by Calculated Risk August 5, 2024 2:00 PM

From the Federal Reserve: July 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices

The July 2024 Senior Lenders Opinion Survey (SLOOS) on bank lending practices addressed changes in standards and terms of, and demand for, bank loans to businesses and households over the past three months, which generally corresponds to the second quarter of 2024.

In terms of business lending, survey respondents reported that, overall, standards for commercial and industrial (C&I) lending to businesses of all sizes tightened in the second quarter, with demand remaining essentially unchanged. Banks reported tougher standards and weaker demand across all commercial real estate (CRE) loan categories..

Regarding household lending, banks reported that overall lending standards remained fundamentally unchanged. Weaker demand for residential real estate loans (RRE loans) across all categoriesAdditionally, banks reported that lending standards remained essentially unchanged and that demand for home equity lines of credit (HELOCs) remained unchanged. Additionally, standards for credit cards and other consumer loans tightened but auto loans remained essentially unchanged, and demand for auto loans and other consumer loans weakened but credit card loans remained essentially unchanged.

On the other hand, banks The bank reported tightening lending standards across most loan categories in the second quarter.The net share of banks reporting tightening lending standards was lower than in the first quarter in almost every loan category.

Add emphasis

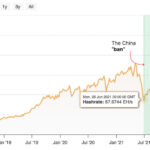

This graph of residential real estate demand: Senior Loan Officer Survey Chart.

This graph is about demand and shows that demand is decreasing.

The graph on the left is from 1990 to 2014. The graph on the right is from 2015 to 2024Q2.