Aiko Concept

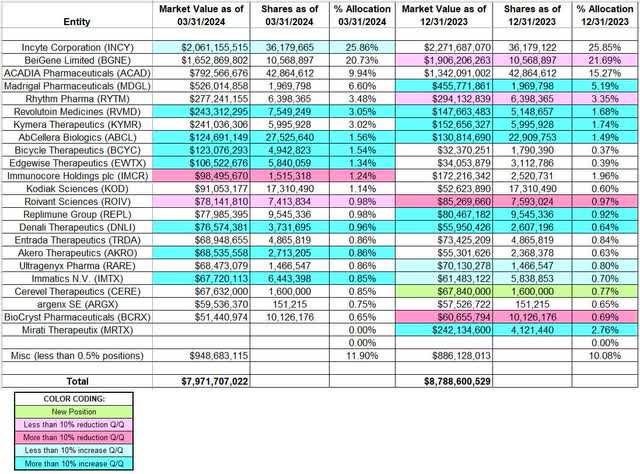

This article is part of an ongoing series analyzing quarterly changes made to Baker Brothers’ 13F stock portfolio, as regulated by Baker Brothers. 13F Form Submitted on May 15, 2024. The value of the 13F portfolio decreased from $8.79 billion to $7.97 billion. The 13F portfolio has approximately 120 positions, but holdings are concentrated in a few large stocks. 22 positions are sizable (more than 0.5% of the portfolio each) and are the focus of this article. The five largest stocks are Incyte, BeiGene, ACADIA Pharma, Madrigal Pharma, and Rhythm Pharma. Together they represent approximately 66% of the portfolio. Track the Baker Brothers Portfolio Their investment philosophy and our past update Regarding fund movements in the fourth quarter of 2023.

Baker Brothers, a biotech investment firm, was founded in 2000 by Julien Baker and Felix Baker. Despite a losing record, the firm has been able to achieve superior returns through prudent position sizing. The allocation to the highest conviction stocks as a percentage of assets under management is very high, at over 30%. Over the years, the firm has hit multiple home runs with portfolio companies being acquired at huge premiums. Recent M&A winners include Pharmacyclics (acquired by AbbVie), Synageva (acquired by Alexion), Salix (acquired by Valeant), Alexion (acquired by AstraZeneca), Global Blood Therapeutics (acquired by Pfizer), ChemoCentryx (acquired by Amgen), Siegen (acquired by Pfizer), and Mirati Therapeutics (acquired by Bristol-Myers Squibb).

Stake Disposition:

Mirati Therapeutics (MRTX): MRTX shares have risen by about 190% in the last quarter.Be Me) agreed to acquire Mirati for $58 per share in cash and up to $12 per share in CVR. The transaction closed in January, eliminating this position.

Stakes Increase:

Insight Co., Ltd. (Incy): INCY already held 1.67 million shares at the time of its first 13F filing in Q2 2003. Holdings nearly doubled by 2006. From 2007 to 2008, holdings grew from ~3.2 million shares to ~11.1 million shares at a high single digit price. Major movements over the past decade include: Q3 2015 saw a ~30% increase in holdings, with prices from ~105 to ~130 dollars. Q1 2016 saw another ~20% increase in holdings, with prices from ~65 to ~100 dollars. Then Q1 2017 saw a ~45% increase in holdings, with prices from ~100 to ~150 dollars. The stock is currently trading at $59.40 and is a top holding, accounting for ~26% of the portfolio. There have been modest increases over the past 4 quarters.

Note: Baker Brothers controls about 16% of the business.

Revolutin medicines (RVMD): The roughly 3% stake in RVMD was acquired primarily at prices between about $18 and $34 over the past two quarters, with shares currently trading well above that range at $39.86.

Note: They hold approximately 4.5% ownership in the business.

Absera Biologics (A.B.C.L.): ABCL had an IPO in December 2020. The stock started trading at about $49 and is currently at $3.51. Baker Brothers’ shareholding dates back to a pre-IPO funding round. In Q2 2023, there was a roughly 60% increase in shares at prices between $5.66 and $7.60. Then the next quarter there was a roughly 25% increase at prices between $4.60 and $7.95. This quarter there was a 20% increase at prices between $4.29 and $5.97.

Note: They hold approximately 9.5% ownership in ABCL.

Bicycle Therapeutics (About BCCYC): The 1.54% position in the portfolio grew 176% this quarter from prices of $16.75 to $26.10. The stock is currently trading at $23.16.

Notes: According to a regulatory filing after the end of the quarter, the company owns about 9.4 million shares (19.9% of the business), compared to about 4.9 million shares in the 13F report.

Edgewise Therapeutics (translation)EWTX represents 1.34% of the portfolio and has increased 88% this quarter between $9.25 and $19.97. The stock is currently trading at $17.13. The company has an ownership interest of approximately 6.3% of the business.

Akero Therapeutics (Acro): AKRO is a 0.86% portfolio stake built at prices ranging from ~$10 to ~$34 in Q3 2022. The stock is currently trading at ~$23. There has been a ~15% stake increase this quarter.

Note: They retain about a 5% ownership interest in the business.

Denali TherapeuticsDNLI) and Immatics NV (IMTX)These small (about less than 1% of the portfolio each) stocks increased during the quarter.

Stake Reduction:

Immunocor Holdings (IMCR): IMCR represents 1.24% of the portfolio and is down 40% this quarter, priced between $60.14 and $75.36. The stock is currently trading at $40.44.

Note: They hold about a 6% ownership interest in the business.

Roivant Sciences (Roive): A small ROIV stake of about 1% of the portfolio was built over two quarters ending in Q3 2023 at prices between about $7 and $13. Last quarter, about 36% was sold at prices between about $8.50 and $12. The stock is currently trading at $10.58. There has been a ~2% cut this quarter.

Staying Stable:

Baygene Co., Ltd.Gune): About 21% of BGNE shares (top 3) are in the portfolio since its US listing in Q1 2016. Shares began trading at about $24 and are now trading at about $156. In Q4 2016 shares doubled between about $28 and $36. In H1 2018 shares grew from about 3.8M shares to about 12M shares at prices between about $100 and $215. Trading has been small since then. There was a decline of about 9% in the last quarter.

Note: Baker Brothers controls approximately 10.2% of the business.

Acadia Pharmaceuticals (Australian Architectural Institute): About 10% of ACAD shares were acquired at very low prices in 2012-2013. The last big move was in Q4 2018 with a roughly 40% increase in shares at prices between about $14 and $22. Currently, the stock is trading near the low end of that range at $14.88.

Note: They hold approximately 26% ownership in the business.

Madrigal Pharmaceuticals (MDGL): MDGL’s most recent major moves have been a roughly 30% increase in shares in Q1 2020, from prices of about $65 to about $90. Last quarter, a similar increase was seen, from prices of about $120 to about $237. The current share price is $255.

Note: they retain about 10% ownership in the business.

Rhythm Pharma (RYTM): RYTM, a 3.48% portfolio share, saw a roughly 47% share increase in Q2 2022 at prices between $4.30 and $30.85. The stock is currently trading well above that range at roughly $41. The three quarters through Q3 2023 saw modest increases, but the final quarter saw a roughly 5% cut.

Note: The company holds approximately 11% stake in Rhythm Pharma.

Chimera TherapeuticsKYMR): Approximately 3% of KYMR shares were acquired at prices ranging from approximately $14 to approximately $35 in the first half of 2023. Last quarter saw a roughly 26% increase in shares, with prices ranging from approximately $11 to approximately $27. Currently, the stock is trading at $34.26.

Note: They hold approximately 9.8% ownership in the business.

Kodiak Science (Cod)KOD currently represents just 1.14% of the portfolio. The original holding dates back to a pre-IPO funding round in Q4 2018. Shares started trading around $10 and are currently at $2.78. The last big move was in Q4 2019 when the holding increased by ~20% with prices ranging from ~$14.50 to ~$76. They retain a ~30% ownership interest in the business. In Q2 2022, the holding increased by ~9%.

Note: In December 2019, Baker Brothers entered into an agreement to pay royalties of up to 4.5% of net sales for the development of KSI-301, a drug for the treatment of eye diseases, for $225 million.

Repliimmune Group (Reproduction): A ~1% stake in REPL grew ~18% in Q4 2022 at prices between ~$17 and ~$28. Last quarter, the position doubled at prices between ~$7 and ~$17. The current share price is around $9.

Note: they retain about 10% ownership in the business.

Cerebelle TherapeuticsSele)CERE is just 0.85% of the portfolio’s merger arbitrage shares, purchased last quarter at prices ranging from about $20.25 to about $42.50, and is currently trading at $40.27. AbbVieABV) is acquiring Cerevel Therapeutics in a $45 per share cash transaction announced in December.

Argenx SE (ARGBS): ARGX shares were primarily built in Q4 2017 at prices from approximately $22.50 to approximately $63. There was a ~10% increase in shares in Q1 2021 at prices from approximately $268 to approximately $380. There was a ~75% decrease in Q3 2022 at prices from approximately $343 to approximately $396. There was then a ~45% sell-off in Q3 2023 at prices from approximately $369 to approximately $548. Currently, shares are trading at approximately $379 and shares represent 0.75% of the portfolio.

BioChristo Pharmaceuticals (BCRX): BCRX is a very long term stock that has been in the portfolio since 2004. It is still a small position at 0.65% of the portfolio. A third was sold at prices between about $1.60 and $8.70 between Q2 and Q4 2019. Then about 20% was sold in the last quarter at prices between about $5 and $7. The stock is currently trading at $6.52.

Note: Baker Brothers controls about 5% of BioCryst Pharmaceuticals.

Entrada TherapeuticsTorada) and UltraGenix Pharma (rare): These small (about less than 1% of the portfolio each) stocks held steady this quarter.

Note: Baker Brothers has significant ownership interests in the following businesses – 2seventy Bio (TSVT), Adapt-Immune (Adap), Achilles Therapeutics (A.C.H.L.), Atira Pharma (Ata), Aerobate (Avute), Aligos (ALGS), Biomare Fusion (BME A), Cabaretta Bio (Hippopotamus), Theraspharma (Consumer Products), HOOKIPA Pharma (needle), IGM Biosciences (IGMS), Calabio (Kara), Monte Rosa (seaweed), Nuryx Therapeutics (NRIX), Opsia Corporation (option), Sagimet Bio (SGMT), TScan Therapeutics (TCRX), vTv Therapeutics (VVT).

The spreadsheet below shows the change in Baker Brothers’ 13F holdings for Q1 2024.

Baker Brothers Portfolio – 1Q 2024 13F Report Quarter-over-Quarter Comparison (John Vincent (author))

Source: John Vincent. Data compiled from Baker Brothers’ Q4 2023 and Q1 2024 13F filings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.