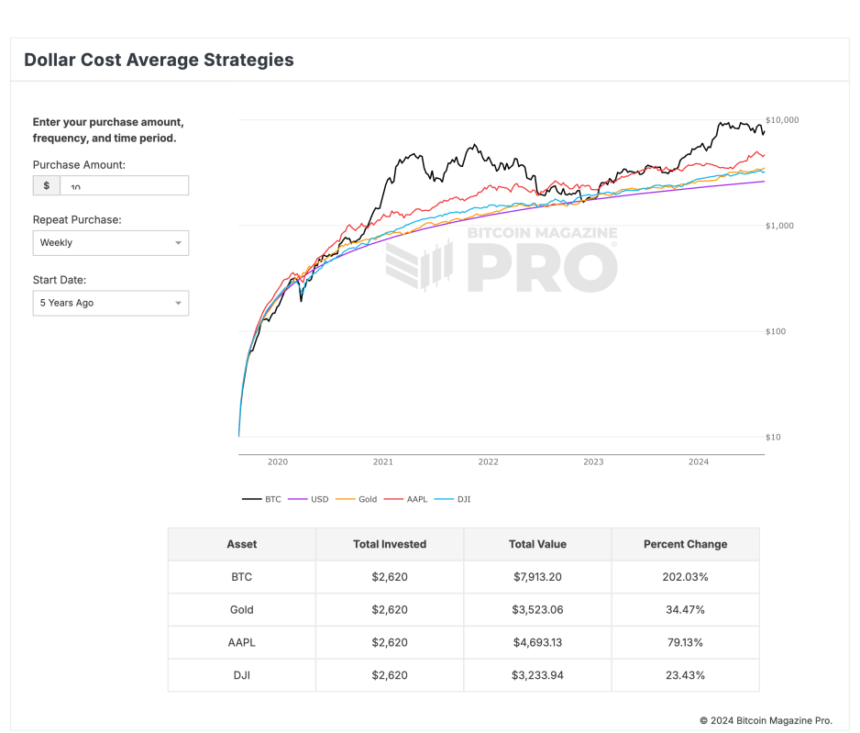

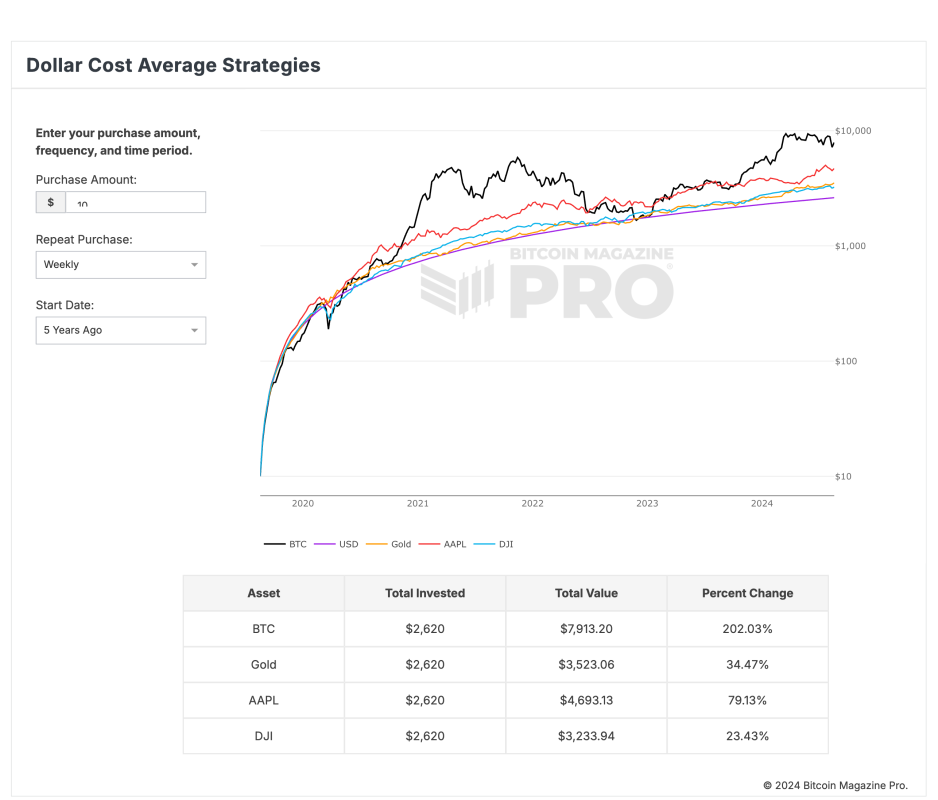

In a recent analysis Bitcoin Magazine Pro It shows the power of Bitcoin dollar-cost averaging (DCA) compared to traditional assets such as gold, Apple stock, the Dow Jones Industrial Average (DJI), etc. According to the data, a consistent investment of $10 per week into Bitcoin over the past five years would have increased a total investment of $2,620 to $7,913.20, reflecting an astounding return of 202.03%.

In contrast, investing $10 in gold during the same week would have generated a return of 34.47%, increasing your initial investment of $2,620 to $3,523.06. Apple stock also performed well, generating a return of 79.13%, turning your $2,620 investment into $4,693.13. Meanwhile, the Dow Jones had the poorest return, increasing by 23.43%, increasing your investment to $3,233.94.

This data highlights Bitcoin’s potential to be one of the best assets, if not the best, for investors to incorporate into their long-term investment strategies. The principle of dollar-cost averaging – investing a set amount of money regularly, regardless of price fluctuations – has proven particularly effective with Bitcoin, allowing investors to accumulate wealth over time.

Investing $10 per week into Bitcoin through dollar-cost averaging (DCA) is an affordable and easy way for beginners to get started investing in Bitcoin. This strategy is especially appealing to those who are hesitant to make large upfront investments or who are still learning about the volatile nature of the Bitcoin market. Investing small, fixed amounts on a regular basis allows individuals to gradually increase their Bitcoin holdings, mitigating the impact of market fluctuations and making it easier to adopt a long-term investment mindset. This approach allows for consistent growth over time without the pressure of trying to perfectly time the market.

Bitcoin Magazine Pro’s Dollar Cost Averaging Strategy tool allows users to explore different investment strategies and optimize their Bitcoin investments over different time horizons. The tool compares Bitcoin’s performance to other assets such as the US Dollar, Gold, Apple Stock, and the Dow Jones, showcasing Bitcoin’s potential as a good store of value in a balanced investment portfolio.

For more information, insights and to sign up for access to Bitcoin Magazine Pro data and analysis, please visit the official website. here.