Bitcoin’s recent price movement has been a roller coaster of highs and lows. But despite Bitcoin hitting new all-time highs and remaining on a nearly consistently positive trajectory for two years, we have yet to see a sustained influx of retail investors. The possibility of a surge in retail investor participation, driving Bitcoin’s price to unprecedented levels, is a prospect that many investors are eagerly anticipating. In this article, we explore when these retail investors will jump back into Bitcoin pools and whether their return could actually propel BTC to even greater heights.

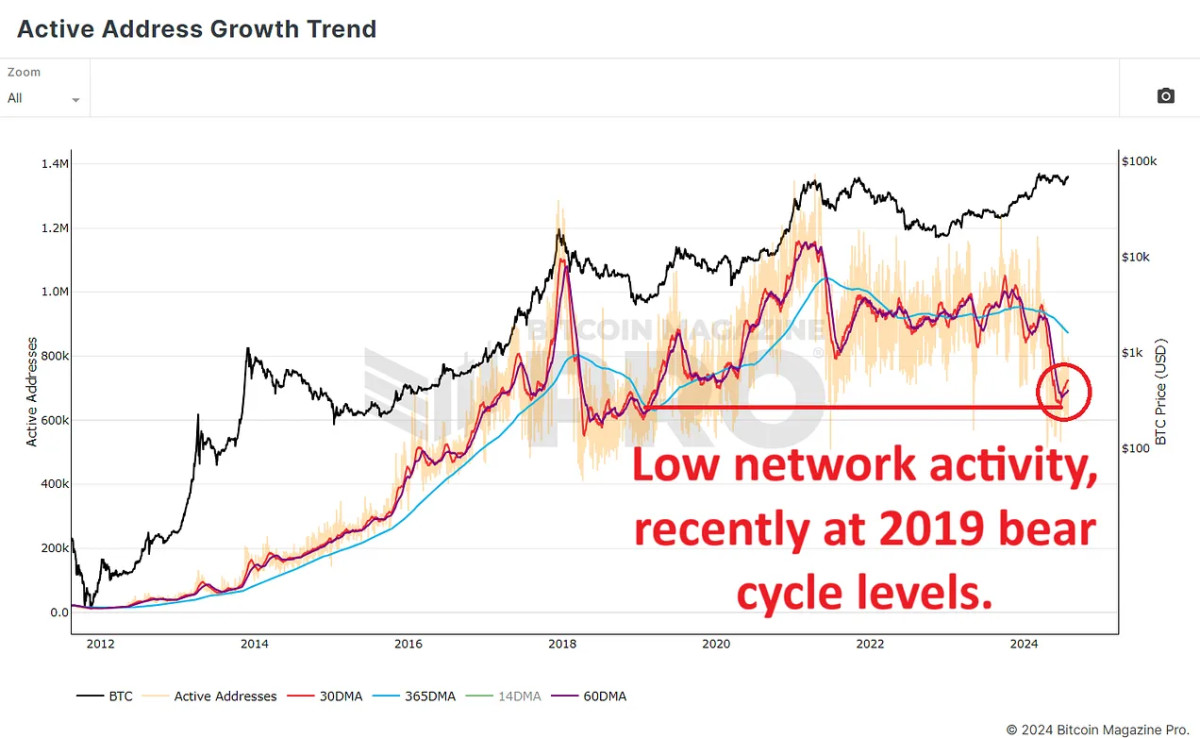

Increase in active addresses and its impact

To predict this potential retail wave: Increasing trend of active addressesAccording to data from Bitcoin Magazine Pro, the number of active network participants has been declining in recent months.Blue Line) and 60 days (Purple Line) and the 30-day average (Red Line) is a telling sign of a decline in network activity, which brings the number of active users back to levels reminiscent of early 2019 following Bitcoin’s bear market, when the price was hovering between $3,500 and $4,000.

The decline in active network users raises questions about Bitcoin’s upside potential in the current cycle. Interestingly, despite Bitcoin setting a new record of around $74,000, there has not been a corresponding sustained increase in the number of network users, a stark departure from previous cycles.

Need for new capital inflows

This trend may reflect the evolution of Bitcoin’s identity. Originally a digital, peer-to-peer currency, Bitcoin is increasingly being seen as a store of value. As a result, fewer people are using Bitcoin for everyday transactions and instead pouring their funds into it as a long-term asset.

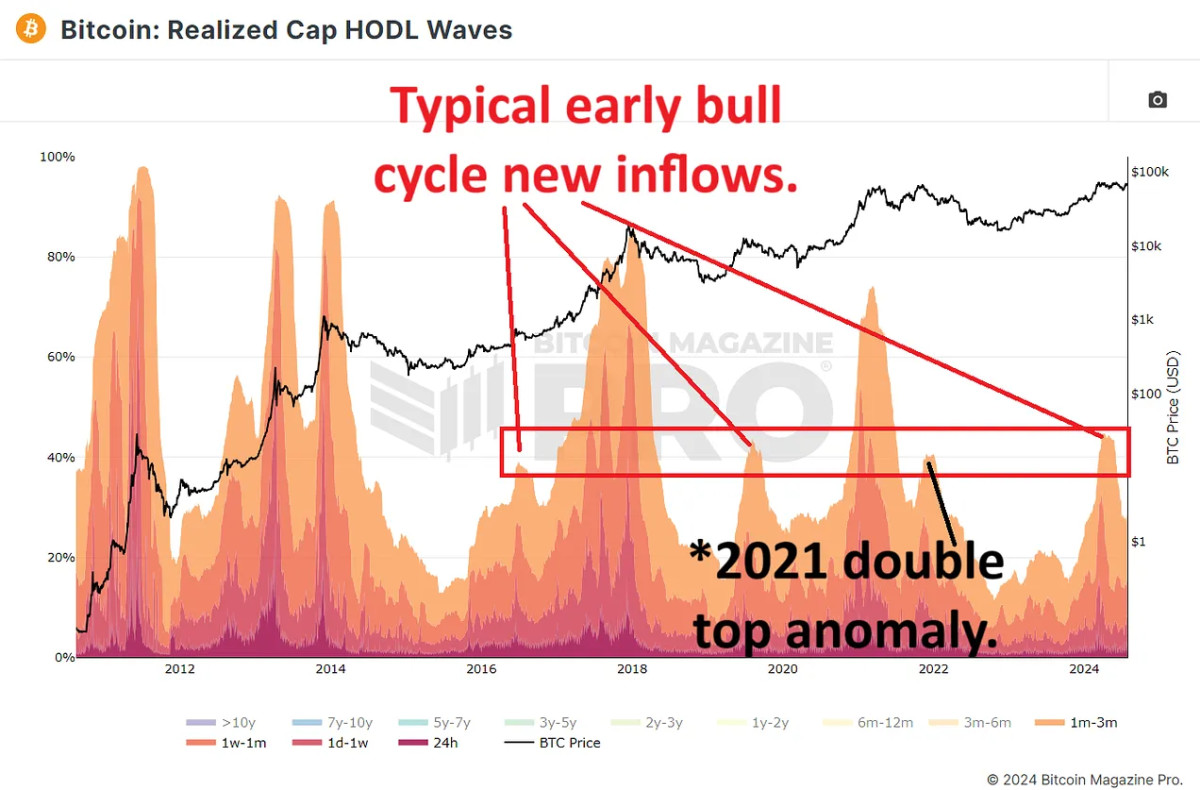

Bitcoin HODL wave and Realized Cap HODL Waves sheds light on this shift. These metrics group Bitcoin network users based on how long they have held their coins and show their cumulative price impact for BTC. Recent data shows that roughly 20% of Bitcoin is held for three months or less, indicating that new users are entering the market, but as can be seen from the average active addresses in the data above, Bitcoin is not being used as frequently as it used to be.

The impact of these new users on the realized cap (Average cumulative price of all BTC) is sizable, with over 40% of the recent impact coming from users who held Bitcoin for less than three months (Shown in the graph below as warm red/orange colorsThis suggests that users are entering the market at higher prices, behaving in a way that is consistent with previous cycles (Recently, we have seen early bull cycle inflows on a par with previous cycles, as shown in the red box.), but not as frequently as before.

Understanding market forces and retail involvement

Looking at past Bitcoin cycles, we see that spikes in retail activity often precede market peaks. For example, during the 2017 and 2021 bull runs, retail interest spiked about six months before the price peaked. The lack of a significant increase in retail interest currently, as Google Trends shows, suggests we are experiencing more cautious and sustainable market growth.

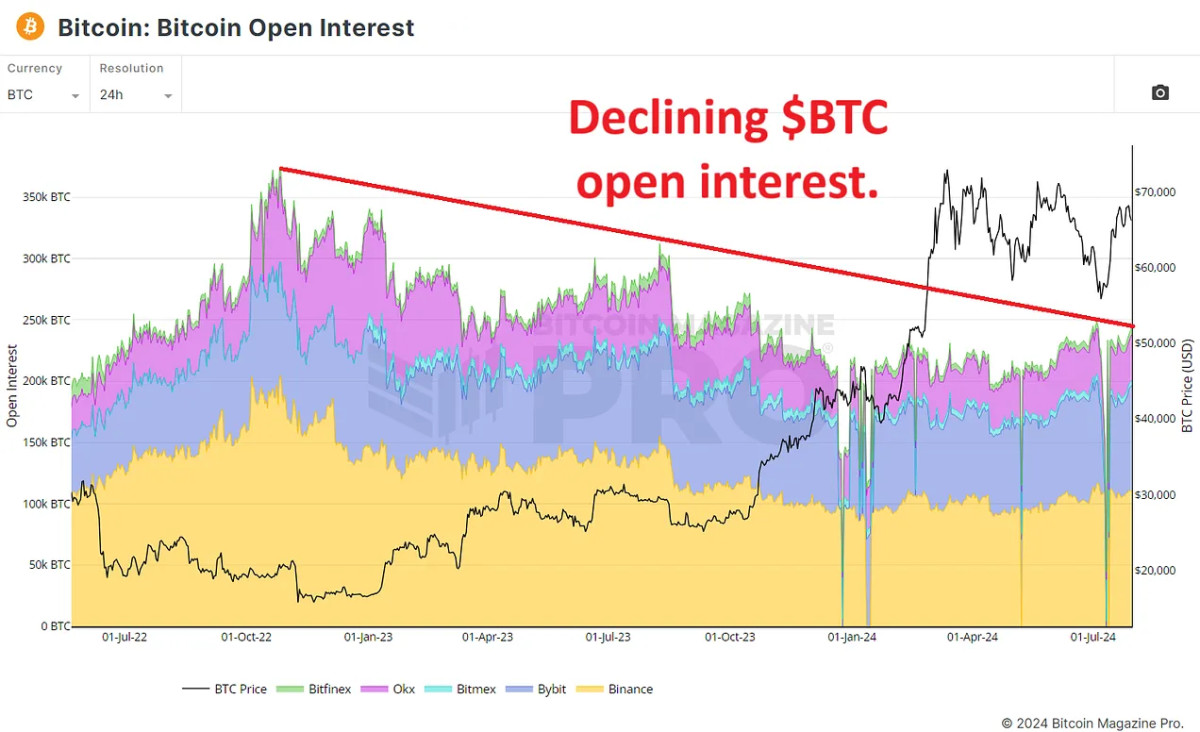

Another important consideration is Bitcoin outstanding balance The chart measures the total value of Bitcoin futures contracts. Since the second half of 2022, this metric has not shown a significant increase. In fact, it has been steadily declining since the bear market lows (This is shown by the red downward line in the graph below.). This indicates that investors are now more interested in trading actual Bitcoin than simply participating in derivatives trading. This indicates a shift in perspective, with investors more interested in holding Bitcoin for the long term than chasing short-term speculative gains.

Conclusion

Given current trends, the lack of retail investor enthusiasm can be seen as a positive sign for the market’s long-term prospects. As Bitcoin approaches new highs, it will be essential to closely monitor retail investor entry. If retail investors start to enter the market in large numbers, will they revert to their old habits of pure FOMO buying or will they prefer to hold for the long term?

So, even though Bitcoin’s active user metric is declining, the market is showing signs of stability and long-term investment. While the lack of immediate retail interest may seem bearish, it’s more likely bullish as it points to a more cautious and sustainable growth trajectory.

If you would like to learn more about this topic, check out this recent YouTube video: