by Calculated Risk June 25, 2024 9:00 AM

S&P/Case-Shiller release Monthly Home Price Index for April (“April” is the three-month average of closing prices for February, March and April).

The release includes prices for 20 individual cities, two composite indexes (10 cities and 20 cities), and a monthly national index.

From S&P S&P CoreLogic Case-Shiller Index hits previous month’s high in April 2024

S&P CoreLogic The Case-Shiller U.S. National Home Price NSA Index, which covers all nine U.S. census tracts, reported that home prices rose 6.3% year-over-year in April.This was down from a 6.5% increase year-over-year in April. The 10-City Composite Index was up 8.0% year-over-year, down from an 8.3% increase in the previous month. The 20-City Composite Index was up 7.2% year-over-year, down from a 7.5% increase in the previous month. San Diego continued to post the highest year-over-year increase among the 20 cities this month, increasing 10.3%, followed by New York and Chicago, with increases of 9.4% and 8.7%, respectively. Portland’s April year-over-year increase of 1.7% was the lowest this month.

…

The upward trend in the U.S. national index, 20-city composite index and 10-city composite index slowed from last month, increasing by 1.2%, 1.36% and 1.38%, respectively, on a seasonally unadjusted basis.After seasonal adjustment, the U.S. national index and the 10-city composite index recorded increases of 0.3% and 0.5% from the previous month, the same as the previous month, while the 20-city composite index recorded an increase of 0.4% from the previous month.

“For the second straight month, our national indexes have risen at least 1% from their previous all-time highs,” said Brian D. Luke, head of commodities, real and digital assets at S&P Dow Jones Indices. “2024 has largely mirrored last year’s strong start, with March and April seeing the biggest gains before the summer and fall slowdown. Heading into the summer, markets are at all-time highs, again testing their resilience to historically more active periods.

“Currently, 13 markets are at all-time highs, with San Diego again taking the lead, topping the list for annualized percentage returns over the past six months. The Northeast was the best performing region over the past nine months, with New York up 9.4% for the year. The last time we saw sustained outperformance of the Northeastern market was in 2011, after which the West and South held the top performing spots for the rest of the decade. It’s now been over a year since the South or West were the top region.

Add emphasis

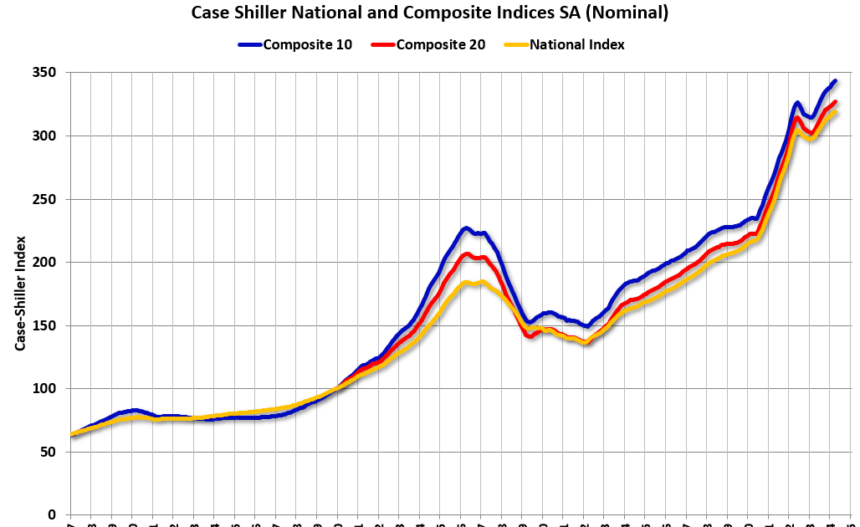

The first chart shows the nominal seasonally adjusted Composite 10 index, the Composite 20 index, and the national index (the Composite 20 index was launched in January 2000).

The Composite 10 Index rose 0.5% in April (SA). The Composite 20 Index rose 0.4% in April (SA).

The national index increased by 0.3% in April (SA).

Composite 10 SA increased 8.0% year over year. Composite 20 SA increased 7.2% year over year.

The national index SA increased by 6.3% year-on-year.

Annual price changes were slightly higher than expected, more details to come later.