Pgiam/iStock via Getty Images

Investment summary

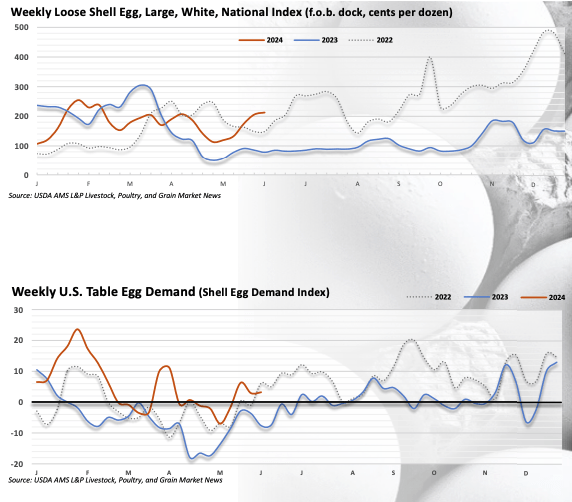

The poultry industry has been struck with another outbreak of the highly pathogenic avian influenza (“HPAI”) virus, and this has potential implications for companies within the domain. According to the USDA, weekly US table egg demand and loose egg sales are tracking in line with the last two years of business, with a “firm undertone”. Our analysis highlights that when this has happened in the past, it causes egg prices to increase, resulting in a medium-term tailwind for companies operating in the domain.

Figure 1.

USDA Egg Markets Overview, June 2024

After breaking out to new highs at the start of the new year, we have been closely observing the equity of Cal-Maine Foods, Inc. (NASDAQ:CALM), one of the country’s largest producers and distributors of shell eggs.

CALM is a fully vertically integrated operation and the business only operates in one segment – shell eggs. The company is the largest producer and distributor of fresh shell eggs in the US, with a biomass of 42.2 million laying hens, and nearly 11 million pullets and breeders. Pullets are chickens less than 12 months old.

This is the largest flock in the US. Consequently, it sells to a diverse breath of industry, including the food and beverage markets, grocery store chains, and other food service distributors.

The key driver to CALM’s operating earnings is the price of eggs, and to some extent, the price of feed grains used to feed the biomass. Chickens typically eat corn and soybean meal, so these are the two factors to keep an ion in terms of industry costs. The business is seasonal as well, with most activity occurring in the fall and winter months.

This is a commodity-type industry where the end product – that is, eggs – is not differentiated in any consumer-important way, such as appearance or utility. Market prices are determined by just that – the market, and not by producers. These businesses are price takers on the underlying egg price, and also on their input costs, namely feed.

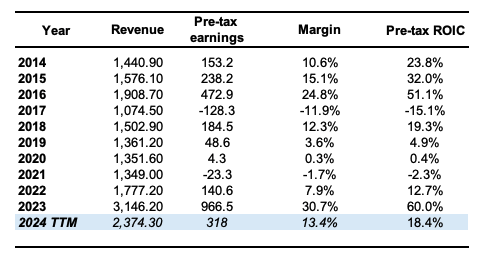

In 2014, the company put up $1.4 billion in revenues on $150 million of operating earnings. It had done $1.5 billion in sales in 2018, on $181 million of operating profit. Four years later, in 2022, sales were $1.7 billion on $138 million of operating earnings.

Figure 2.

Company filings

However, across 2023, when egg prices increased substantially, the company’s average realized prices ticked up alongside this. Sales were therefore $3.1 billion, the highest they had been in 10 years, on operating income of $964 million. With favourable industry dynamics and a positive outlook on egg pricing for producers, my opinion is that CALM could trade up to $93.50 per share over the 12 months as a fair valuation.

This analysis delves into the provable facts from the company’s recent developments, including 1) the impact of HPAI outbreaks, and 2) links this back to the broader investment debate through economic analysis and intrinsic valuation. Net-net, l rate CALM a buy.

Industry outlook

After a strong period of pricing over the past two years, average shell egg prices are expected to increase by 2.2% over the next two years. The overall poultry eggs market is projected to grow at 3.3% per year out until 2032.

Sharp costs and potential supply disruptions are two major tailwinds for the industry. But, the recent HPI outbreak has also impacted the demand/supply balance for the coming two years. I delve into this a little later, but the point is egg pricing is expected to remain strong on the back of this additional catalyst. In my view, the outlook for the industry remains strong and this is supported well by 1) the data and 2) forecasts from various sources. This is an important part of the investment debate, and I am constructive on CALM.

Q3 FY 2024 earnings breakdown

1. Production trends

My judgement is that CALM’s management has implemented strategic adjustments to its production capabilities in response to 1) shifting market dynamics and 2) changing customer requirements. This is particularly true given the growing demand for cage-free eggs.

The underlying trend driving this demand for cage-free eggs primarily stems from legislature passed throughout the US. A total of ten states have passed legislature, either mandating “cage-free requirements” or mandating the cage-free egg sales only. By 2026, these laws will all be in effect.

According to CALM in its most recent 10-Q:

“These states represent approximately 27% of the U.S. total population according to the 2020 U.S. Census. California, Massachusetts, Colorado, Oregon, Washington, and Nevada, which collectively represent approximately 20% of the total estimated U.S. population, have cage-free legislation currently in effect.”

The net-net effect is an impulse on egg production prices throughout the US—even in the states where such legislation was not passed.

To illustrate, management noted last quarter that many of the company’s customers are committing to increasing their purchases of cage-free eggs. We see this in two ways:

- Cage-free egg revenue accounted for ~28% of total net shell egg revenue in Q3 FY 2024.

- It also booked a record number of dozens sold under its specialty eggs division during the quarter, reflecting this demand cycle.

This shift necessitates continuous capital investment in cage-free facilities to meet future customer requirements and state regulations.

2. Financial performance

Total net sales for Q3 FY 2024 were $703.1 million, down ~30% year over year off a high base in Q1 FY 2023. This was the company’s highest quarterly sales period at $997.5 million, driven by the 2023 outbreak of HPAI, discussed later. For the first 3 fiscal quarters, sales were down to $1.7 billion from $2.5 billion the year prior. Shell egg sales contributed ~96% of the top line.

The decline in top-line growth was underscored by lower conventional egg prices. For instance, the net average selling price (“ASP”) per dozen in Q3 FY 2024 was $2.247, compared to an ASP of $3.298 last year. Conventional egg prices dropped to $2.15 per dozen from $3.67, and specialty egg prices were $2.41 compared to $2.61. Price reductions were influenced by the market conditions discussed earlier, including the impact of HPAI outbreaks.

It pulled this to gross profit of $218.6 million for Q3 FY 2024, a decrease from $463.0 million, on operating income of $162.8 million and earnings of $3.01 per share (down from $6.64 the year prior).

In my view, it is evident that realized ASPs on conventional egg prices are critical to the company’s growth outlook.

3. Production Metrics

CALM also booked record quarterly sales volumes across both total dozens and specialty dozens in Q3. Total dozens sold were up by 320 basis points to ~302 million in Q3 FY 2024, up from 291 million in Q3 last year. This YTD, the total number of dozens sold increased by ~130 basis points from 850.8 million to 862 million.

As to farm costs, the cost to produce a dozen eggs decreased by 10.5% during the quarter, and 6.6% for the fiscal YTD. This was underlined by lower feed costs vs. 2023–’23. Specifically, feed costs per dozen produced decreased by 19.9% year over year.

Impact of HPAI outbreak

HPAI outbreaks have significantly impacted the industry’s—including CALM’s—performance over the year. In the most recent quarter, an outbreak in Kansas led to the depopulation of ~1.5 million laying hens and ~240,000 pullets, representing 3.3% of its total inventories. Another incident in Texas post-quarter resulted in the depopulation of 1.6 million laying hens and 337,000 pullets, tallying 3.6% of the company’s biomass.

These events underscore the vulnerability of poultry farms to HPAI and how susceptible CALM’s biomass is to an outbreak. At the end of the day, these hens are the company’s cash-producing assets, and a reduction in biomass volume might correlate to a reduction in production volume.

It could also impact running costs, as the expenditures tied to each hen are distributed across a more concentrated flock. The USDA is now heavily active in mitigating the disease’s spread. Last month, it committed c.$200 million to prevent the spread of HPAI among dairy cows. I’d stress two things, however: 1) CALM has insurance coverage for this kind of business interruption, and 2) It participates in USDA indemnity programs for HPAI outbreaks.

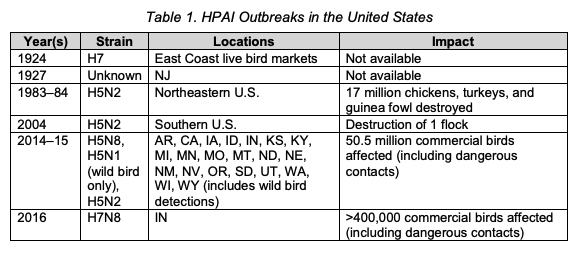

I wanted to understand how prior HPAI outbreaks have impacted the industry, its earnings, and market valuations in the past. There are a few instances worth mentioning, but two that stood out to me whilst compiling the research were the 1983-’84 outbreak in Pennsylvania and the 2015 US outbreak:

(i) 1983-1984 HPAI outbreak in Pennsylvania:

Around 17 million birds were depopulated to contain the virus. The depopulation led to a substantial reduction in egg and poultry meat supply, causing egg prices to spike. For many producers, the immediate effect was an increase in revenue due to higher prices.

However, similar to later outbreaks, the increased costs associated with controlling the disease and repopulating flocks significantly impacted net earnings. So despite a jump in earnings, the cost burden remained high. This is a good footnote for the current day in my view.

(ii) 2015 HPAI outbreak:

The 2015 HPAI outbreak was one of the most severe in the US, resulting in the loss of ~50 million birds – including 43 million commercial layers.

Again, the significant reduction in the supply of eggs led to a sharp increase in egg prices. Wholesale egg prices ended up more than double the 3-year average at $2.80 per dozen.

Companies like CALM saw greater revenues due to higher ASPs, but the overall impact on earnings was mixed. The increased revenue was again offset by higher costs associated with biosecurity measures, depopulation, and repopulation efforts.

These two instances serve as a good prelude to what can happen if the disease isn’t contained. My opinion is that CALM’s huge volumes and deep customer network gives it more “HPAI-proof” earnings. It is well protected from the cost-perils of an outbreak in my view.

Figure 3.

Source: Animal and Plant Health Inspection Service (APHIS), USDA HPAI Outbreaks

Analysis of business economics

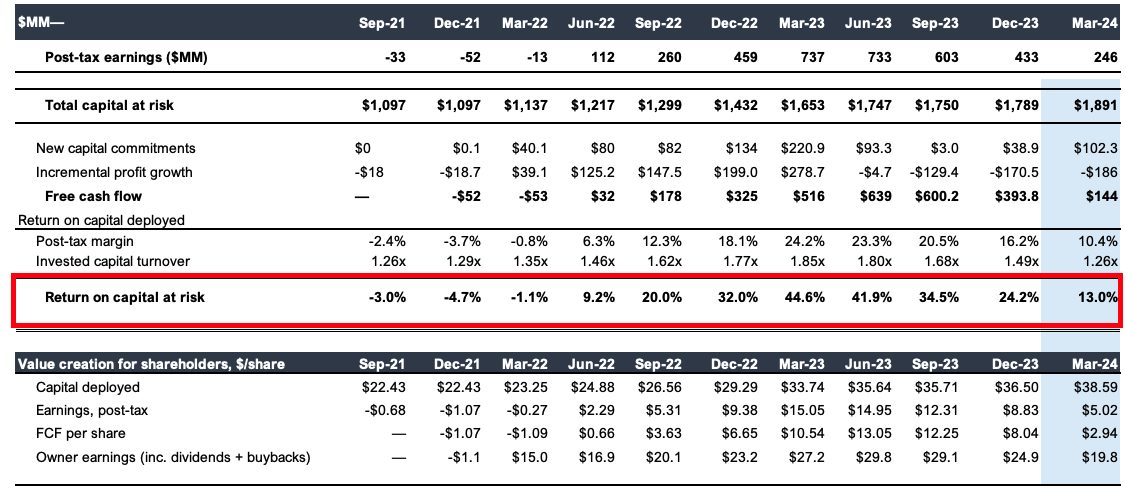

Here I’ll demonstrate where I believe the value is in owning CALM using our “Performance, Health, Valuation” (“PHV”) framework. Performance reflects a combination of 1) financial performance and 2) performance against capital invested in the business. Health examines if a company is creating economic value for its shareholders above what they could reasonably expect to achieve elsewhere. Whereas valuation captures both of these elements and implies the growth assumptions moving forward.

1. Performance

Figure 4 illustrates the earnings CALM has produced against business capital operating in the enterprise since 2021 on a rolling 12 month basis. As seen, the company has invested $38.60/share of capital into the business as of last quarter. On this, each produced $5.02/share in net operating profit after tax per share, otherwise a 13% return on capital. In recent times, the company has seen increasing returns on its business assets, shooting from 9.2% in the 12 months to June 2022, to as high as 44.6% in Q1 last year. This was due to the higher average realised prices for eggs in the last two years. The rate of NOPAT on employed has tightened since this time as 1) average egg prices have compressed, and 2) the base has increased with all earnings retained.

Over this timeframe, management has invested an additional $16.20 back into the business to 1) maintain its competitive position, and 2) grow sales from $1.3 billion to $2.4 billion in the last 12 months. It has also grown post-tax earnings by $5.70 per share in the same time. This equates to a 35.3% return on incremental capital invested. I’m not surprised therefore to see its stock price climb by 60% in the same time.

In my view, the company has exhibited tremendous financial performance that was only exacerbated by the higher ASPs realized across the last three years. The underlying fundamental economics are well in situ.

Moreover, this isn’t out of sync with what the company has produced historically. In 2014, 2015, and 2016, the company had 15%, 20%, and 32% return on capital, respectively. After a slump in earnings (all margin-driven) across the 2015 – 2018 period, the combination of industry dynamics and the company’s return drivers has driven business returns higher again.

Figure 4.

Company filings, Author

For instance, the company has always been tremendously productive when measured as the ratio of sales against capital employed in operations. Capital turnover has averaged more than 1.5x over the last 10 years and has stretched up recently. This implies that every $1 management has put to work in the business rotates back $1.50 in sales.

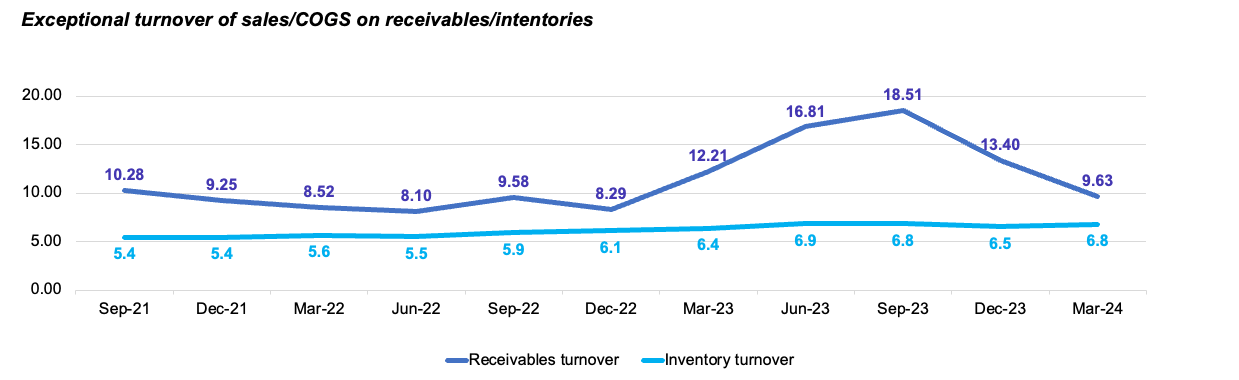

This is further exemplified in Figure 4.a, which shows the inventory turnover and turnover on receivables in the last three years on a rolling 12-month basis. As observed, management turns over the corporation’s inventory around 6x on average every 12 months. It recycles a dollar of investment into receivables more than 8 to 9x over this period. It is good to see this, in my view, given the nature of the business model – inventory along with biomass produce the profits.

Figure 4.a

Company filings, Author

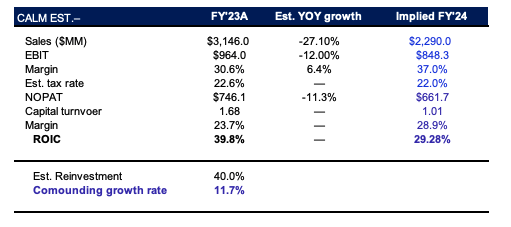

Therefore, pre- and post-tax operating margins are the key driver of increasing business returns. We see that, over the past 10 years, when post-tax margins are left above 5% for this company, it can produce double-digit returns and invested capital.

This is tremendously bullish in the investment debate, in my opinion. Figure 5 illustrates the implied pre-tax margin CALM will produce in 2024 if consensus numbers prove correct. Wall Street is expecting a 27% decrease in sales to $2.3 billion and a 12% decline in tax income to $848 million. In 2023, the pre-tax margin was 30.6%, but the implied estimates listed above would suggest a pre-tax margin of 37 – a 7 percentage point increase.

I estimate the company will reinvest around 40% to 50% of its earnings back into the business this year, calling for around $385 million of capital spend in 2024. This is in line with annual actuals over the past decade. This would call for a $385 million investment in 2024, leading to an invested capital base of $2.6 billion.

Consensus numbers project $661.7 million NOPAT this year (down 11.3%) which implies $661 million in post-tax earnings on sales of $2.3 billion, a margin of 28.9%. As a result, the street is implying that CALM could produce around 30% return on capital this year. if it does reinvest 40% of earnings, then I estimate it would compound its intrinsic valuation at 11.7% based on these stipulations.

Figure 5.

Note: Estimates are implied on Tax, NOPAT and ROIC, (Bloomberg, Seeking Alpha, Author)

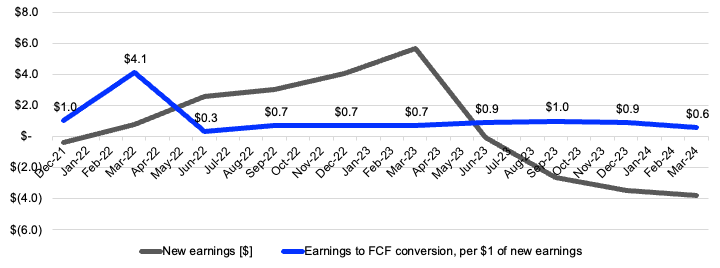

My view is management will utilize this profitability well. As seen below, it has methodically rotated incremental earnings growth into free cash flow on a rolling 12-month basis since 2021. It has rotated each new $1 tax earnings into an average of $0.50 to $0.70 of additional free cash flow and just about every point along the testing period. This is a good bedrock of fundamentals to move forward with.

Figure 6. Methodically rotating earnings into FCF

Company filings, Author

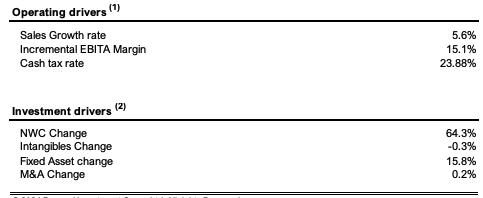

Projections of corporate value under various scenarios

Management’s capital allocation decisions along with the corporation’s financial performance are noted in the figure below (Figure 7). It shows this on a rolling 12-month basis since 2021. In recent times, sales have compounded at 5.6%, but the pre-tax margin is 15% due to operating losses of 2021 and 2022. To produce a new dollar of sales, management has invested $0.64 in working capital and $0.16 in fixed capital. This squares with the economics of the business. In other words, to grow sales by $993 million across this time, it had to invest $635 million in short-term assets such as inventory and receivables, and $159 million in fixed assets, such as plant and machinery.

Figure 7.

Company filings, Author

The ~6% sales growth rate is overly confident to carry forward in my opinion and doesn’t reflect the company’s actions, but rather market forces (egg pricing due to reduced capacity).

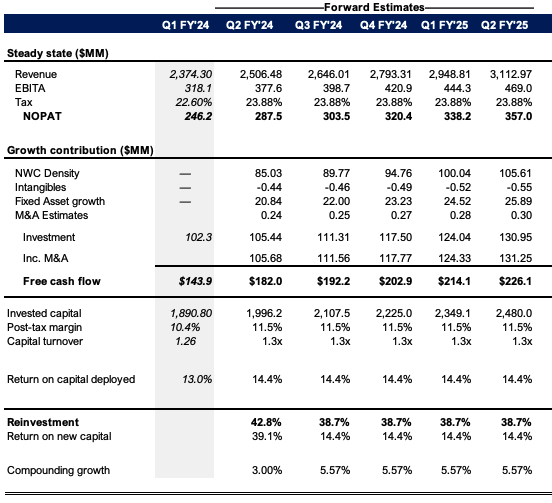

A 1%—2% growth rate is more reflective in my view. If it grows sales at 1% moving forward, and keeps the tight 15% EBIT margin, then I would estimate it to do $2.9 billion of sales in 2025 on a pre-tax income of $444 million, throwing off free cash flow of $214 million for the year (Figure 8).

However, I believe that the pre-tax margin in this instance is overly pessimistic. Egg prices are projected to remain buoyant for the foreseeable future, and this could drive higher ASPs on conventional egg and specialty egg shell sales for the company.

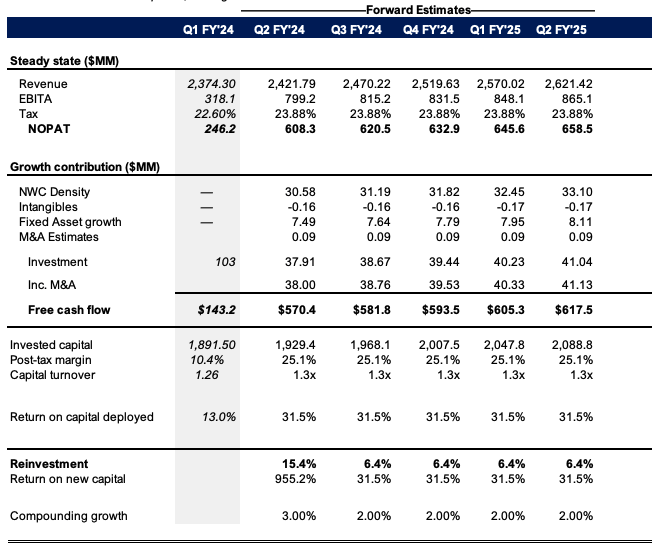

In that respect, I am assuming a 1% incremental sales growth rate, and, 35% pre-tax margins to reflect these changes.

Figure 8.

Author estimates

The delta in outcomes produced by these changes is shown below (Figure 9). I get CALM producing $2.6 billion of revenue in 2025, on pre-tax earnings of $865 million and free cash flow of $617 million. This reflects a high return of 31.5% on all the capital invested in the business. Under the stipulations, I estimate the company could compound its intrinsic valuation at 2% each quarter going out to the end of 2025. This annualizes to around 12.4%, ahead of Wall Street expectations from earlier. This is a bullish point in the valuation debate in my view.

Figure 9.

Author estimates

Valuation

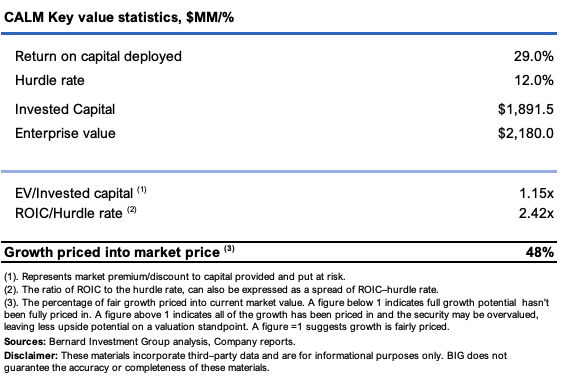

From the attractive economics on display here, the stock trades at just 10.4x earnings, and 6.9x trailing pre-tax earnings. This tells me investors are paying much less for each dollar of CALM’s earnings than the sector.

We are asked to pay 1.6x the net assets employed in the company for a trailing return on equity of 17%. If paying that multiple, the investor return is a little over 10% and that still attractive in my eyes. The last two multiples are severely discounted – 50% and 55% below the sector median, respectively.

The question is what is on offer at this discount. For one, the company is doing business on a 10.32% trailing “owner earnings” yield ($6.00 of free cash flow + dividends per share). This is attractive. Secondly, the company trades at 1.15x EV/invested capital, Which is quite a fair value in my opinion. If we compare this to a composite made of my forward estimates on ROIC of 29%, my opinion is the market has only captured 48% of this growth at the current enterprise value.

Figure 10.

Author estimates

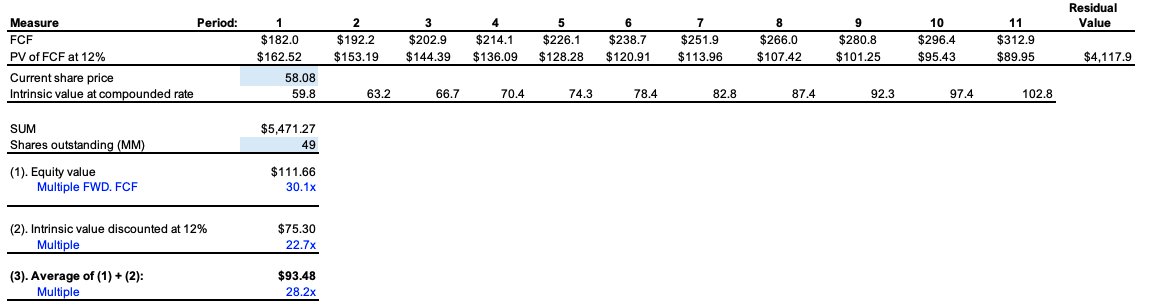

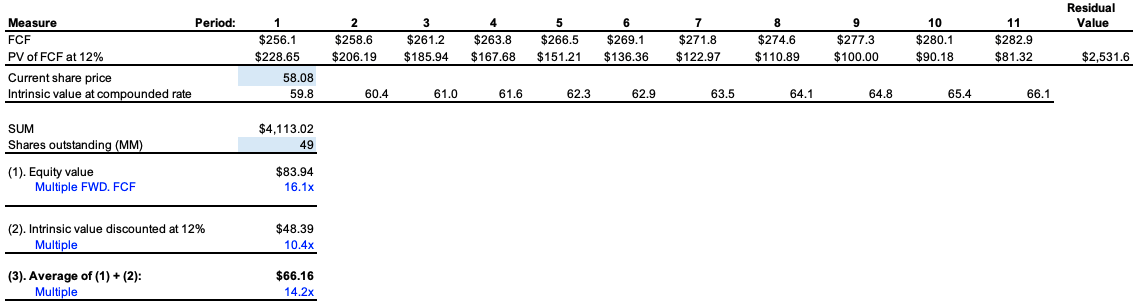

Finally, projecting my estimates of free cash flow out over the coming 10 years and discounting these back at a 12% hurdle rate (one that signifies the long-term market averages), I get to a valuation range of $66-$93.50 per share.

The former target ($66) stems from the estimates at CALM’s steady-state operations, where not much changes from the last three years of business. If you remember, this included a relatively tight pre-tax margin, one I thought was overly pessimistic. The second target ($93.50) includes the revised figures.

The fact that, even when baking in what to be reasonably soft assumptions, (my downside case), the stock still commences evaluation of around 14% higher where it trades today.

Figure 11. Upside case

Author estimates

Figure 11.a Base case

Author estimates

Risks to thesis:

The following risks are relevant to the thesis:

- If egg pricing were to weaken sharply, this could hurt CALM’s revenue base and would stall its growth cycle.

- The HPAI outbreak could have negative consequences on the industry, and potentially reduce capacity substantially. This may hurt demand for shell eggs.

- A slowdown in the US economy could have the same impact and reduce CALM’s earnings growth. This should be factored into every investment appraisal.

In short

CALM looks well positioned to capture egg industry tailwinds caused by reduced capacity and supply constraints from the HPAI outbreak. My research suggests that when outbreaks have occurred previously, this has caused a short-term increase in egg pricing, due to reduced supply with no change in the demand or product cycle. Added to this, the company has highly efficient business assets that could throw off up to 30% return on capital this year in my best estimation.

Projecting modelled cash flows out over the coming years in various DCF scenarios, I get to a valuation range of $66-$93.50. The upside on this is that with my base case assumptions, I still project a valuation higher than where we trade today. That means, in the base case it is worth about where we pay for it today – even slightly more – but in the best case it could be multiples of. This supports a buy rating.