Dear patient readers, I have suddenly fallen ill with what I hope is just food poisoning and am unable to post the post I planned and researched, so I am posting this crosspost instead. Sorry! –lambert

by Violaine Faubert, economist at the Banque de France; Nathan Gesse, economics graduate student at ENSAE and the Paris Polytechnique Institute; and Julien Le Roux, senior economist in the European Relations Unit of the Bank of France’s Statistics, Economics and International Directorate. Originally published on VoxEU.

The energy transition will require large amounts of critical raw materials that are extracted and processed in countries geopolitically distant from the EU. This column documents the ownership of mining companies, which is essential information for an accurate assessment of the EU’s strategic dependencies. Investors from outside the EU control a significant proportion of the capital of global listed companies involved in the extraction of cobalt, copper, lithium, nickel and rare earths, highlighting the need for greater strategic autonomy for the EU and for a metals-specific strategy going forward.

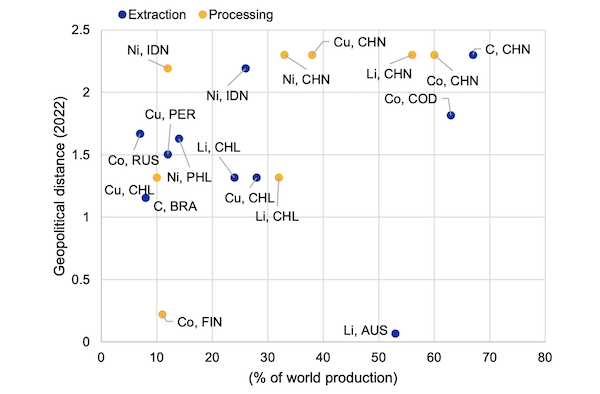

The EU recently enacted legislation aimed at improving security of supply and strategic autonomy for critical raw materials (CRM) (Critical Raw Materials Act 2024). The energy transition will require large quantities of CRMs, but their mining and processing are concentrated in countries geopolitically distant from the EU (see Figure 1). For example, 73% of cobalt is mined in the Democratic Republic of Congo (DRC), 69% of rare earth elements are mined in China, and half of the world’s nickel supply is mined in Indonesia (USGS 2023). This concentration of supplies has raised concerns that dominant countries will leverage their market positions to pursue other strategic priorities (Buysse and Essers 2023), highlighting the urgent need to strengthen the EU’s raw materials strategy.

The geographic concentration of production is further exacerbated by the concentration of companies controlling CRM supply, creating an oligopolistic market structure (IRENA 2023): a handful of multinationals and state-owned or state-owned enterprises (SOEs) monopolize a significant portion of global production: for example, the top four mining companies control around 55% of cobalt production, and the top five mining companies control 80% of global lithium production.

Figure 1 The share of world production imported from the EU (x-axis) versus the geopolitical distance of CRM producers from the EU (y-axis).

Note: Geopolitical distance reflects countries’ stance towards the US-led liberal order, based on a dynamic ordinal spatial model using UN General Assembly votes as input. This indicator is unitless and ranges from 0 to 6. For each mineral and production stage, only two major producing countries are shown. C stands for natural graphite, Co for cobalt, Cu for copper, Li for lithium, Ni for nickel. AUS stands for Australia, BRA stands for Brazil, CHL stands for Chile, CHN stands for China, COD stands for Democratic Republic of Congo (DRC), FIN stands for Finland, IDN stands for Indonesia, PER stands for Peru, PHL stands for Philippines, RUS stands for Russia.

source: Bailey et al. (2017), European Commission (2023), and authors’ calculations.

Non-European investors control significant proportion of listed CRM mining company’s capital

While the geographic concentration of resources is well documented (IRENA 2023; Javorcik et al. 2023), the ownership of extractive companies is less documented. However, documenting the source of control of extractive companies is essential to assess strategic dependencies. Building on Leruth et al. (2022), we designed a comprehensive database documenting the origins of shareholders of global publicly listed companies involved in the mining of cobalt, copper, lithium, nickel, and rare earths (Faubert et al. 2024).

We developed several metrics to map the geographic origins of capital ownership that complement production- and market-capitalization-weighted ownership, as well as metrics focusing on majority ownership. All metrics suggest that non-European investors control a significant portion of the capital of listed CRM mining companies.

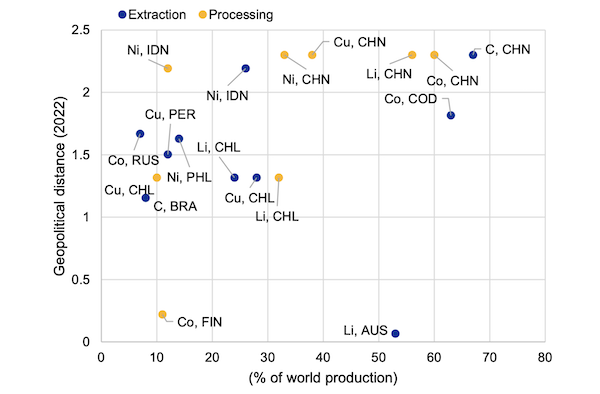

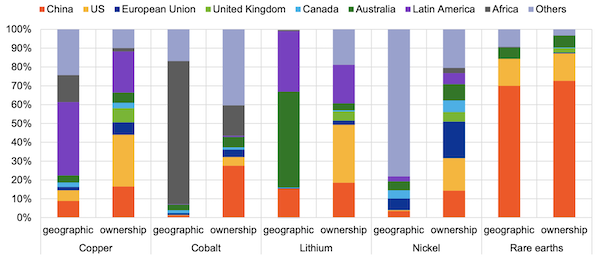

Figure 2 summarizes the ownership of cobalt, copper, lithium, nickel, and rare earths by investor origin. China’s leading position is particularly evident in the mining of rare earths, cobalt, and, to a lesser extent, lithium. In contrast, European investors hold limited shares in CRM mining companies. The relatively high EU shareholding in the nickel sector partly reflects investments in Cyprus representing Russian interests. Besides China, US investors also hold significant shares, especially in the lithium and copper sectors. Latin American investors hold a significant proportion of the capital of companies producing lithium and copper, but are underrepresented in terms of the share of world production in this region. The weight of Australian investors is relatively limited in terms of lithium, given the importance of the country’s lithium resources. Indeed, while Australia accounts for half of the world’s lithium production (USGS 2023), two of the country’s largest lithium mines are owned by Chinese companies.

Figure 2 Weighted ownership of listed mining companies’ critical raw materials production

Note: In the nickel mining sector, Russian investors’ share is estimated at 15%, but is closer to 4% if European investors representing Russian interests are excluded. In the cobalt mining sector, Russian investors’ share is estimated at 3%, but is closer to 1% if Cypriot investors representing Russian interests are excluded.

source: Refinitiv and author’s calculations.

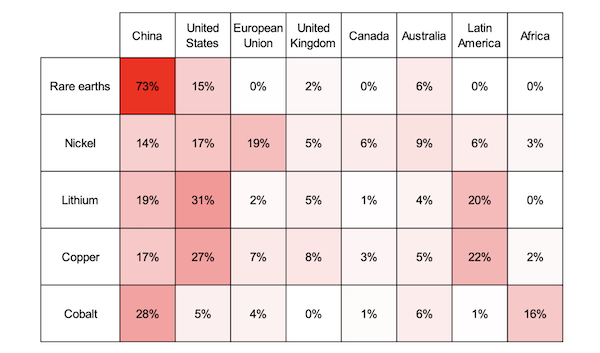

Figure 3 highlights the discrepancy that exists between the geographic concentration of production and the geographic concentration of investors analysed through corporate ownership. US investors, and to a lesser extent EU and UK investors, play a major role in copper and lithium supply compared to their respective country production. In contrast, Chinese investors hold large stakes in nickel and cobalt companies, but these minerals are mainly mined in Indonesia (nickel) and the Democratic Republic of Congo (cobalt). In contrast, for rare earths, production and capital ownership are aligned, with both the US and China being major producers and investors.

Figure 3 Geographic concentration of production and ownership

NoteNickel production is geographically concentrated in Indonesia, with the “other” category making a large contribution in the bar chart breaking down nickel production by region.

source: U.S. Geological Survey, Refinitiv, and author calculations.

Strategic investors play a key role in CRM adoption

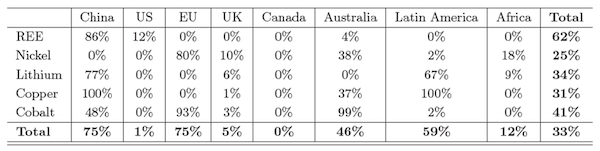

Table 1 shows that strategic investors, such as state-owned enterprises and other strategic investors (including founding families, directors and management teams), dominate in the ownership of companies involved in rare earth mining, and to a lesser extent in cobalt, lithium and copper mining. Chinese investors are overwhelmingly strategic investors, which is consistent with the literature (IRENA 2023). Indeed, strategic investors account for 86% of Chinese investor holdings in the rare earth sector. Strategic investors also play a key role in the development of lithium and copper resources in Latin America. Strategic investors account for 67% of Latin American investor holdings in lithium extraction companies. Overall, the last column of Table 1 confirms the dominance of strategic investors in rare earth companies, which are mainly owned by Chinese investors. Strategic investors also own more than one-third of the capital of companies involved in cobalt, lithium and copper mining. For example, two strategic companies (Chile’s Pampa Group and China’s Tianqi Lithium) control half of the capital of Sociedad Química y Minera (SQM), the world’s second largest lithium company.

table 1 Strategic Investors’ Share of CRM Mining Companies in 2022

Note: Strategic investors account for 86% of Chinese investor holdings in the rare earth elements sector.

source: Refinitiv and author’s calculations.

Conclusions and policy implications

Our database provides an overview of ownership of listed CRM companies against the backdrop of rising geopolitical tensions. Although the EU CRM law aims to reduce strategic dependence by diversifying EU supplies, it does not address vulnerabilities linked to mining capital concentration. Indeed, the CRM law sets diversification targets at the producing country level. Such targets do not address concentration risks linked to capital ownership. However, assessing mining sector concentration through shareholding data shows a very different picture compared to geographic mine locations. Our database may therefore help to identify vulnerabilities linked to capital ownership and refine diversification targets.

The CRM law also aims to increase the EU’s capacity to extract, process and recycle critical raw materials. The development of the European mining industry will require significant private financing (Hache and Normand 2024). Given the EU’s efforts to strengthen economic security, assessing the source of control of European mining companies is crucial to gauge intra-EU supply and geopolitical risks. Against this background, our results suggest the need for greater transparency regarding the source of control of new mining projects announced in the EU.

Overall, our analysis highlights the need for greater strategic autonomy for the EU and suggests the need for a metals-specific strategy. In particular, our database could be useful in guiding investment decisions when European companies seek to increase their shareholdings in major CRM companies.

Author’s note: The views expressed are those of the author and do not necessarily reflect those of the Banque de France.