Hi, Yves. If you follow KFF Health News, you know that our “Bill of the Month” often highlights egregious fraudulent claims where healthcare providers (usually hospitals) won’t retract the fraudulent claims. The negative publicity, or the possibility of it, from KFF Health News almost always forces the claimant to make concessions.

I was surprised to see KFF Health News portray an obvious fraud in such plain language: As the headline states, the patient was charged for two separate procedures when he only had one, which was easily proven by the fact that there were no two dates for the procedure/surgery center listed, nor was the anesthesia administered twice.

The egregiousness of this fraud is indirectly supported by the fact that the patient, a graphic arts designer, won in court despite his typically ill-advised defense. Interestingly, however, the district in which this case was heard only has two judges, and they hear both regular civil cases and small claims cases. As most readers know, small claims court allows parties to defend themselves when the amounts at stake are usually too small to cover the cost of hiring an attorney.

The relatively small amounts at stake also raise the question of whether the defrauded health care provider, Pacific Rim Outpatient Surgery Center, engaged in such fraudulent practices on a regular basis. One troubling aspect of this case is that it is not entirely clear whether the debt collection firm that pursued patient Jamie Holmes purchased the debt from Pacific Rim Outpatient Surgery Center or from its buyer, PeaceHealth. The article suggests that the disputed invoices were assigned to PeaceHealth and then sold. It would be useful to know whether Holmes also tried to dispute the invoices with PeaceHealth, or whether the debts were assigned and sold before she became aware of the change in ownership of the company. This is not just an academic question; continuing to pursue Holmes would also implicate her in the fraud.

The reason we’re making such a fuss about this is because it’s clearly a fraudulent practice that could be curbed by law or regulation. For example, if healthcare providers and their agents or successors insist on recovering duplicate billings, they should be liable for three times the cost of the fraudulent billings plus attorneys’ fees. Exposing these fraudulent practices is good, but achievable reform proposals are even better.

Tony Reyes, local editor/correspondent for KFF Health News, previously worked as a reporter and editor for the Des Moines Register. KFF Health News

Jamie Holmes says the surgery center tried to get her to pay for two surgeries when she only had one, and she refused to budge even after a debt collection agency sued her last winter.

Holmes, who lives in northwest Washington state, had a tubal ligation in 2019, a permanent birth control procedure that her insurance company had agreed to cover in advance.

During the operation, while Holmes was under anesthesia, the surgeon noticed early symptoms of endometriosis, a common condition in which fibrous scar tissue grows around the uterus, Holmes said. The surgeon then told her he spent about 15 minutes cauterizing the problematic tissue as a preventative measure. She remembers the surgeon telling her he finished the entire operation within the 60 minutes that were allotted just for the tubal ligation procedure.

She said her doctor assured her that further treatment for endometriosis would cost very little.

Then came the bill.

patient: Jamie Holmes (38), of Linden, Washington, who was a member of Premera Blue Cross at the time.

Medical Services: Tubal ligation surgery and treatment for endometriosis discovered during surgery.

Service Provider: Pacific Rim Outpatient Surgery Center in Bellingham, Washington, has since been acquired, closed and reopened under a new name.

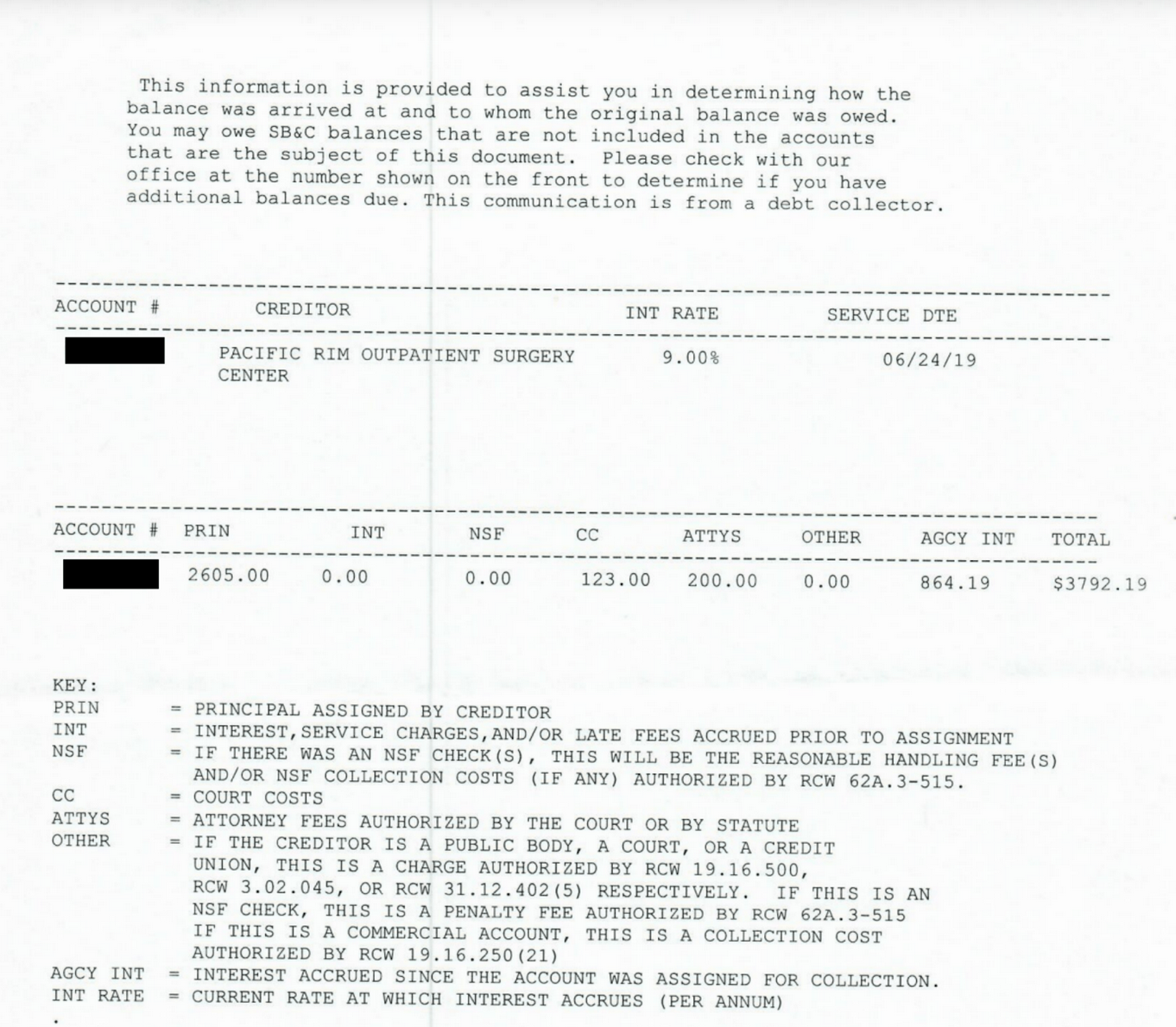

Total bill: $9,620. The insurance company paid the in-network center $1,262. After adjusting the price to the insurance company’s contract allowed, the center billed Holmes for $2,605. A collection agency then obtained the debt and billed Holmes for $3,792.19, including interest and fees.

What you will receive: The surgery center that provided the equipment and support staff for her surgery sent invoices suggesting Holmes had two separate surgeries, one for a tubal ligation and one to treat endometriosis, each costing $4,810.

Holmes said separate bills from the surgeon and anesthesiologist showed no such issues and were paid by the insurance company.

Holmes thought someone in the center’s billing department must have mistakenly thought she’d been on the operating table twice, and she said she tried to explain this to staff, but to no avail.

She said it was like ordering a meal at a fast food restaurant and then getting an extra serving of fries and being charged for two meals: “I didn’t get an extra burger, I didn’t get an extra drink, I didn’t get a toy,” she joked.

Her insurance company, Premera Blue Cross, refused to pay for both surgeries, she said, and the surgery center billed Holmes for much of the difference, but she refused to pay.

Holmes said she understands the surgery center may have incurred additional costs because the surgeon spent about 15 minutes cauterizing the endometriosis spots. About $500 seemed like a reasonable charge. “I’m not opposed to paying that cost,” she said. “I’m opposed to paying for a bunch of things that I didn’t get.”

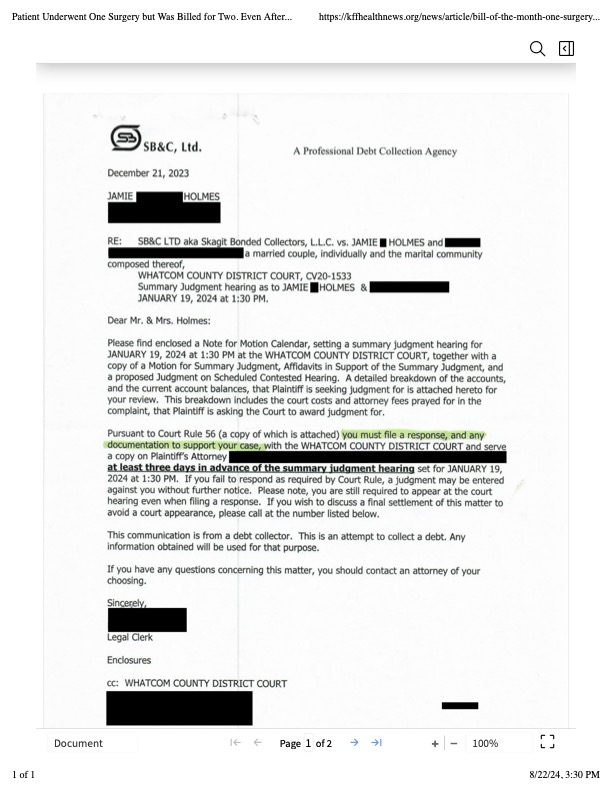

The physician-owned surgery center was later bought by PeaceHealth, a regional health system, and closed, but the debt was passed on to debt collection firm SB&C, which filed suit against Holmes in December 2023 seeking $3,792.19, including interest and fees.

The debt collection company asked the judge to grant summary judgment, which would have allowed the company to garnish Holmes’ wages as a graphic artist and marketing specialist for a real estate agency.

Holmes filed a written response and then appeared at two hearings, via Zoom and in court, to explain her case without a lawyer. A judge ruled in February that the debt collector was not entitled to summary judgment because the facts of the case were disputed.

Representatives for the debt collection agency and the closed surgery center declined to comment for this article.

Sabrina Corlett, co-director of the Georgetown University Center on Health Insurance Reform, said it was absurd for a surgery center to charge for two procedures and then refuse to back out after the patient explained the situation. “It’s like something out of a Kafka novel,” she said.

Corlett said surgery center staff should become accustomed to these situations: “I think it’s pretty common for surgeons to look inside a patient and say, ‘Oh, there’s something else going on. Let’s deal with it while we get the patient on the table.'”

It would not have made medical or financial sense for surgeons to have Holmes undergo another operation for the secondary problem, she said.

Corlett said he would advise patients to file complaints with state regulators if the surgery center is still open.

Solution: So far, the debt collection companies have not pursued a lawsuit seeking a trial after the judge’s ruling, and Holmes said she may hire an attorney and sue for damages and attorney’s fees if the collection companies continue to sue her over the debt.

She could have paid in installments, but she said she was doing so as a matter of principle.

“I was treated really badly. They treated me like an idiot,” she said. “If they’re mean to me, I’m going to be mean to them back.”

summary: Don’t be afraid to fight fake medical bills, even if the dispute goes to court.

Debt collectors often seek summary judgment, which allows them to seize money through wage garnishment and other means without having to prove in court that they are entitled to payment. Judges often grant summary judgment to debt collectors when sued consumers do not appear in court to present their side of the story.

However, if the facts of the case are disputed — for example, if the defendant comes to court and claims that they only paid for one surgery instead of two — a judge may deny summary judgment and send the case to trial, forcing the debt collector to choose between spending more time and money pursuing the debt or dropping the case.

“In these situations, it pays to be stubborn,” said Berneta Haynes, a senior attorney at the National Consumer Law Center, who reviewed Holmes’ bill for KFF Health News.

Many people don’t attend these hearings because they don’t receive enough notice, can’t read English or don’t have the time, she said.

“I think a lot of people would just cave in if they were sued,” Haynes said.

Emily Sinner reported the audio article.