by Calculated Risk July 22, 2024 11:20 AM

In today’s CalculatedRisk Real Estate Newsletter: NMHC: “Apartment market conditions continue to ease”

excerpt:

From NMHC: From NMHC: Although conditions in the apartment market continue to ease, transaction volume increased for the second consecutive quarter amid more favorable borrowing conditions.

Conditions in the apartment market were mixed. National Multifamily Housing Corporation (NMHC) Quarterly Apartment Market Conditions Survey July 2024. Debt financing (63) and sales (57) indices show a more favorable situation than this quarter, while equity financing (49) and market tightness (47) are below the breakeven point (50).

…

“Survey respondents have reported overall easing market conditions for the eighth consecutive quarter, with concessions becoming more common in markets where deliveries are increasing.” Chris Brune, economist and senior research director at NMHC said:

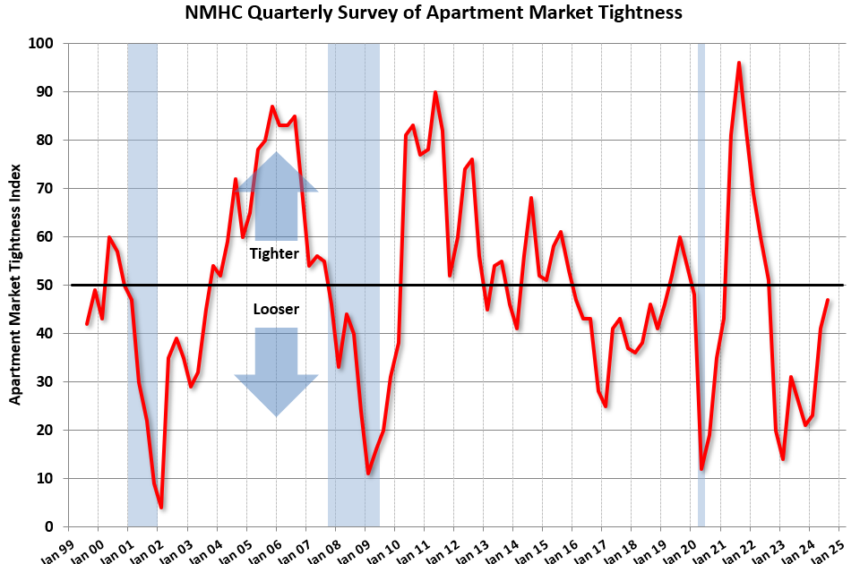

…• Market Tightness Index Market conditions for the quarter came in at 47, below the breakeven mark of 50 and marking the eighth consecutive quarter of easing. However, half of respondents believe market conditions are no different than they were three months ago, and 27% believe the market has eased, down from 37% in April. 22% of respondents report that markets are tighter than they were three months ago.

The quarterly index rose to 47 in July from 41 in April. A reading below 50 indicates conditions have eased from the previous quarter.

The index is a good leading indicator of rents and vacancy rates, suggesting rising vacancy rates and further declines in asking rents. Conditions have been relaxed for eight consecutive quarters From the previous quarter.

There’s a lot more in the article.