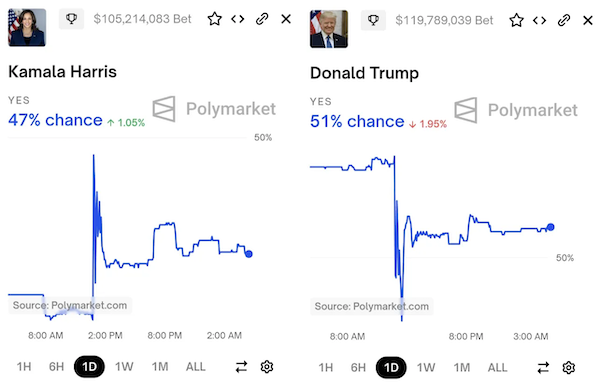

There are several statistical models and prediction markets that are forecasting the upcoming presidential election, which is expected to be very close, with Harris favored. Five Thirty Eight Prediction and Predict,but, Silver Bulletin Prediction and Polymarket. economist The race is essentially tied.

Some political scientists Assert These predictions are completely meaningless, and it will take decades, maybe centuries, to accumulate enough data to be confident that they are any more accurate than a simple coin flip. I do not agree I disagree with this assessment, but both models and markets have serious limitations. Models are built and calibrated based on past results, and if we Uncharted territoryAnd the market Overreaction and operation.

wonderful Attempt Evidence of this can be seen in the following sharp price movements during yesterday’s operations in the polymarket.

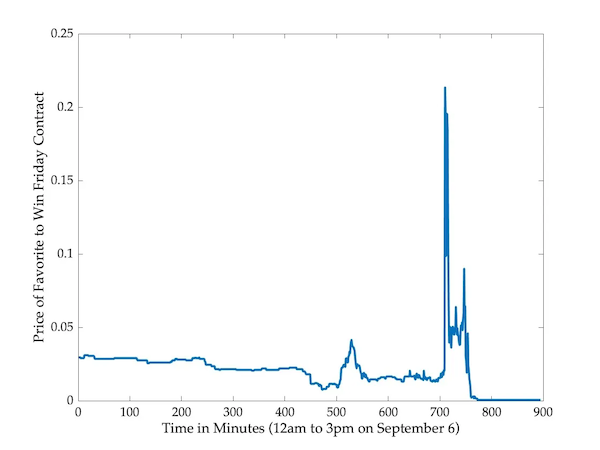

What happened was that a group of traders placed huge bets on Harris, trying to get a lead against Trump for a few hours. The bets were pretty big. One trader They wagered about $2.5 million each. Their goal was to ensure that Harris contracts would trade higher for most of the three-hour period between noon and 3 p.m. ET on Friday, allowing them to profit from the derivatives market, which tracks primary market prices.

Specifically, the market Friday’s Polymarket winner We listed contracts that would pay $1 if Harris led for the majority of the 180 minutes of the reference period. These contracts were trading for around 3 cents at the start of the day but rose to over 20 cents by the start of the three-hour window.

One trader He spent over $11,000 to buy these contracts at an average price of 8 cents each, accumulating about 140,000 contracts. If the attempted manipulation had been successful, he would have made a profit of about $130,000. This would have been offset by losses in the primary market, assuming prices had returned to pre-manipulation levels. Still, his $2.5 million investment appears to have secured him a six-figure profit in one day.

Although the attempt failed, most of the money spent in the primary market was recouped: the would-be operators lost a few thousand dollars, but nowhere near the millions they had bet to pull off the scheme.

Andrew Gelman Assert He said such manipulation amounts to “interference in democracy.” His argument is understandable, since beliefs about the outcome of elections can be self-fulfilling: pessimism about a candidate’s chances leads to lower morale, fundraising, volunteering, and turnout among supporters, which in turn makes defeat objectively more likely.

Of course, markets that reference prices in other markets are common in the financial world, and all stock options and index futures have this property. But with regard to election prediction markets, I see no basis for such derivative contracts. They serve no legitimate purpose, but rather enable obvious manipulation strategies. And even if the manipulation attempts ultimately fail, it would still arouse suspicion and create confusion.

This type of derivative contract Continued It will be listed on Polymarket. I hope it gets discontinued.