by Calculated Risk July 5, 2024 9:14 AM

The June employment report showed higher-than-expected payrolls, but revised down the April and May payrolls by a combined 111,000. The participation rate increased, the employment rate remained unchanged, and the unemployment rate rose to 4.1%.

Construction employment increased by 27,000, 630,000 above pre-pandemic levels.

Manufacturing employment fell by 8,000 and is now 170,000 above pre-pandemic levels.

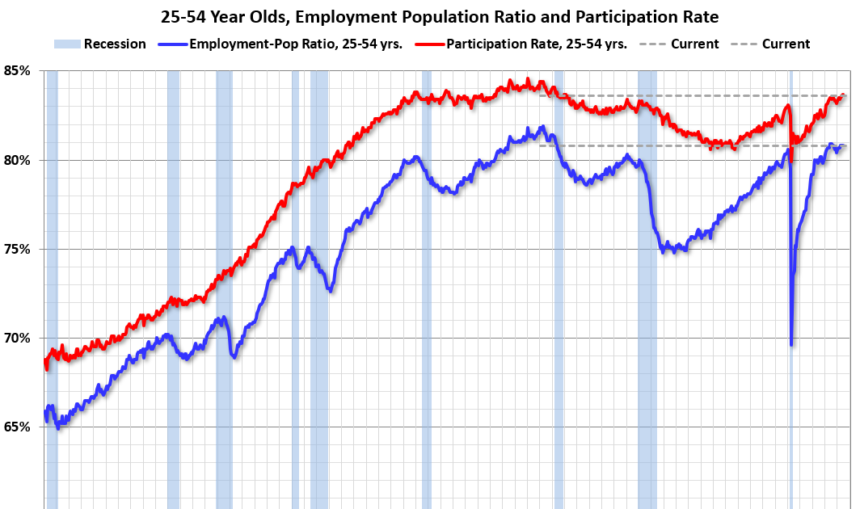

Participation among those ages 25 to 54 rose from 83.6% in May to 83.7% in June. The highest level since 2001.

The proportion of the employed population aged 25 to 54 remained unchanged from the previous month’s 80.8% at 80.8%.

Average hourly wage

Wage growth has been declining since peaking at 5.9% y/y in March 2022, to 3.9% y/y in June.

“The number of people working part-time for economic reasons remained almost unchanged in June at 4.2 million – people who wanted to work full-time are now working part-time because their hours were cut or they could not find full-time work.“

The number of people working part-time for economic reasons fell to 4.22 million in June from 4.42 million in May, lower than pre-pandemic levels.

These workers: Alternative measures Labor force underutilization (U-6) was unchanged at 7.4% from the previous month. This is down from the all-time high of 23.0% in April 2020 and up from the all-time low (seasonally adjusted) of 6.5% in December 2022. (This series began in 1994.) This indicator is above the February 2020 (pre-pandemic) level of 7.0%.

Unemployed for more than 26 weeks

According to the Bureau of Labor Statistics, 1.515 million workers have been unemployed for more than 26 weeks and are still looking for work, up from 1.35 million the previous month.

This is above pre-pandemic levels.

Continuous employment

The jobs report indicates 42 consecutive months of positive employment growth through June 2024, making the current employment streak the fifth-longest in U.S. history (since 1939).

| Hot Jobs, Top 10 Consecutive Years | ||

|---|---|---|

| End of fiscal year | Consecutive Records, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| Four | 1979 | 45 |

| Five | 20241 | 42 |

| 6 ties | 1943 | 33 |

| 6 ties | 1986 | 33 |

| 6 ties | 2000 | 33 |

| 9 | 1967 | 29 |

| Ten | 1995 | twenty five |

| 1Current Winning Streak | ||

summary:

The June employment report showed higher-than-expected payrolls, but revised down the April and May payrolls by a combined 111,000. The participation rate increased, the employment rate remained unchanged, and the unemployment rate rose to 4.1%.

But another decent report showed the three-month average job gain slowed to 177 jobs per month.