As a long-time provider of valuable content and insights on Bitcoin investing, I have spent countless hours analyzing data and examining charts to help you build a solid foundation for your Bitcoin investment strategy. In this article, I will explain my unique approach to managing my Bitcoin (BTC) investments, focusing on a data-driven methodology that ensures unbiased decision-making. Whether you’re an experienced investor or just starting out, these insights will help you navigate the often volatile Bitcoin market.

Watch the full video here Check out my full breakdown of my Bitcoin investment strategy.

Understanding Bitcoin’s Orbital Catalyst

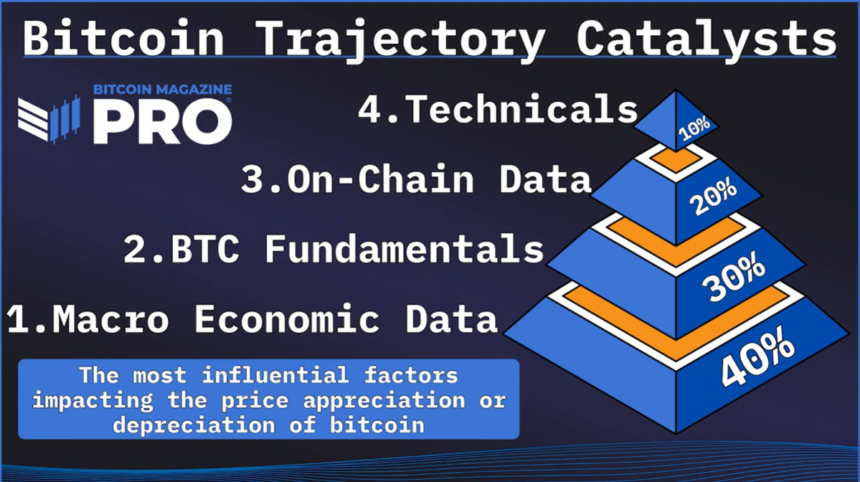

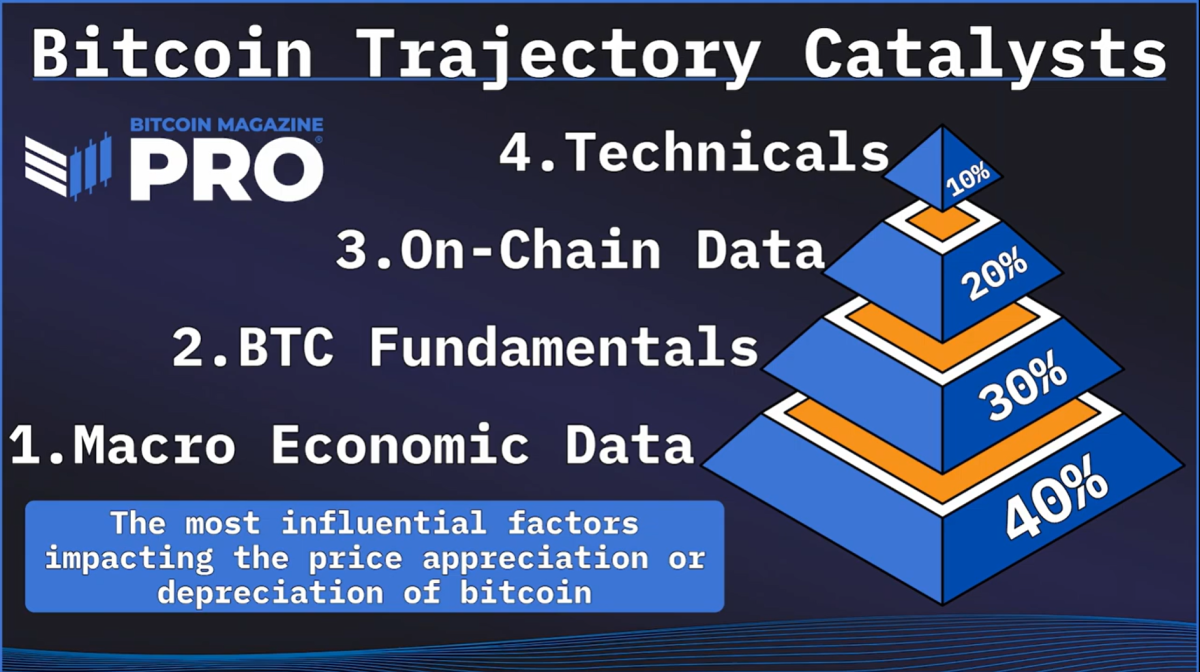

First, it is important to recognize the main factors driving Bitcoin price movements, which I call “Bitcoin Trajectory Catalysts” (BTC). These catalysts fall into four main categories:

1. Macroeconomic data: This is the fundamental basis for predicting bullish or bearish trends in Bitcoin’s price. By tracking global liquidity cycles such as the M2 money supply, we can predict how changes in the broader economy will affect Bitcoin.

2. Bitcoin Fundamentals: Major events and trends such as the Bitcoin halving, ETF launches, and legal frameworks will have a significant impact on Bitcoin supply and demand trends. Understanding these fundamentals will help you determine long-term price trends.

3. On-chain data: Metrics such as coin destruction days and 1-year HODL waves provide insight into investor behavior and the overall health of the Bitcoin network. These metrics are particularly useful for understanding when to accumulate or sell BTC based on market sentiment.

4. Technical Analysis: Short-term market movements are best understood through technical analysis. Tools such as the Golden Ratio Multiplier and MVRV Z-Score can help identify overbought and oversold conditions and are essential for timing trades.

The power of confluence in investing

A key aspect of my strategy is finding the confluence of these various indicators. When multiple indicators from different categories coincide, it provides a stronger signal for making buy or sell decisions. For example, if macroeconomic data indicates a favorable environment for Bitcoin and technical indicators confirm an uptrend, the probability of a successful trade increases significantly.

To streamline this process, I Bitcoin Magazine Pro An API that provides advanced analytics and alerts. The tool allows you to monitor the markets efficiently without constantly monitoring charts, allowing you to make data-driven decisions that reduce the risk of emotional trading.

Scaling in and out of Bitcoin positions

One of the most difficult aspects of Bitcoin investing is deciding when to enter or exit the market. We recommend scaling in and out of your positions rather than making all-or-nothing moves. For example, if technical indicators show that the market is overbought, consider setting a trailing stop loss rather than immediately selling your entire position. This approach allows you to capture additional profits while protecting your gains if the price continues to rise.

Similarly, if you are accumulating Bitcoin during a market downturn, set incremental purchase levels to capitalize on a possible price recovery. This method will increase your chances of buying near market bottoms and selling near peaks, optimizing your investment returns over time.

The importance of patience and discipline

Investing in Bitcoin requires a disciplined approach. Patience is key, as the market can be volatile and unpredictable. Sticking to a clearly defined, data-driven strategy will help you avoid the pitfalls of emotional decision-making and increase your chances of long-term success. Whether you trade frequently or prefer a more passive approach to investing, it’s important to tailor your strategy to your personal goals and risk tolerance.

Conclusion

Incorporating a variety of indicators into your Bitcoin investment strategy can help you understand the market more comprehensively and make more informed decisions. Whether you focus on macroeconomic data, on-chain indicators, or technical analysis, your goal is to create a strategy that works for you.

If you want to see more content like this, YouTube Channel Here we regularly share analysis, insights and strategies on Bitcoin investing, so don’t forget to turn on notifications so you don’t miss any updates.

Moreover, if you are serious about optimizing your Bitcoin investment strategy; Bitcoin Magazine Pro.com Get access to 150+ live charts, personalized metrics, in-depth industry reports, and more. With a subscription, you can cut through the noise and make data-driven decisions with confidence.

By following these strategies, you will be prepared to navigate the complexities of Bitcoin investing with a balanced, data-driven approach. Remember, the key to success in this volatile market is not just knowledge, but the discipline to apply that knowledge consistently.

Now it’s time to take the next step in your investment journey.

- Watch the full video To get a detailed breakdown of these strategies.

- Subscribe to our YouTube channel Browse regular updates and expert insights.

- Explore Bitcoin Magazine Pro Access powerful tools and analytics to help you stay ahead of the curve.

Invest wisely, stay informed and make data-driven decisions. Thank you for reading and we wish you continued success in the Bitcoin market.

Disclaimer: This is for informational purposes only and should not be considered financial advice. Always conduct your own research before making any investment decisions.