by Calculated Risk September 10, 2024 11:22 AM

From Dodge Data Analytics: Dodge Momentum Index rose 3% in August

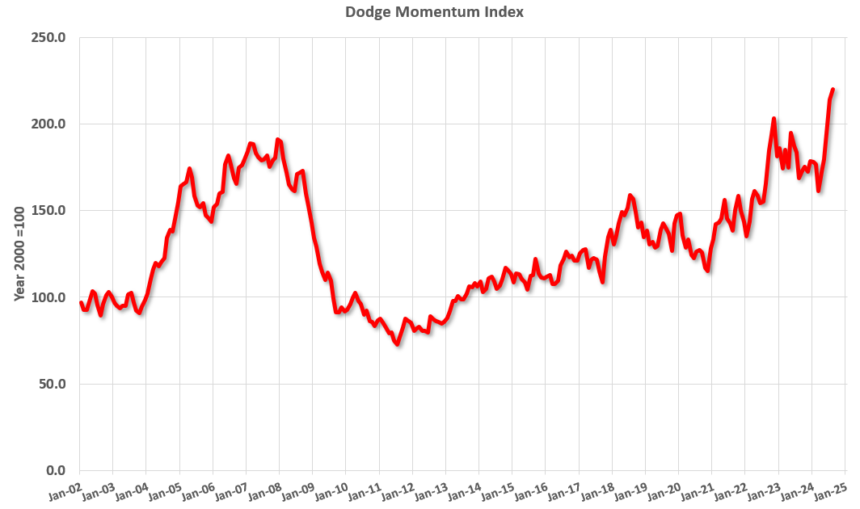

The Dodge Momentum Index (DMI), published by the Dodge Construction Network, is Increased by 2.9% in August The index rose to 220.4 (2000=100) from a revised 214.2 in July. On a monthly basis, commercial plans expanded 1.9%, while institutional plans improved 5.7%.

“Owners and developers continued to prepare their plans in August for what they expect to be favorable market conditions next year,” said Sarah Martin, associate director of forecasting at Dodge Construction Network. “With the Federal Reserve’s September interest rate cut all but confirmed, selective lending standards and inflation will ease next year, and consumer demand will also pick up a bit. Planning activity picked up in August, with most nonresidential sectors growing..”

Commercial planning saw another month of widespread improvement. After slowing in recent years, warehouse projects have picked up momentum in the past three months. Hotel and retail planning has also expanded steadily. Data centers continued to dominate large project activity, but the rate at which planned projects are queuing up eased in August after several months of very strong growth. On the institutional side, healthcare was the main driver of expansion last month, followed by recreational planning. The DMI in August was 31% higher than in August 2023. The commercial sector was up 42% year-over-year, while the institutional sector was up 8% over the same period.

…

The DMI is a monthly measure of the value of nonresidential construction projects in the planning stage and has been shown to lead nonresidential construction spending by one year.

Add emphasis

This chart shows the Dodge Momentum Index since 2002. In August, the index was 220.4, up from 214.2 the previous month.

According to Dodge, the index “predicts nonresidential construction spending by one year. The index suggests a slowdown in 2024 and early 2025 before a recovery by mid-2025.

Commercial construction is typically a lagging economic indicator.