grade bond alternatives.

When handpicking a BDC with the right characteristics to deliver an attractive dividend on a sustainable basis, here are the key financial elements a BDC should have:

- An investment strategy limited to only well-established, durable businesses that already have cash flow (i.e. no investments in VC type businesses or CLO structures).

- The majority of the portfolio investments were concentrated in senior secured first lien assets.

- A high margin of safety in covering the base dividend by generating adjusted net investment income.

- A balanced leverage profile, without a heavy reliance on fixed rate loans, which were assumed at below-market interest rates and now must be rolled over at much higher rates.

It’s not so easy to find a BDC that has actually structured its business in a defensive manner and can safely provide current (and high-yielding) dividends. But in my opinion, the BDCs that have a large margin of safety when it comes to distributing stable, predictable income are: Ares Capital (NASDAQ:ARCC) (see my article here), Gladstone Capital (NASDAQ:happy) (see my article here), and Pennant Park Floating Rate Capital (NYSE:PFLT) (see my article here).

#3 Infrastructure

Infrastructure investing is a great way to complement a yield-seeking portfolio with income stability and growth over the long term. At its core, infrastructure investing offers risk and return factors that are intermediate between bonds and equities.

Infrastructure assets generate cash flows from long-term contracts (similar to REITs) where the pricing is already set, there are usually regular price increases, and it is backed by strong tenants (or users of the asset). In addition to this, the underlying cash flows are not completely fixed or linked solely to the CPI (or fixed upside). Infrastructure funds have the opportunity to reinvest undistributed AFFO into new assets and, more importantly, by monetizing some of the projects that are already de-risked and operational, they can unlock value that can be invested in new projects.

Due to the nature of infrastructure businesses, they are inherently less risky than BDCs or equity REITs, which operate in more volatile sectors like shopping malls, offices, healthcare, etc. However, when investing in this sector, it is still important to research companies with strong balance sheets, conservative AFFO dividend profiles, and that derive the majority of their cash flows from predictable contracts like PPAs (power purchase agreements), tariffs, and PPPs (public-private partnerships).

The following three stocks make up the largest portion of infrastructure investments in my portfolio: Brookfield Renewable Partners LP Limited Partnership Units (NYSE:Beppu) (see my article here), Brookfield Infrastructure Partners (NYSE:VIP)(TSX:BIP.UN:CA)(VIP-Cook) (see my article here), Clearway Energy (NYSE:Quen) (see my article here).

3. Main risks

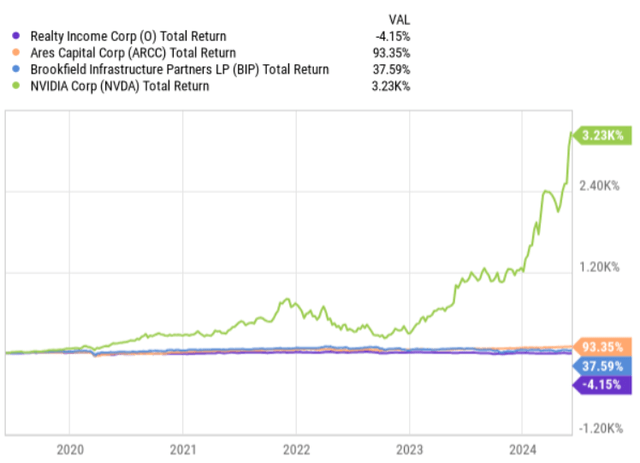

The main risks of following such a retirement income-focused strategy are best illustrated in the graph below.

Investing in income-producing assets, especially those that already offer a significant yield from the get-go, by definition means that growth factors are downplayed. This leads to a potential opportunity cost of negative total wealth generated by high dividend and defensive dividend strategies in relative terms (i.e. compared to an allocation to high growth stocks).

These discussions become even more important when you’re in a position like mine, in your early 30s with a long future ahead of you.

Here, I explain why I chose to implement a boring, conservative investment strategy to achieve my goal of retiring early.

beginningIt doesn’t really matter to me whether some asset or another investment strategy outperforms my income generating portfolio. What matters to me is that the investments I make provide a steady and gradually increasing current income stream, allowing me to reinvest more of my cash flow as my portfolio grows, thereby minimizing my reliance on outside contributions to my portfolio in the process of achieving the portfolio size I need for retirement. The goal is to cover my living expenses solely through distributions, and to do so by a more or less specific date, so volatility in the portfolio (or the underlying companies) doesn’t matter.

Number 2To leave some upside options in the portfolio, I specifically introduced a minor satellite bucket under the retirement portfolio where I can be more aggressive and deviate a bit from the core strategy. This bucket represents 5-7% of the portfolio, enough to capture other risk and return drivers without putting too much strain (and unpredictability) on the core strategy.

The thirdDividend investing fits my emotional profile better, and collecting regular cash flow and watching it compound as I reinvest, organic dividend growth, or additional contributions are made increases the likelihood that I can actually sustain this long-term strategy.

Conclusion

If your overall motivation is to cover your living expenses with dividend income without selling stocks from your base portfolio, investing in segments that generate high and defensive yields is a sound strategy to achieve your retirement goals in a stable and predictable manner.

REITs, BDCs and infrastructure are asset classes that can help achieve this goal by generating sustainable and growing current income streams. Additionally, the timing is also very attractive to buy these assets as more restrictive interest rates are driving up yields.

The main risk of investing heavily in dividend or yield-focused stocks is the opportunity cost of not allocating to growth companies. To mitigate this, investors can introduce a separate bucket (which does not need to be very large) into their core portfolio with specific investments in the growth and lower yielding segments.