It’s Eve. With so much news to go around and so many hours in the day, I must confess to having missed the fact that UK Chancellor Rishi Sunak advocated for free ports for years before he became Prime Minister, and only recently introduced them. Free ports are a very bad idea in that they effectively create lawless zones for commerce (though admittedly the parties would have to agree on the legal jurisdiction of any agreements they make). Of course this is the sort of thing a die-hard Liberal would advocate.

Free ports seem like a solution to some of the problems created by Brexit. Their appeal is that they would be easier to implement than going back into the EU and making selective deals to repair the damage. But as we will see, free ports will bring their own collateral damage.

beginning, From New European in February:

The name “Freeport” itself sounded like the perfect fit for an ambitious young centre-right politician to catapult himself to the forefront. In addition to dependable external sophistication and personal wealth, Rishi Sunak needed big ideas…

Thus in November 2016, Sunak worked with the Policy Research Centre to publish “The Freeport Opportunity”, a paper that positioned him as a serious political thinker: turning UK ports into freeports would “provide a huge boost to UK manufacturing” and “revitalise the economy post-Brexit”.

Outside the UK’s own customs borders, even if geographically internal, free ports allow goods and household items to be imported duty-free and then reworked into products with lower tariffs for transport into major economies or for re-export (a so-called “tariff inversion”). …Today, he turns to the US and its 250 “free trade zones,” citing success stories such as Nissan’s car assembly plant in Tennessee, which he explained has been able to produce 640,000 cars a year “by taking advantage of tariff inversion.”

Unfortunately, what Sunak overlooks is the development of European trade since ancient Delos, making comparisons with the US meaningless. While tariffs on imports into the US are common, tariffs are minimal in Europe and the UK. They are non-existent within the customs union, and only negligible on UK imports from EU countries outside the union (first under the transition agreement, then under the 2021 UK-EU Trade and Cooperation Agreement). Extended trade agreements with other countries around the world and new trade agreements post-Brexit also keep tariffs to a minimum.

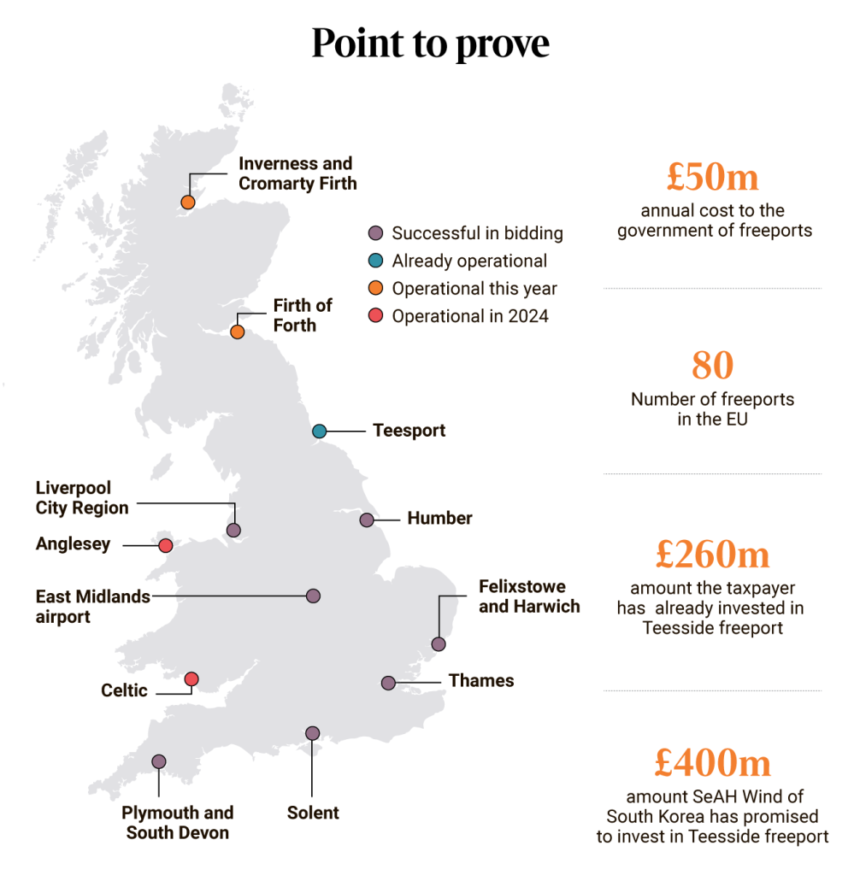

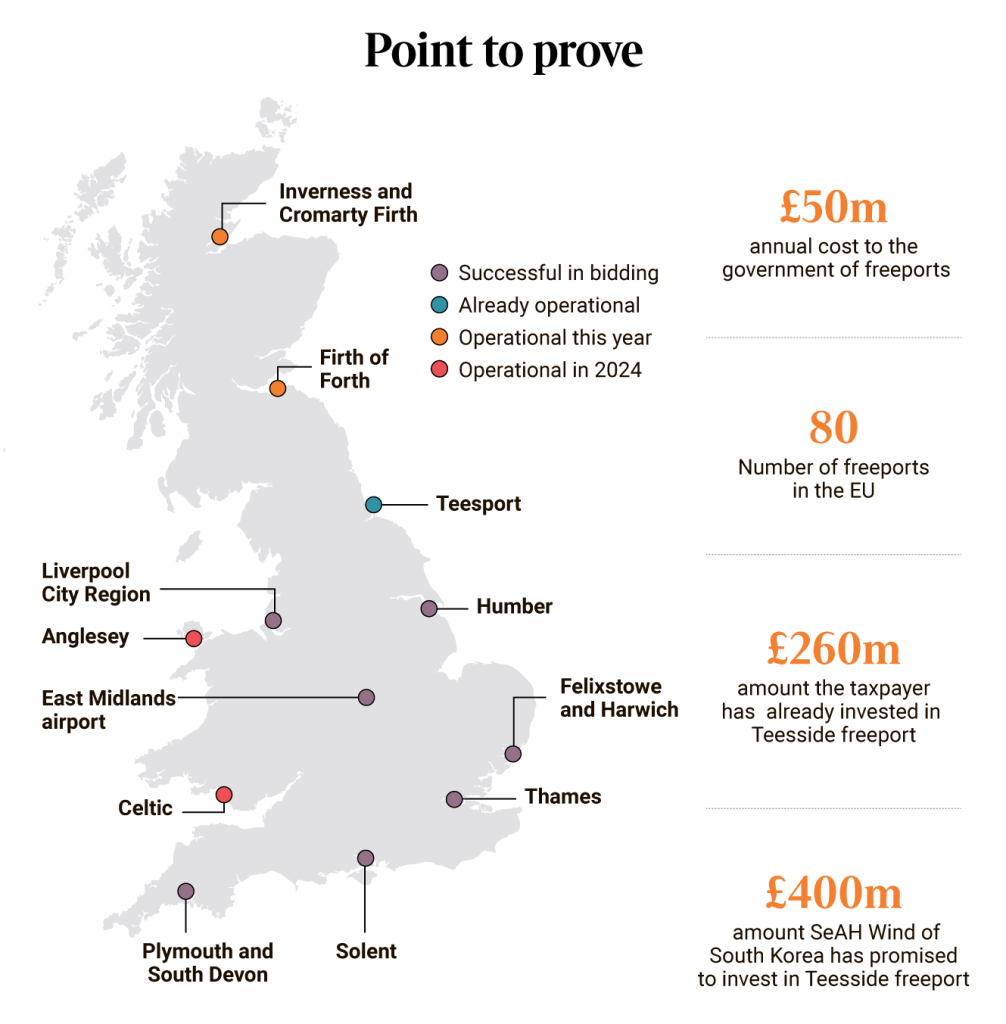

So his freeport model was built on completely flawed premises, but Sunak came to the Treasury in 2019 determined to push through the policy. By spring 2021, eight freeports had been confirmed in England (with four more in Scotland and Wales), with Teesside at the forefront…Nearly three years on and, with the exception of Teesside, very little has happened in Britain’s free ports. They are even struggling to find a way to spend the £25 million “seeding funding” handed to them by Whitehall. In the ongoing parliamentary inquiry into free ports and investment zones, academic Peter Holmes recently said that the only business he could identify as benefiting from the free port benefits of tariff inversion was the dog food industry…

Gove argued that the current game around freeports is about investment incentives – those born in 2021 have been given various tax and business rate reliefs for five years – but even these are economically powerless as they merely divert investment from one place to another.

It’s good news in some ways that low UK tariffs mean the freeport plan hasn’t made much progress. But as the article explains with supporting details, the response has been to pump more money into investment subsidies. But so far the big gainers have been investors… investors in Tesside property deals, so there’s plenty of incentive to expand what could be called the looting apparatus.

And if, as the headline suggests, freeports are being funded enough to operate beyond marginal levels, there is plenty of reason to be concerned.

At the same time, free ports pose serious security risks. Customs and border procedures are effectively outsourced to private companies delegated as “responsible authorities”. In Liverpool Freeport, for example, the “responsible authority” at one of the two customs facilities is a manufacturer of bodybuilding supplements. In Teesside, the authority is a local shipping broker, but physical security at the border of the customs area is run by a family-run company with a record of tax evasion, which employs the owner’s son, who was recently released from prison after serving an 11-year sentence for serious organized drug offences.

The relative lack of border controls in free ports poses a number of inherent risks, from drug and people smuggling to gun smuggling, money laundering and asset concealment. These have been recognised for some time: the EU cracked down on its own free ports, citing “high rates of corruption, tax evasion and criminal activity”, just before Sunak introduced them.

Be aware that “bodybuilding supplements” are not as harmless as they seem. Bodybuilding aids that were openly sold in the US for many years and later cracked down on include ephedra (the source of ephedrine and pseudoephedrine, the precursors to methamphetamine), thyroid, and gamma-hydroabuterol (now a Schedule 1 drug).1 And that’s before we get to the sale of diverted, potentially adulterated or counterfeit steroids, human growth hormones and other performance-enhancing drugs.

The Times was also critical, though in carefully worded terms. From an article in late 2023:

In March 2021, Chancellor of the Exchequer Rishi Sunak announced the eight successful candidates for freeport status in England: East Midlands Airport, Felixstowe & Harwich, the Humber, Liverpool City Region, Plymouth & South Devon, the Solent, Teesside and Thames. Freeports were given financial benefits to “stimulate growth”, such as tax cuts for businesses, 100% retention of business rates by local authorities (usually a percentage is returned to the government), simplified customs procedures, and no duties on goods entering and leaving the freeport customs house if imported.

Other growth levers available to them include faster planning permission, £300 million seed capital and targeted trade and investment support. Each Freeport will be up to 28 miles in diameter and will have an area with special tariff treatment and one to three ‘tax zones’ where tax and business rates relief applies…

Small businesses fear they will miss out on the benefits because they cannot afford to relocate to freeport zones and the supply chains are not strong enough to include them…

The government has tried to address these concerns by creating “special investment zones” … but a study by Make UK and Barclays due to be published this year finds that special investment zones are similarly opaque.

Again, look at the increased subsidies. The article also discussed whether free ports create jobs rather than simply taking jobs away from elsewhere.

Back to the final section of The Times:

Tuesday’s hearing ended with a rapid-fire barrage of questions: “Are the incentives long-term enough?” “No.” “Are the incentives big enough?” “No.” “Is governance too opaque?” “Yes.” “Will the current policy framework help the government achieve its levelling up ambitions?” “No.”

The free port policy has yet to prove its effectiveness as economists are not convinced.

The freeport has been in the news again since Mr Sunak touted it as something of an achievement against the backdrop of the upcoming parliamentary elections.

Freeports and special economic zones restrict workers’ rights, roll back environmental regulations, and give big corporations years of tax exemptions. Billions of dollars of our money are being funneled into them.

— Jeremy F (@jeremyf1965) June 23, 2024

Wow! Great question about “Why Brexit has robbed young people of their futures”

Mr Sunak said they could do the work at the Teesside Freeport. pic.twitter.com/r3GULEBJHf

— Mike Galsworthy (@mikegalsworthy) June 20, 2024

More simply, the freeport is an example of the Singapore-on-Thames or, more modestly, post-Brexit UK piracy model. But it does show how the liberal arts ploy serves to siphon public funds. Interesting.

Now, Richard Murphy.

By Richard Murphy, Adjunct Professor of Accounting Practice at the School of Management, University of Sheffield, Director of the Corporate Accountability Network, Member of Finance for the Future LLP, and Director of Tax Research LLP. Originally published in Funding the Future.

This morning, as always, we have a new video out, in which we suggest that Rishi Sunak’s very limited legacy will include the creation of freeports. But freeports are very dangerous places where the normal rule of law is suspended in the interests of finance capital, and usually at the expense of workers in the places and communities that host them. So freeports undermine democracy. What could go wrong?

An audio version of this video can be found here:

The records are as follows:

Freeport is dangerous.

This is a big and bold opening statement, because we have quite a few free ports in this country now, but they still pose a serious threat to our well-being.

why is that?

What could be the problem? Free trade port?

So let me explain what a freeport is.

A free port is a place where the normal regulations that apply at home are suspended for the benefit of the people who do business there. So free ports exist almost exclusively to benefit businesses, employers, and people engaged in trade, by suspending normal tax rules, and also other things like environmental protection and employee protection.

Now, why deliberately suspend normal laws in one part of the country, and how does that benefit everyone else?

And why should some people, because they work in a freeport, have a lower level of protection during their working years than if they worked outside a freeport?

And that’s especially true when freeports don’t have clearly defined boundaries. In fact, it’s very hard to find the boundaries of freeports, because they’re mostly imaginary spaces: a few warehouses here, one or a few warehouses there, ring-fenced within planning areas, which themselves are loosely delineated on maps, but have no clear boundaries.

These free ports are the figment of planners’ imaginations. Planners of all kinds, tax planners, regulatory planners, people who want to plan to exploit environmental protections and certainly people who want to exploit employee rights. And the danger is that when you create these things and, particularly, when you put them under the control of private corporations who are tasked with deregulating these areas and managing them in their own interest, not in the interest of society as a whole, you end up with something very harmful that is dominated by corporations.

Corporate governance is fascismIn fact, that is exactly what Mussolini described it as.

Let me be clear: Although our free ports currently offer relatively limited exemptions from regulations, their very existence is a threat to our government’s democratic control over our country. As such, free ports are extremely harmful and as dangerous to effective democratic control over the well-being of most of the world’s people as tax havens have ever been.

___

1 My endocrinologist said the crackdown on GHB was completely unjustified. GHB gives you better quality sleep than any prescription drug, leaves your body in four hours, and is easy to make in your kitchen. The fear was in response to GHB’s threat to over-the-counter and prescription sleep aids.