by Calculated Risk August 3, 2024 8:11 AM

This will be a light week for economic data.

The key report this week is the trade deficit for June.

—– Monday, August 5th —–

10 am: ISM Service Index The July forecast calls for it to rise to 51.3 from 48.8.

2 pm: Survey of senior loan officers’ opinions on bank lending practices (SLOOS) July edition.

—– Tuesday, August 6th —–

8:30 AM: Trade balance report June statistics from the Census Bureau.

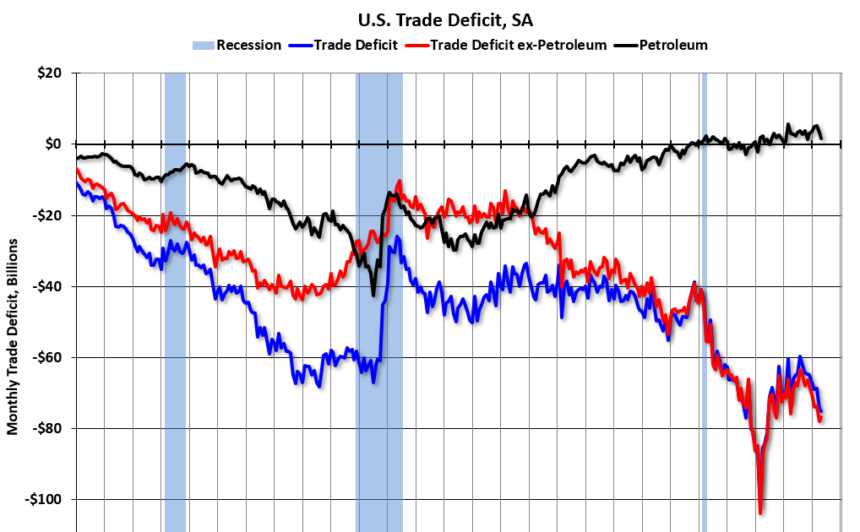

8:30 AM: Trade balance report June statistics from the Census Bureau.This graph shows the US trade deficit with and without oil up to the latest report. The blue line is the total deficit, the black line is the oil deficit, and the red line is the trade deficit excluding petroleum products.

The trade deficit is generally expected to be $72.6 billion. The U.S. trade deficit was $75.1 billion last month.

11am: NY Fed: Second Quarter Household Debt and Credit Report

—– Wednesday, August 7th —–

7:00 AM EST: The Mortgage Bankers Association (MBA) Mortgage Purchase Application Index.

—– Thursday, August 8th —–

8:30 AM: Unemployment claims (weekly) The report is coming out. The consensus is for new claims to be 240,000, down from 249,000 last week.

—– Friday, August 9th —–

No major economic data releases are scheduled.