Over the long term, the US economy has been shifting from goods to services. If the US switched to high tariff policies, this shift would accelerate. To understand why, we need to review some basic concepts in trade theory.

To illustrate some ideas, consider a 20% tax on all imported goods, hypothetically exempting services. Let’s start with the example of imported oil. For simplicity’s sake, we’ll assume that the United States imports most of its oil (an assumption that is no longer valid).

If the world price of crude oil is $80 a barrel, a 20 percent tax would tend to raise prices by $16. But because the tariff encourages domestic production and discourages domestic consumption, the price increase would probably be slightly less than $16. Thus, the resulting price increase would be capped at $16, which is about 40 cents per gallon. The actual increase would likely be slightly less, about 37 cents, about twice the federal tax on gasoline of 18.4 cents.

Currently, the United States is a major oil producer. It still imports large amounts of oil, but it also exports a significant amount. In that case, the net impact of the tariffs is more complex. Some of the oil that is currently exported could be diverted for domestic consumption in some parts of the United States that currently import oil. In that case, the main impact would be higher transportation costs as the oil is rerouted.

Most economists assume that tariffs are paid by consumers in the domestic economy. If a tariff has the effect of lowering the world price of an imported good, then in principle some of the burden will be borne by foreign exporters. On the other hand, if other countries retaliate with tariffs of their own (as they may), it is still reasonable to assume that the tariff is borne almost entirely by domestic consumers. In my view, this is the most reasonable assumption.

So is a 20% customs duty the same as a 20% VAT? No, because VAT applies to both goods and services, whereas customs duty applies only to goods.

Do tariffs improve the current account? Probably not, because the current account is domestic savings minus domestic investment. In most cases, tariffs will increase the current account only if they increase domestic savings, which can only happen if the tariff revenues are used to reduce the deficit. And even in those unlikely cases, the effect is fairly small. The main effect of tariffs is to Trade in all goodsBoth imports and exports. With a high tariff policy, both imports and exports will decline. Most importantly, the goods sector of the economy is taxed at a much higher rate than the services sector, so the share of goods in GDP will decline.

This may seem counterintuitive, because one tends to think that tariffs would increase production of goods that were previously imported. In fact, that is true. However, the negative effect on goods production is even larger. This is because the positive effect on domestic production of reduced imports is offset by the negative effect of reduced exports. But tariffs tilt consumption away from goods and towards services. This additional effect (beyond the trade balance) shifts the economy away from goods production and towards services production.

Will a 20% tariff increase inflation? That depends on how the Fed responds. The Fed is likely to allow a temporary price increase because the effects of the tariff are “temporary.” If the Fed wants to avoid higher prices, it will be forced to tighten monetary policy, which reduces nominal wages. In any case, tariffs tend to reduce real after-tax wages unless offset by other tax cuts.

High tariffs on imported oil would discourage oil consumption, a policy supported by many environmentalists. Whether this is the goal of the majority of supporters of high tariff policies is up to the reader to decide.

P.S.: Obviously the world is complicated and we can make assumptions that lead to different outcomes, but I think what many people don’t understand is that the primary effect predicted by standard trade models is that tariffs boost services production and reduce goods production.

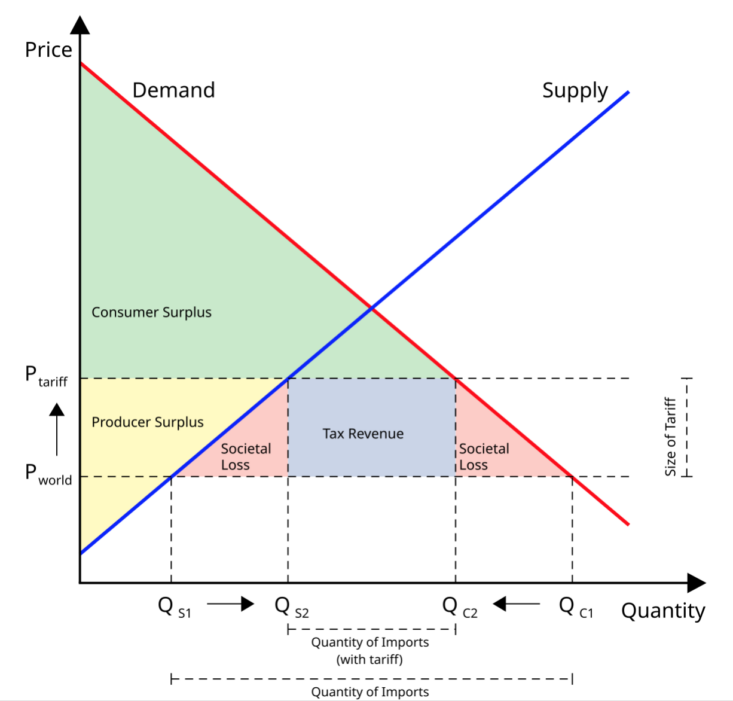

Below is a simple trade graph for the special case where importing countries have no effect on world prices.