By Wolf Richter, editor of Wolf Street. Originally published on Wolf Street.

The dominance of the US Dollar is slowly and gradually eroding. The Chinese Yuan continues to weaken, while many other currencies strengthen, including gold.

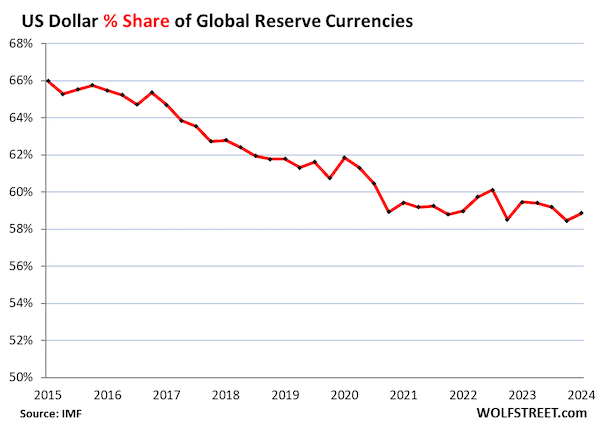

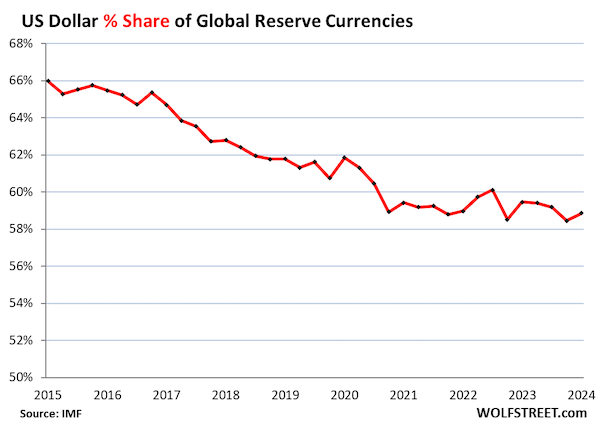

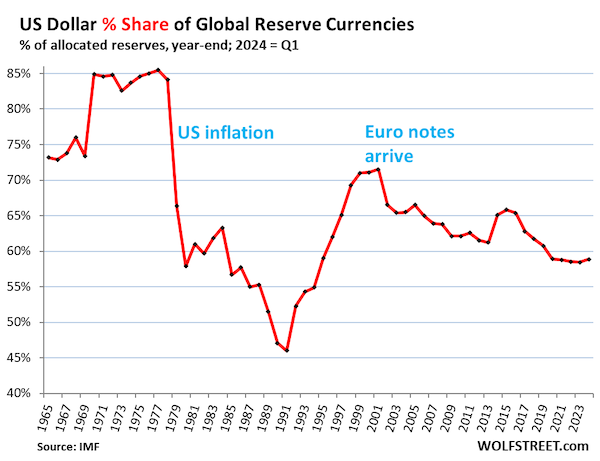

Among the many reserve currencies held by central banks, the US dollar remains by far the world’s reserve currency, but its share has been declining over the years as central banks have increasingly diversified into other reserve currencies and even gold, but the process has been slow and uneven.

According to the IMF’s first quarter 2023 COFER data released on Friday, US dollar-denominated foreign exchange reserves as a share of total foreign exchange reserves rose to 58.9% in the first quarter from 58.4% in the fourth quarter, the lowest since 1994.

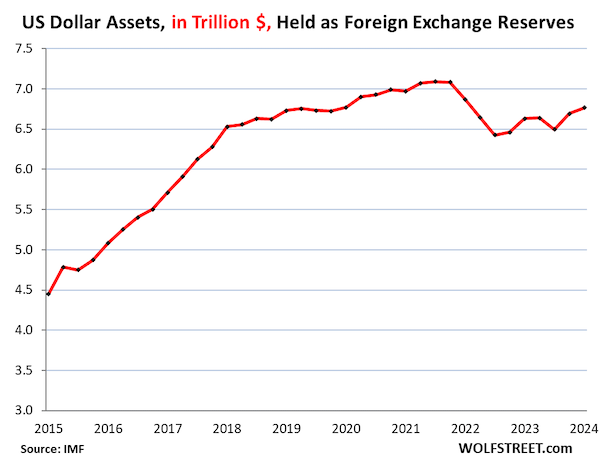

In the first quarter, central banks held a total of $12.3 trillion in foreign exchange reserves across all currencies, including $6.77 trillion in U.S. dollar-denominated assets such as U.S. Treasury securities, U.S. government agency securities, U.S. government guaranteed MBS, U.S. corporate bonds, and even U.S. stocks.

However, it excludes central banks’ holdings of assets denominated in their own currencies, such as the Fed’s holdings of government bonds and MBS, and the ECB’s holdings of euro-denominated assets.

In dollar termsForeign central bank holdings of U.S. dollar assets increased to $6.77 trillion in the first quarter.

Central banks are not “dumping” dollar assets. In dollar terms, central bank dollar holdings have not changed much. As central banks take on assets denominated in many alternative currencies, and as their overall foreign exchange reserves grow, the value of the dollar is increasing. share Of the overall reduction.

After inflation exploded in the United States in the late 1970s and the world lost confidence in the Fed’s ability and willingness to control inflation, the U.S. dollar’s share of the world’s reserve currency experienced major turmoil between 1978 and 1991, with its share plummeting from 85% to 46%.

By the 1990s, confidence was restored and central banks again began accumulating dollar assets, until the Euro emerged (Year-end shares excluding 2024 = Q1)

Other major reserve currencies.

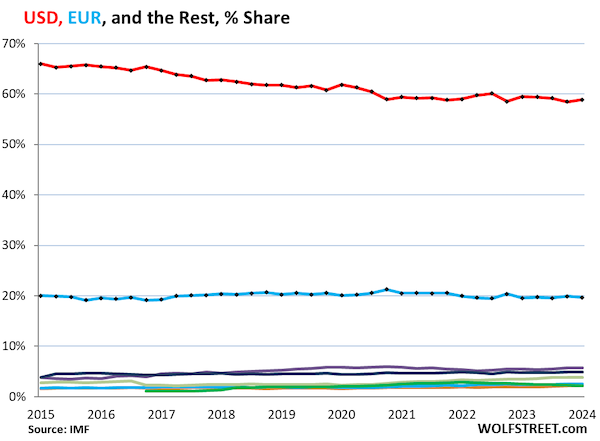

The euro is in second place. Its share in the first quarter was 19.7%. Its share has hovered around 20% for many years (blue line in the graph below). Other currencies are shown as colorful lines at the bottom of the graph.

What’s hard to see in this graph, but easy to see in the next one, where we hold a magnifying glass over the colorful tangle of bits at the bottom, is that while other currencies except for the renminbi are gaining share, the dollar is losing share and the euro’s share is stable. It’s not one currency that’s rising against the dollar, but many of what the IMF calls “non-traditional reserve currencies” that are gaining share.

The rise of “non-traditional reserve currencies”.

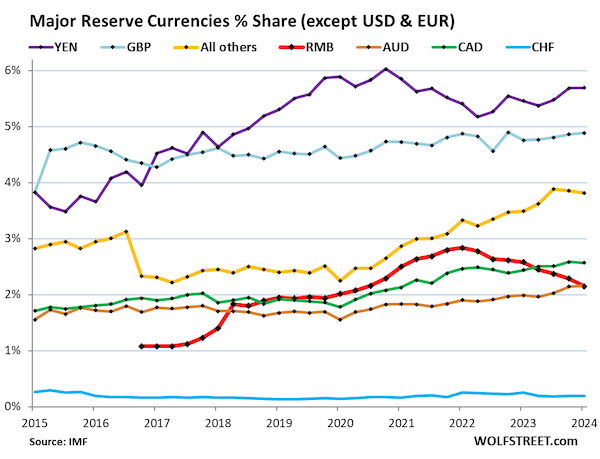

The chart below zooms in on other currencies, and their share of the total is growing year by year.

The exception is the Chinese yuan. China is the world’s second-largest economy, but its currency’s role as a reserve currency is small and declining. When the IMF added the yuan to the basket of currencies that underpins the Special Drawing Right (SDR) in 2016, many assumed the yuan would soon threaten the dominance of the U.S. dollar as the world’s reserve currency. But that has not been the case.

The graph below shows the percentage of total foreign exchange reserves in the first quarter of 2024.

- Japanese Yen, 5.7%, the third largest reserve currency after the US Dollar and the Euro (purple).

- British pound, 4.9%, fourth largest reserve currency (blue).

- “All other currencies” together are at 3.8% (yellow). The renminbi was once part of this group. However, when the renminbi was added to the SDR basket in 2016, the IMF started showing it separately, and as a result of the separation, the share of “all other currencies” decreased by the share of the renminbi. After the separation, the share of “all other currencies” excluding the renminbi was 2%. This increased to 3.8% by the first quarter.

- Canadian dollar, 2.6% (green).

- The Chinese yuan fell 2.1%, its lowest since Q2 2020 and its eighth consecutive quarterly decline (red) due to capital controls, convertibility issues and other issues, as the central bank appears wary of holding yuan-denominated assets.

- Australian dollar, 2.2% (brown).

- Swiss franc, 0.2% (blue).

The IMF: 2022 Papers There are 46 “active diversifiers,” meaning they hold at least 5% of their foreign exchange reserves in “non-traditional reserve currencies,” the report said. The list includes major advanced and emerging market economies, including most of the G20 countries.

The IMF believed that two main factors contributed to the rise of “non-traditional reserve currencies”.

- This increases market liquidity for these currencies, making it easier to trade these assets.

- In a time of 0% in the US and Europe, they chase higher yielding assets elsewhere.

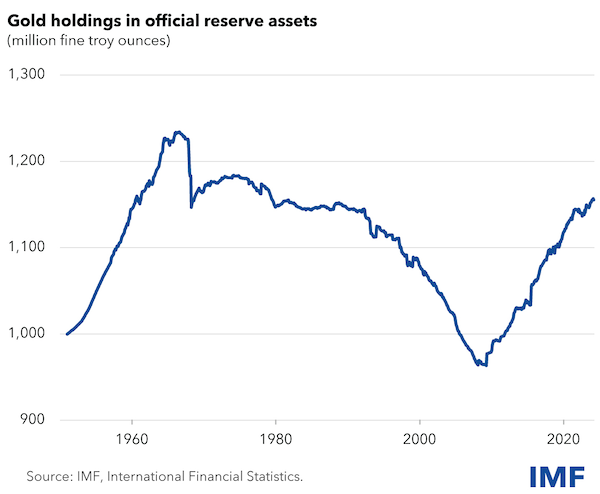

The rise of gold as a central bank reserve asset.

The central bank “foreign exchange reserves” in the data above do not include gold bullion.

However, gold bullion holdings are included in central banks’ overall “reserve assets,” which they have been rebuilding over the past decade after decades of reducing. According to the IMF, gold bullion now stands at 1.16 billion troy ounces, or roughly $2.7 trillion, while foreign exchange reserves total $12.3 trillion (IMF chart).

US Dollar Exchange Rate and Foreign Exchange Reserves.

Foreign exchange reserves are reported in US dollars. US dollar holdings are naturally reported in US dollars, and holdings of euros, yen, British pounds, Canadian dollars, Chinese yuan, etc. are converted to US dollars at the prevailing exchange rate. Therefore, exchange rates between the US dollar and other reserve currencies change the size of the foreign exchange reserves. Non-US Dollar Assets – However, this does not include US dollar assets.

For example, Japan’s holdings of US dollar-denominated assets are expressed in US dollars and do not change with the Yen/US dollar exchange rate. However, its holdings of Euro-denominated assets are converted to US dollars at the current EUR/US dollar exchange rate. Therefore, the value of Japan’s holdings of Euro-denominated assets expressed in US dollars will fluctuate with the EUR/US dollar exchange rate, even though Japan’s holdings do not change.

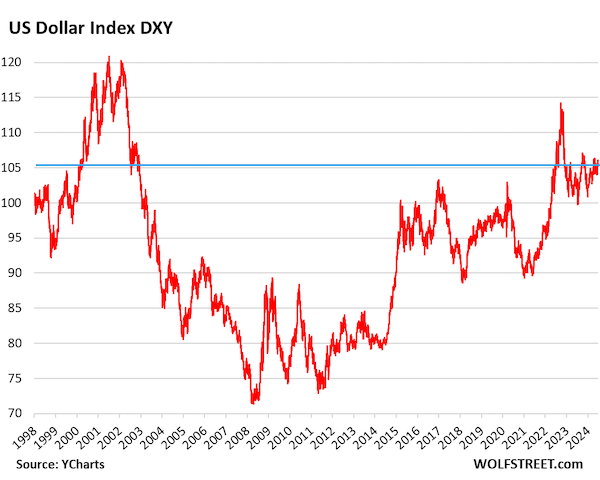

Exchange rates fluctuate widely. But over the long term, the Dollar Index (DXY), dominated by the euro and yen, is back to its 1999 high of 101 (data source: Y Chart):