by Calculated Risk August 7, 2024 7:00 AM

From the MBA: Latest MBA Weekly Survey Shows Increase in Mortgage Applications

According to the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending August 2, 2024, mortgage applications increased 6.9% from the previous week.

The Market Composite Index, a measure of mortgage application volume, increased 6.9% from the previous week on a seasonally adjusted basis. The unadjusted index increased 6% from the previous week. The Refinance Index increased 16% from the previous week and was 59% higher than the same week a year ago. The seasonally adjusted purchasing index rose 1% from the previous week.The unadjusted purchasing index rose 0.3% from the previous week. That’s 11 percent lower than the same week a year ago..

“Mortgage rates fell across the board last week, and mortgage applications hit their highest level since January of this year. Following dovish comments from the Fed and weak employment data, 30-year fixed rates fell to 6.55%, their lowest level since May 2023. This raised concerns that the economy will slow more quickly than expected,” said Joel Kan, MBA associate dean and associate chief economist. “As a result of lower interest rates, refinance applications increased for all loan types, particularly VA loans, which increased by about 60% from the same time last year and reached a two-year high.”

Kang added, “Despite lower interest rates, purchasing activity only increased slightly, with an increase in traditional purchase applications offset by a decrease in government purchase applications. Active inventory has started to gradually increase in some parts of the country, and homebuyers may be waiting for the right timing to enter the market given the prospect of lower interest rates.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 6.82% to 6.55%, and points for loans with an 80% loan-to-value ratio (LTV) decreased from 0.62 (including origination fees) to 0.58.

Add emphasis

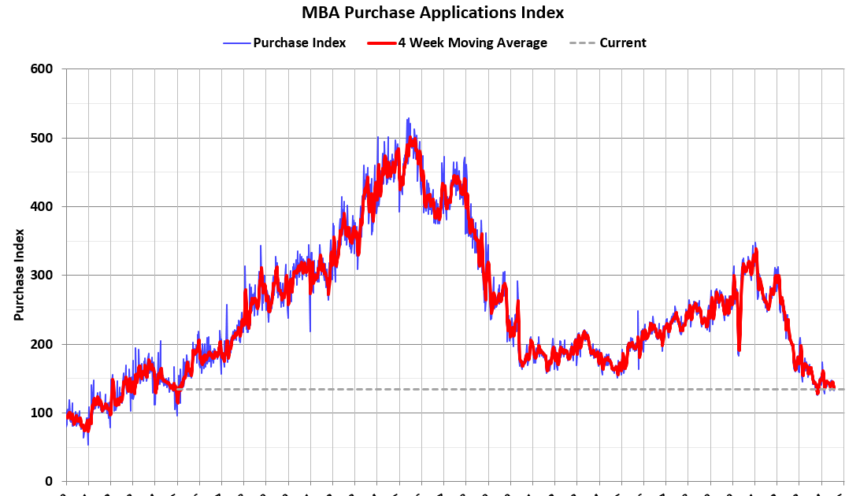

The first chart shows the MBA Mortgage Purchase Index.

Purchasing activity was down 11% year-over-year on an unadjusted basis, according to the MBA.

Red is the four-week average (blue is weekly).

Purchase application activity is up about 7% from its lows in late October 2023 but remains below the lows seen during the housing bubble collapse.

The refinance index fell sharply in 2022 due to rising mortgage rates and has remained roughly flat since then, although it has seen some increases recently.