The use of algorithmic underwriting is on the rise across the insurance industry. Algorithmic underwriting approaches can enhance decision-making, improve risk assessment, and optimize insurer operations and customer experience.

In this article, we take a closer look at the evolution and benefits of algorithmic underwriting and share our perspective on building and scaling an algorithmic underwriting platform.

evolution…

Algorithms have always been part of the underwriting process, but typically limited to ratings. For example, when determining risk factors for auto insurance, we use algorithms, or mathematical formulas, to set rates based on the vehicle make, model, driver age, location, and past history. Algorithms, both simple and complex, have long been our core rating tool.

The use of algorithms in other areas of the underwriting process is limited due to the risk that these factors may overlap with pricing, or simply because other parts of the underwriting process lack the data and analytical power to make these decisions. Instead, it is common in the insurance industry to use complex rules engines for decisions about risk acceptance, risk hierarchy, and reporting order.

Advances in data access and analytical tools are causing insurers to rethink their use of algorithms, using them alone or in conjunction with traditional rules engines to enhance decision-making throughout the underwriting process.

How to use…

Algorithmic underwriting uses analytical models to automate decisions in the underwriting process or provide insights to assist the underwriter. For more homogeneous risks, underwriting can be fully or partially automated.

Key decisions made using algorithmic underwriting:

- Determine whether the application meets the insurer’s risk tolerance

- Identify key risk characteristics, including the correct SIC/NAIC code

- Prioritize accounts based on desirability and acquisition potential

- Conduct risk assessment for some or all of the risks

This approach helps insurers accept or reject risks more quickly, reducing underwriting burdens, and providing more personalized risk assessments, real-time risk management, and a seamless experience for customers.

5 Benefits of Algorithmic Underwriting

Algorithmic underwriting offers significant benefits to the insurance industry in five key areas.

- Process Efficiency: By automating the underwriting process, algorithmic underwriting reduces processing times by up to 50%, streamlining operations, increasing testing speed, and simplifying maintenance of complex decision-making systems. Additionally, the automated algorithmic underwriting process can accommodate up to 25% more applications to be reviewed, allowing insurers to increase premiums without incurring additional operational costs.

- Accuracy: The accuracy of risk assessment can be improved by analyzing broader data sets. These analyses help identify patterns and correlations that may be missed by human underwriters alone. With greater insight and judgment from underwriters, errors in risk assessment can be minimized and fraud can be more easily detected. Some insurers estimate that fraud losses can be reduced by up to 30%.

- price: Enhanced risk assessment allows for more accurate pricing. Algorithmic underwriting helps tailor premiums to individual risk profiles, increasing customer satisfaction and competitiveness. It also supports dynamic pricing, adjusting premiums in real time based on changing risk factors, which can increase underwriting profitability by up to 20%.

- Proactive risk management: Algorithms help insurers proactively identify emerging risks and adjust their underwriting and risk management strategies, which can mitigate potential losses, lower loss ratios and improve overall portfolio performance.

- Customer Experience: Algorithmic underwriting enables instant or near-instant decisions on coverage eligibility, pricing, and personalized offers. Predictive and prescriptive analytics enable insurers to make contextual offers in real time, making insurance more accessible and relevant to individual customer needs. It also makes insurance more affordable for customers and segments that may have been left behind by traditional underwriting methods.

Building a large-scale algorithmic underwriting platform

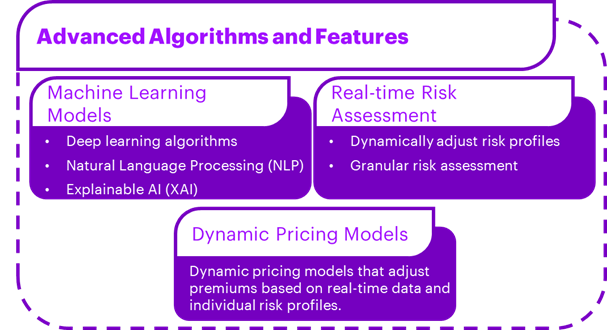

An algorithmic underwriting platform requires a multi-layered approach that allows for future scalability. Some of the advanced capabilities to look for when considering an algorithmic underwriting platform include machine learning models, real-time risk assessment, and dynamic pricing models.

Issues to consider when optimizing your data and algorithmic underwriting platform:

- Data quality and availability: Data may be fragmented, incomplete or out of date.

- Model interoperability: Complex machine learning algorithms used in underwriting can lack transparency and interoperability, making results difficult to explain.

- compliance: As algorithmic models and AI become more regulated, insurers will need to stay ahead of the guidance and adjust their models as needed.

- Impartiality and bias: Unless proactively addressed, algorithmic underwriting runs the risk of perpetuating unfair practices and historical biases.

- Data Privacy and Security: Algorithmic underwriting involves the collection, processing and storage of large amounts of personal and sensitive data. Protecting customer data is essential for compliance and maintaining customer trust.

Success stories…

There are examples of successful algorithmic underwriting across industries. For example, in P&C: Insurance Leverage AI and algorithms to generate instant commercial insurance quotes and automatically issue policies. Hiscox In collaboration with Google Cloud, the company developed AI models to automate underwriting for certain products. spirit Use machine learning to assess risk and provide simplified insurance claims.

Conclusion

Algorithmic underwriting is not a new concept in the insurance industry, but it is revolutionary in terms of enhanced access to new data sources, improved data quality, and improved analytical tools. These enhancements allow underwriters to gain insights from other areas of the value chain and extend their capabilities beyond legacy models and knock-out rules.

Insurers should be aware that despite their advanced technology, algorithmic underwriting models can be prone to bias and lack of transparency. Ethics and compliance with data privacy, consumer protection, fair lending laws, and more will be challenges insurers need to address from the get-go.

As technology continues to evolve and data analytics capabilities expand, we see algorithmic underwriting revolutionizing the insurance industry, driving innovation and enabling financial institutions to make more informed, data-driven decisions.