by Calculated Risk July 10, 2024 2:11 PM

From Dodge Data Analytics: Dodge Momentum Index rose 10% in June

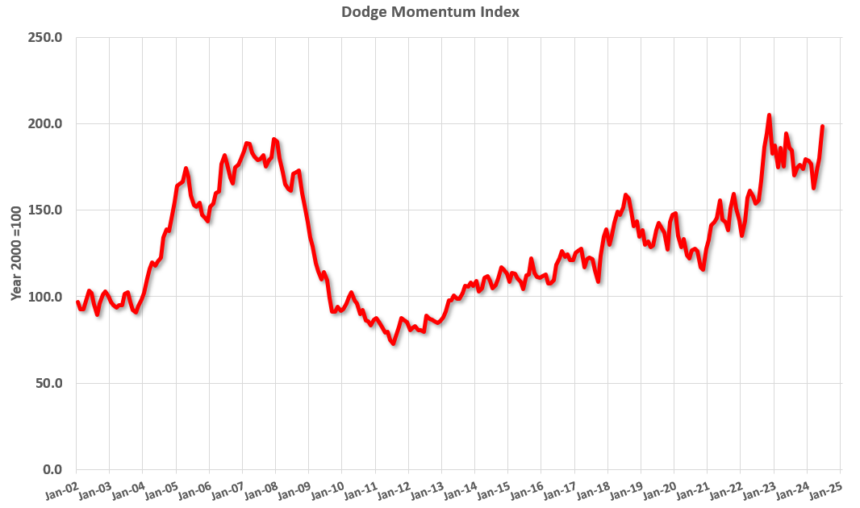

The Dodge Momentum Index (DMI), published by the Dodge Construction Network, rose 10.4% in June. The index rose to 198.6 (2000 = 100) from a revised 179.9 in May. Commercial plans increased 14.5 percent and institutional plans increased 0.2 percent for the month.

“Data centers continued to dominate planned projects in June, marking another strong month for commercial planning,” said Sarah Martin, associate director of forecasting at Dodge Construction Network. “Planning momentum, while not as strong as data centers, is seen across most segments, signaling confidence in market conditions in 2025. The DMI is up 43% from June 2019 levels, signaling solid construction spending in 2025.”

Data center planning remained the main driver of commercial growth in June, along with modest growth in retail, hotel and warehouse projects. On the institutional side, weakness in healthcare planning was offset by improved education activity. Additionally, public planning also strengthened last month, with construction of a large detention facility scheduled to begin.

The DMI in June was 7% higher than in June 2023. The commercial sector was up 25% year-over-year, while the institutional sector was down 25% over the same period.

…

The DMI is a monthly measure of the value of nonresidential construction projects in the planning stage and has been shown to lead nonresidential construction spending by one year.

Add emphasis

This chart shows the Dodge Momentum Index since 2002. In June, the index was 198.6, up from 1179.9 the previous month.

According to Dodge, the index “predicts nonresidential construction spending by one year. The index suggests growth will slow in 2024 and early 2025, but could pick up by mid-2025.

Commercial construction is typically a lagging economic indicator.