by Calculated Risk June 19, 2024 1:51 PM

Last week’s US inflation data reinforced our view. The first quarter surge was unusual. meanwhile, The labor market is at a potential turning point A further decline in labor demand will affect not only vacant positions but also actual employment, This could push up the unemployment rate even more significantly.Therefore, we continue to expect two Fed rate cuts this year (September and December)…

Add emphasis

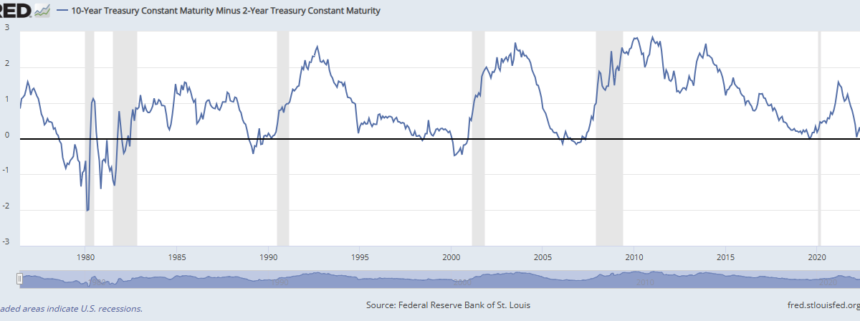

The “technique for a soft landing” requires the Fed to cut rates fast enough to keep economic growth positive, but slow enough not to reignite inflation. In my view, a soft landing is achieved if growth remains positive, inflation returns to target, and the yield curve flattens or normalizes (longer-term yields exceed short-term yields).

The good news is that growth remains positive and inflation is approaching the 2% target, but the yield curve remains inverted, so we’re not out of the woods yet.

If Hatzius is correct that the first-quarter increase in inflation was “exceptional,” then the FOMC is likely to cut interest rates soon, perhaps in September.

Most market participants expect two rate cuts this year, with the first coming in September.