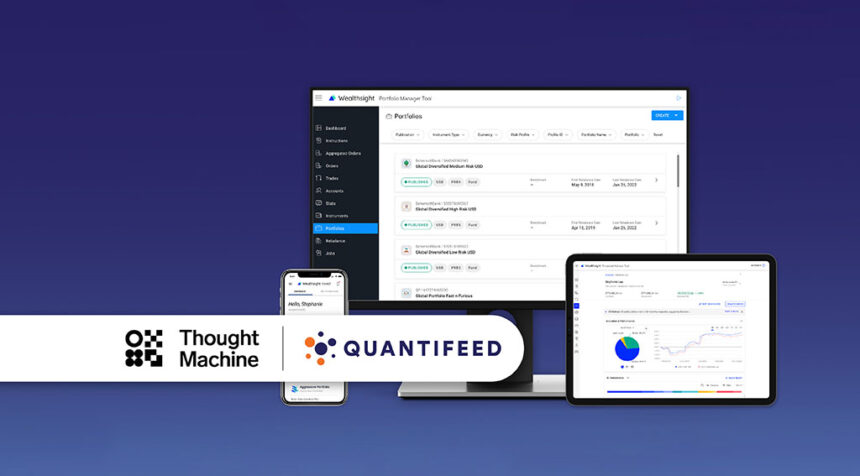

Thought Machine, a cloud-native banking technology company, and Quantifeed, a leading provider of digital wealth management solutions, have announced a new partnership to serve the private banking sector globally.

TPartnership Integrates QuantifidQEngine Platform Thinking MachineWe implemented Vault Core, our core banking platform, to create a comprehensive solution for private banks. Vault Core is already in use by leading financial institutions including Lloyds Banking Group, Standard Chartered and Intesa Sanpaolo.

Quantifed enables financial institutions to offer modular, customer-centric investment services. Combining software engineering and quantitative finance expertise, Quantifed has implemented digital wealth solutions for clients such as: DBS, HSBC, Mitsubishi UFJ Bank BBVA is in Asia, Fidelity and Julius Baer are in Europe.

The partnership will bring together Quantifeed’s QEngine platform with Thought Machine’s Vault Core to deliver a comprehensive solution for private banks. The system connects the front, middle and back office, easing the transition from legacy technology and enabling the development of new investment products and distribution channels.

Collaboration is already underway with several clients, including a fast-growing digital bank in Hong Kong.

Financial institutions, advisors and portfolio managers benefit from streamlined advice generation and trade execution, improving overall productivity, while their clients experience a seamless and engaging service while achieving their investment goals.

Featured Image Credit: Quantifid