Hi, Yves. Many experts explain that buybacks reflect perverse incentives that allow corporate executives to manipulate stock prices to benefit their own salaries or equity incentive deals. The SEC made the mistake of authorizing buybacks in 1982. The SEC’s recent efforts to compel disclosure of buyback activities to ensure companies’ compliance with safe harbor rules were successfully challenged in court for not considering costs and benefits. The SEC could probably get over this hurdle, but it’s another administrative burden.

Examples of criticism of share buybacks include: Profit without ProsperityTaken from the Harvard Business Review in 2014, the opening paragraph reads:

Five years after the Great Recession officially ended, corporate profits are high and the stock market is booming. But most Americans are not benefiting from the economic recovery. While the top 0.1 percent of earners (which includes most corporate executives) have enjoyed most of the income gains, good jobs continue to disappear and new employment opportunities tend to be unstable and low-paying. Corporate profitability has not translated into broad-based economic prosperity.

The allocation of corporate profits to stock buybacks deserves a major rebuy. Consider the 449 companies in the S&P 500 index that were publicly traded from 2003 to 2012. During that period, these companies spent 54% of their profits on stock buybacks, totaling $2.4 trillion, most of which was purchased on the open market. Dividends absorbed another 37% of profits, leaving little money to invest in productive capacity or increase employee income.

So since the SEC can’t even make a slight change to the buyback rules, and isn’t going to make things worse by repealing the rules, the heavy lifting of tax reform is more doable, but it’s not very doable.

Jessica Corbett, Common Dreams staff writer A common dream

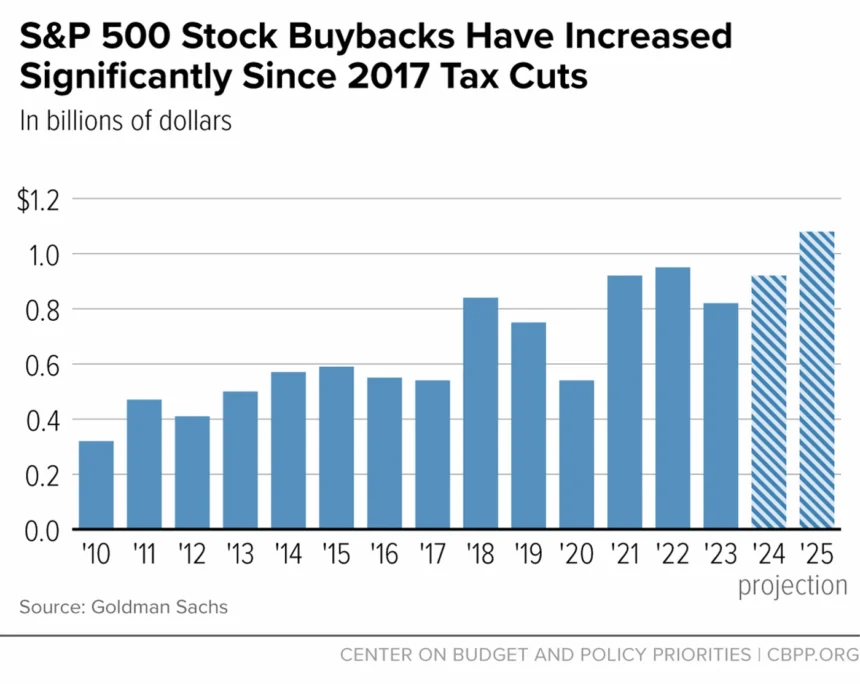

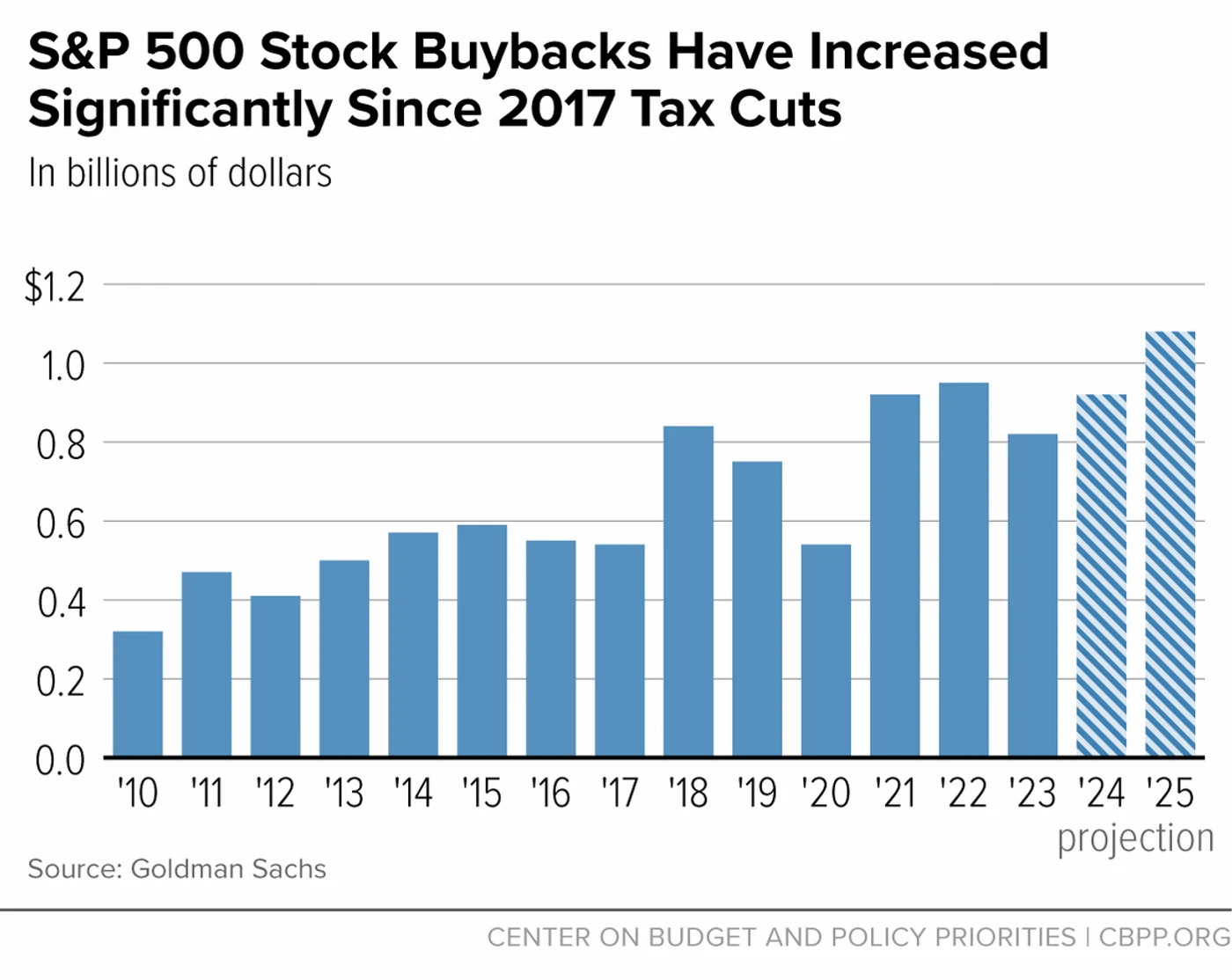

Amid an escalating battle between Republican lawmakers and former President Donald Trump over his administration’s 2017 tax reform law, a progressive think tank said on Monday. undulation in Share buybacks as evidence that federal policymakers should raise corporate tax rates.

Trump is the leading Republican candidate to challenge President Joe Biden in November.Signed Regarding the Tax Cuts and Jobs Act, which would reduce the corporate tax rate from 35% to 21%, Trump declared, “Corporations are literally going crazy about this, and I think it’s gone way beyond what I ever expected.”

“Other studies have found that lowering the corporate tax rate would be a better way to protect jobs,” Chuck Ma, vice president of federal tax policy at the Center on Budget and Policy Priorities, wrote in a new analysis. Overwhelmingly It benefits high-income earners and fails to deliver the benefits to workers that its supporters promised.”

He cited studies from the American Enterprise Institute, the Brookings Institution, the University of North Carolina, as well as the Joint Committee on Taxation and the Federal Reserve. Expose How is the law Not yet He acted in line with the Republican Party’s position.

“The fact that they have also begun large-scale share buybacks is further reason for policymakers to reconsider cutting rates next year. A bigger course correction With key parts of the 2017 law expiring, necessary measures should be taken in the country’s revenue policy,” Ma argued.

A share buyback is when a company purchases its own outstanding shares to reduce the number of shares outstanding on the market and increase the value of the remaining shares, further enhancing profits for shareholders.

“Except for the 2020 pandemic-induced economic downturn, share buybacks have increased significantly every year since the 2017 law was enacted and are projected to exceed $1 trillion for the first time in 2025,” Ma noted. Quote Goldman Sachs.

Some companies, like John Deere, are laying off employees while buying back stock. A common dream Have report.

“The fact that corporations are holding large amounts of excess cash beyond their investment needs and using it to further enrich already wealthy shareholders suggests that partially reversing the corporate tax rate cuts, as President Biden has proposed, poses little risk to investment or the broader economy,” Ma wrote. was suggested The percentage is 28%.

“Policymakers need to move away from corporate tax cuts that don’t deliver on their economic promise. Increase your revenue “Through progressive policies like higher corporate tax rates, governments can raise tax revenues,” he explained, “and then use that revenue to invest in things like expanding the child tax credit, expanding the earned income tax credit, expanding child care, expanding housing, making the economy work better for everyone.”

Ma also called on lawmakers to go further and “raise the excise tax on stock buybacks from the current 1% to 4%.”

The CBBP is not the only organization predicting a looming crisis. date of expiry They see the tax cuts as an opportunity to pursue more progressive policies. Groundwork Collaborative That is Call out Congress should “use the expiration of these provisions as an opportunity to address long-standing problems in the tax code, rather than simply making cosmetic tweaks.”

Some progressive members of Congress, such as Sen. Elizabeth Warren (Democrat, Massachusetts) support Companies are also seizing the opportunity to implement a wealth tax targeted at the wealthiest Americans.

Warren Said Earlier this month: “It’s time for us to be courageous. President Biden is right: If the 2025 tax bill doesn’t require the wealthy and large corporations to shoulder a bigger share of the costs of running this country, Democrats should reject it in its entirety. No more Trump tax cuts for billionaires.”