Interest rates are important, but not in the way that most people think. To understand why, it might be helpful to start with an analogy: Why is inflation important?

Ask the average shopper and they’ll tell you that inflation is obviously a bad thing because it means people pay more for the things they buy. But read any economics textbook and you won’t find this factor mentioned anywhere as a “cost of inflation.” Because when people spend more money on goods, others can sell those goods and make more money. Rising prices are a zero-sum game in themselves.

This doesn’t mean that high inflation isn’t a problem — I think it is a very serious problem — but it’s not a problem for the reasons that most people think it is a problem.

The same can be said about interest rates. Most people (wrongly) think that low interest rates are good for the economy. Stock traders know better. In fact, stocks plummeted on Friday even as long-term interest rates plummeted. Like inflation, interest rates matter, but not for the reasons you might think.

I suspect most people, from personal experience, make the same mistake shoppers make when it comes to inflation. So you might imagine that lower interest rates would make it easier to buy a house or a car. But interest rates are a zero-sum game. When one person pays more interest, another person receives more interest.

I guess you could argue that interest rate changes could cause some “redistribution,” but I’m not sure exactly how that happens. When interest rates are low, the media complains that big banks benefit and retirees with savings accounts suffer. When interest rates are high, the media complains that credit card holders suffer and big banks benefit. But even if lower interest rates do redistribute money to lower-income earners, that doesn’t necessarily help the economy. Low interest rates tend to slow velocity because people have a stronger incentive to hoard cash. As always, it depends on why interest rates change.

Consider these two claims:

1. It is nonsense to talk about how interest rates affect the economy. It is like talking about how changes in oil prices affect the oil market.

2. It makes a lot of sense to talk about how monetary policy affects the economy.

If both are true, then interest rates are clearly not monetary policy. So what is monetary policy?

3. Monetary policy is a set of measures taken by a central bank to affect the demand for and supply of base money, often with the aim of influencing macro aggregates such as prices, employment, and NGDP.

So what do interest rates have to do with monetary policy?

1. Prior to 2008, the Fed targeted the federal funds rate by directing its open market desk to buy and sell Treasury securities. This policy directly affected the base money supply and indirectly affected interest rates.

2. Since 2008, the Fed has continued to modify the supply of base money (through QE), but it has also used the instrument of interest rates on bank reserves to influence the demand for base money.

3. The Fed also influences the demand for base money by influencing the expected growth rate of NGDP: the faster NGDP grows, the lower the real demand for base money tends to be.

Notes: These three effects do not all operate in the same direction.

This is an important point that many miss, even many economists overlook the issue. (If you are familiar with the recent debates, you will know that the first two mechanisms are emphasized by Keynesians, while the third has implications related to neo-Fisherism.)

Monetary policy affects interest rates in complex and often contradictory ways, so we cannot infer anything about the stance of monetary policy by looking at changes in interest rates. I believe the reason the US has never experienced a mini-recession (defined as a 1% to 2% rise in unemployment rate followed by a fall) is because central banks are often confused about the relationship between interest rates and monetary policy. When the economy goes into a mini-recession, the Fed initially tightens monetary policy, making things worse and causing a bigger recession. They mistakenly assume that because the Fed lowered its target rate, it is not tightening policy. But low interest rates are not easy money, especially when the natural rate of interest is falling even more rapidly.

Let’s assume that central banks are slowly beginning to realize this mistake. If my hypothesis is correct, the US should start experiencing a mini-recession. A mini-recession, rather than a regular recession, will occur because the Fed will no longer be distracted by its obsession with interest rates. The Fed will start to focus more on various financial market indicators and will also be more willing to adopt a “whatever it takes” approach to stabilize market expectations of future aggregate demand (NGDP).

It would take decades of improved performance before I was convinced it was more than just luck. So I won’t know for sure if my prediction will come true in my lifetime. In fact, I’m not even sure the Fed has even begun to move beyond the mistaken notion that interest rates are monetary policy, which is a prerequisite for improved performance. It’s possible that the severity of business cycles could be reduced through other policy reforms, such as adopting rate targeting.

I estimate there is a greater than 50% chance that we are entering our first mini-recession. If so, I think there is a good chance that this period will not be classified as a “recession” by the NBER. In that case, this would be the first soft landing in history. And, closely related to these points, this would be the first violation of “Sam’s Rule.”

Or we could slip into a full-blown recession. Either way, the next 12 months are going to be a lot more interesting than the last 12. Here are my (very unscientific) guesses:

1. Good economy: Unemployment peaks at 4.3% — 5% probability

2. Mini-recession: Unemployment peaks between 4.4% and 5.3% — 65% probability

3. Recession: Unemployment rate exceeds 5.4% — 30% probability

I’m curious to know what you, my readers, are hoping for. Feel free to add yours in the comments. As an aside, these are my definitions. The NBER uses a different metric for defining a recession. I define a soft landing as at least three years of economic expansion without high inflation, even after unemployment has approached cyclical lows. We’ve never achieved that. That would be a much more impressive national goal than a repeat of the 1969 moon landing in the 2030s.

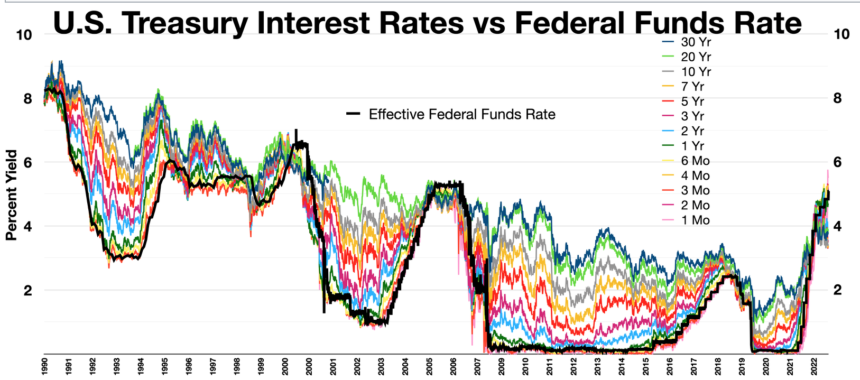

PS. Here’s a cool graph: